Wealth building: Real estate, stocks, cryptocurrency … ?! Capital accumulation with 20, 30, 40 years – tips

Wealth accumulation – When does it make sense to start building wealth through strategically intelligent investment? At 20, 30, 40 or even at 50? Is there a simple formula or tips for investing with good returns? What about risk, depending on the type of investment? Here’s an in-depth look at wealth building, for beginners. Without equity and with little equity. From the principle of effective trading (saving), calculation examples, investment impulses and first tips.

Planning for the long term: strategy for asset accumulation

Long-term wealth accumulation does not start when assets are needed in a timely manner. That means, for example, shortly before retirement or shortly before a decision when money “must” be spent. For example at the end of the year or if it concerns larger investments, also before elections, for example the federal election (up-to-date with donation / WEG establishment). But – we want to stay at the very beginning.

Wealth accumulation at 20, 30, 40, 50 years?

When should you start building wealth? When you start building up assets does not depend on your age. What is important is that you start “as early as possible” to deal with the matter of capital accumulation. Every euro you have available for investment can generate new profits. The profits can in turn be reinvested and so the added value, the return factor of a single euro, is already significantly greater. The longer your money can “work”, the better. As can be seen in the calculation example (later),

every euro doubles, every 10 years, with a return of only 10% p.a. (per anno = per year)

This way your assets grow, more and more equity can be used for investment.

Whether 20 years, 30, 40, 50 … the important thing is: start!

Comparison: Wealth accumulation by age

In this comparison, we assume an investment of 50,000 euros. Here you can see the return up to the age of 60, at 10% p.a.:

- 20 years > 1,870,217 Euro at age 60

- 30 years > 721,049 Euro at age 60

- 40 years > 277,995 euros at age 60

- 50 years > 107,179 Euro with 60 years

You see, the sooner you start, the better.

Time is money!

Investment forms and age – Age is also irrelevant when it comes to choosing the right investment form. Whether quick investments, as with shares or long-term investments, as with real estate as an investment. An overview of investment forms can be found here, for example, list: Capital investments (external, magazine). The basis is the amount of your equity and the question, which investment can I afford?

How does building wealth work?

First of all, there is one golden rule that you have to live with:

Much helps much, who has something, much or even very much capital, is in the advantage

Why? Wealthy investors, for example, can afford tax advisors who also take care of tax avoidance. So while you’re paying capital gains tax, they’re using loopholes in the law to avoid tax. Which is perfectly legal. If you know how to save taxes, you should use your knowledge – more on that later, too. So we hold:

Money helps a lot: equity / return comparison

Your goal is:

Wealth creation

Why “more money is good”, you can see here. Capital only multiplies slowly. Let’s calculate a small, real return that you earn annually with your investment.

Example 100,000 Euro equity – Let’s say you generate a return of 10% per year, whether with real estate (equity min. ~ 20,000 Euro, why you will learn in a moment [leverage effect]) or an ETF fund of various stocks (equity from 100 Euro, example solar industry), then you increase your capital from:

- Invested: 100.000 Euro

- Return on investment: 10,000 euros

- Equity capital (new): 110,000 Euro

Example 10,000 euros equity – If you approach wealth accumulation on a smaller scale, for example, through a portfolio of cryptocurrency, stocks or ETF, with 10,000 euros, you make accordingly 1,000 euros plus.

- Invested: 10.000 Euro

- Yield: 1,000 euros

- Equity capital (new): 11,000 Euro

Make money “just” work

So if you “only” let money work, you need a lot of money so that you can live on it, so to speak without working, as passive income through “interest”. With “only” 10,000 euros, you would need 40 years to come to 50,000 euros of equity. With a stable 10% annual return.

Example table:

And … then come the taxes

Profits and taxation – Another disadvantage for those who have little equity: Taxes. Not even considered, the capital gains tax, each at 25% on the capital gains. Accordingly, the return on 10% real, only 7.5%, so after tax.

Large investors have a decisive advantage, they can afford tax advisors who know how to avoid taxes through company constructions (such as family trusts) and other refinements, e.g. gifts within families.

So you see:

Wealth accumulation needs equity capital, ideally 100,000 euros and more, so that it is “fun”; but it is also important: If you have less available, see this sum of 100,000 euros equity capital as the first goal and incentive!

Why? If you want to invest in real estate at some point – which all large investors do – you need capital, for example for the purchase, but also for renovations that are pending.

Now you know the starting situation, let’s move on to the tools (knowledge) you need.

Leverage effect and debt capital

That’s why it’s so important to learn a few initial mechanics and levers. First:

Borrowed capital (loans) is part of the business

Leveraged finance, real estate and similar transactions are the means of choice when equity (through debt) is to be increased.

Through this leverage, you could buy a condo worth 1 million, rent it out afterwards, and only have to put up 100,000 to 200,000 euros of equity to buy the property.

As a rule, you need (10 to) 20% equity for the first property.

It is no different with shares and stock market transactions, a certain proportion must always be presented as collateral when you trade with leverage. The broker lends you money for your investment. The bank lends you money for your real estate investment. As I said, leverage (loans) is part of the deal.

Your return basis (e.g. from renting) is now 1,000,000 euros, instead of “only” 100,000 euros.

Here, large investors have another advantage, once there are enough asset shares, the financing game turns around. Suddenly you no longer have to go to the bank and ask for financing, banks approach you to realize project with them. It just comes down to creditworthiness and your assets.

Conversely, for all beginners, be patient and focus on a long-term strategy to build wealth!

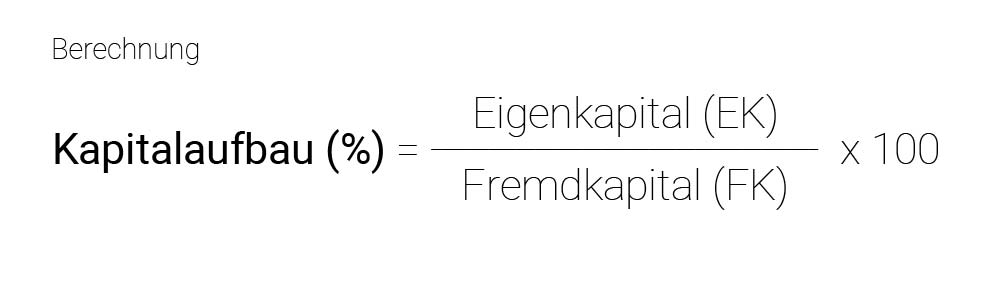

Formula: Excursus from business administration

Of course, there is no exact formula for safely building up your assets. For the sake of completeness, however, it should be mentioned that there is a formula for return on equity from classical business studies, which you can use to compare different periods (month, quarter or year), for example.

After the formula come the tips!

Tips: Save, invest smart, diversify

- Saving: Earning” money without working

- Invest (in yourself) instead of spending money

- Spreading investments: minimising loss risk

Saving: Earning” money without working

So the key is, what have you already read out at the beginning, think long term! It starts very simple. Quick times to Starbucks, luxury hotel on vacation, always, immediately the latest smartphone model.

The ultimate, first tip, especially for beginners: saving makes for more wealth, always.

Whether it’s Starbucks coffee for those with almost no equity or the “superfluous” boat (with subsequent costs) for those who are already wealthy. Saving is essential when building wealth.

In order to increase your equity, cut out unnecessary costs, saving is the order of the day! A quick example: for entrepreneurs who, for example, do not have to adhere to fixed working hours, should take advantage of the off-season when booking travel, already the holiday costs 15% – 30% less. But also think about taxes, don’t avoid the issue! Tax allowances are cash money that you get back at the end of the year.

On a small scale in the case of conversion costs that can be deducted in the tax return, on a large scale, for example, 500,000 euros in tax-free allowances when setting up a family foundation (saving gift tax).

From saving money to taxes, there’s a lot you can do here, without any new hassle.

So don’t leave your finances to chance, plan actively, for your own future and as retirement savings.

Invest (in yourself) instead of spending money

Always invest in yourself! Simply put, an expensive car as prestige, perhaps “good” for the personal ego, depending on how you look at it, but bad for the balance sheet when it comes to building wealth. On the other hand, if you spend your money on further education, whether it’s mechatronics or auto industry design, then it’s money well spent. Because it will multiply as your performance increases.

Education is important as a progression, as in the example of a web designer furthering his education in auto industry design, to the topic of taxes, as mentioned above.

Spreading investments: minimising loss risk

Another important insight, do not invest in a single “channel”. The more diversified your investments, the lower the risk of failure of individual stocks. For example, let’s say you bet everything on the stock of an electric car manufacturer. Suddenly there are multiple, unforeseen incidents, perhaps even fatalities on the road, negative press. The stock price may now go on a long-term slide that may take months or years to recover.

Should you need to access your reserves within this period (price low), this would only be possible if you accept a high price loss.

That’s why you diversify your investments:

- Equities, better ETF (bundled equity securities); possibly a small share of crypto

- Precious metals like gold

- Real estate as an investment

That was a first, small insight. Now let’s go deeper into practice and start with saving:

Invest money and build assets

- Wealth through savings: Without and with equity capital

- Wealth accumulation on the stock market: Alternative

- Shares and ETFs

- Cryptocurrency

Wealth through savings: Without and with equity capital

Those who are still at the very beginning in terms of wealth accumulation have little or no equity capital available. Accordingly, we come back to one of the most important rules, reduce costs. The less money you have to spend, the more remains in your pocket to reinvest the money.

Our free guide offers a very detailed basis. From everyday household, to shopping, to saving on travel. Taxes, water, electricity and much more!

Read numerous tips on how to save money here:

Wealth accumulation on the stock market: Alternative

For many, the easiest way to get started is the stock market. Today, through apps like eToro, you can participate in stock market trading within minutes, whether stocks, currencies, ETF or

Shares and ETFs

Comparatively little risk, in relation to investments such as cryptocurrencies but also currencies, offer shares and even less risk, bundled share packages, so-called ETF. But even within individual stocks or sectors, the risks differ. If you look at the largest real estate stocks, for example, you can see the steady growth over the past years and decades, and thus also the dividends for investors, as well as their returns when selling the shares.

Cryptocurrency

Cryptocurrencies may sound like a classic currency (FIAT currency) at first, but in principle it behaves more like the stock market, only without the equivalent value of the company. This is because in currency trading, as you will learn in a moment, you are speculating in the form of currency pairs, or the news and information behind the economic/political systems that make up the currency in question.

Cryptocurrencies are more of a mass phenomenon. The more who believe in the increase in value or even the stability of value, the more will invest. The fewer believe in it, the fewer will invest. Behind the product is no company, accordingly, the price can fall far overnight, even without negative news.

Where there is high risk, there are also high potential profits. Accordingly, the trade with cryptocurrencies attracts a lot, especially because you can already invest with a few euros or dollars. So even small investors can get started with 10, 100 or 1000 euros or dollars.

FIAT currency (euro, dollar, etc.) – digression

Here’s a little digression, if you’re interested in currency trading, here’s another informative article that summarizes all the material on Forex.

Wealth accumulation with real estate

Less risk, long-term thinking – buying real estate is the name of the game when it comes to solid, sustainable forms of investment.

Advantages, requirements and location

Building wealth through real estate begins in advance, with the considerations and planning for the purchase of real estate.

With real estate, you have various advantages, for example, tenants and the state take over a large part of the monthly costs. You only have to make sure that you always have sufficient capital available, for example for renovation, refurbishment and vacancy (more common in C-locations).

Real estate, whether condominium, house or apartment building, in A-location and B-location, are a safe bank. So the very first step is always, the first property. Learn more about the topic here:

- Buy property

- Just like buying a house

- Buy a condominium

Residential, commercial, owner-occupied or rental

But it is not done with the purchase, now comes the question of owner-occupation or renting? Here quite clearly renting! With the question residential property or commercial property, quite clearly residential property. In many inner cities commercial properties are empty. The new renting is therefore clearly more difficult.

Let’s continue with the topic of taxes. What taxes do you face when you buy a condo or a house? The topic of taxes can go on and on. A tax consultant can provide the right impulses. As a rule, however, taxes are a matter for the boss and are therefore subject to your personal planning, in consultation with the tax advisor.

Example: Speculation tax on resale

One easy-to-remember type of tax, for example, is the speculation tax. It states that real estate can be sold on tax-free after 10 years. So if you hold your property for ten years and then sell it, you are exempt from speculation tax. If you only own a condominium and don’t know about it, sell the condominium after nine years, you will learn about speculation tax for the first time. Accordingly, again the reverse: you are the best organizer for your wealth accumulation!

Accordingly, wealth accumulation with real estate is only possible if you gradually expand your portfolio. Wealth accumulation with the peculiarities, is not enough to build a solid foundation for old age. Ideally, you buy a property and rent it out.

So that you already have a little insight into how taxes can be avoided, for example through certain legal forms / constructs, here are two examples. Whenever it is no longer just about individual properties, but perhaps even about 50, 100, 500 or even 5,000 residential units, you need other constructs than the typical, individual GmbH. If you want to look a little deeper into real estate, investments and taxes, here are two more good examples of what is possible when you eventually get to the point that you have “made it”.

Typically for families, especially to pass on wealth to the next generation, but also to be able to pass on profits, in part, tax free, many become the family foundation.

Family foundation – example

In very simple terms: If you own a lot of real estate, you can set up a family foundation. The advantage: With a family foundation you pay only 15% corporate income tax on the rental of real estate and capital gains are tax-free (after the speculation period). It gets even better, for example at incorporation. When transferring assets upon formation, up to 500,000 euros can be transferred to the beneficiary of the foundation tax-free (free of gift tax) (tax-free amount).

It gets even bigger later, much, much later in asset management.

Asset management – example

Wealth management is also called the investment of the rich. The fact is that investing with asset managers is only profitable above a certain amount and is not a sensible option for small investors. How exactly do asset managers work and when does it make sense to let someone else manage your money? The topic of asset management is very multi-faceted and is only worthwhile for certain people. Especially for institutional investors, such as insurance companies, the investment is worthwhile.