Berlin buy & rent: House, apartment, property – Square meter price

Berlin buy & rent – The Place To Be for celebrities, politics, business but also actors and many other public figures. As a hotspot, the capital is therefore also subject to the effects of the current real estate market. Condominiums, houses, plots of land, in Berlin everything is in demand and is sought after by investors worldwide. As a real estate agent there is therefore a lot to do! To give you an insight into the city, as a buyer, investor or tenant, we have collected the most important key figures for Berlin here. A detailed overview with figures from the Federal Statistical Office, selected and prepared for you as a tenant or buyer.

If you’re looking to invest in Germany’s thriving real estate market, Lukinski has you covered. From guides to German inheritance law, tax optimization, additional costs and hidden purchase fees, renovation, and the list goes on. Want to delegate the work? As German real estate experts, we can be your man on the ground:

Needs No Introduction

Berlin is known worldwide as one of Europe’s mega-cities. It offers everything from fashion, art, finances, startups, and the list goes on. There’s hardly a person that wouldn’t find their passion represented in this 3.75 mil. city. This is also evident in its sprawling size and distinct districts. For this reason it’s often described as being many cities in one. Walking through Berlin-Mitte is totally different from Kreuzberg, and Prenzlauer Berg won’t often be confused with Zehlendorf. It’s arguably the hip city in Germany, and can compete with other metropolises like London, Prague, and Paris.

What does Berlin Offer?

Not only is it attractive for its lively and diverse cityscape, it has great infrastructure. This means that, despite its geographic distance in the relative east of Europe, its massive central station, and modern airport (opened in 2020), BER, it is not difficult to reach. Within the city, a sprawling public transportation network means every part of the city can be reached without much difficulty.

The districts you have to know are Berlin-Mitte, Kreuzberg, and Friedrichshain, where the world-famous nightlife takes place. They also boast cafes, and especially Kreuzberg and Friedrichshain, thanks to their relatively inexpensive rent prices are home to artists and students which make these parts very lively. Also important are Prenzlauer Berg, where young families spend their days walking along the long tree-lined promenades and 18th century facades. For professionals, the districts of Treptow-Köpenick and Stelgitz-Zehlendorf are desired for their close proximity to the city without losing greenspaces, and a calmer atmosphere.

Rent or Buy in Germany’s Mega-City?

Berlin is a city where real estate investment is fairly low risk. With the city growing in popularity as heavily as it has in recent times, it is unlikely that prices will cease increasing. At the moment, Commercial investors have slowed their investment within Berlin, with private invetors now increasing their shares. The same reasons whcih drove commerical investors from investing in Berlin are what make purchasing a property here so enticing. It is almost certainly a good investment to buy real estate in Berlin, and with increasing rent prices, as well as political uncertainty surrounding renting, real estate investment is the right choice here.

- Rent/m²: €9,50-€28,00

- Price/m²: €4.000-€20.000

All the Cities in One

Real estate is a major draw in Berlin. Prices are increasing steadily, especially in the up-and-coming districts like Kreuzberg. Last year, around 20.000 new living units were approved, showing just how much this city is gaining in popularity. Average price of an apartment is around €305.000, which is only the 6th highest in the country, yet it has increased by 13.5% in the past 3 years, taking top spot in Germany. Similarly for single- or double-family residences. These are on average €511.000, 6th highest, but growing by 16,2%, also the most in Germany. On average, rent prices can reach €9,50-28,00 per square meter in good areas. Foreign investment here is common. With the international flair of the city making visitors and expats feel welcomed.

Apartments Price €/m² for different regions

- Very Good – €4.000-€20.000 (increasing)

- Good – €3.100-€11.500 (increasing)

- Mediocre – €2.200-€6.500 (steady)

- Simple – €1.800-€5.000 (steady)

Buy in Berlin

First we take a detailed look at current statistics for buyers. Here you will find a lot of information, from the purchase price for a newly built condominium to tips for renting property and ask the big question: Is it worthwhile buying in Berlin?

- Purchase price for houses

- Luxury houses, share of sales

- Let the property

- Approval volume (residential construction)

- Is it worth the buy?

- Buy without a broker

Typical for Berlin: modern meets classic and cult. But Berlin’s yellow underground and suburban trains also characterize the cityscape, as do many modern buildings, especially in Berlin Mitte.

Before we come to prices for real estate, houses and condominiums, here is a look at a typical apartment in Berlin Mitte. Elegant, simple furnishings, since most of the time is often spent on the job.

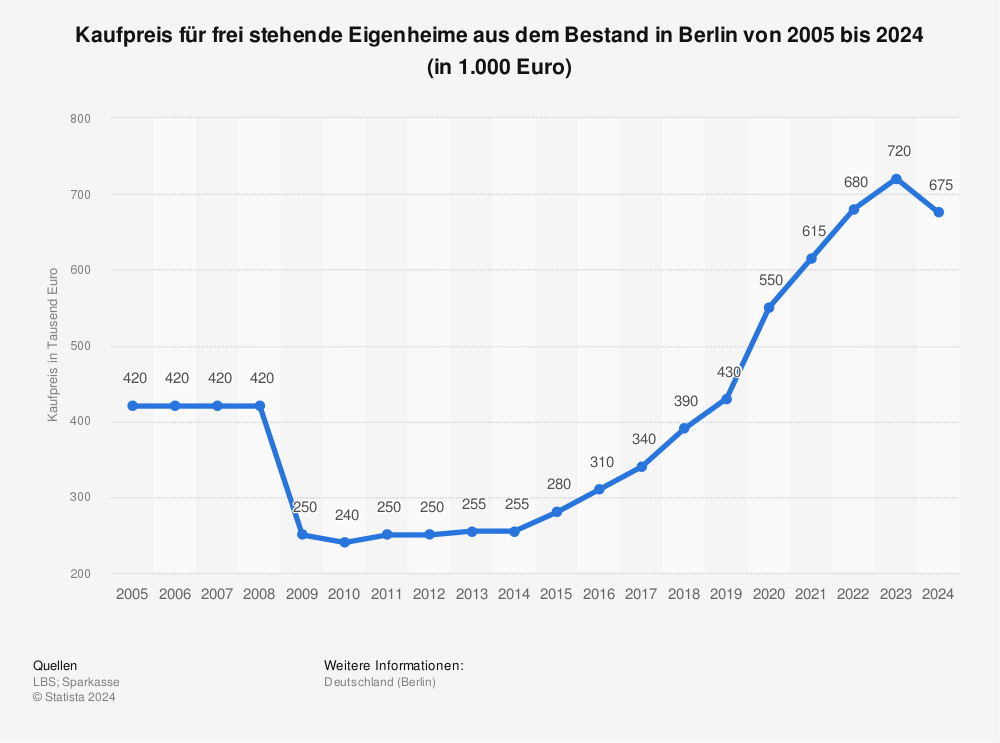

Purchase price for houses

Purchase price for freestanding homes from the Berlin portfolio from 2005 to 2019 (in 1,000 euros).

More statistics can be found at Statista

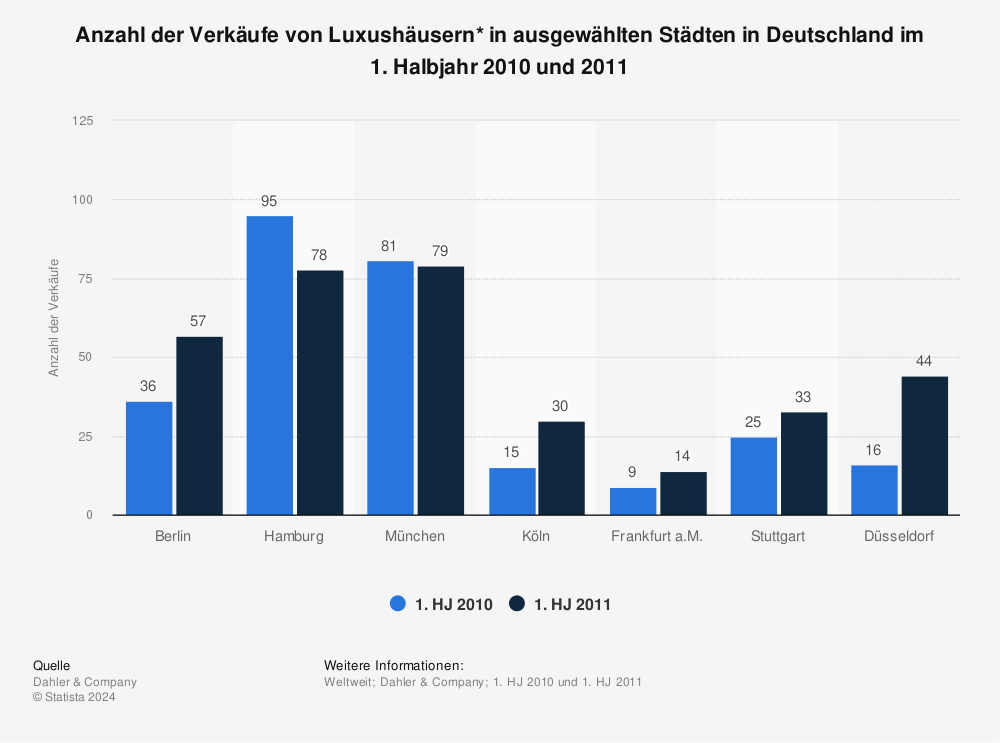

Number of sales of luxury homes

How many luxury properties are sold and bought in Germany each year? These statistics show how manageable the market is. Here you can see the number of sales of luxury homes in selected cities in Germany.

More statistics can be found at Statista

Data show for visualization last survey in the 1st half of 2010 and 2011, since then much has happened in the city. Especially Berlin Mitte attracts millions of tourists, but also buyers of land and real estate. The location, around the government district, offers the most advantages.

Here you can also find extremely modern architecture.

Are there enough apartments?

You can live in your own property yourself or you can rent it out. With the current housing shortage, this is a good prerequisite for increasing rental income. Because as always, supply and demand. The chart shows the share of annual building completions in 2016-2018 in the annual demand in the period 2016-2020.

- Hamburg and Düsseldorf Coverage / year at 86%

- Frankfurt am Main Coverage / year at 78%

- Berlin coverage / year at 73%

- Munich Coverage / year at 67%

- Stuttgart Coverage / year at 56%

- Cologne Coverage / year at 46%

More statistics can be found at Statista

More statistics can be found at Statista

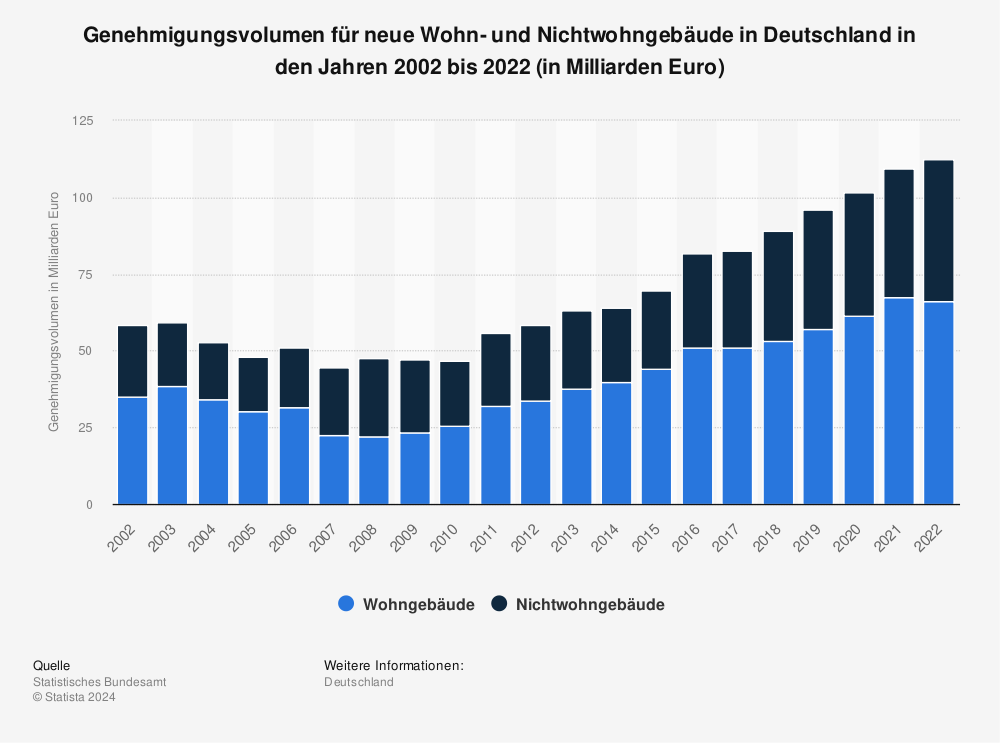

Approval volume (residential construction)

Here you can see, looking back over 18 years, the development of the approval volume for new residential and non-residential buildings in Germany in the years 2000 to 2018 (in billion euros). In 2018, the last measurement, there was another big leap forward. There will be a lot of investment to create living space.

More statistics can be found at Statista

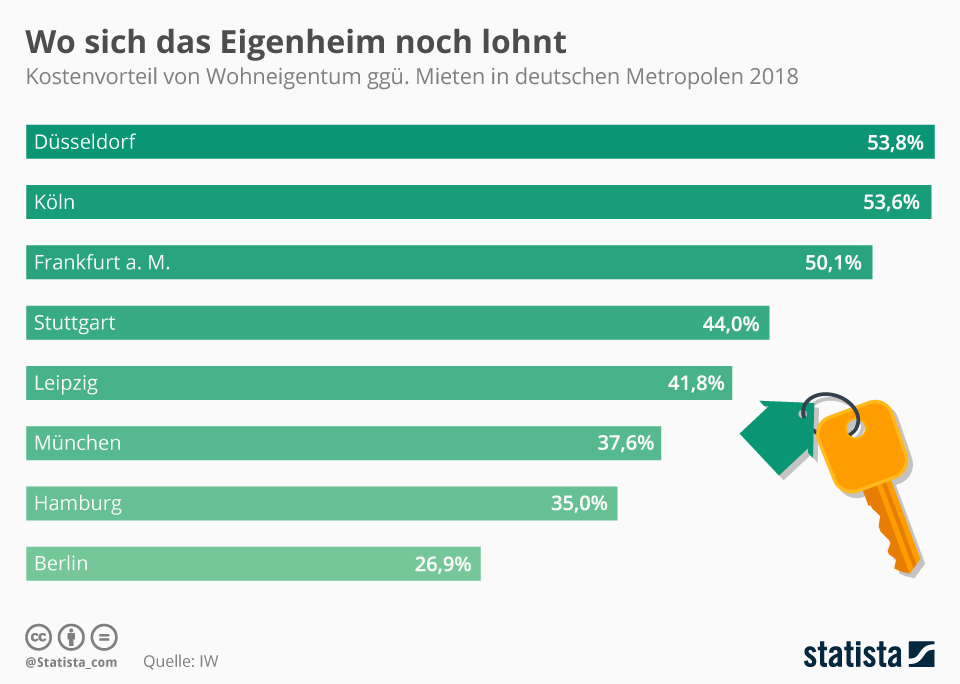

Where is it worth buying? comparison

Where is it worth buying a property (house, semi-detached house, condominium, etc.)? In comparison, one sees the potential that lies dormant above all in NRW and Hessen. This chart shows the cost advantages of home ownership compared to rents in German metropolitan areas in 2018.

- Düsseldorf with 53.8%

- Cologne with 53.6%

- Frankfurt with 50.1%

- Stuttgart with 44.0%

- Leipzig with 41.8%

- Munich with 37.6%

- Hamburg with 35.0%

- Berlin with 26.9%

More statistics can be found at Statista

More statistics can be found at Statista

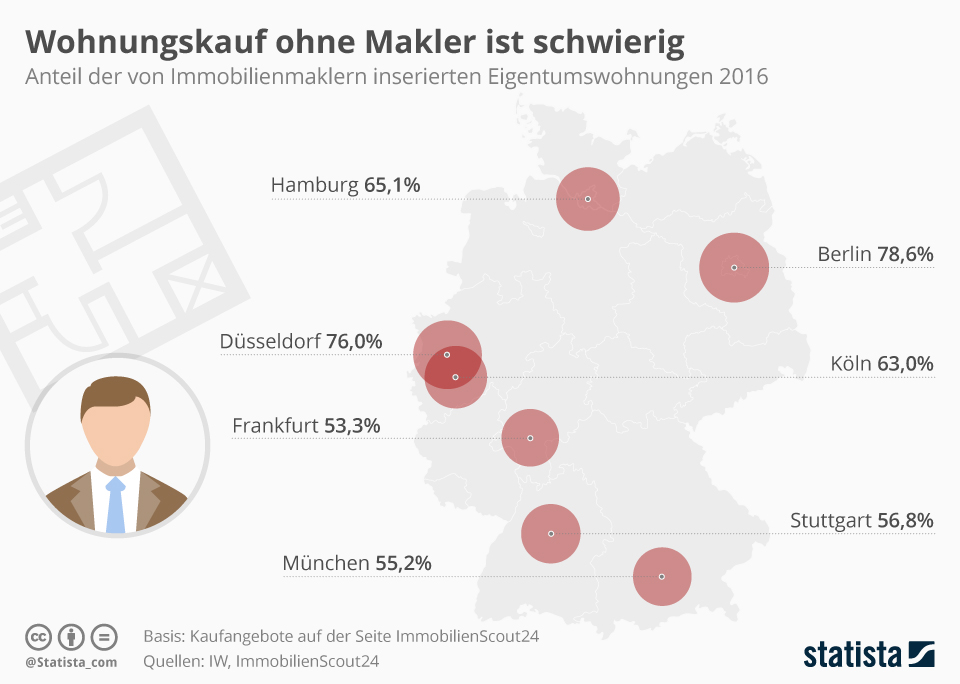

Purchase of an apartment without an agent

The chart shows the proportion of condominiums advertised by real estate agents in 2016.

3 out of 4 condominiums (78.6%) are offered by real estate agents

Here you can clearly see that the majority of the market is in the hands of experienced real estate agents. High-quality and good properties are always sold with the help of an estate agent. After all, it is not “only” about the viewing. Buyer acquisition, network, negotiations, credit assessment, purchase contracts, all this belongs to the profession of an estate agent.

- 78.6% of Berlin’s condominiums through real estate agents

- Düsseldorf ETW at 76.0% via brokers

- Hamburg ETW 65.1% via brokers

- Cologne ETW at 63.0% via brokers

- Stuttgart ETW at 56.8% via brokers

- Munich ETW at 55.2% via brokers

- Frankfurt ETW at 53.3% via brokers

More statistics can be found at Statista

More statistics can be found at Statista

City Palace

Rent

- Distribution of completed apartments

- Rent a commercial property

- Rent office: The most expensive cities

- Rent office: Free areas and practices

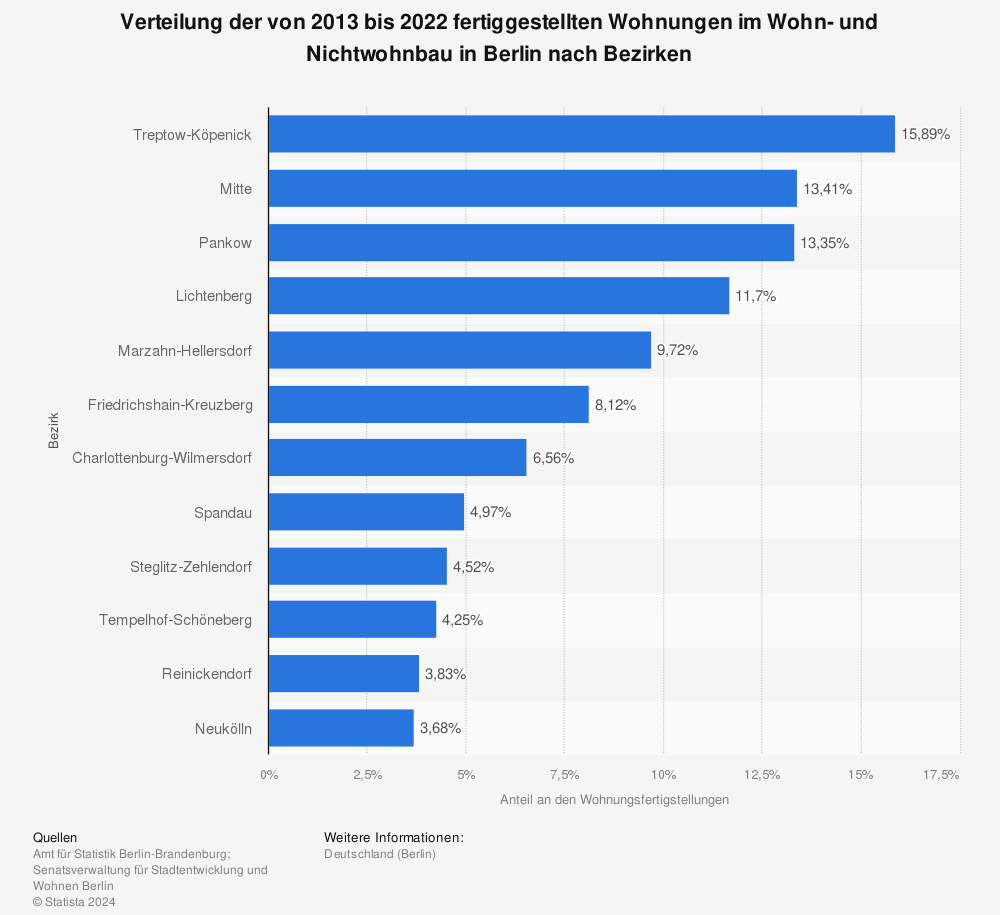

Distribution of completed apartments

Distribution by districts of residential and non-residential apartments completed between 2008 and 2017 in Berlin.

More statistics can be found at Statista

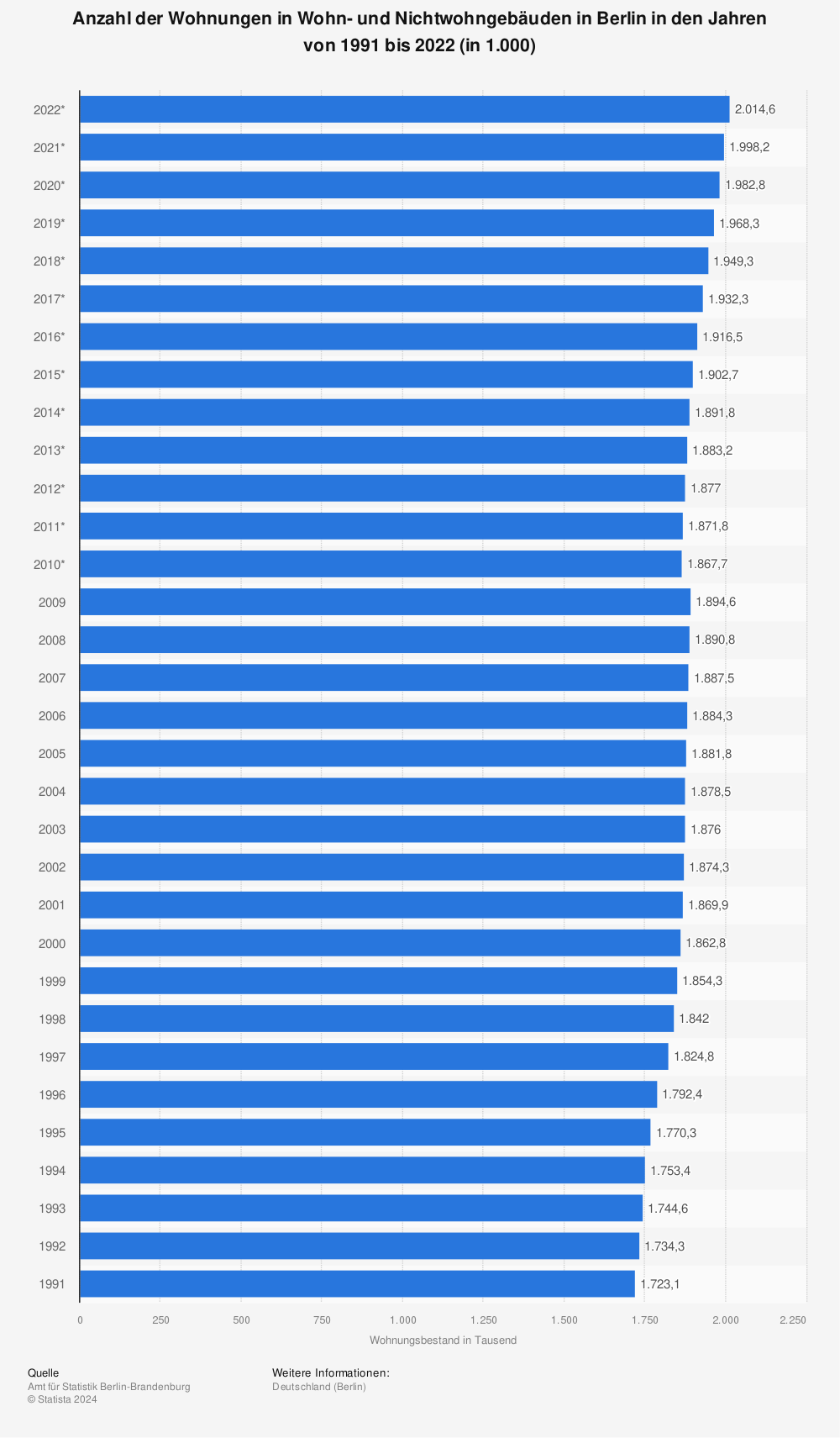

Number of apartments

Number of apartments in residential and non-residential buildings in Berlin in the years from 1991 to 2018 (in 1,000).

More statistics can be found at Statista

Commercial property rent

Location is everything! Especially for entrepreneurs and companies. In all major cities the rents for commercial properties are rising, only in Berlin the costs for the monthly rent are getting cheaper, and that in the best location. This chart shows the indexed costs for commercial real estate in the largest cities in Germany (Hamburg, Cologne, Frankfurt, Munich and Berlin) in comparison. A joint index takes into account shop rents in prime locations, shop rents in secondary centres, office rents in city centres and the prices for commercial properties.

- Hamburg

- Cologne

- Frankfurt

- Munich

- Berlin

More statistics can be found at Statista

More statistics can be found at Statista

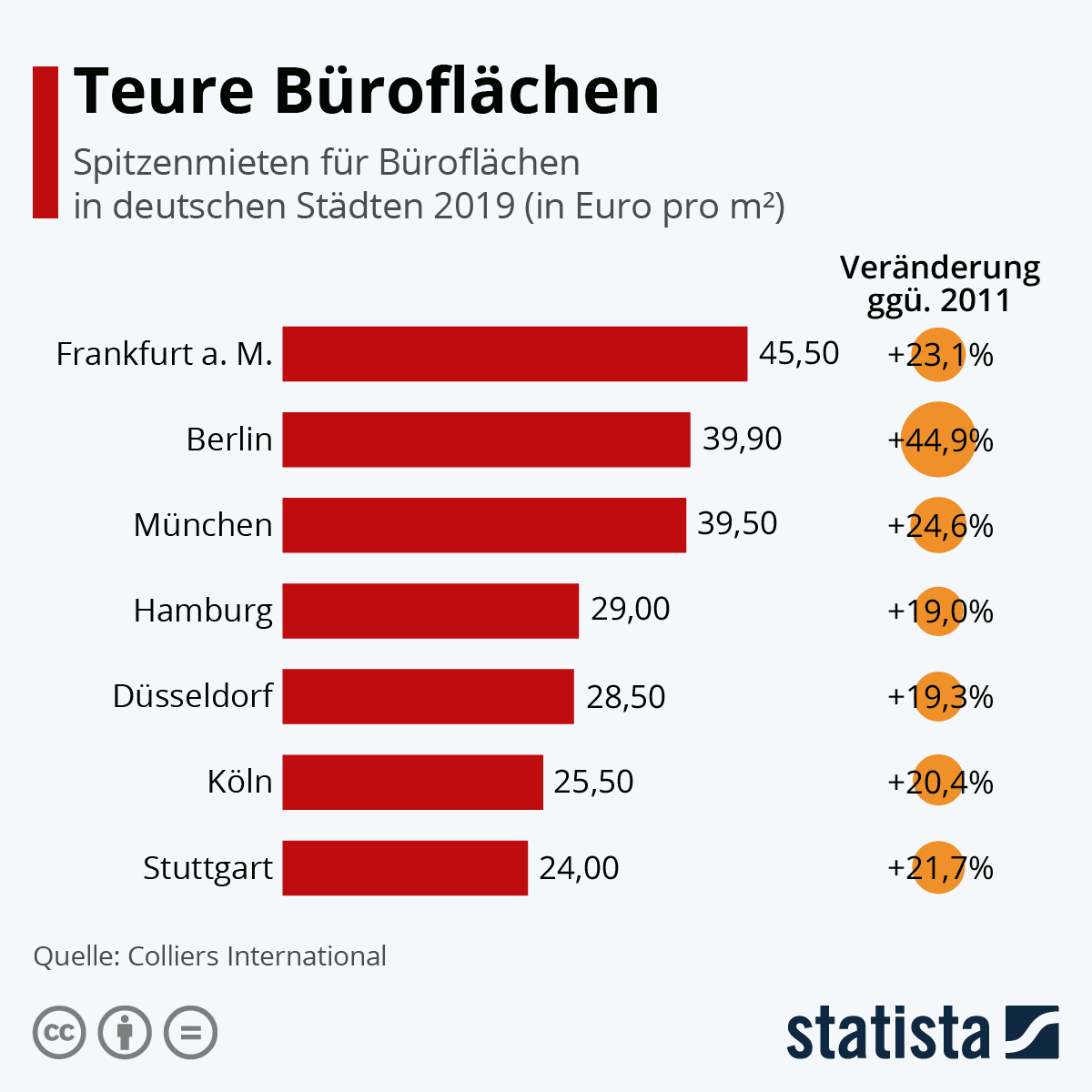

Rent office: The most expensive cities

Where are office rents currently highest? Berlin is at the top of the league, with current office rents averaging 39.90 euros / m². Here you can see the top rents for office space in German cities.

- Frankfurt – 45.50 Euro / m² (+ 23.1%)

- Berlin – 39.90 Euro / m² (+ 44.9%)

- Munich – 39.50 Euro / m² (+ 24.6%)

- Hamburg – 29.00 Euro / m² (+ 19.0%)

- Düsseldorf – 28.50 Euro / m² (+ 19.3%)

- Cologne – 25.50 Euro / m² (+ 20.4%)

- Stuttgart – 24.00 Euro / m² (+ 21.7%)

More statistics can be found at Statista

More statistics can be found at Statista

Rent office: Free areas and practices

Finding the perfect office – How does Berlin compare to other German cities? How many free spaces and practices are there in relation to Hamburg, Munich & Co. This chart shows the proportion of vacant office space as a proportion of total office space in selected German cities in 2018.

- Frankfurt am Main – 6.8% free / 93.2% rented

- Düsseldorf – 6.4% vacant / 93.6% rented

- Hamburg – 3.6% vacant / 96.4% rented

- Cologne – 2.8% free / 97.2% rented

- Stuttgart – 2.3% free / 97.7% rented

- Munich – 1.8% free / 98.2% rented

- Berlin – 1.5% free / 98.5% rented

More statistics can be found at Statista

More statistics can be found at Statista

Exclusive apartments in Berlin Mitte? Get in contact with us!

Living, population and economy

- City Map of Berlin

- Population

- Comparison: Berlin, Hamburg, Cologne and Munich

- Average age of the population

- Berlin’s gross domestic product

- Unemployment rate

- Private households: Forecast until 2030 in Berlin

City map Berlin

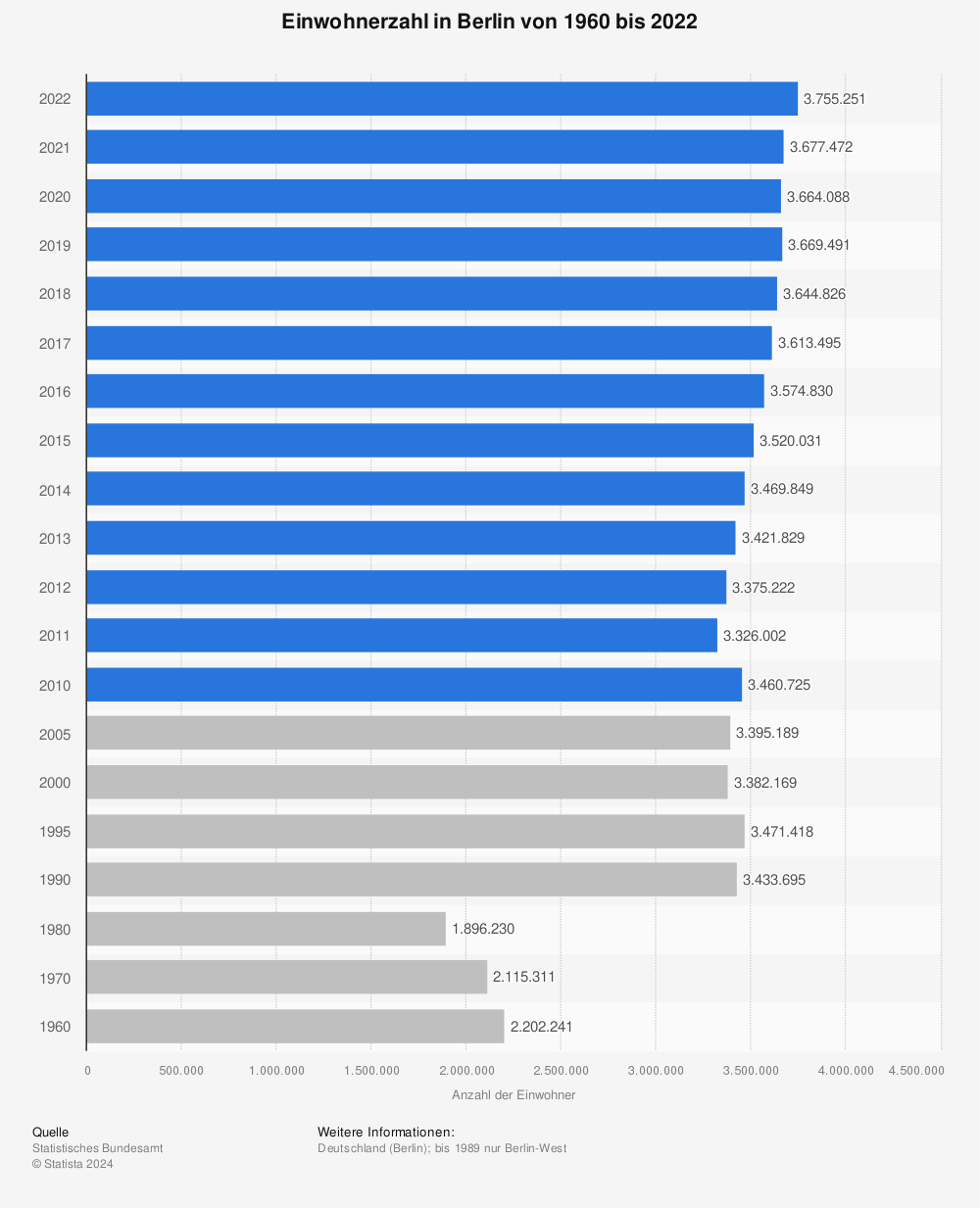

Number of inhabitants

Number of inhabitants in Berlin from 1960 to 2018.

More statistics can be found at Statista

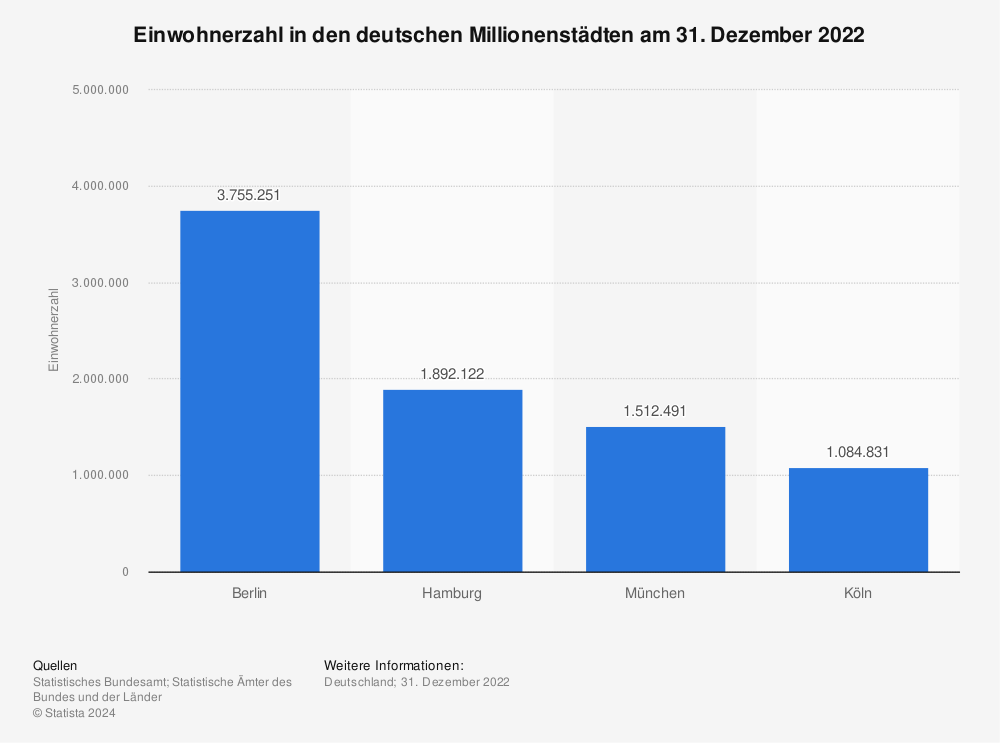

Comparison: Berlin, Hamburg, Cologne and Munich

Where do most of the inhabitants live? Here you see visualized, the 4 biggest cities in Germany. The graph shows the number of inhabitants in the German megacities on 31 December 2018, at the turn of the year 2018 / 2019.

- Berlin – 3,644,826 inhabitants

- Hamburg – 1,841,179 inhabitants (- 1,625,647 cf. Berlin)

- Munich – 1,471,508 inhabitants (- 2,173,318 see Berlin)

- Cologne – 1,085,664 inhabitants (- 2,559,162 cf. Berlin)

More statistics can be found at Statista

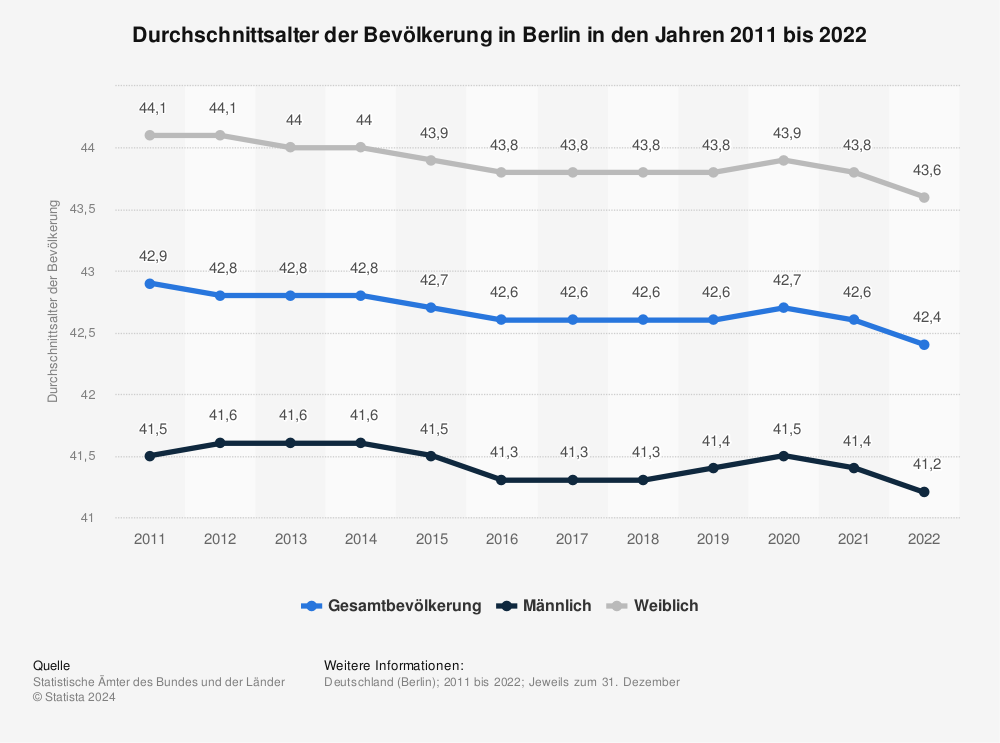

Average age of the population

Average age of the population in Berlin in the years 2011 to 2018.

More statistics can be found at Statista

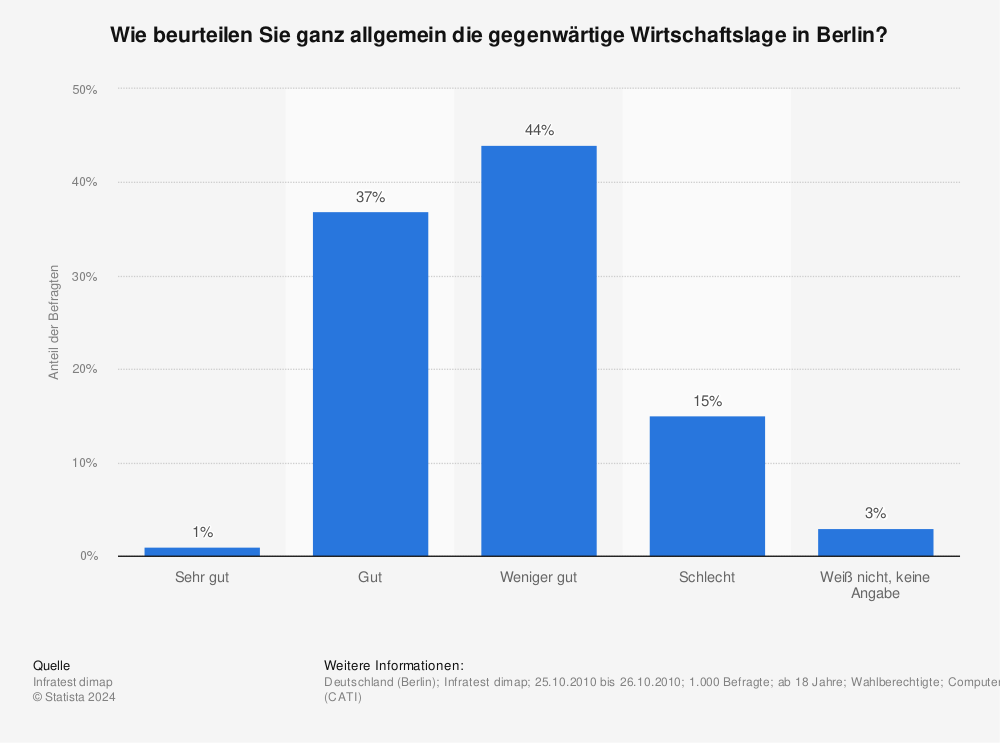

Assessment of the economic situation

How do you generally assess the current economic situation in Berlin?

More statistics can be found at Statista

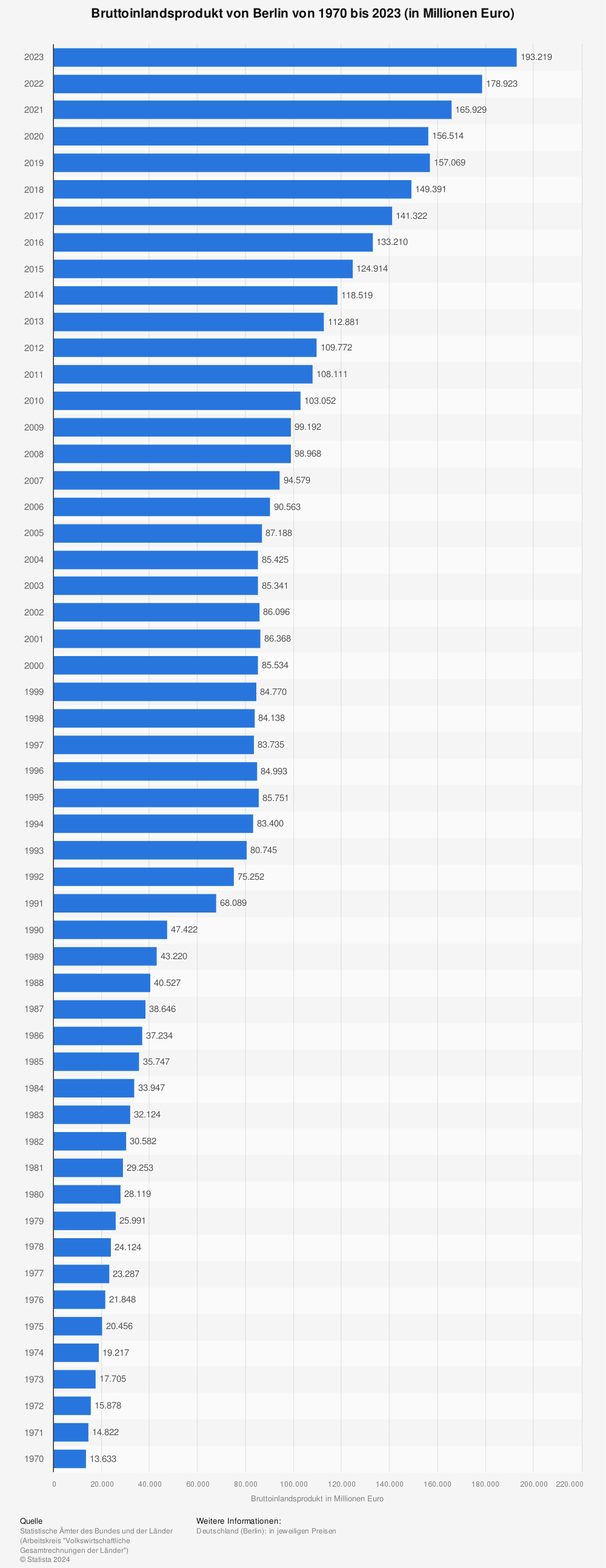

Berlin’s gross domestic product

Gross domestic product of Berlin from 1970 to 2018(in million euros)

More statistics can be found at Statista

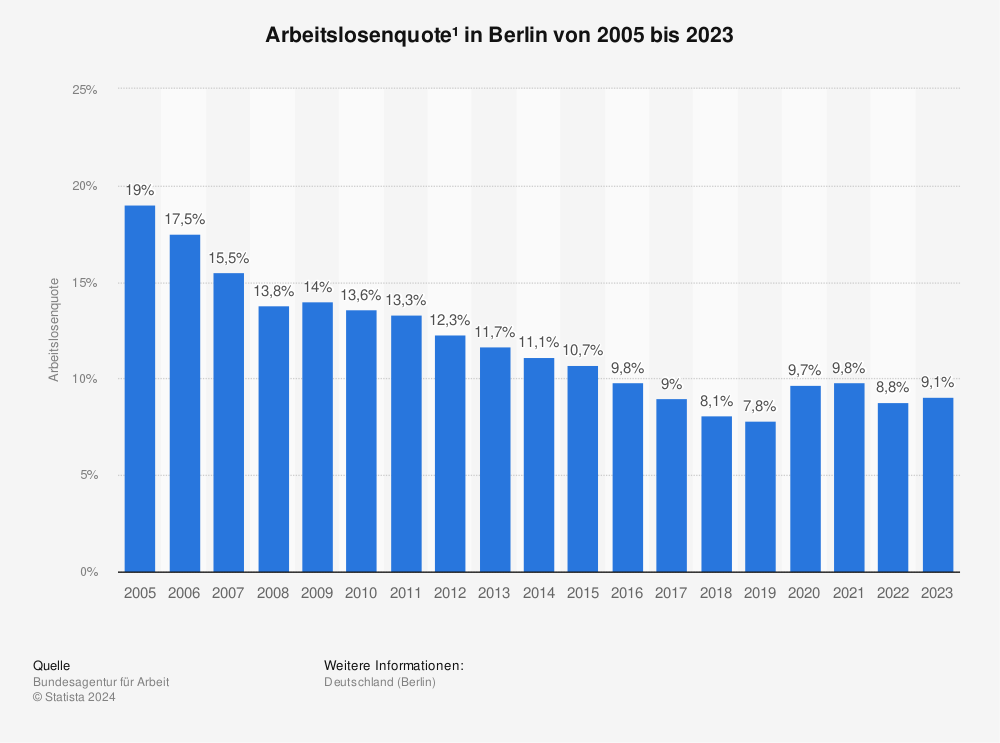

Unemployment rate

Unemployment rate in Berlin from 2001 to 2019.

More statistics can be found at Statista

Private households: Forecast until 2030

How is Berlin developing as a city and federal state? Here you can see the number of private households in Germany by federal state in 2018 and forecast for 2030 (in 1,000). This is an optimal situation for landlords as the demand for living space increases.

More statistics can be found at Statista

Buy in Germany

Tip! Read more about Buy an apartment: The 10 most expensive German cities.

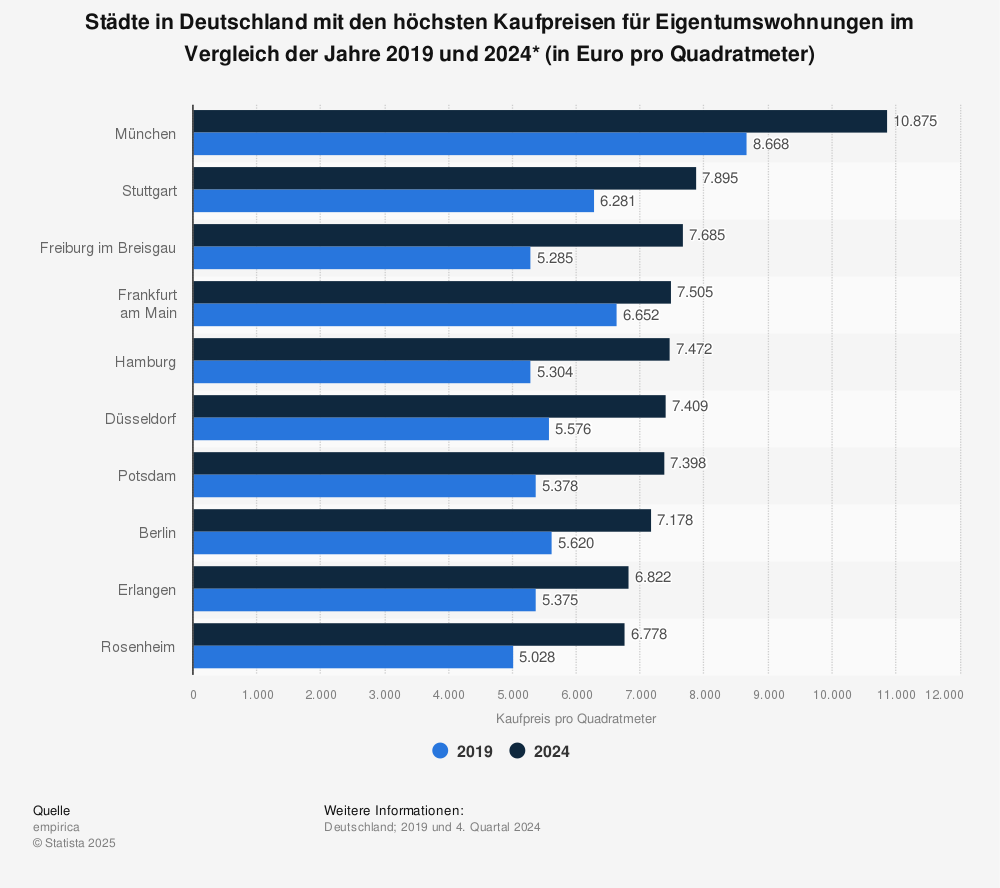

- Ranking: Square meter prices for condominiums

- House price index: Development of house prices

- Development of construction investments in Germany

- Ownership ratio in Germany

Ranking: Square meter prices for condominiums

Cities with the highest prices per square meter for condominiums in 2015 and 2019 (in euros per square meter).

- Munich – 8,993 Euro / square meter

- Frankfurt am Main – 6,701 Euro / square meter

- Stuttgart – 6,324 Euro / square meter

- Potsdam – 6.1.64 Euro / square meter

- Berlin – 5.578 Euro / square meter

- Hamburg – 5,507 Euro / square meter

- Düsseldorf – 5,470 Euro / square meter

- Erlangen – 5.416 Euro / square meter

- Regensburg – 5.411 Euro / square meter

- Freiburg im Breisgau – 5,349 Euro / square meter

More statistics can be found at Statista

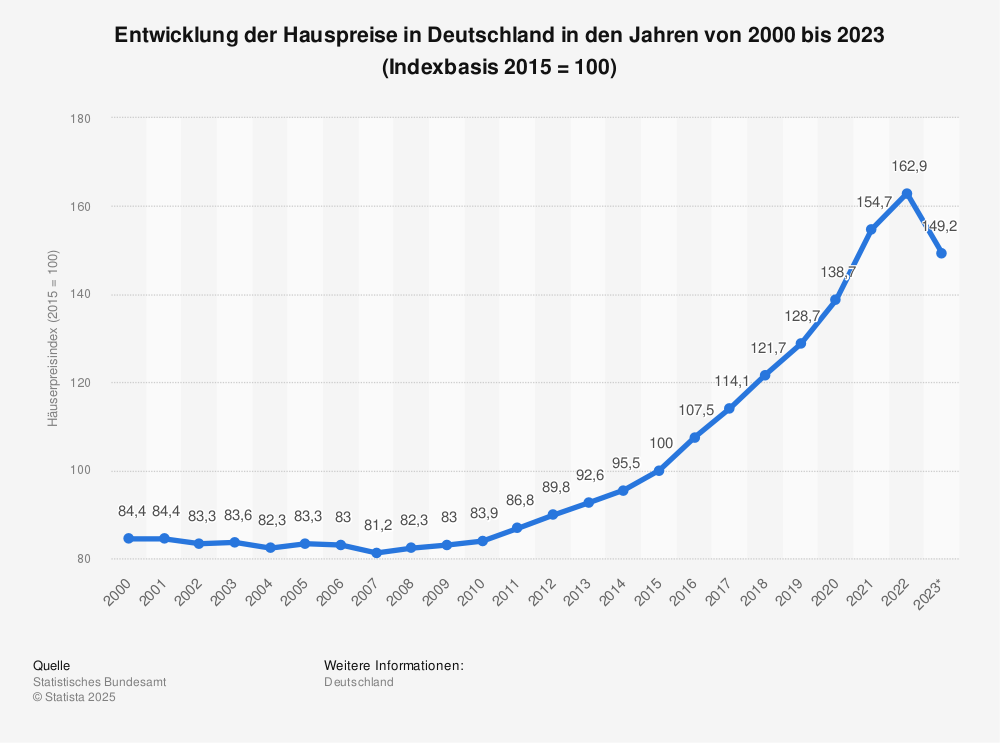

House price index: development of house prices

Development of house prices in Germany in the years from 2000 to 2018 (2015 = Index 100).

More statistics can be found at Statista

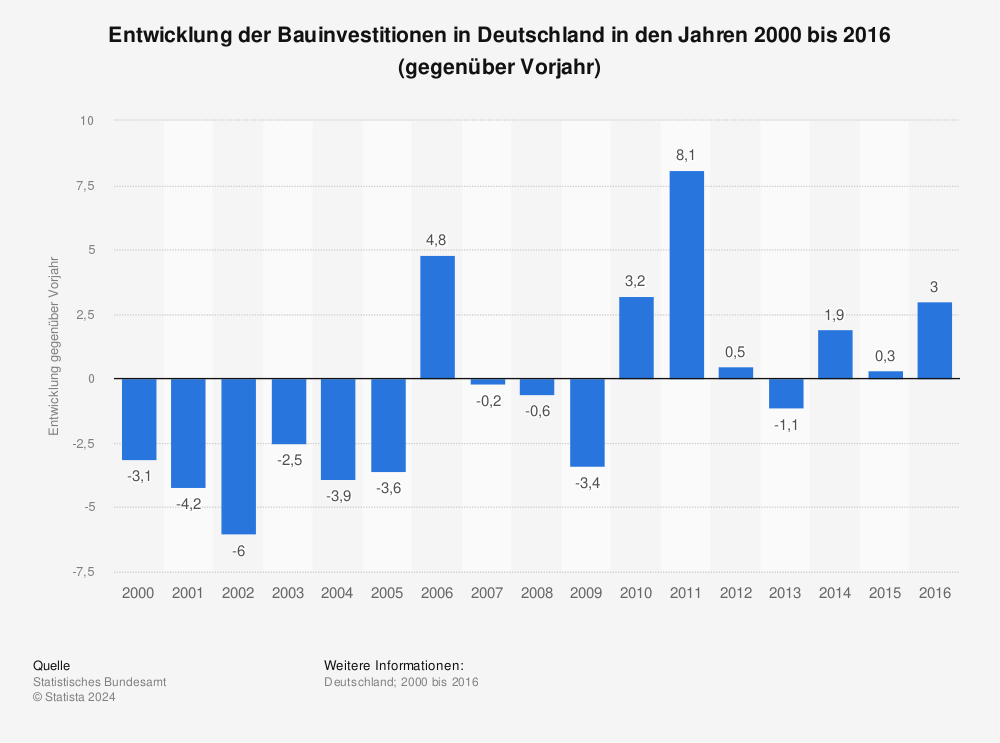

Development of construction investments in Germany

Development of construction investments in Germany in the years 2000 to 2016 (compared to previous year).

More statistics can be found at Statista

Ownership ratio in Germany

Ownership rate in Germany in the period from 1998 to 2018 by Länder

| 1998 | 2002 | 2006 | 2010 | 2014 | 2018 | |

|---|---|---|---|---|---|---|

| Baden-Württemberg | 48.3% | 49.3% | 49.1% | 52.8% | 51.3% | 52.6% |

| Bavaria | 47.6% | 48.9% | 46.4% | 51% | 50.6% | 51.4% |

| Berlin | 11% | 12.7% | 14.1% | 14.9% | 14.2% | 17.4% |

| Brandenburg | 35.5% | 39.8% | 39.6% | 46.2% | 46.4% | 47.8% |

| Bremen | 37.5% | 35.1% | 35.4% | 37.2% | 38.8% | 37.8% |

| Germany total | 40.9% | 42.6% | 41.6% | 45.7% | 45.5% | 46.5% |

| Hamburg | 20.3% | 21.9% | 20.2% | 22.6% | 22.6% | 23.9% |

| Hessen | 43.3% | 44.7% | 44.3% | 47.3% | 46.7% | 47.5% |

| Mecklenburg-Vorpommern | 32.2% | 35.9% | 33.2% | 37% | 38.9% | 41.1% |

| Lower Saxony | 48.9% | 51% | 49% | 54.5% | 54.7% | 54.2% |

| North Rhine-Westphalia | 37.4% | 39% | 38.7% | 43% | 42.8% | 43.7% |

| Rhineland-Palatinate | 55% | 55.7% | 54.3% | 58% | 57.6% | 58% |

| Saarland | 58.1% | 56.9% | 54.9% | 63.7% | 62.6% | 64.7% |

| Saxons | 28.7% | 31% | 29.5% | 33.7% | 34.1% | 34.6% |

| Saxony-Anhalt | 36.5% | 39.6% | 37.9% | 42.7% | 42.4% | 45.1% |

| Schleswig-Holstein | 46.8% | 49.4% | 47.1% | 49.7% | 51.5% | 53.3% |

| Thuringia | 39.2% | 41.8% | 40.6% | 45.5% | 43.8% | 45.3% |

All further information on statistics can be found at Statista

Rentals in Germany

Tip! Read more about Rent an apartment: The 10 most expensive German cities.

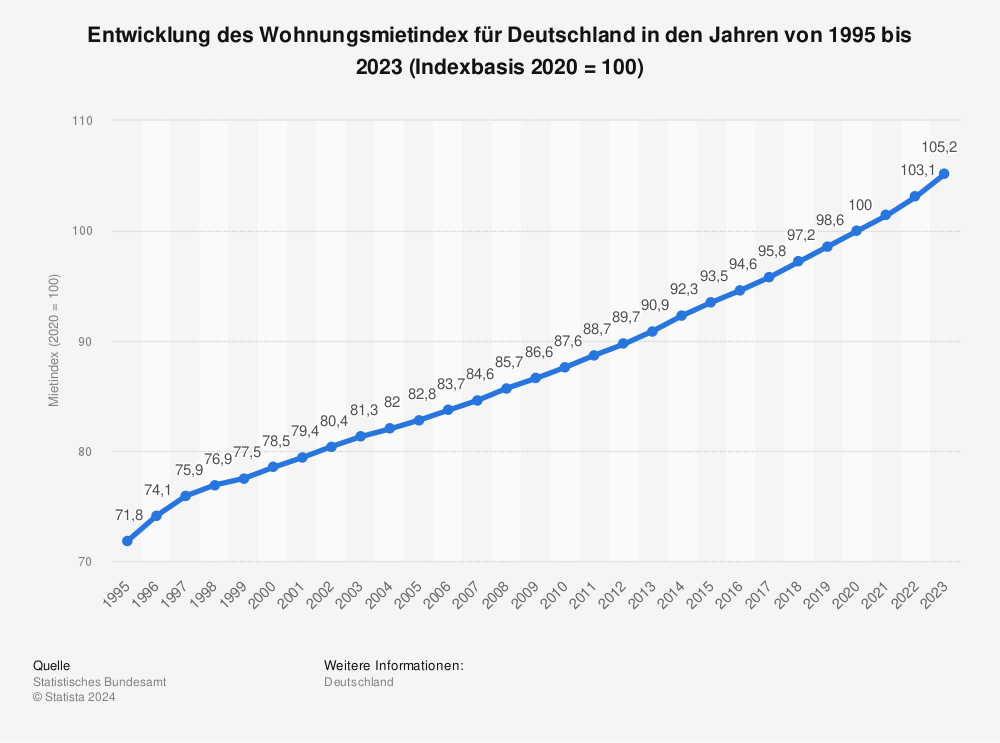

- Development of the rental price index

- Ranking: Rents for apartments

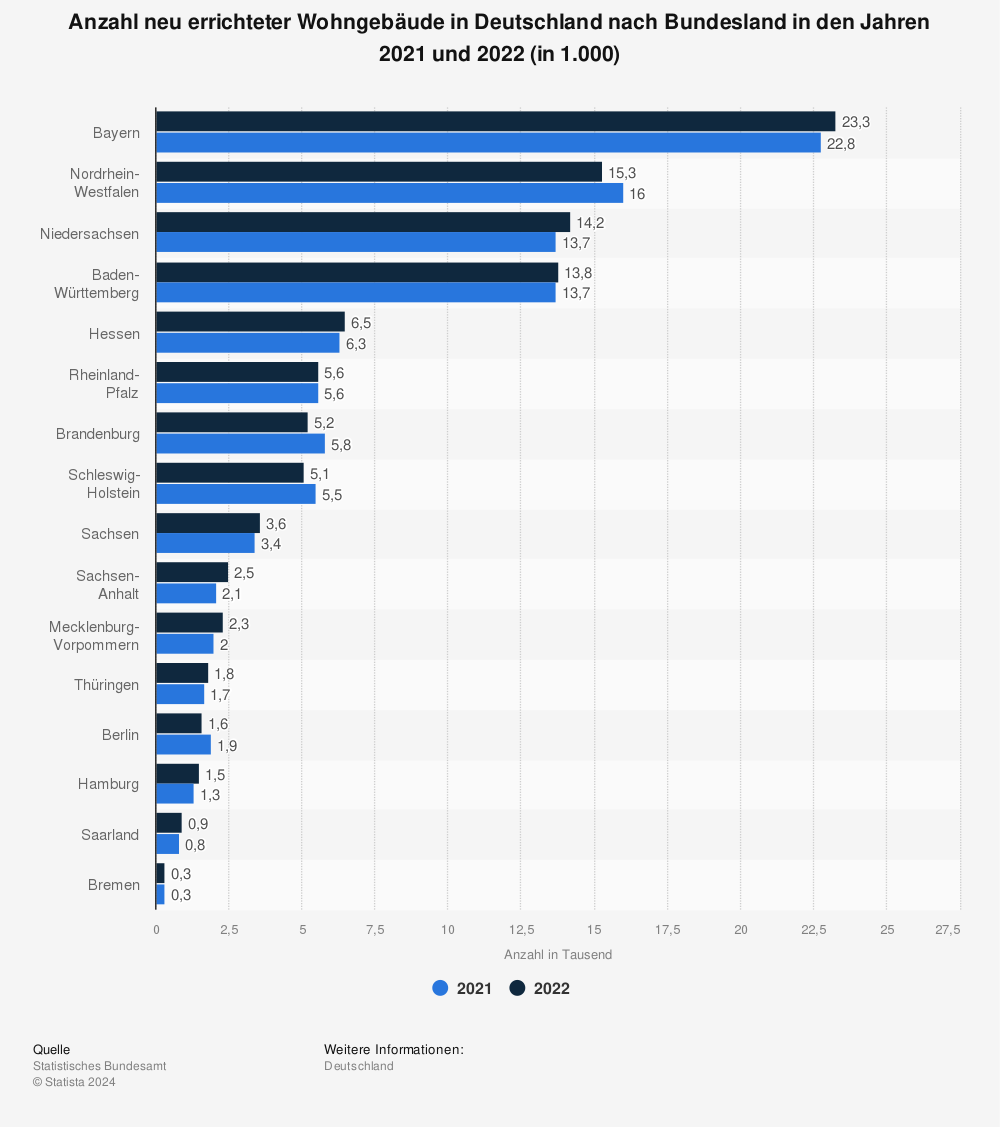

- Number of newly constructed residential buildings

Development of the rental price index

Development of the rent price index for Germany in the years from 1995 to 2019 (2015 = Index 100)

More statistics can be found at Statista

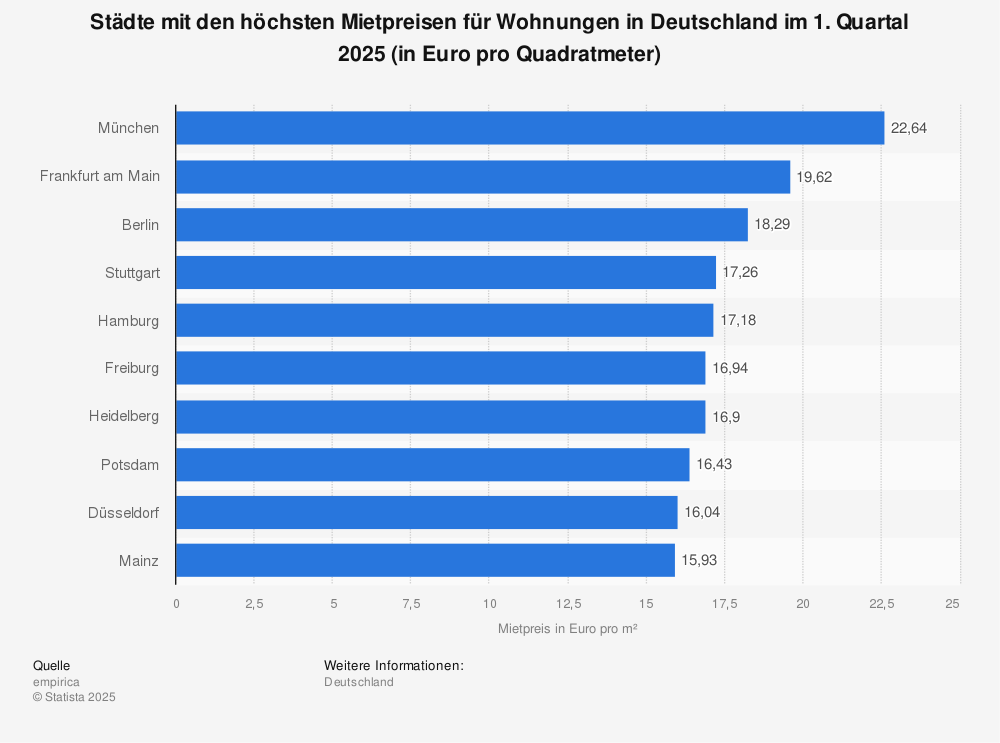

Ranking: Rents for apartments

Cities with the highest rental prices for apartments in Germany in the 4th quarter of 2019(in euros per square metre)

More statistics can be found at Statista

Number of newly constructed residential buildings

New construction: Where are new apartments being built? Number of newly constructed residential buildings in Germany by federal state in 2017 and 2018 (in 1,000).