Selling an apartment building: Determine price, taxes & tenants + speculation tax

Selling apartment house 2025 – Fully rented or with vacancy, the sale of apartment houses (also rental house / apartment building) is more special, but also more lucrative, you evaluate everything from the types of apartments, to the land. It becomes more special when selling old apartment buildings, with and without real estate agents. But let’s start step by step, with the procedure in the sale and in advance with the 3 most important questions for first-time sellers. After that you will learn more about renovation, appreciation and of course taxes when selling real estate.

Sell apartment house 2025: Step by step

First, let’s start with the 3 most common questions for those selling for the first time:

- How much is your apartment building worth?

- With or without a real estate agent?

- Sell publicly or discreetly?

Then you will learn all 18 steps of the sale!

How much is your apartment building worth?

Berlin, Hamburg, Munich, Cologne, Düsseldorf, Frankfurt and Germany-wide, there are many questions to answer. The best answer is to have an expert on your side for real estate valuation. If you want to sell your apartment building, then it comes down to one thing: An informed, market-oriented, realistic purchase price. The type of property determines the valuation method used to determine the market value. There are three standardized valuation methods for determining the market value of real estate: the comparative value method, the asset value method and the capitalized earnings value method. As a rule, at least two of these methods are used simultaneously.

- Comparative value method

- Income capitalization approach

- Real value method

- Residual procedure

- Determination of the mortgage lending value

The central questions of property owners: What is my property worth? How do you calculate the value of an apartment building? How does the tax office determine the value of a house? Who determines the market value of a property? How does the bank value a property? In order to give you a first impression of the complexity surrounding location, market value, comparative properties, building fabric & Co. we have written this guide on the subject of valuing multi-family houses for you.

Sell with or without a broker?

You must not underestimate the preparation time. Be realistic and honest with yourself, for example, about the possible backlog of renovations. On top of all the work on the condominium or house, there are all the preparations for the sale.

Over 70% sell with professional support from the broker. From the appraisal to the creation of the exposé, to the customer approach and the sales phase, months pass without market knowledge. In all areas, the location is the most important factor, not only in the sale of multi-family houses. Mistakes in real estate sales are quickly made, especially mistakes in the sale of larger properties such as apartment buildings.

To the question with: “Sell with or without a broker?” comes the question:

Sell On Market or Off Market?

Off Market – An off market sale means your real estate sale will never be publicly visible. Your apartment building will only be recommended to an internal, solvent group of buyers with an ideal constellation. Off Market sales are especially claimed by prominent persons who want to keep the sale as well as address, photos and much more secret. Private persons also make use of the service, for example if the family should not find out about the upcoming sale or the neighborhood. Your advantage: No one will find out about the sale.

On Market – With On Market sales, your multifamily property is presented by the broker through the usual marketing channels. You probably know the typical marketing channels:

- Advertisement display at the broker’s office

- Regional newspaper advertisements

- Supraregional real estate portals

- Classifieds portals like Ebay

So to the usual 18 step process, +1 question is added for you:

Sell On Market or Off Market?

To find good off market real estate agents, you should pay particular attention to references, properties that have been sold. You can often find these on the real estate agents’ websites. So it pays to take a closer look at the website of the real estate agent instead of just going to “Contact”.

18 steps to the sale: checklist MFH

Procedure, costs and tips – all this in one big free article for land, apartment, house, villa, apartment building. Learn how to sell a property, step by step: sell property.

All 18 steps in 3 phases:

- Preparation: prepare house and sale

- Financial planning and timing of sale

- Hire real estate agent

- Records and documents

- Increase real estate value

- Determine offer price

- Create exposé

- Sales phase: market the house and find buyers

- Market real estate

- Contact with prospective buyers

- Filter and select prospective buyers

- Credit check

- Viewing dates

- Sales talk & purchase price negotiation

- Sales processing: purchase contract until handover

Here are a few more details.

Preparation to sale: procedure

You want to sell your property without a real estate agent? Then you should plan and carry out these sales steps in their order.

Decision to sell

When is the right time to sell? Ultimately, only you decide when to sell. There is no time of the year that is particularly “promising” or “particularly unsuccessful” for selling real estate. If you do not want to burden yourself with the vacation or Christmas season, that is only your decision. Because the buyers themselves usually decide completely independently of the time of year.

Lukinski’s tip: Properties with gardens actually sell better between spring and fall. However, the garden should then also be in a well-kept condition.

Market analysis and pricing strategy

How do I get the right selling price?

Here it becomes already very special! Because the assessment of the real estate market in general and also regionally needs a lot of knowledge and experience. This also applies to the valuation of a property. Especially when it comes to your own “four walls” that are for sale.

Determining the value of real estate is best done without an “emotional attachment” to the property. So if you want to sell your property without a real estate agent, you have to free yourself from all “ties” to the house. But even then, there are still plenty of “traps” that the private seller can fall into. For example, investments in high-quality fittings for bathrooms, floors, etc. do not per se increase the value of the property. Especially the choice of bathrooms, flooring, fixtures, etc. are often dependent on the owner’s taste. A new owner, for example, would not want to spend money on these things and will try to push down the purchase price in this way. A real estate agent such as Lukinski knows for sure which equipment of a property is considered “upscale”.

An important indicator for the “right” price of your property can be through a comparison with the price of other properties in comparable location, equipment and condition. To do this, you must then either talk to buyers and sellers of other properties, or browse the relevant brokerage portals in your region. However, even then you do not know for sure whether the prices of other properties are completely transferable to your situation. This is because micro factors always play a role in real estate valuation, which real estate experts will explain to you without prejudice.

Preparations: Renovate, design, modernize?

Frequently asked question when selling a house: Do you have to renovate beforehand? Our Lukinski tip at this point: If you want to achieve a maximum price for your property, then major construction defects should be eliminated. Of course, this should be verifiable by means of corresponding invoices. Damp spots on walls, mold, window frames with peeling paint, “blind” windows or worn parquet significantly reduce the purchase price. Even if there are only a few places where your property is not showing its best side, these deficiency items will rub off on the property as a whole.

The costs of a renovation or modernization must always be in reasonable proportion to the expected sales price. It is often very difficult to estimate this. Of course, a building expert can be consulted here as well. But this expert opinion costs money in any case. Lukinski and of course other brokers advise at this point with a lot of expertise and experience free of charge.

A special case are properties that are not (anymore) inhabited at the time of sale. If all furniture and personal belongings are then removed from the house or apartment, then possible damages reveal themselves very quickly. Here, too, it is a matter of: remove! Otherwise, a sale can be rescinded later due to concealment of defects in the worst case. If there are still furnishings in the object for sale, they should be in perfect condition. Everything else gives the impression of “bulky waste” and should be removed before the first viewing appointment.

Difficult for private sellers, but already common practice for real estate experts: so-called “home staging”. Empty apartments are specifically furnished for viewing appointments. This gives the buyer an impression of comfort and homeliness and thus increases – often unnoticed by the buyer – the intention to buy.

Marketing and presentation: exposé

How to create a sales exposé?

Certainly one of the more demanding tasks in the sales process: the creation of a meaningful sales document for the property. Very often, the exposé is one of the deciding factors for the price and also the speed with which you sell your property. Correct lighting conditions for the photos, a good perspective when photographing and meaningful texts are the decisive factors for the exposé. The pictures should convey a realistic view of the property, and the texts should not be overly worded. If statements in the exposé and reality are too far apart, this gives the buyer an impression of the seller’s untrustworthiness.

Even in the digital age, printed and bound exposés are often very useful. Especially if your property is of higher quality. If you want to produce the exposé on your home printer, the color cartridges should be well filled. Dull colors or streaky printing are absolutely unprofessional.

No matter how: the presentation of your property by means of photos and text requires a lot of time. In addition, you should have a deeper experience in choosing the right words for the accompanying text. Leave out all personal relations to the property and take – as best you can – a distanced perspective to your object.

Offer and negotiation

Who is the best buyer and how do I get the best price?

Those who sell their property without an agent have almost no possibility to filter the buyers in advance. Prospective buyers can make an excellent impression on the phone. But in the end, you never know who you will actually let into your house during the viewing. For the first exploratory conversation, make a list of questions to ask the prospective buyer. This includes, among other things, the question of where and how you currently live. Important also the question whether there is already a financing bank for the possible purchase. However, only trained ears can hear here whether the prospective buyer is telling the truth on the phone or not.

Those who sell their property privately must also coordinate and conduct all viewing appointments themselves. This part is usually the most time-consuming work for particularly interesting objects. It costs your time and often also nerves, because real prospective customers ask very detailed questions during the visit. And finally, you yourself have to cancel the interested parties who do not make the short list. This also costs time and nerves.

Purchase contract: How individual may the contract be?

The appointment of a notary for the final purchase contract is also the responsibility of the seller in the case of a private sale. Of course, the notary will also tell you which things belong in the contract and which do not. Many buyers have individual wishes regarding payment of the purchase price, handover date, liability, etc. The discussion of these contract items is also very time-consuming. On the other hand, there is certainly less risk of major errors for the private seller at this point, since the notary acts in an advisory capacity in the run-up to the purchase contract.

House handover

Depending on the relationship between real estate and seller certainly one of the most emotionally difficult parts of selling a house. Especially if the house sale has arisen out of an emergency situation and the separation from the property is more or less involuntary. Selling through a third party – such as Lukinski – is especially silent and unproblematic at this point.

There are often delays in the handover of a house. For example, because the seller’s new property is not yet ready for occupancy, or other things delay the handover. In a purely private sale, it is then again up to the seller to manage these delays. Often also with unpleasant discussions with the buyer up to rechntlichen arguments. As a mediator in the true sense of the word, the knowledge and experience of the broker can also be in demand here.

Inspection, negotiation and error

Preparation: documents, planning and support

You want to sell your house or a condominium and quickly find an adequate, solvent buyer? Then be sure to keep in mind that the preparation phase is the foundation for a smooth house sale. Be prepared for a time-consuming and complex task.

For a sale from private you need a whole contingent of documents. Even the smallest mistakes can have costly consequences and make selling a house very difficult and long-term. The complexity already starts with the offer price determination. If you set the condition based on a professional real estate appraisal, you have a good chance of achieving the desired selling price. Nevertheless, a lot of negotiating skills, sensitivity and knowledge of human nature are necessary. Be prepared for a wide variety of questions from potential buyers and arm yourself with all the necessary documents that could be asked for or should be shown without being asked. Now an exposé must be created and your object must be described according to the truth, yet from its most beautiful side. The choice of words in the presentation decides significantly how quickly and at what price your property changes hands.

Visitation: Talks and presentation

Every prospective buyer would like to visit the property before buying it, in order to get an idea of what it looks like. The viewing is therefore an important part of the sales phase. The more attractively the property is presented and the better prepared you are to answer the prospective buyer’s questions, the higher your chances of success. However, this requires some preparatory work and good organizational skills.

The first impression counts

Tidiness, openness and the right atmosphere – The same applies when selling a house: The first impression counts. That’s why a property should be presented as attractively as possible. This means that both the interior and the exterior should be prepared accordingly. Lawns and hedges should be well-kept. If necessary, a new coat of paint on the facade is recommended. Garbage and bulky waste should be removed. Inside, tidy and clean rooms make for a pleasant ambience. In the best case, tours should take place during the day. In the winter months, sufficient lighting should be provided. If the rooms are dark, they convey an uncomfortable impression. You can make the room look inviting by using discreet decorative items, such as plants or curtains.

Presentation and decoration

But it is not only the presentation that counts. House sellers should also be able to answer critical questions at the viewing appointment. Here, too, you have an advantage if you hire a real estate agent. He knows the common questions and of course the appropriate answers. He has the floor plan and the energy passport ready and knows the floor space of the house. Many potential buyers are also interested in information on ancillary costs and house fees. During the viewing, all questions should be answered satisfactorily. Advantages can be emphasized. Conversely, defects must not be concealed. The seller is liable for these even after the contract has been signed, at least if he knew about the defects in question and did not name them when asked. An experienced broker knows exactly what he must disclose and what not.

As a rule, it is advisable for the seller not to be present himself at the viewing appointment. Instead, leave this task entirely to the broker. This has many advantages. For example, the prospective buyers have fewer inhibitions to ask questions. In addition, you as the seller do not run the risk of making a remark that could possibly scare off the prospective buyer. In addition, the broker always remains professional and unemotional during the conversation. After the viewing, he hands over a prepared exposé with all the important key data of the property to the interested parties.

Negotiation: preparation, expertise and experience

Negotiating the sale of a house requires not only expertise and experience, but also sensitivity. Owners who sell their apartment or house are usually emotionally attached to the property and often estimate its value higher than it is. This is not only detrimental when determining the value of the property, but also during negotiations. A real estate agent, on the other hand, always remains objective. He is not guided by emotions and can therefore usually offer a better negotiation result.

If you would like assistance in selling a house and in negotiating, it is best to contact Lukinski. We sell real estate and distinguish ourselves through our expertise and years of experience. In the negotiation talks we use our know-how and our tact, so that you can achieve the best purchase price. Trust in our sales talent and benefit from our routine.

What matters in the negotiation

Good preparation is the key to a successful price negotiation. Lukinski’s broker knows that the buyer will also prepare for the negotiation and will know how to use every flaw in the house against him. It is all the more important to know the advantages of the property. These include, for example, a quiet location in the countryside or a central location in the city. Good transport links and shopping facilities also raise the value of a property. Other advantages can be a newly installed heating system, freshly painted walls or a recent renovation. The proximity to a university or an important employer also speaks for the property.

Since the sale of a house is basically negotiated, it is to be expected that the starting price can not be achieved. Accordingly, it should be set higher, but also not too high. If the broker and seller decide on a moderate starting price, the buyer feels that he is being treated fairly and does not have the feeling that he is sitting across from a profiteer. An inflated purchase price leads to longer and tougher negotiations, during which the price must be lowered more. If the house is in a desirable location and needs to be sold quickly, there is also the possibility of setting a low price, which then leads to several prospective buyers outbidding each other and you, as the seller, ending up with the desired price. Which strategy is suitable for your property depends on many individual factors.

Avoid mistakes: Sell privately or use a broker?

It can’t be that difficult to sell your own house or apartment. But if you proceed to sell your house with this certainty, costly mistakes are already pre-programmed. Before we go into more detail about the mistakes and show you why you should entrust an experienced broker like Lukinski with the sale of your property, we would like to point out a fundamental problem.

If you manage the house sale alone, you are practically on duty day and night and have to invest all your time in presenting the property, answering buyer inquiries and scheduling viewings. Even the necessary procurement of all documents in advance is a hurdle race that not every owner willing to sell can overcome without a “black eye”. You can sell real estate in a serious and professional manner by outsourcing the complex task and concentrating on professional execution by real estate agents like Lukinski. As an online real estate agent, we work quickly and reliably, so that you can sell at the best price to a solvent buyer without any stress.

The most common mistakes in the sale

The first mistake occurs long before you even deal with the exposé and its creation. You set the asking price for your property too high and tend to overvalue it, which is perfectly human in terms of your emotional connection to the property. In the end, an astronomically high price that is completely out of touch with the market will cause the sale to drag on unnecessarily, and your property will not arouse any real interest among buyers. The opposite, too low an offer price also brings disadvantages for you. If you offer your property for less than its value, numerous buyers will come forward immediately, but the loss on conclusion of the contract is pre-programmed. Missing documents, meaningless or underexposed photos, pictures of the property taken on rainy days, and photos on which the street and your house number are recognizable always prove to be mistakes in real estate sales. If you don’t want to be rung out of the house without an agreed viewing appointment, you should make it difficult to locate your property and for this reason specifically refrain from publishing information such as a house number or street identification in the exposé. A sale from private sources attracts bargain hunters, but also numerous dubious resellers. You will hardly save yourself from inquiries, but you will hardly be able to achieve the desired price and a satisfactory sales transaction. At the latest during an inspection, the presence of the owner can have a detrimental effect on the sale.

Purchase contract: procedure, notary, preliminary and main contract

The contract of sale records all the regulations and information necessary for the sale of your house. Therefore, it should be prepared with great care. In order to avoid ambiguities and unpleasant surprises, it is recommended to place the purchase contract and the entire house sale in the hands of an experienced real estate agent.

Notarized preliminary contract is almost always binding

When selling a house or a condominium, so-called preliminary contracts are concluded. These only become legally binding when they are notarized. Only with the signature of the notary is the house really sold. The preliminary contract sets out all the key points for the sale of the house. If both parties agree and the preliminary contract is concluded, the main contract follows. If the preliminary contract was not notarized, it has no meaning. In this case, both the buyer and the seller can withdraw from the contract without giving any reason. However, once it has been notarized, the preliminary contract is binding, so that it provides security for both parties. Only in rare cases is it possible to withdraw from the preliminary contract. These include natural disasters, for example. If there are no serious reasons and one of the two parties withdraws from the preliminary contract, the other party can assert claims for damages.

The following points should be stated in the preliminary contract:

- Name and address of buyer and seller

- Details of the object of purchase including furniture

- The purchase price and payment terms

- Fixed date for the conclusion of the main contract

- Indemnity clause

Once the financing has been clarified, the preliminary contract can be signed and notarized. The notary checks the land register and discusses further details with both contracting parties. The notary then draws up the main contract. This contains the information from the preliminary contract as well as all the conditions that were discussed during the notary’s meeting. This includes, for example, the handover of the house, the regulation of the purchase price payments and the due date, land register declarations and, if applicable, a financing power of attorney. This is required if the buyer needs a loan to finance the property.

Both sides have time to review the main contract. If there are no objections, the main contract can be signed and notarized. With this the house sale becomes legally binding. After the payment date, the handover of the house and keys can take place according to the agreements in the contract.

Check buyer: Credit check

Creditworthiness and solvency check – The creditworthiness check provides information on various factors. It certifies, on the one hand, the ability to finance a real estate purchase and, on the other hand, the willingness to pay and reliability. These data can be obtained by past credits and installments. Through a self-disclosure from Schufa, sellers can realistically assess whether the buyer is able to pay the purchase price and other costs, such as for the notary or for the land transfer tax, and whether he is also willing to do so. The seller can request the information from Schufa himself or demand a self-disclosure from the buyer. The latter is more likely to be used in practice, as it involves fewer costs. In addition, the self-disclosure contains all relevant data, such as the overall assessment of the payment risk and all information about payment experiences in the past. The self-disclosure is free of charge for the buyer.

Financing confirmation, notary escrow account and credit rating

Furthermore, a financing confirmation can be requested from the bank. However, this is only meaningful if the loan is expressly intended for the financing of a real estate purchase. In addition, the disbursement of the loan should not be subject to other conditions.

To provide more security, a notary escrow account can also be set up. This is monitored by the notary and is intended to protect the seller. Only when the money has been received is the property transferred into the buyer’s possession.

The credit check should take place as early as possible. This prevents long negotiations that turn out to be superfluous in the end. Also, you may have already turned down other prospective buyers who have purchased another property in the meantime. A good realtor will conduct the vetting of the buyer in a timely manner. In addition, he also advises the buyer to hold financing discussions with his bank as early as possible. This is because it can take up to 14 days for a financing confirmation to be issued. In addition, the buyer must have documents ready for the approval of a loan, which may have to be obtained first.

Handover: protocol, handover of keys and documents

Once the purchase contract has been signed and the notary appointment has been dealt with, the final step of the house sale follows: the handover. This is when you place your property in the hands of the new owner. To ensure that nothing goes wrong and there are no unpleasant surprises after the conclusion of the purchase contract, there are a few points to bear in mind. Damages or a subsequent reduction of the purchase price make many buyers’ hair stand on end.

Once the purchase contract has been signed and the notary appointment has been dealt with, the final step of the house sale follows: the handover. This is when you place your property in the hands of the new owner. To ensure that nothing goes wrong and there are no unpleasant surprises after the conclusion of the purchase contract, there are a few points to bear in mind. Damages or a subsequent reduction of the purchase price make many buyers’ hair stand on end. But that doesn’t have to be the case.

The handover is the last hurdle you have to take when selling a house. As a real estate agent, we naturally also take on this task for you. A handover protocol creates clarity and avoids disputes. The purchase contract alone does not record all the essential points. Defects, meter readings and existing inventory can be recorded again or in more detail in a protocol. This is signed by the seller so that he cannot subsequently claim that he did not find the house as contractually agreed.

The handover protocol for the sale of a house is not that dissimilar to the protocol for the handover of a rental property. However, other important points must be recorded. These include, for example, defects that still need to be remedied by the seller. A date for this should also be set. In addition, the handover protocol should record which inventory still needs to be removed. In addition, all meter readings are written down. The process of handing over the keys is also noted in the protocol. If keys are still missing, a note is made of how many and when they will be handed over. By the way, the keys are usually handed over only after the purchase price has been paid in full.

At the handover of the house, not only the keys are handed over, but also many other important documents. Building plans, floor plans, the calculation of the living space, building contracts, expert opinions, maintenance contracts, insurance certificates and much more are handed over to the new owner on this day. If you are selling a rental property, the rental contracts and the documents about the various tenants must also be handed over. During the handover, the seller will usually also explain to the buyer how the heating system works, as well as other important appliances in the house.

Checklist documents handover:

- Construction plans

- Floor plans

- Calculation of the living space

- Construction contracts

- Expert opinion

- Maintenance contracts

- Insurance policies

Notarization: Notarization by a notary public

In order to draw up a purchase agreement for a property, it must be notarized. The purpose of notarization is to protect the buyer and seller from hasty decisions and to ensure that the interests of both parties are properly recorded. The recording of the interests is carried out by a notary, who is not a representative of the interests of one side, but acts impartially.

Real estate valuation: Determine market value

For what price can I sell my house? This question is asked by every owner who wants to sell a house and know what price is realistic in the offer. Although the real estate appraisal is an estimate, it is based on an objective and therefore plausible assessment. In practice, it is seen that the value varies from appraiser to appraiser and that, despite real estate appraisal, there may be different price recommendations. Nevertheless, you should not rely on your gut feeling or your own emotionally made estimate when it comes to the selling price of your house. In order to value a property, various factors must be included in the determination. The more comprehensive and professional the real estate appraisal is, the more cost-proof you will sell the house and the lower the risks of presenting an offer below or above the actual market value.

No real estate valuation? No realistic pricing possible!

Not having a real estate appraisal means that the price of your house depends primarily on a feeling and the expenses you put into the object. Properties that are sold without a property appraisal are usually priced too high and are therefore practically unsaleable, or too cheap and therefore incur a loss when sold. As an owner, you do not need to know the factors influencing the asking price if you choose to have an appraisal done by an expert. Before you name a price and commit to a sale amount, be sure to find out what the fair market value of your home is. If you sell without a property valuation, you are making one of the biggest mistakes in the real estate business and will rarely produce an offer that is authentic in the context of the property on offer and therefore interesting to the buyer and right for your own finances.

Real value and market value – the differences

When selling a house, there are ultimately two values, of which the market value or fair market value is relevant for determining the price. The actual material value states what value a house has based on its year of construction, its equipment and its substance as well as the size of the plot. If you know the material value, you know what objective value is associated with your house. But the purchase price is not related to the pure objective value, but to the market value or fair market value. In this real estate valuation, factors relevant to the environment and the market are incorporated and form the basis of the pricing. In order to determine the market value, a lot of know-how and market knowledge, analyses and comparisons as well as experience in the valuation of real estate are necessary. Due to high demand and few offers, the market value today is often higher than the pure asset value and gives you the opportunity to sell the property at the current highest possible price. The market assumes the greatest importance in the determination of market value is a decisive factor in deciding whether you can sell your house at a good or a rather low price. To avoid mistakes, you should hire a real estate agent or appraiser to handle the challenges of the appraisal and determine the best asking price for which your property will be advertised and sold.

The mortgage lending value is based on a well-founded expert opinion of a real estate valuation

The market value is an important parameter not only for you as the owner, but also for potential buyers. To enable real estate financing, the lending bank requires the property’s mortgage lending value. This is based on the market value and amounts to 80 percent of the sum determined as the market value in the property valuation. Explicitly, the mortgage lending value is a well-founded estimate of the sum for which a property can be sold in the longer term. For an interested party, the valuation of the property is important for two reasons. The asking price reflects seriousness and indicates that it was determined with expertise and not estimated with emotional influences. In second place is the mortgage lending value, which is important in the context of financing and decides decisively whether a prospective buyer can finance the property for the specific offer price and obtain confirmation from the bank.

Important facts in the value appraisal

The real estate valuation is composed of different aspects. Of course, the building fabric, i.e. the actual material value of the house, plays an important, not to say the most important role. But equally significant are the details of the location, which have a significant impact on the selling price. In highly frequented and popular regions, the real estate prices are far above the offers in rural, infrastructurally weak and less sought-after regions. While the tangible value of the property is a variable variable, for example through demolition and new construction, the location remains static and unchangeable. A property valuation takes into account the future development of the region as well as the current popularity of the location in which you want to sell your property. The better the infrastructural development and networking at the location of the property, the higher the offer price can be. For a property valuation, the demand for a property in this location and the supply volume of houses are also taken into account. Comparative prices of similar properties in the same location are also included in the valuation.

Determine market value

The determination of the market value of a property is regulated by law in the Real Estate Valuation Ordinance (ImmoWertV). In addition to the type of use, the size of the property and the condition of the property, the energetic condition are also important factors in determining the market value. The value relevance of urban development circumstances (urban planning measures in urban redevelopment areas) and foreseeable future developments are also taken into account. The market value is determined by brokers or appraisers. However, only licensed real estate appraisers can determine a judicially recognized market value.

The fair market value (market value) is the price that can be obtained in the specified time frame in the ordinary course of business according to the legal circumstances and actual characteristics, other features and the location of the property or other object of the valuation. In 2004, the term “market value”, which is used throughout the EU, was added to the definition of market value in Section 194 of the German Building Code (BauGB). The market value is therefore an estimate of the price that can be achieved on the market. The market value is generally used for the sale and purchase of land and buildings. The determination of the fair market value may also be required in the case of foreclosures, tax levies by the tax office, and divorces and inheritances.

Determining market value: which factors are important?

The determination of the market value refers to the macro-location (city/region) and the micro-location (immediate surroundings of the property) of the property, its section, size and any existing land charge entries that may reduce the value. In accordance with the German Building Code (BauGB), the market value is not a permanently fixed value, but refers to the reference date stated in the appraisal report. It is possible that the market value may change significantly over a certain period of time.

The market value quantifies the value at the time of valuation. The market value appraisal takes the following points into account:

- Tangible value of the property, if developed

- Nature and location of the land plot (size, type of development)

- Legal circumstances (e.g. land register, monument protection)

- Other objects of the valuation

In fact, however, market demand decisively influences the value of your property. The demand for real estate as well as the equipment features sought vary greatly from region to region.

Practical procedure for determining the market value

When it comes to selling real estate, the free real estate appraisal is an excellent starting point for a quick and good sale. However, if an appraiser is to determine the market value, the exact task is first discussed with the client. An appraiser must be appointed in special cases (e.g. in the case of inheritance disputes or in the case of divorce), for example, if a market value appraisal or a written statement on the market value is required. The appraiser may only determine the condition and value of the property in an on-site appointment with access to all premises.

Documents for the determination of the market value

In general, the following documents are evaluated for the determination of value in the sale of real estate:

- Land register excerpt

- Construction plans, floor plans, sections

- Building description

- Site plan and parcel map

- Living space calculation

- Energy certificate

In the case of condominium ownership, the following are additionally required:

- Minutes of the last three owners’ meetings

- Business plan

- Declaration of division (land register)

- Housing allowance statement

In the case of income properties, the following must also be submitted:

- Operating costs

- Rent statements

- Rental agreements

In the case of rights and encumbrances, the following must also be included:

- Notarial deeds

- Special registrations (rights of way, residential rights, etc.)

Weighting of criteria in the fair value

Special weighting is given to the location and the expected future risks of the property. The risks are mostly modernization risks, such as the costs to be expected from a renovation backlog. For this purpose, the most expensive maintenance measures, which usually include the roof, basement, windows and heating, are assessed. The type of house is also assessed. With a year of construction until 1945 it is an old building, after 1945 the building is listed as a new building. In addition, the exterior design, floor plan, garden, facade, room layout and lighting conditions are taken into account.

Factors such as location, balcony and attractiveness to the target group play an important role in the rentability of the property. Other factors included in the valuation are, for example, an elevator and the furnishings of the property:

- Property area (proportionate living area or total area)

- Living space according to the Living Space Ordinance (WoFIV)

- Garage, underground parking, parking spaces (existing renovation risks)

- Basement additionally usable or e.g. renovation backlog in the basement

- Demographics to object location

- Property type (commercial, residential, care, monument, other special types, mixed property)

Valuation: capitalized earnings value method & asset value method

All important information on valuation for the sale of real estate and the other valuation procedures clearly summarized for you:

The capitalized earnings value method – division into market value & building income value

The capitalized earnings value method divides the property into the market value of the land and the building income value. This includes rental income, maintenance costs and costs for managing the land and building. Accordingly, the rental income less the management costs and the land value including its interest are compared.

Our team of investors at Lukinski will gladly prepare yield calculations for your desired property. Prospective buyers can be convinced of good returns. Upon request, we will inform you of the data required for the calculation. After receipt of the documents, we take over the determination of the yield value and give you a first estimate of the yield.

The asset value method – value for the new construction of a property

The calculation first determines the market value of the land using the standard land value, and then adds the real building value. The real building value is calculated from the building production costs less any age-related reductions. The land value (market value of the land) and the building value are added together and multiplied by an asset value factor. The calculation of the real value factor depends on the type of building, the preliminary real value and the standard land value. The total tangible asset value determined in this way indicates the financial resources that would have to be expended to rebuild the property.

The comparative value method – comparison with similar properties

The comparative value method compares your property with similar properties. It is used in particular for the sale of condominiums and apartment buildings. The comparative value can also be determined for undeveloped land. Only properties in similar locations and with a comparable layout are taken into account in the comparison. The properties included in the valuation should be from the immediate vicinity of the residential property. The comparative value method is considered to be particularly close to reality. It is frequently used to determine the value of real estate because the locations are relatively comparable from a regional perspective.

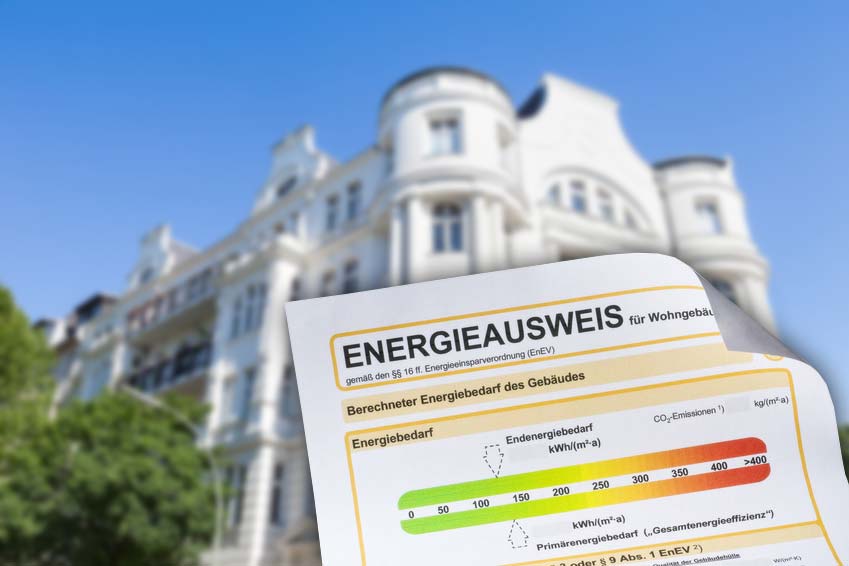

The energy certificate – mandatory when selling real estate

The energy condition of a property is one of the most important decision-making criteria for prospective buyers. This is where the energy passport comes on the agenda, as it provides information about the energy efficiency of the house and thus about future consumption. The energy efficiency is classified on a scale from A+ to H, whereby the letter H stands for urgent measures in energy refurbishment and indicates that the property is no longer up to date in terms of energy consumption.

No real estate sale without energy certificate

Only authorized experts may take care of the preparation of an energy certificate (according to §16 of the EnEV). This means that you need to look for an expert with the appropriate license. The §16 EnEV specifies that every real estate buyer must receive an energy certificate. For you as an owner and seller, this means that you must have the pass produced and included in the sales documents. If you refuse to produce and present it, owners commit an administrative offense and can be fined up to 15,000 euros.

Why is the energy certificate so important? It contains all the information relevant to the buyer on the energy status of the property. It also provides information on how much energy has been consumed and what supply costs the future owner can expect. If the energy balance is negative, this circumstance points a prospective buyer to the necessity of an appropriate reorganization and thus to high costs, which come for example by the renewal of outdated electricity and a heating system on it. The energy certificate is an integral part of the exposé when a house is sold by our brokers and is published directly online. During a viewing, interested parties receive a direct view of the original and an explanation from us on how to read and evaluate the energy certificate.

Demand certificate or consumption certificate?

A consumption certificate costs 100 euros, while a demand certificate costs between 300 and 500 euros. The costs for issuing the energy certificate are borne by the owner, who is obliged to provide this data when selling the house. We advise you to have the informative requirement certificate drawn up and not to save at the wrong end by only providing a consumption certificate with far less helpful data for the buyer.

The consumption certificate is based on the last 3 annual bills of the energy provider. In contrast, the demand certificate contains concretely determined facts that are checked by an energy consultant on site. The main difference between a consumption and a demand certificate is that the former provides information about the past, while the demand certificate looks at energy consumption in perspective. This requires an on-site specialist to check the condition of the building, the insulation and the heating system, and to use this individual data in combination to create a forecast for the building’s energy balance.

Real estate agent: advantages

The biggest challenge in the sale of houses or apartments is the determination of a correct offer price. In this regard, we recommend a market value assessment, which includes all factors far from the pure real estate price.

The equipment and building fabric of a house are just as important in determining the market value as the location, market-specific factors and infrastructure, as well as the difference between supply and demand. If you have the valuation carried out as a private client, you must expect costs of around 1,000 euros and more.

Determination of market value and ancillary purchase costs

If, on the other hand, you hire a real estate agent, the market value appraisal is included in the scope of services and is financed by the buyer via the ancillary purchase costs. You can have your property sold professionally without incurring any costs when selling the house or apartment. If you do without a market value appraisal, you usually estimate an implausible price and offer the house above or below its real value. In both cases, you are making a momentous mistake that can prolong the sales process or lead to avoidable losses.

With an experienced real estate agent, you protect yourself from mistakes when selling real estate and have the certainty that you will be presented with an offer for sale that includes the current value of your house, land or apartment based on all the facts. Likewise, you do not have to worry about organizing documents, preparing the exposé or publishing your offer. All processes relevant in the sale are carried out from one source and in a professional manner.