Legal: Notary, main contract and tax regulations

Legal – You want to sell your house? Then you not only need a willing buyer, but you should also know about your rights and obligations. The sale of real estate is strictly regulated in Germany. This is because it is the only way to protect the seller and the buyer. However, this also leads to the fact that laymen hardly have a chance to overview the entire legal scope of a house sale without extensive research. This is where an estate agent can help.

Notary: purchase contract, ownership and tax law

The notary must certify the sale of any property. He acts as an independent legal authority and is supposed to protect both buyer and seller. After the preliminary contract has been drawn up, he holds a meeting with both parties and consequently draws up the main contract. He does not represent one of the two sides, but both. This reduces the legal risk for both parties. Not only does he have to notarize the purchase agreement, but he also has to explain all the legal issues. In addition, he is the one who arranges for the transfer in the land register. This only takes place when the buyer has also paid the purchase price. Furthermore, the claims formulated in the contract are immediately enforceable. The seller does not have to sue in case of non-payment. Instead, the notary can immediately instruct the bailiff.

Before the notary appointment: organisational matters, documents

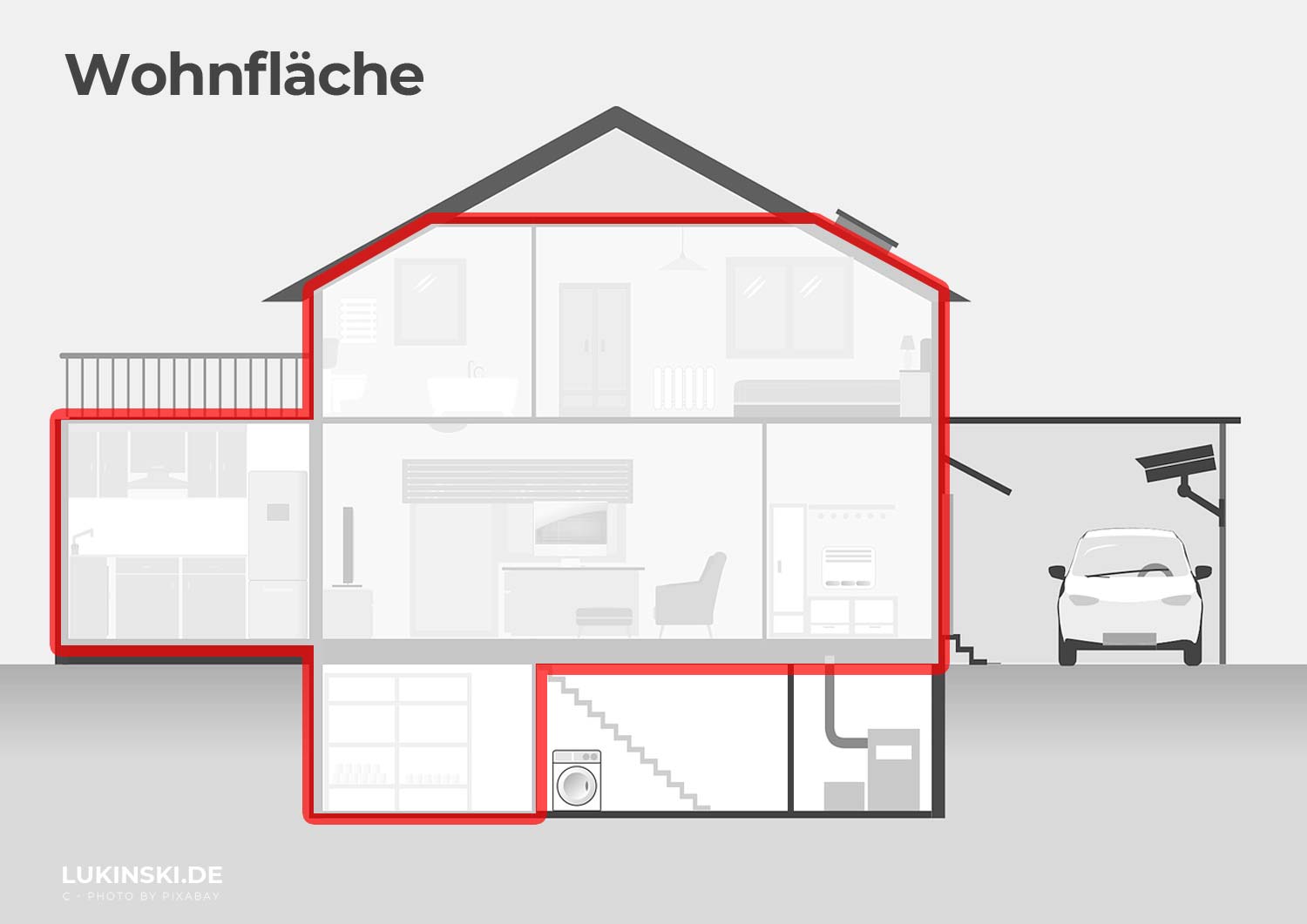

But before it even comes to the notary appointment, many other legal issues must be clarified. For example, the ownership structure must be clarified and proven. Check whether you are really the sole owner or whether other people may also have a claim to the property. For example, if the property is jointly owned by two people, there will be a purchase price distribution after the sale that corresponds to the ownership shares.

Last but not least, tax regulations must also be taken into account. If you sell a property that you have used yourself, no tax is due. If the property is rented out or used commercially, it must have been in your possession for at least 10 years. Otherwise, the so-called speculation tax must be paid. Here, the legislator is guided by the date of the notarization of the purchase contracts. The land transfer tax must always be paid. However, this is usually borne by the buyer. The amount of the real estate transfer tax is a matter for the federal states and is set by the respective federal states themselves.

Legal support from an experienced broker

The sale of real estate in Germany is legally regulated by the notary. He clarifies all legal questions concerning the purchase contract. However, a great deal of research and work is necessary in advance in order to meet all legal requirements and avoid pitfalls. It is therefore advisable to contact an experienced real estate agent who knows the legal regulations. This will save you a lot of tedious research as well as a lot of stress and frustration.

Broker contract: tips and help

You want to sell a house or an apartment, have no experience in the real estate market and want to avoid mistakes at all costs? Then you are well advised to use the comprehensive services of an estate agent and simplify the time-consuming and complex sale of your residential property. When you hire an agent, you don’t have to factor the sale of your property into your schedule, as all tasks are handled directly by your real estate agent and carried out in your best interest.

Tasks of a broker

Basically, a real estate agent fulfils all tasks that are important before and during the sales and rental phase. He creates an exposé, determines the market value of your property, advertises your property and is then the interface between you and interested parties. While the creation and publication of an advertisement is a time-consuming but unique task, answering customer enquiries is part of the daily business of an estate agent.

- Here you can find more information about the tasks of a broker.

Commission for the broker – The most important regulations

More than 80 percent of all properties for sale or rent are brokered. This means that the owner commissions a real estate agent to advertise the offer and to carry out all tasks up to the conclusion of the contract on his behalf. Professional brokerage is a service that is agreed between the client and the real estate agent. After the service has been rendered, a commission, the so-called brokerage fee, is due. Who pays the commission depends on the type of commission and the reason for the commission. If you sell your property through an estate agent, the buyer usually pays. In the case of lettings, the buyer principle has applied since 2015, so that the invoice recipient and commission payer is identical to the person who has commissioned a brokerage service.

- Here you can find more information about the broker commission.