Crypto Trading: Buy, Invest & Trade Cryptocurrency

Crypto Trading – Make Fast Money with Cryptocurrencies! The world is not that simple! Or is it? With the important trading strategies, can be achieved with cryptocurrencies, as strong returns, as with shares, of course, with higher risk. But how does crypto trading work? Are there differences in trading and risk? Stocks are more speculative than ETFs, cryptocurrency is more speculative than stock trading. So, safe wealth building tends to mean investing in ETFs or stocks. Speculation means higher risk, but at the same time potentially higher profits. As a trader, you have to decide which is more important to you. This is a comprehensive insight for you into crypto trading, with many more links to other crypto topics from me. Good luck with your learning! Buy, invest, hold and sell: Crypto Trading.

Cryptocurrency: What is it? Explanation

The most important thing to get started: cryptocurrency is simply explained by the term “digital currency”. You trade cryptocurrency or digital currency like shares at brokers or online brokers (apps).

The price is determined by demand and supply. Just like in the real world, there is a quantity X of product Y. The more product Y want, the scarcer as the quantity X. Supply, demand. The more people buy a stock or (crypto) currency, the more expensive the price becomes.

Coins are limited. New ones are produced by “mining”, more about that later.

Cryptocurrency: comparison with investment forms

But shares have the advantage that you have a real value behind them. But behind the Bitcoin (and other coins) is no company, no economy, behind digital currency is psychology. Comparable to gold. Theoretically gold has no value, but by us humans measuring value to gold we can trade it. The scarcer the good, the more demand, the higher the price.

In fact, you can compare cryptocurrency more to precious metals like gold or silver. Possibly diamonds as well. Nobody really needs them but everybody wants them.

Cryptocurrency are like diamonds

I find the example of the diamond even more beautiful. Objectively just a stone. But because everyone wants diamonds, they get a value. But diamonds are actually just a piece of carbon, a better piece of coal.

Coin mining through graphics cards:

Is cryptocurrency a currency like dollars and euros!

No.

Cryptocurrency, unlike classic FIAT currencies (US dollar, euro, etc.) is not determined by central banks, but by market mechanism of demand and supply.

Difference to FIAT currencies:

- Crypto price determines supply / demand

- None Central Bank / Committees

- Ergo, no central control through interest rates, money printing, etc.

- No “money printing” possible (mining very costly)

Limitation of coins and blockchain technology

Blockchain technology – Once you trade cryptocurrency, you will automatically hear about blockchain technology. The amount of cryptocurrency is regulated. Simply explained, new coin blocks need to be calculated.

There can be a maximum of 21 million Bitcoins (example). Each block (each calculation task) becomes more complex. Accordingly, fewer and fewer new Bitcoins come onto the market. This creation of blocks is called “mining”. Mining is a complex process, accordingly producing new coins costs a lot of time (computing power, electricity). This makes for a “limited money supply”.

Limited money supply – By limiting the money supply, the typical concept of scarcity of supply prevails here. While cryptocurrencies were still highly speculative at the beginning, they have now arrived in the middle of society. Even international companies like Paypal or Tesla want to accept Bitcoin as a means of payment in the future.

The Bitcoin is currently, so to speak, the leading currency among the cryptocurrencies.

Unsafe, unserious, … ! Bitcoin history and future

Many “old” investors are still afraid of cryptocurrency: unsafe, dubious, … but let’s be honest:

The Bitcoin was invented in 2009. At that time, the coin was available for a few cents. Few predicted the cryptocurrency future back then. Bitcoin, was an absolute “nerd thing”.

I remember the first jump above $1,000 myself, the $8,000 I still remember, as well as the $14,000. Last week it was still at $45,000 and just now bitcoin has jumped to $54,000.

Tonight we will surely see the $55,000 mark and this year we will see the $100,000 mark.

In addition, news from the economy, such as Tesla or Paypal, that the Bitcoin will soon be accepted as a means of payment. News from politics that individual countries are thinking about introducing their own digital currencies.

Meanwhile, digital currencies are on everyone’s lips. Everyone is talking about them and many trade them, just like stocks. Currently, there are about 1400 different cryptocurrencies. However, only a fraction of them reach a trading volume of over $1000 per day.

Want to see all BTC / ETH transactions?

By the way, through the blockchain technology, all transactions can be looked up. In fact, all transactions are stored live in the blockchain.

Here you can see for example the movements of Bitcoin and Ethereum

Everything is set up as a P2P network (peer-to-peer). Data is therefore stored decentrally. All data blocks are linked to that of the predecessor. Within this distributed database, all transactions are actually known!

So the whole thing is a network where cryptography-signed messages are published – technical term: blockchain. You want to take a look at these transactions? Take a look at how individual trades can sell up to 100 Bitcoins and millions of dollars are transferred across the table:

- Bitcoin transactions – live on blockchain.com

- Ethereum transactions – live on blockchain.com

Digital currency as the future?

Due to the pure supply/demand situation, it’s good that we don’t have a digital currency yet, because it could theoretically go almost completely to 0 in seconds. Example: There is a scandal or security breach, a large portion sells, so the price collapses (no regulation), more investors leave the coin. It would be an economic crisis of unprecedented proportions.

But back to investing in cryptocurrencies!

Is there an insider tip?

I would ask, Stephan what is the insider tip? The big secret tip is practice, learn, build knowledge. Get involved with the financial products and with the news.

Crypto Trading? Learn and practice

Tip. In all good trading apps you can also create a “virtual account”. Here you get 100,000 $ play money to practice. Such a virtual account is great, because here you can gain experience, make mistakes and learn without losing money. After all, it’s all about building wealth!

Learn, practice, move on:

Advantages and disadvantages of trading

The key advantages and disadvantages of cryptocurrencies lie in the higher risk that comes with the simultaneous option of higher profits.

Stock exchange opening hours: 24 / 7 buy and sell

One big advantage I really appreciate when trading cryptocurrency, as an entrepreneur, you can do crypto trading 24 hours a day, 7 days a week. Perfect for off times, mornings, nights and just time on the weekends. That’s why more and more individuals are getting into crypto trading, they are earning passive income.

In stock trading, including ETFs and other financial products, you have to follow the individual stock exchange opening hours, from Hong Kong to New York.

Danger: No real countervalue

At the same time, cryptocurrency has the great danger that the fall in the price can be very high. Whereas financial products, like stocks, have a real exchange value, the company, the ideas and patents, the logistics, the products. Digital currency, on the other hand, is 100% determined by supply and demand. So the price can sometimes plunge by 50% or 60% and more.

Benefits of cryptocurrency:

- High profits possible

- No stock exchange opening hours, trading possible seven days a week

Disadvantages of cryptocurrency:

- High losses possible

- No real equivalent value, price losses higher than for shares

Here you see for example the NYSE (New York). All shares traded here can only be bought and sold during the day. The stock exchange is also closed on weekends and American holidays.

NYSE (New York, Wall Street):

Buy cryptocurrency

How do I buy cryptocurrency? How do I invest in cryptocurrency?

Buying cryptocurrency is not difficult. The only hurdle is signing up for an app. Once you have installed a trading app (online broker), you can immediately buy cryptocurrency. The important thing is: always choose brokers without additional fees!

Normal is the margin. As you can read in the trading strategies, you always pay a small surcharge at the broker, from which the platform lives. When you buy cryptocurrency, this margin is 3%.

- Selling price = Current price

- Purchase price = Current price + Margin (3%)

I’m sure you’ve heard the saying, “there’s profit in buying”. It’s the same with trading cryptocurrencies. What strategies there are, where the differences are, how high the risk is, you learn here in the free article on trading strategies.

Sell cryptocurrency

Selling cryptocurrency is just as easy as buying it. Usually you only need two clicks or taps on your smartphone. You always sell cryptocurrency at the market price.

When selling cryptocurrencies, two functions that you can find at any online broker will also help you. More precisely, the Take Profit (TP), which means a targeted profit taking at a certain, positive price and Stop Loss (SL), the automatic sale at a certain negative price value.

- Take Profit (TP): Take profit from price XY $ / %.

- Stop Loss (SL): Stop losses below price XY $ / %.

Take Profit allows you to take targeted profits just before psychological price limits.

A typical example here would be every 10,000 steps in bitcoin. As soon as bitcoin reaches a level of 40,000, 50,000, many traders take profits. Accordingly, the price goes down. If you really want to trade actively, you should definitely deal with TP / SL.

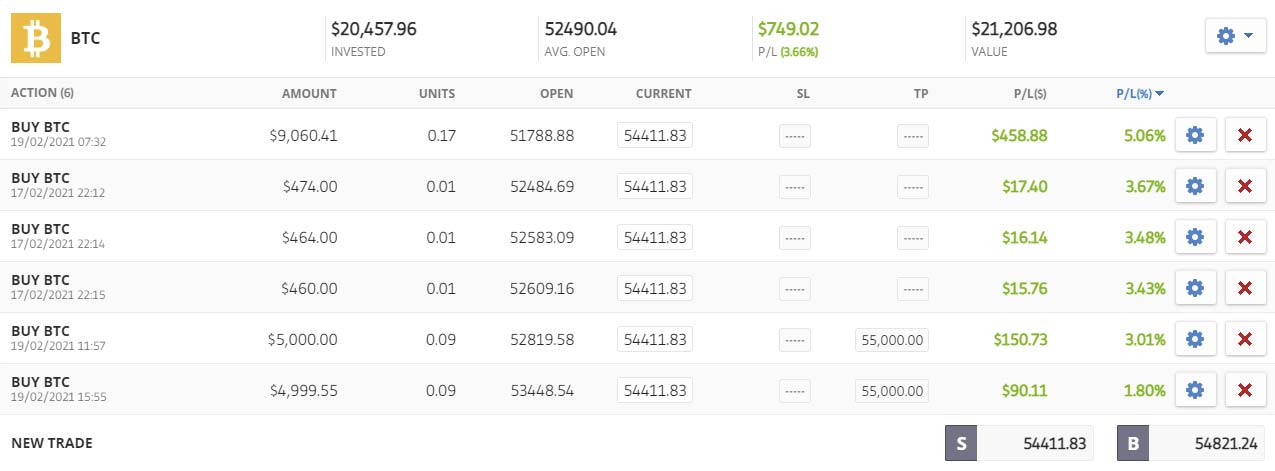

How do I buy / sell? Example

Here is a small example of how I trade cryptocurrency. I trade actively, so use TP / SL in the trade, so I can take price jumps or profits.

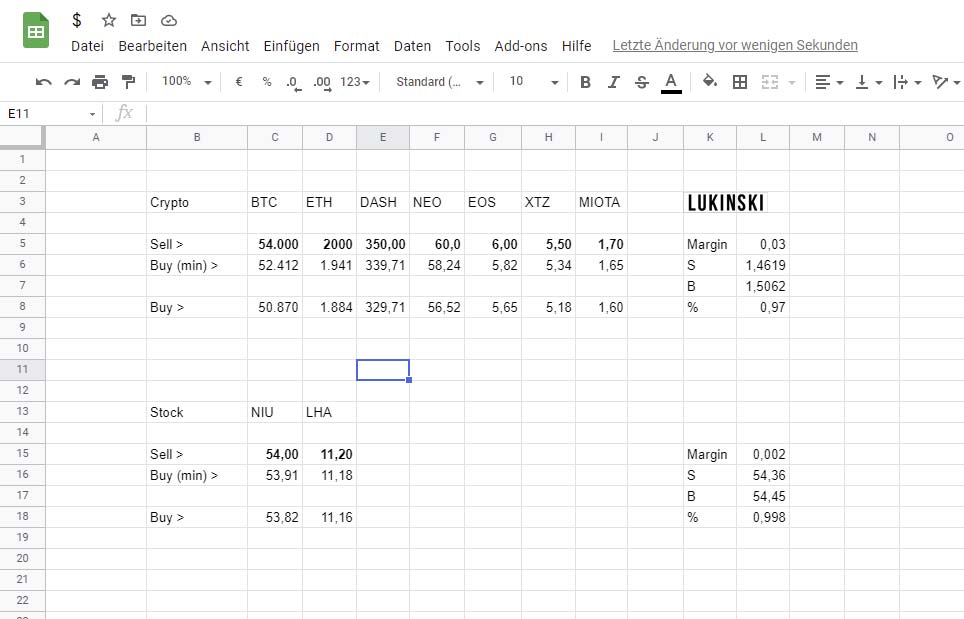

So that I can calculate selling & buying quickly, I made myself a simple spreadsheet. It automatically calculates for me at which point I have to or want to buy again after the price falls at a certain psychological limit. You can also download the table here for free and then use a trading!

Tip: I have also included stocks in the table. With traders like eToro you usually pay a margin of 0.2% (much less than with cryptocurrency).

- Sell / Buy – Table, Download

The table contains:

- Calculation margin sale / purchase for cryptocurrency (% at eToro)

- Calculation margin sale / purchase for shares

- Calculation of lifting effect (spreadsheet 2)

How does the calculation work? Simply enter the target value (market value) for your sale in the “Sell” line. The table automatically calculates at which price you should re-enter. The price value here is realistic, about 6% below the high. That means 2x margin.

In addition, I set up a price alert in the trading app, so I know shortly beforehand and can actively intervene in what’s happening if I want to. As soon as the price high is reached, the price drops and I trigger a new order at a specific, lower price value. I take the value from my table.

Advantage of this crypto trading strategy

The advantage of this trading strategy, I use the falling price, sell and then buy again cheaper. Thus I take the price jump, up to the previous price high, as a profit. Traders who “only” hold, do not take this gap: “Quantum interest”.

Also at this point again the tip, you can learn more about selling cryptocurrency here:

Cryptocurrency Trading Platform Germany

Where can I trade cryptocurrencies? I’d best summarize that point for you quickly. After a lot of practice, training, and time with real trades in all forms, I would summarize the market from trading platforms right now:

- Classic banks, also with online broker and app with fees

- Online broker with fees

- Online broker without fees (my recommendation!)

Traditional banks: custody fees, order fees, …

Traditional banks – house banks do not have the most modern systems. Some do not even have an app. More importantly, the depot registration takes a long time and often the fees are very high. You pay e.g. custody fees, but also order fees, for each individual purchase of financial products. Of course, many are still traditional with your bank and get here shares or ETF savings plans. I would express my recommendations but clearly for online brokers, for those without fees.

Disadvantages:

- Registration takes a long time, mostly contract, verification, everything via mail

- Deposit fees for account management

- Order fees per trade

Tip. Trade with an online broker (browser / app)

Online brokers / apps with fees

Online brokers with fees – Most online brokers have fees, just like banks. However, the fees are usually much lower. The account maintenance fee here is usually not in the triple digits, but maybe only $10 or $20 a year. Many also charge an order fee, usually in the amount of $5, on each individual purchase of securities. Therefore, when choosing your trading platform, make sure that there are no fees other than margin (explanation above).

Tip, always pay attention to this:

- No custody fees

- No order fees

Online Broker Apps / without fees (recommendation)

Online Broker without fees (my recommendation) – The best trading app? The best trading app is the one that costs nothing! So when choosing your trading platform for cryptocurrencies, make sure that you don’t pay any custody fees and no order fees. Especially if you are doing strategies like the high/low trades described earlier. So you would have to pay an additional +$5 with each trade. With 20, 30 trades a day already 100 $, 150 $. Only the margin is what the online broker should earn on the trade.

What do I trade my cryptocurrency with? Read more about mine here:

Cryptocurrencies and rates

As mentioned at the beginning, there are now over 1,400 different digital currencies. Keeping track of them is not that easy! So that you have an overview of which digital currencies are currently interesting, I have a big list and overview for you:

Accordingly, when you buy and sell cryptocurrency, you are no longer just trading bitcoin. You have the choice between different types of investments. Accordingly, you can diversify your investment portfolio, just like in stock trading. For example, you can bet on new coins that cost less than $1! You can also bet on the established coins, such as Bitcoin, Ethereum, Litecoin or Dash.

Popular cryptocurrencies currently include, for example:

- Binance Coin (BNB)

- Bitcoin Cash (BCH)

- Bitcoin (BTC)

- Cardano (ADA)

- Dash

- EOS

- Ethereum

- Ethereum Classic (ETC)

- IOTA (MIOTA)

- Litecoin (LTC)

- NEO

- Ripple (XRP)

- Stellar (XLM)

- Tezos (XTZ)

- TRON (TRX)

- ZCASH (ZEC)

How such a diversification of your crypto investment portfolio can look like, you can see in this article:

Trading strategies: buy, hold and sell

When to invest in cryptocurrency? Which cryptocurrency to invest in? Buying and holding cryptocurrency is the big challenge for many beginners and novices.

The mistake I made is short-term thinking. The price goes down, instead of profit, you make loss and already you sell! Wrong!

Tip: Read more about my trading experiences and mistakes here.

If you already know how to trade stocks, you have a lot of advantages in crypto trading. Because, you already have the peace of mind to hold values. Price fluctuations in the stock market are quite normal and happen every trading day. Sometimes the prices fluctuate more, sometimes less. Important, keep patience.

Just as the share price can fall by 13% today, it can also rise by 13% tomorrow, or perhaps even by 26%, and your loss has already turned into a 100% profit.

Trading cryptocurrency is accordingly like trading stocks, only on the fly.

The downside of crypto trading, you can’t base your information on economic, financial and political news. The market and psychology play a big role. If the price suddenly drops by 10%, many get weak kneed, sell, the price drops further and further. This happens much faster in cryptocurrency trading than in regular stock trading. Here, the strategies are set for a longer term. Want to learn even more about trading strategies? Then be sure to check out this free guide from me.

ETF Cryptocurrencies: Bitcoin to ZCash

Many then ask the question, isn’t there an ETF for cryptocurrencies? If you’ve never heard of “ETF”, here’s a quick explanation!

So-called ETFs (Exchange Traded Funds) bundle several individual stocks into one financial product.

ETF example: Tesla or e-car sector

Instead of 1 product with 100% risk, you have 1 product that contains many individual stocks that minimize the risk of your investment. Instead of “Tesla”, in the example of stock trading, you buy an ETF that deals with electric automobility and contains, for example, in addition to Tesla also values such as Nio (electric cars from China) and Niu (scooters). The risk is distributed.

In the stock market, ETFs are therefore even called ETF savings plans. Trading with ETFs is therefore about solid asset accumulation with little risk. Individual stocks, as well as shares but also cryptocurrencies, can experience strong price fluctuations due to effects, news. If you are not just in front of your trading app and learned of the news, you lose money quickly.

Risk minimisation through diversification

As described, ETFs bundle various individual stocks into one financial product. This has the advantage that you invest simultaneously, for example, in 30, 40 or 50 shares. If a single stock suffers a strong price loss, it only makes up a part of your portfolio. Thus, a 30% price loss becomes only 1, 2% loss, in the portfolio. This low-risk form of trading stocks is what makes ETFs so interesting for asset managers and private wealth accumulation.

Now back to the question:

Is there an ETF for cryptocurrency?

I would like to answer this question with a yes and a no. There are crypto portfolios that resemble an ETF. But I also want to tell you that the risk of crypto portfolios, whether they are colloquially called “ETF” or not, remains high.

Read more here, with comparison bitcoin / crypto portfolio of my current investments:

Buy crypto for small and medium businesses

Speaking of ETFs and relatively safe investments: Doesn’t investing in cryptocurrency then also increasingly make sense for companies?

- Paypal News: Bitcoin is accepted as a means of payment

- Tesla News: Tesla invests 1.5 billion USD in Bitcoin

Just as this article is also for beginners and beginners, mentioned again:

Invest only “play money” in speculative trades!

Especially as entrepreneurs and business owners, a core competence is most likely not the financial products, but in other areas. As an entrepreneur myself, I trade most mornings, nights or weekends – believe me, you don’t have the time for day trading! Between new business, employees, taxes, only invest the money you have left. But if you have profits to spare, crypto trading is an interesting option for your wealth building.

If you look at the performance of stock prices, stock markets in general, over the last few decades, you can see that there are profits to be made over the long term.

Cryptocurrency has now been around since 2009, over a decade. Prices have steadily increased from a few cents to $1, $10, $100, a thousand and maybe soon it will be $100,000. Digital currency is the future. So why not invest some of your profits in cryptocurrency?

Cryptocurrency or stocks? As previously described, stocks have significantly less risk of default. Stocks are not only subject to the pure market mechanisms of demand and supply, they have substantial goodwill behind them.

Here’s the strategy I use at my company:

In regular times, I invest a maximum of 20% in cryptocurrency.

In case of news and expected price increases, my investments in the cryptocurrency portfolio also increase once up to 40%. Such news are e.g. messages from PayPal that the Bitcoin will soon be accepted as a means of payment. Such news also comes from Tesla, which recently invested 1.5 billion dollars in the Bitcoin.

Cryptocurrency future

Which cryptocurrency is the future? Here is another analysis, looking back at the last 12 months and the cryptocurrency list. With all the digital currencies you should have on your radar if you want to buy, hold and sell cryptocurrency. How has digital currency performed over the last 12 months? An analysis: