Inherited house – own use, rent or sell?

A house is a “big” inheritance, facing a large amount of money and with responsibilities. In openly communicating families, you as the heir do not have to consider whether you should accept the house or disclaim the inheritance. If you do not know whether the house is encumbered with a major land charge or mortgage and perhaps needs extensive renovation, you should definitely obtain more detailed information before accepting the inheritance. Especially in the case of older houses, for example your parents’ house or your grandparents’ property, checking the actual circumstances can save you from financial problems.

What happens to the house? Your options when inheriting real estate

If you are the sole heir to a house, you can decide entirely for yourself and according to your wishes. It is possible to move into the inherited property yourself. Renting is also possible if you already own a house and inherit a property that is rentable without major maintenance costs due to its condition.

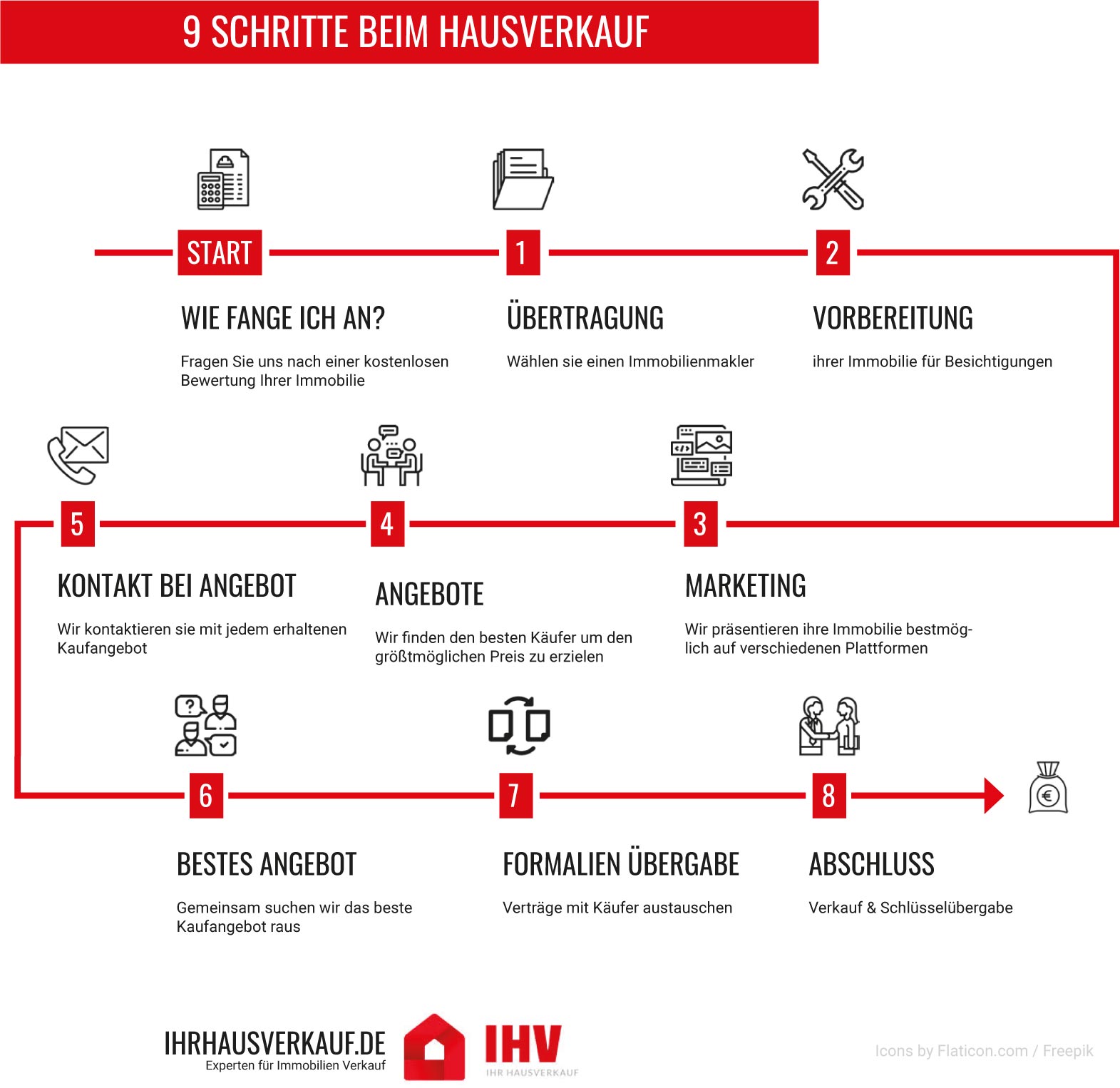

The third most common procedure with an inherited house is to sell it. Before you decide, you should generally know the market value and whether the property is unencumbered or encumbered with liabilities that you have also inherited. In the case of a house with a land charge, for example, it may be worthwhile to favour the sale and in this way pay off all liabilities to the bank.

Speculation tax on inheritance

You should also consider the tax aspects. If the house was owned by the deceased for less than 10 years, you may be liable for speculation tax. If you use the property yourself, you do not pay this tax. On the other hand, if you sell the property, you will receive a demand for payment from the tax office and must expect the financial burden of the speculation tax to be enormous. If you are a co-heir and the house is to be sold as part of a community of heirs , you need to take note of a few special features.

More information about inheritance:

More information about inheritance:

Inheritance settlement

Properties inherited in community pose a particular difficulty when selling. Within the framework of a community of heirs, there are several owners in the land register. This circumstance has a detrimental effect on the interest of potential buyers and makes the sale process more difficult. There is a solution to simplify the settlement and at the same time provide for a clear guideline of all heirs with equal rights. The settlement of an estate refers to the dissolution of a community of heirs, which is carried out on the basis of clear contractual regulations and is not bound by any particular form. Everything you need to know about inheritance settlement.

Community of heirs

From practice it is known that a community of heirs rather rarely agree. But from the disagreement and open disputes in relation to a real estate inheritance arise losses that you can avoid with prudence. Avoid conflicts about the estate by consulting an estate agent and finding the best way with support. If the will does not provide otherwise, all co-heirs are equally entitled and obliged. This means that a sale is often the best solution and gives you the opportunity to divide the proceeds of the estate between all the co-heirs, thus avoiding the problem of an inheritance dispute. Learn more about the community of heirs.

Inheritance tax

For many heirs, grief, joy and sorrow are closely linked. When you inherit a house, this process is always linked to a painful, emotional loss. After some time, a slight joy spreads and you realize that you are a homeowner. At the same time comes the worry that the tax office will claim inheritance tax from you and you will only be able to pay this amount if you sell the house. You have an exemption amount, below which there is generally no inheritance tax. The amount of this allowance is based on your degree of relationship to the deceased. Spouses can inherit real estate tax-free up to 500,000 euros, children up to 400,000 euros. To ensure that you do not pay speculation tax, you should consider whether you would like to live in the inherited house yourself if it was acquired less than 10 years ago. Everything about inheritance tax.