Leverage Effect (Leverage): X2, X5, X10 – leverage effect explained for shares, currency & co.

Many people give you an extremely complicated answer to the question, what is a leverage effect? However, the leverage effect is simply explained. When buying stocks, cryptocurrency, currencies and many other financial products, traders rely on their own strategies in trading financial products. In the end, it’s always a bet based on information such as news from the economy, finance and politics or gut feeling and psychology as in cryptocurrencies. If trade are very sure about a price jump (profit), take additional capital to make more profit: X2, X5, X10 and more – here is the explanation of how the leverage effect works:

What does leverage mean in financial products?

It’s not just real estate that has the leverage effect for good returns, you need to know about the leverage effect in financial products as well.

No investment advice or purchase recommendation!

All information provided here does not constitute investment advice or a recommendation to buy. All statements are my general published opinion. I have obtained the information from my experience as a private investor. This experience report cannot and is not intended to replace personal investment advice from professionals.

For example, I myself lost a lot of money in the beginning because I didn’t notice the X20 at a new broker – tip: take your time for trading – silver plummeted by a few % afterwards.

The collapse of the silver course I have noticed at the edge, thought ok, are only a few hundred euros. Not quite, it was a few hundred euros x 20. That within a few hours.

Risk increases / capital increases

Leverage:

Leverage means increased capital / risk.

Lever quickly explained

For pretty much all products you can use leverage in trading apps and with brokers. Simply put, a short-term loan from the broker. This increases the profits and (!) the risk. You give $1,000, take a leverage of 10, and you have $10,000 of capital tied up.

X10 = from 1.000 you make 10.000

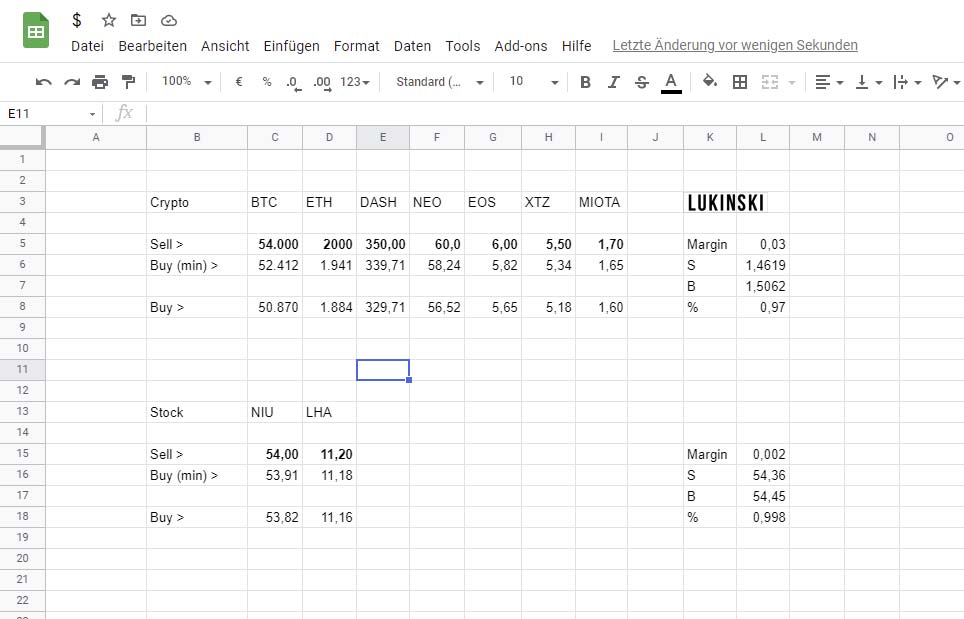

Table: X10, X20 and X30 levers

Examples of levers:

| Invested amount | Lever | Trade |

| 5.000 $ | 1:1 / X1 | 5.000 $ |

| 5.000 $ | 1:2 / X2 | 10.000 $ |

| 5.000 $ | 1:5 / X5 | 25.000 $ |

| 5.000 $ | 1:10 / X10 | 50.000 $ |

| 5.000 $ | 1:20 / X20 | 100.000 $ |

| 5.000 $ | 1:30 / X30 | 150.000 $ |

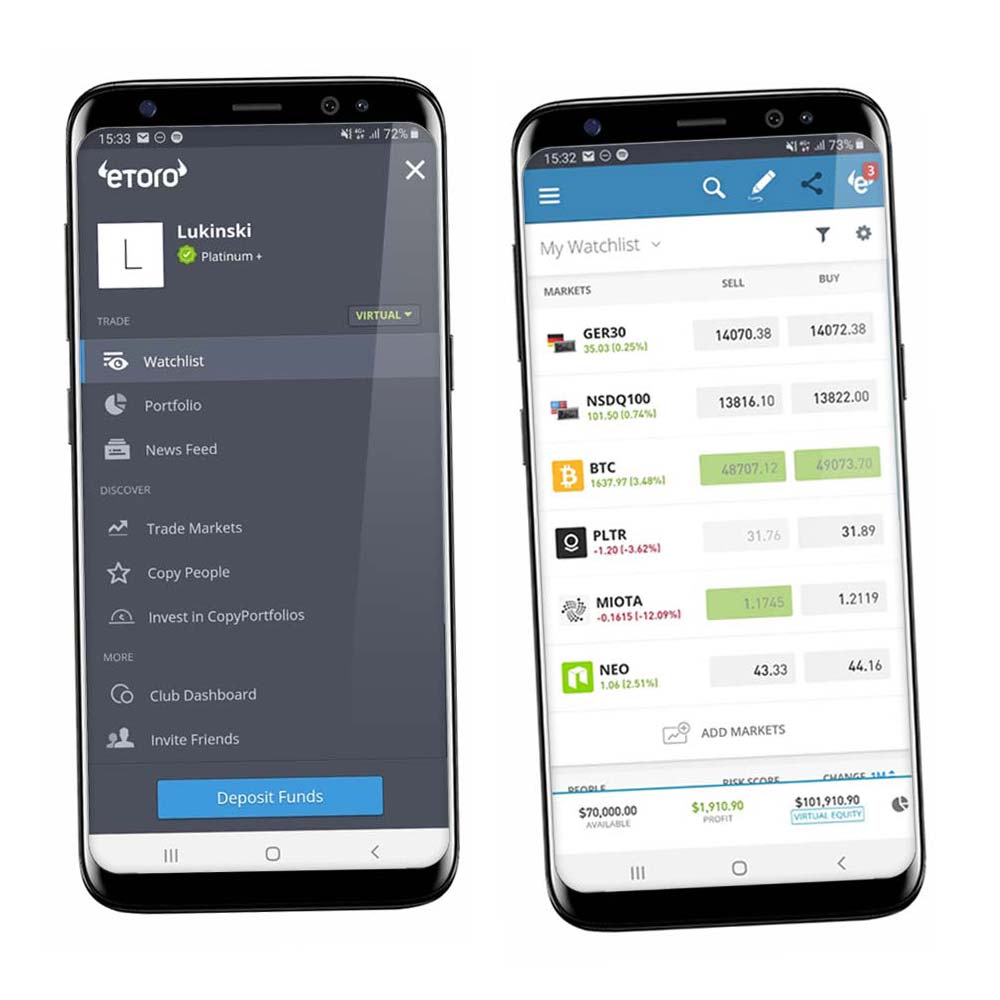

Trading has never been so easy! Buy from 1 euro with these apps:

Trading strategies

Whether it’s cryptocurrency, currency trading, stocks, commodities or precious metals, these 3 strategies will help you understand the basic stock market game. I developed these 3 strategies to help beginners and novices understand the mechanics in a nutshell. Since I grew up with Bitcoin rather than stocks, here in particular a strong reference to digital currencies. However, the mechanisms or strategies are the same for these 5 investment types: cryptocurrency, currency trading, stocks, commodities or precious metals. I would exclude ETF and index funds here, as the risks and price fluctuations are significantly lower here.

Stocks, ETF, Forex, Cryptocurrency, Social Trading – Here’s a little list of a few learnings that cost me money but are so simple you should know them! You want to buy stocks, index funds, cryptocurrency like Bitcoin or Ethereum, foreign exchange (currencies)? You’re thinking whether house bank, direct bank, online broker or app? Trading all on your own at risk or new options like social trading via app? My experiences and mistakes!