EToro App Tips: Copy traders – invest money like professionals?! Explanation + Guide

eToro App: Copy Trader – Trading Beginners have a big problem, they are not familiar with trading financial products. No matter if it’s stocks, currencies, cryptocurrencies, index funds, ETF or leverage. As I have already described in the great guide to eToro App, the “big advantage” of eToro lies in “social trading”, or rather in an exact function of it, the “copying of trading profiles”. That is, you can as a beginner and beginner (but also professional), passively actively participate in the stock market! Once copied, all financial products are traded 1:1: Stocks, cryptocurrencies, ETF and index funds. What this means, you will learn in this article!

How do I learn to act? Methods

In the past, this was virtually the only way to do it:

Trial and Error.

Trial and error means you actively participate in trading and thus learn, mostly through mistakes you make, i.e. losses. Today, you can “just copy” traders. Let’s look at the function of “social trading” and the 2 ways or methods with which you can improve your trading knowledge (besides Youtube videos, books, etc.), directly in the app.

First, the “classic method” of trial and error.

No investment advice or purchase recommendation!

All information provided here does not constitute investment advice or a recommendation to buy. All statements are my general published opinion. I have obtained the information from my experience as a private investor. This experience report cannot and is not intended to replace personal investment advice from professionals.

Trial and error: learning from mistakes

The classic way – The classic way is, “learning by doing”! You hear about methods, strategies, you read about them, you try them yourself. In the process, you usually lose a lot of money. But that’s okay, because (!) you use for trading of course only money that you have left. One of the most important rules!

Only invest money that you have “left over

This is the only way to stay calm, even if prices slip into the red.

But you can also “copy profiles”, observe traders and draw your own conclusions for your trading strategies. Passively your assets will increase, if chosen correctly.

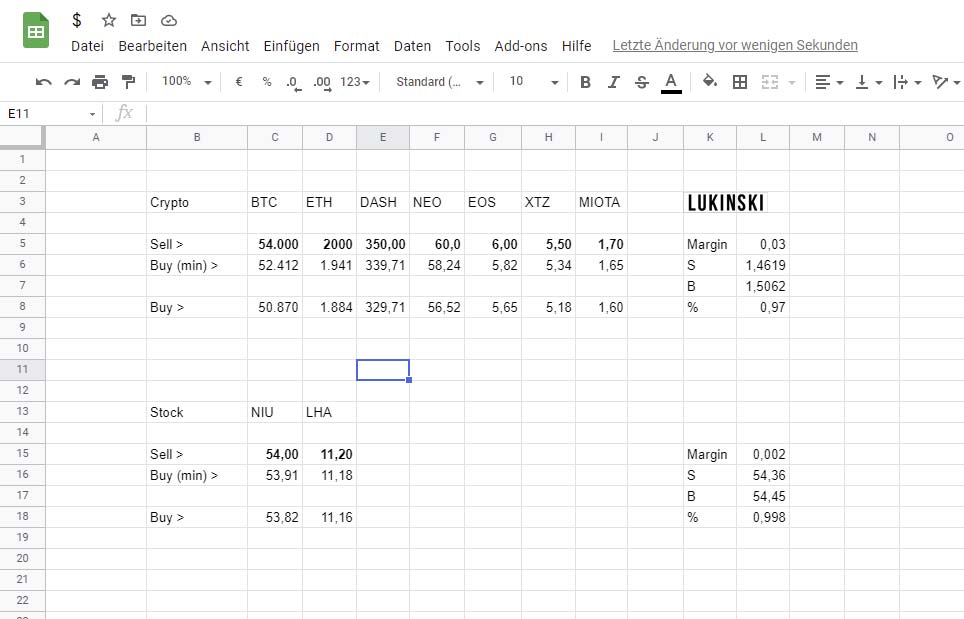

Now before we “celebrate trading”, here’s a look at a day full of red numbers! Losses, risk, “play money”, be aware of all these factors if you want to trade. In the morning, it can look like this.

Trading app in the browser (price losses):

If you can handle it, let’s move on!

Trader copy: Modern anlagen

The modern method – Modern means in this aspect, copy the investment portfolio of a successful trader. This is exactly the advantage of eToro. Through this “copy feature” in social trading, you can easily copy investment portfolios of other traders.

After copying, the app triggers all actions exactly as the trader does. Accordingly, all financial products are bought and sold simultaneously. As a result, your assets grow and are reinvested, automatically. The big advantage is that your portfolio acts on the basis of the actions of an experienced trader. This reduces risk.

Social Trading: Copy investment portfolio and traders

Social trading is therefore, among other things, another step towards minimizing risk. Why? You do not manage your portfolio yourself and have to check the daily news, financial data, other stock values.

You do not give away your money. You just copy the portfolio and all the trader’s actions. In the eToro app you can take a close look at all movements and transactions. This way, in addition to your own learning, you can build up further practical knowledge. Simply by checking daily which movements are triggered by the experienced traders.

Before I get to the individual functions, here are my quick experiences.

My experience: The first 3 months

I was bored at Christmas and this is exactly where I tried eToro for the first time.

What I really liked was the extremely fast registration. Other trading apps often take days, banks even weeks. Here, the entire registration process was over after 10 minutes and everything was verified after 30 minutes. Accordingly, I was able to start on Christmas Eve and copied my first profiles.

Gain 24/7 trading experience instead of hiring banks

In my experience, it is a nice feeling when you can rely on an experienced person for the first time. PS: Yes, there are classic banks that take over the trade for you, but here you have no real-time insights, you get “only” monthly evaluations. In the app, you are live 24/7 if you want.

For the first time I didn’t have to check the news every morning, someone else does that. I just check the portfolio, compare the different traders with each other and optimize every 14 days. That is, I change a few traders, sometimes only assets allocated to individual traders.

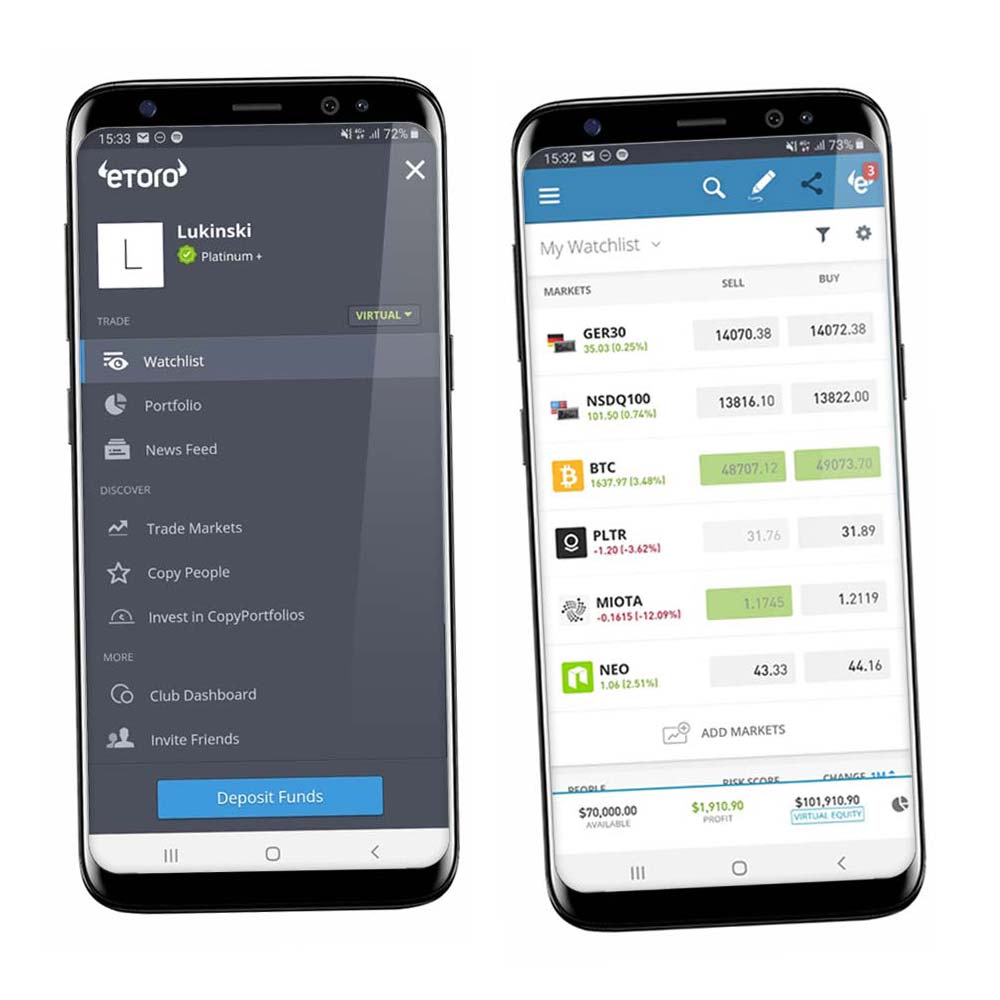

This is what the app looks like (menu and watchlist):

Asset accumulation in history: comparisons

Another big advantage, which I find particularly good in this context, of course, is that you can look at the trader’s asset accumulation in the entire history.

So I can not only look at how the current investment portfolio of the respective trader looks like, I can also look at how the individual months have gone in retrospect. When did the trader achieve returns, when did he or she make losses?

Comparability – The simple and quick overview allows me to compare different traders with each other. So I can easily decide which trader or investment profile I want to copy.

Find a trader: Guidance and overview for beginners

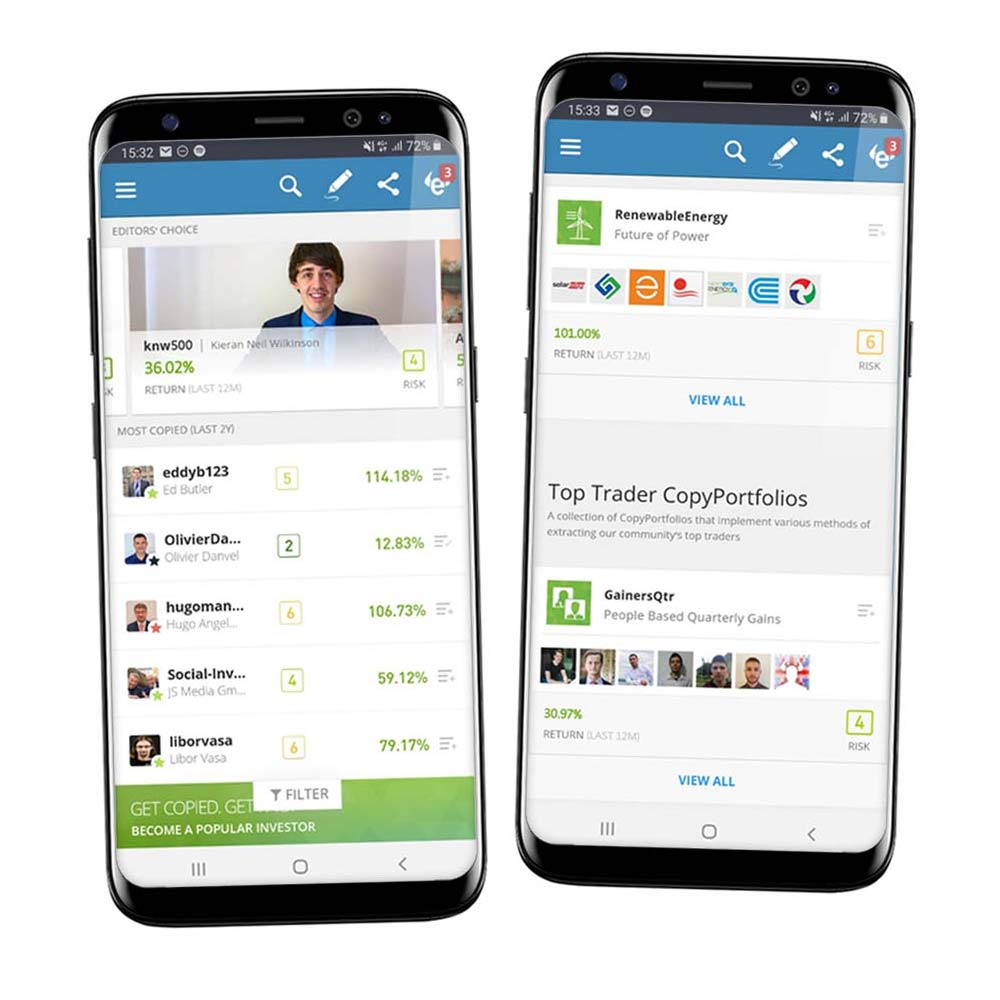

Finding traders – Your very first step is to compare different trailers. As I just described, the overview in eToro is really strong. In the overview you can see the most popular trailers.

Filter – Through the filter function, you can go even deeper. For example, you can search for traders who have a relatively low investment risk, thus a lower return but stable and safer. You can also select traders who have a higher risk, e.g. because they invest in cryptocurrencies or because they trade with leverage. Accordingly, the profits are higher, but so are the losses – be careful!

You can also select individual countries, so that you only follow traders from your home country, for example, who may then also invest in financial products that you know.

This is how the overview of trader profiles looks like:

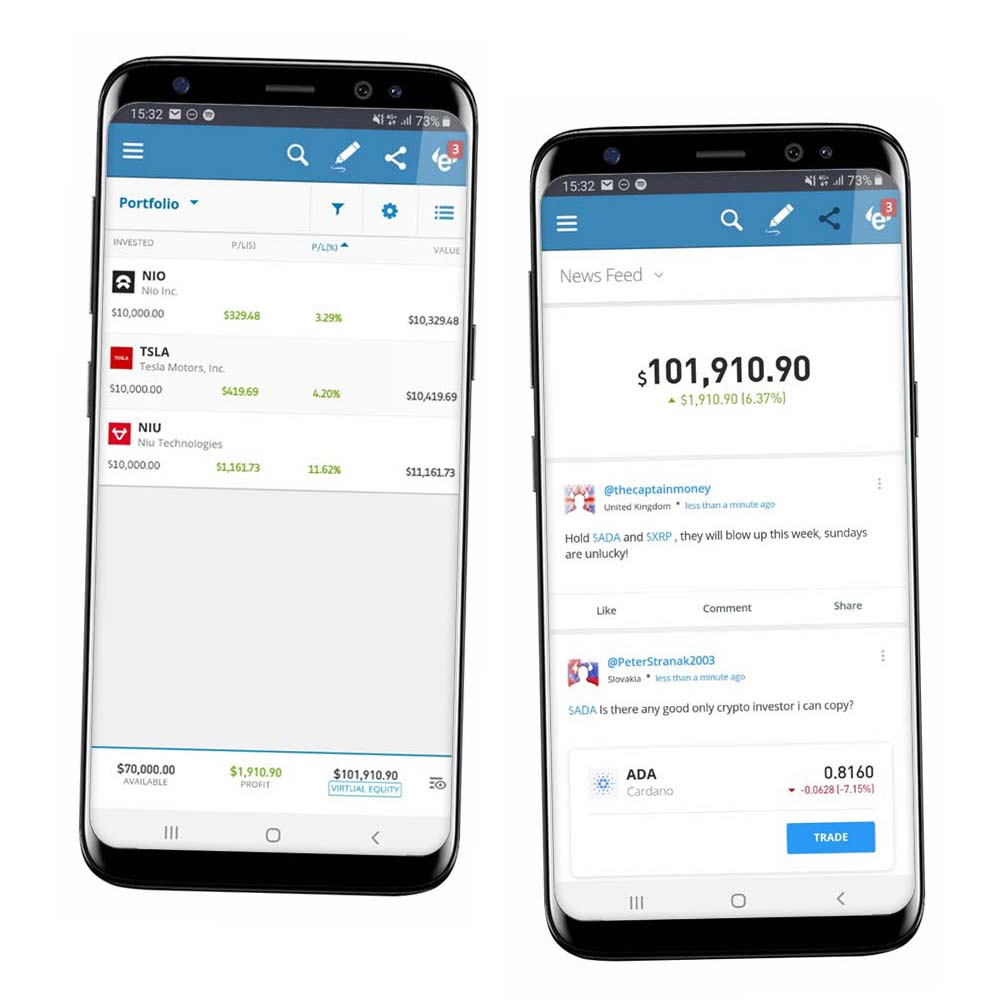

Trade Profile: Investment portfolio, see profits and losses

Within the overview you will then find the individual traders, with their investment portfolio and the history of their trading, that is, profits and losses in retrospect for the individual months and years. If you now open several tabs on your browser, you can easily compare the different traders and make your choice! Tip: Shortcut ” Ctrl + Tab “, or for Mac ” CMD + Tab ” to switch tabs.

Diversify investments – As always in trading financial products, the more diverse your portfolio, the less risky your investment. Accordingly, you should also divide your assets among different traders.

One trader may invest more in the American market, another more in the Asian market and yet another somewhat more speculative also with cryptocurrencies. Through the mix are the default risk of a single product.

Another advantage – Due to the fact that your single product is a trader, your investment portfolio is already broad anyway. Most traders on eToro hold between 10 and 50 financial products. Usually, of course, stocks.

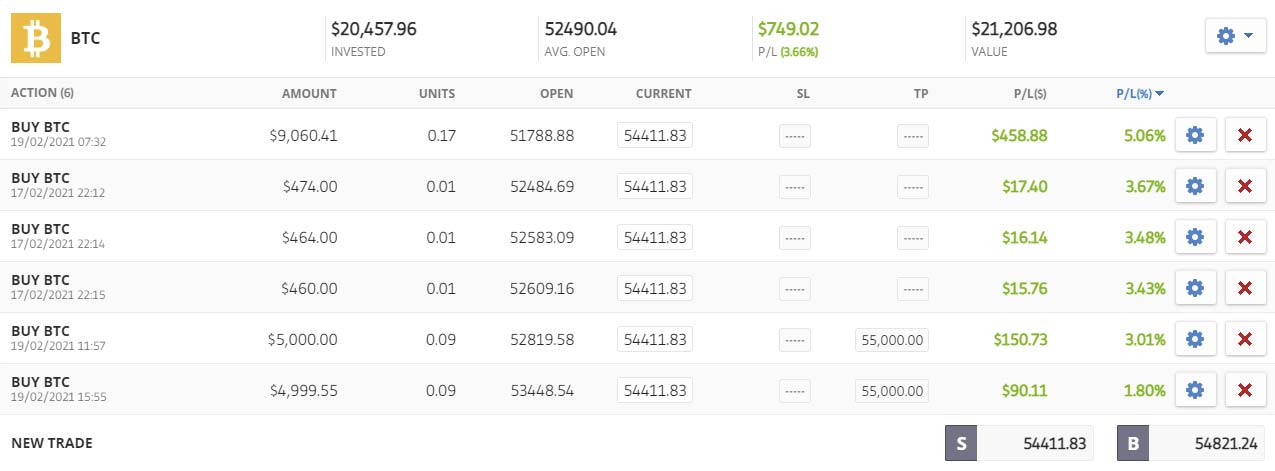

This is how trading works: trader copy

Once you have copied a Trader Portfolio, the individual financial products are automatically bought / sold in the same ratio.

If you now wait a few hours or a few days, you will see that the first values are also sold again. Traders usually do not hold individual financial products for years, but they use ups and downs of the prices to generate additional profits.

So after a few days you will also see the first evaluation of the profits and losses that your trader has told. Since you automatically copy his or her investment portfolio, you have the same profits or losses that the trader has. This way your assets will increase step by step.

Reinvest – Your additional assets that were earned through profits are then reinvested as well. So you trade at some point with 105% of your capital, 110%, 120% and so on. Thus, your assets increase and you can, as described at the beginning, passively actively participate in trading.

Increase profit through asset accumulation

Profit increase through asset accumulation, simply calculated:

- Profit from 100% = 5% | 1,000 Euro = 50 Euro

- Profit from 105% = 5% | 1,050 Euro = 52.50 Euro

- Profit from 110.2% = 5% | 1,102.50 Euro = 55.13 Euro

Capital investment in copying: Overview

The maximum amount you can currently invest in a single trader is 2,000,000 US dollars, equivalent to 1,680,000 euros. You can copy a maximum of 100 profiles per eToro app account. Trades in general are opened from 1 US dollar. Therefore, the minimum amount per trader copy is 200 US dollars, i.e. 168 euros.

In summary:

- Minimum deposit / profile: $200 / €168

- Maximum amount / profile: 2.000.000 $ / 1.680.000 €

- Maximum copies: 100 profiles

Copy functions

If you want to withdraw money from your portfolio, e.g. because you want to invest it, you have several options. You can stop the portfolio of the trader immediately, so that all financial products are closed and you can, depending on stock exchange opening hours, usually within 6 to 12 hours to access your capital. On weekends, of course, it takes longer, due to the exchange opening hours.

If an individual trader still has losses in the portfolio, you also have the option to stop copying only partially.

In the app, you have these options:

- Add Funds

- Remove Funds

- Pause Copy

- Set Copy Stop Loss

- Stop Copying

- Write New Post

- View Chart

Here briefly explained all the functions in copying the trading profiles:

Add Funds / Add money

Here you add additional capital to an existing, copied profile.

Remove Funds / Withdraw Money

With this function you can deduct open amounts (not invested). Usually this is 0.5 – 10% of the invested capital.

Pause Copy / Pause copying

When you stop, all items are immediately closed (sold). If you don’t want that, choose Pause. Now no new trades will be executed. So you could hold the portfolio and sell it yourself, step by step. For example, because you first want to sell only individual items.

Set Copy Stop Loss

Here you determine how much loss you accept. The standard stop loss (SL) is 60%. That means:

- Invested: $10,000

- Depot loss: -$4,000 -> sell

If the individual deposit or copied profile falls below 6,000 US dollars, it is automatically sold. This “protects” you from even higher losses.

Stop Copying / Stop Copying

With “Stop Copying” everything is sold immediately. As described above, the sale takes time depending on which stock exchange which paper is traded on (time zones). Read more about stock exchange opening hours & time zones here.

Write New Post / New Post

Every trader has a profile and a news feed. Like on Facebook, Instagram & Co. With this function you can write new posts, which are then displayed in the trader’s news feed.

View Chart

Here you can see the entire historical course of your investment with profits / losses in a curve.

EToro: Get to know the app

Stocks, ETF, Cryptocurrency (Bitcoin), … Costs, rating + experience – where do we start? Best here! eToro app – trade stocks, ETF, cryptocurrency, in my blog you have already learned a lot about trading.

Lots of questions of course: what app do you trade with, what do I recommend? So today I want to share with you my favorite trading app, eToro. 29.88% asset growth in 12 months, with low risk through “Copy People” and “Copy Portfolios” or up to 127.35% through active trading and trading strategies.

Learn here step by step about the app, fees and much more. Of course, with all the criteria of valuation, costs and all trading options, from stocks to ETF, index fund, currency, cryptocurrency and commodities.

In addition, the ultimate eToro advantage: You can copy successful traders! Keyword “Social Trading”. In the end, you know the app inside out for your first trades. You want to start right away? Start in the browser or get the app: