ETF Cryptocurrencies: Crypto Portfolio (ETF) from BitCoin, DASH, Ethereum & Co.

ETF Cryptocurrencies – A crypto portfolio (ETF) of BitCoin, DASH, Ethereum & Co., is there such a thing? As already described in Crypto Trading, the answer is yes / no! s there are Crypto Portfolios that resemble an ETF. But I also want to tell you that the risk with Crypto Portfolios, whether they are colloquially called “ETF” or not, remains high.

ETF explained: Bundled values

So-called ETFs (Exchange Traded Funds) bundle several individual stocks into one financial product. Instead of 1 product with 100% risk, you have 1 product that contains many individual stocks that minimize the risk of your investment. Instead of “Tesla”, in the example of stock trading, you buy an ETF that deals with electric automobility and contains, for example, in addition to Tesla, stocks such as Nio (electric cars from China) and Niu (scooters). The risk is distributed.

“Ready-made” portfolio or design your own crypto portfolio?

Basically, you have two options. Option number 1: You invest in a ready-made crypto portfolio that is created and managed by an online broker. That is, you invest equity and then wait and see what happens. Option number 2: You create your own crypto portfolio and decide for yourself how much you want to invest in different digital currencies.

Let’s look at the first, simple option first.

Buy “ready-made” Crypto Portfolio

I myself trade with eToro. I have already described the advantages of the trading app many times. Fast registration, no custody fees, no order fees.

In trading apps like eToro, for example, you can get or invest in different “crypto portfolios”.

The advantage is that trading – buying, holding, and selling individual positions – is handled by another person, just as it is with typical ETFs, which consist of stocks and are managed by a company or your broker. Here, it’s similar. In my example, eToro provides several “Crypto Portfolios”. I can then invest with 2 clicks.

Another advantage, with such managed portfolios you have little work.

These crypto portfolios then include a certain number of cryptocurrencies. For example, you can invest in the two most successful cryptocurrencies, Bitcoin and Ethereum, or in a mix of 15 cryptocurrencies.

Comparison: Bitcoin (single) and Crypto Portfolio

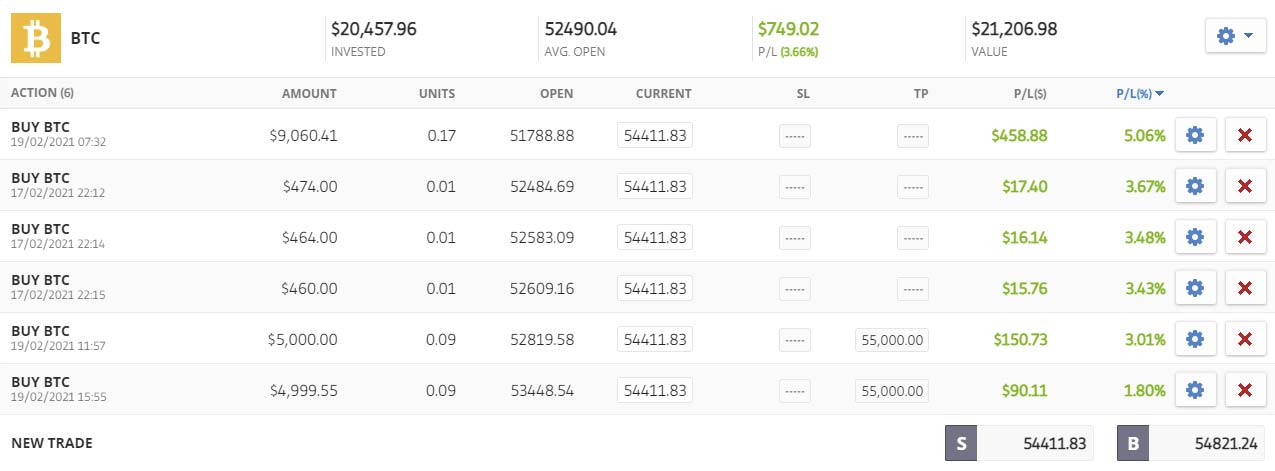

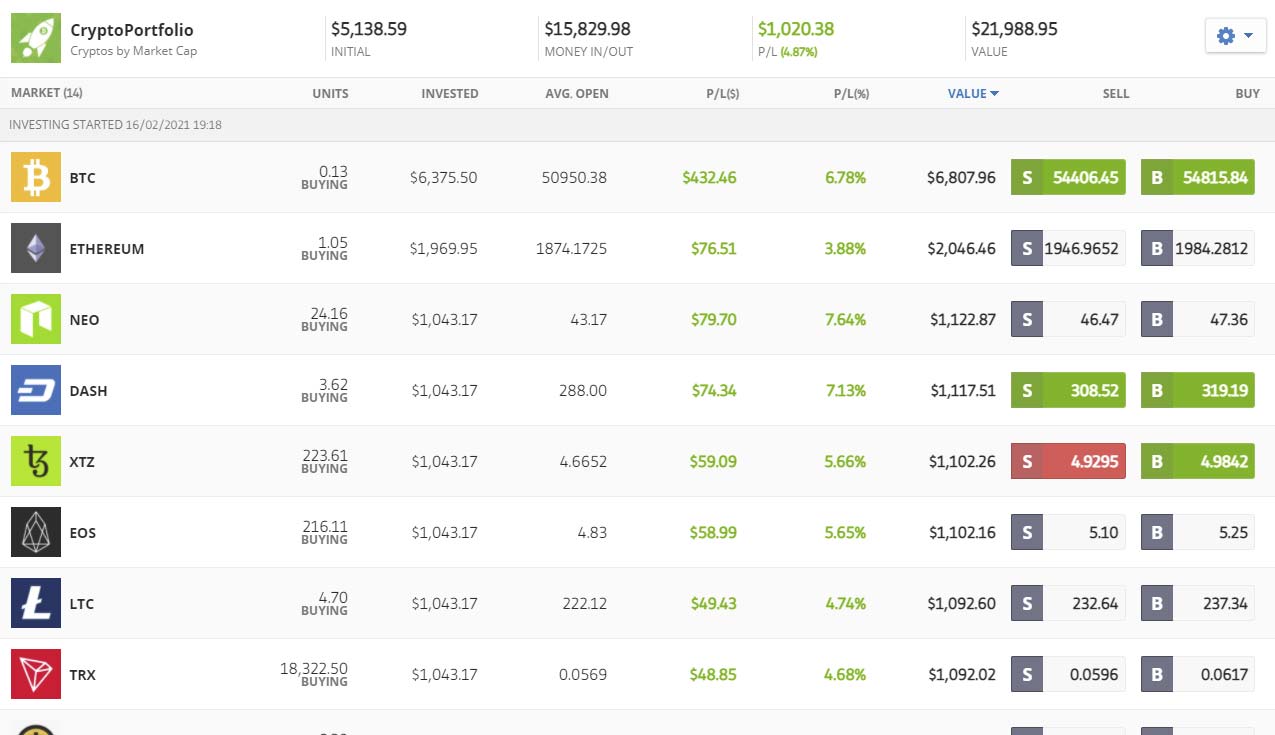

Here I have made two screenshots for you. In screenshot 1 you see Bitcoin individually. In screenshot 2 you see a finished product of the broker called “Crypto Portfolio”.

Bitcoin single (investment dependent on BTC)

Here you can see my purchases from 17.02. to 19.02. – The advantage: I have this one cryptocurrency exactly in view. With tools like Google Alert, I can be informed about news at any time. The trading app itself also offers a “price alert” so I can react quickly to changes. The downside – “all my money” is in one investment.

Importantly, always think risk! This is only a snapshot and not an automatism

Crypto Portfolio (Distribution on 10+ Cryptos)

Here you can see my crypto portfolio at the exact same time. The advantage – My investments are spread across different digital currencies. If one loses value, it hopefully only affects that single asset and the rest of the investment remains unaffected. The disadvantage – Keeping track of all the rates is time consuming. Therefore, it is worth considering such a “cryptocurrency ETF”. Here, as mentioned, purchases and sales are made by the broker.

The risk of these crypto portfolios is high, but so is the potential profit. The values you see above were generated in less than 48 hours. A big driver in this trend is of course always Bitcoin, but also other values like Ethereum,

A small reminder of the risk: such a crypto ETF does not offer the same security as a regular ETF from stocks. This is because the individual stocks themselves are subject to such large fluctuations.

Crypto ETF: Create your own investment portfolio

Once you’ve gained a bit of experience in crypto trading, you can also build your own cryptocurrency portfolio.

Caution: Course correlations at Crypto

But then it’s important that you stick with it. Unlike stocks, cryptocurrencies are still very close to each other in their price. If, for example, the Bitcoin sinks, many other cryptocurrencies usually go down with it. This is not always the case, but it is often the case. It’s quite different with stocks, imagine Mercedes sinking in value, that would have no effect whatsoever on McDonald’s stock. However, if a central currency drops again Bitcoin or Ethereum, many of the smaller stocks will drop with it. If a value is sold frequently (by active traders), this can also have a negative effect on the overall psychology in the market (private individuals).

As already described in the article on buying cryptocurrency, cryptocurrency is subject to the pure market principle of demand and supply. There is no overriding, regulating body that defines the price or can readjust it, e.g. by printing money, interest rates and other instruments.

Create your own crypto portfolio

Off of that, creating your own “crypto ETF,” if that’s what you want to call it, is relatively simple. You need to look at the different stocks, then consider which stocks do you want to include in your portfolio? Additionally, ask yourself which stocks are the most relevant and should make up what percentage of the portfolio?

- What stocks do you want to take in your portfolio?

- What are the relevant stocks and should they make up what proportion of the portfolio?

Step 1: Important cryptocurrencies

The first step, as I said, is to make yourself a market overview. What are the important cryptocurrencies? So that you don’t spend days on the internet, I have summarized the most important cryptocurrencies in an overview for you.

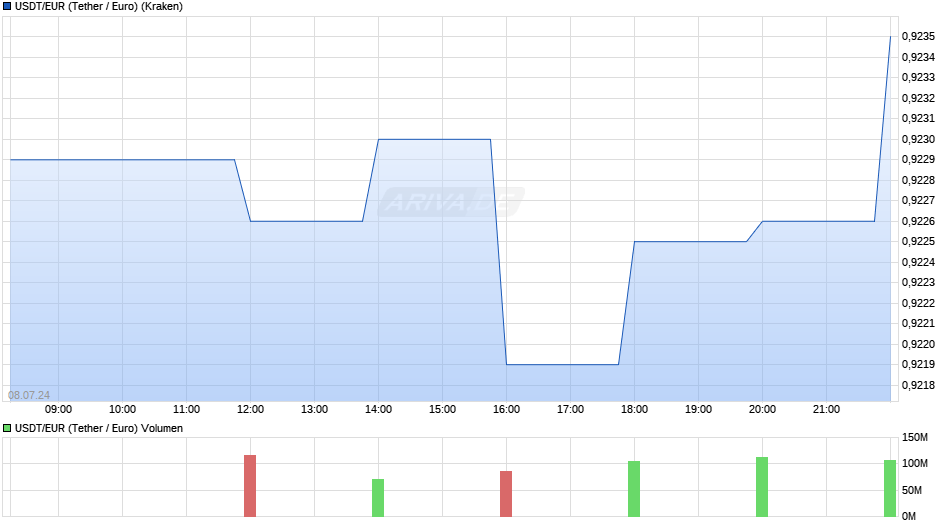

Here you can find various important digital currencies. The popular cryptocurrencies currently include e.g.:

- Binance Coin (BNB)

- Bitcoin Cash (BCH)

- Bitcoin (BTC)

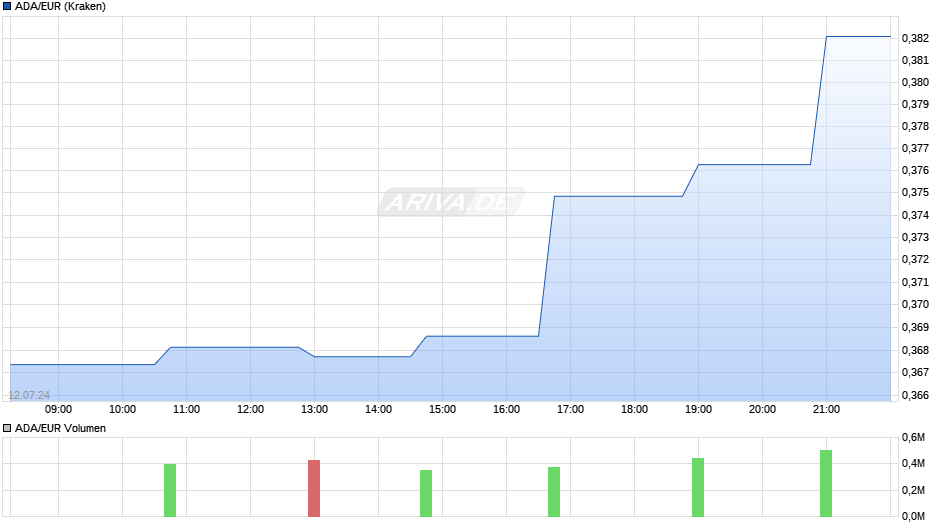

- Cardano (ADA)

- Dash

- EOS

- Ethereum

- Ethereum Classic (ETC)

- IOTA (MIOTA)

- Litecoin (LTC)

- NEO

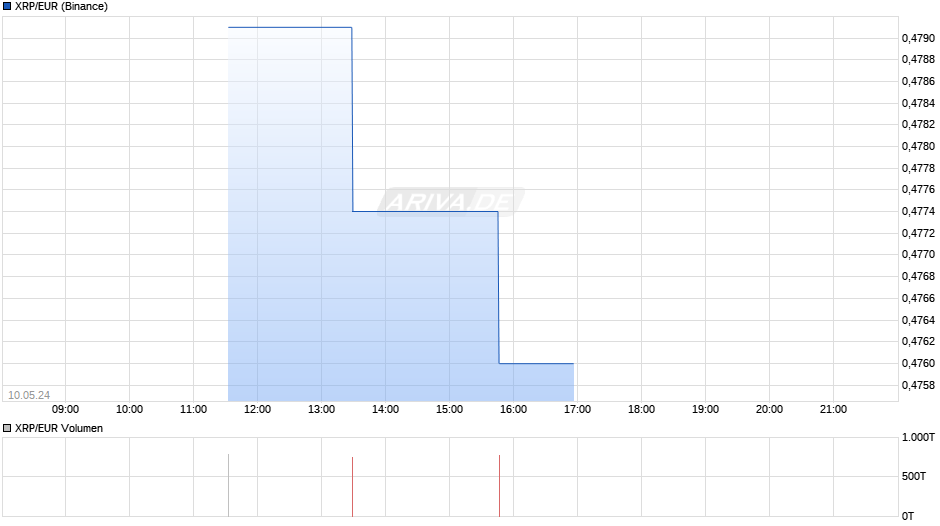

- Ripple (XRP)

- Stellar (XLM)

- Tezos (XTZ)

- TRON (TRX)

- ZCASH (ZEC)

Do your research, talk to friends and acquaintances who trade cryptocurrencies themselves and about having virtual accounts with online brokers. Find out which mix currently delivers the best performance.

If you want your own created ETF to end up with 15 currencies, you need to think about the allocation of your investment. In my portfolio, I have identified 3 cryptocurrencies, of which I have bought a double-digit percentage of each. The remaining 12 currencies are in the single digits.

- A Cryptocurrencies: 3x at 10-20%.

- B Cryptocurrencies:

Under “B Cryptocurrencies” I see mostly new and cheap coins, currently for example Neo. The portfolio then looks like the screenshot above, here again:

Crypto Trading: Learn to trade

Crypto Trading: Make quick money with cryptocurrencies! The world is not that simple! Or is it? With the important trading strategies, can be achieved with cryptocurrencies, as strong returns, as with shares, of course, with higher risk. But how does crypto trading work? Are there differences in trading and risk? Stocks are more speculative than ETFs, cryptocurrency is more speculative than stock trading. So, safe wealth building tends to mean investing in ETFs or stocks. Speculation means higher risk, but at the same time potentially higher profits. As a trader, you have to decide which is more important to you. This is a comprehensive insight for you into crypto trading, with many more links to other crypto topics from me. Good luck with your learning! Buy, invest, hold and sell: