Inheritance and Inheritance in Germany: Real Estate Statistics & Studies

Until now, inheritances in Germany were assumed to be up to 300 billion euros (as reported by Der Spiegel). At the same time, the inheritance and the volume is increasing, as you will also see later in the statistics. According to the DIW study, the trend continues and there will be significantly more assets inherited or given away in Germany, a whole 400 billion. If an inheritance is accepted, this means accepting all rights, but also all obligations. If the inheritance is a purely monetary amount, this value is determined immediately. It is different with real estate. Not only does the house pass into the hands of the heir, but also any debts such as a mortgage are then assumed by the heir. In practice, this means that the heir is liable for these debts with his or her own assets.

Statistics on inheritance, inheritance, house and apartment

Further studies and statistics can be found on the websites of the Federal Statistical Office and with us under:

Inheritance and gifts

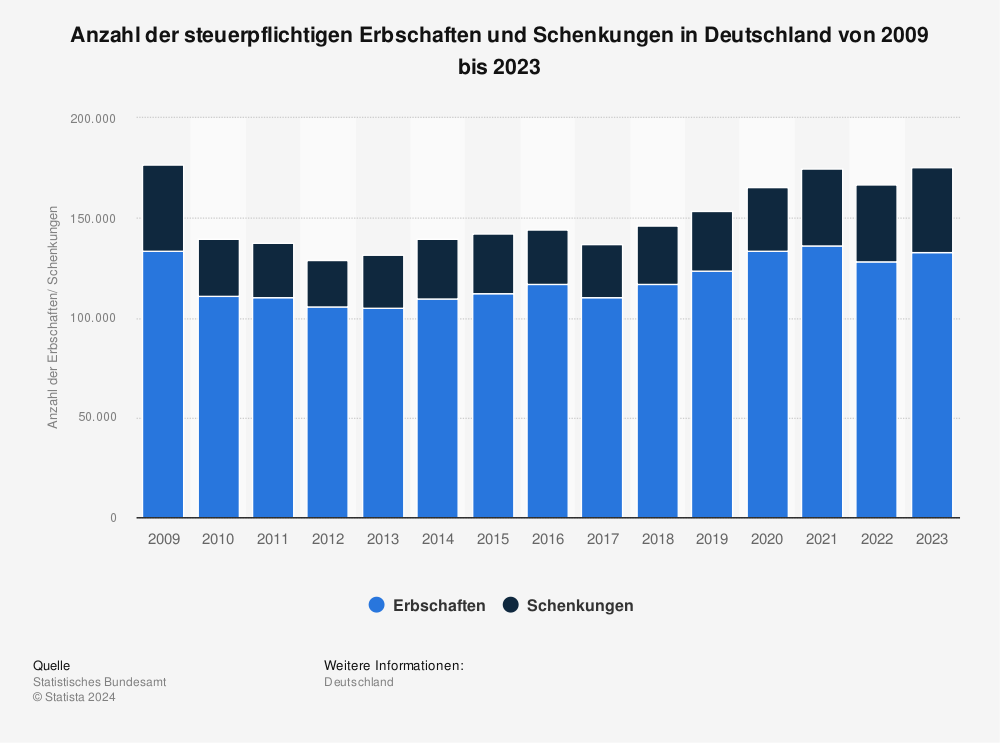

Here you can see inheritances and gifts in Germany. The survey ranges from 2008 to 2018 and shows that over 110,000 inheritances are distributed each year. Great potential for dispute if the community of heirs does not agree.

You can find more statistics at Statista

How much money is inherited?

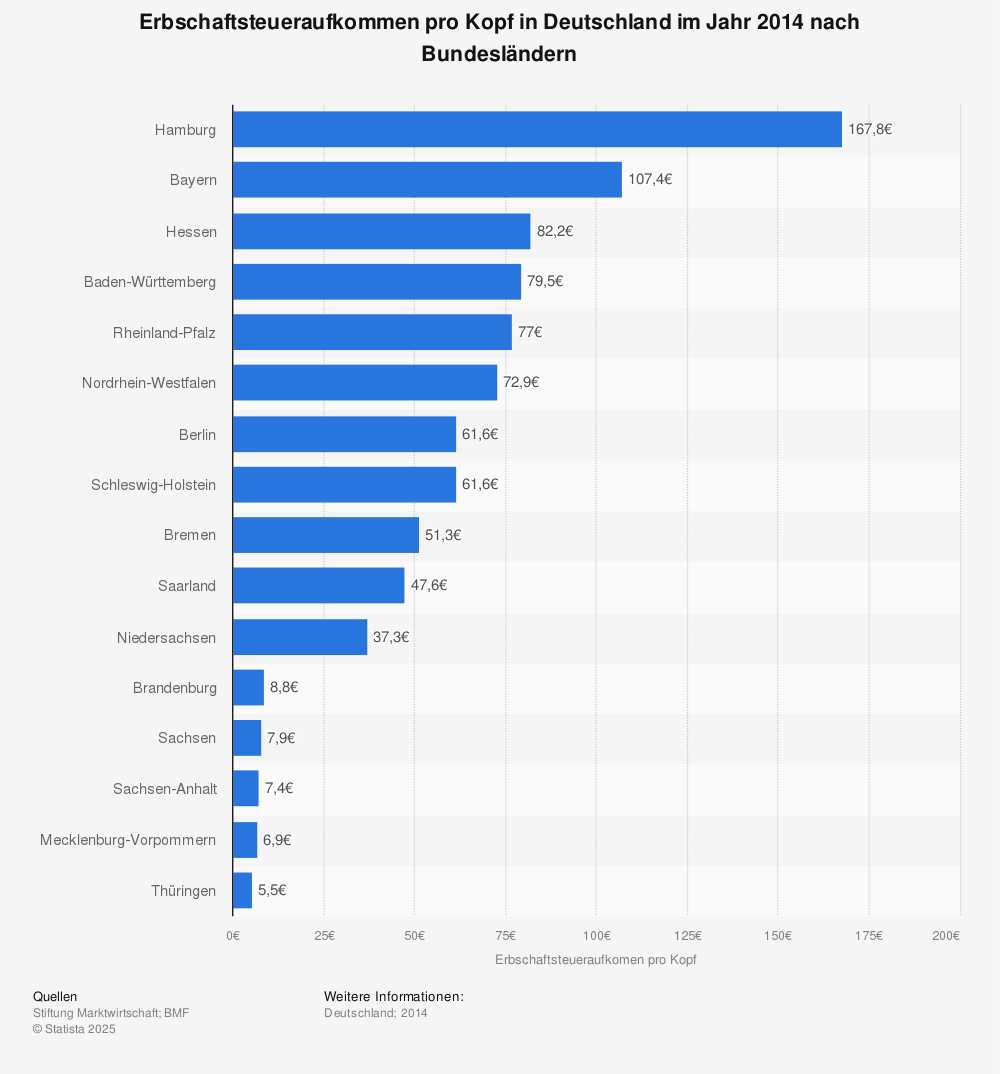

Since 2014, Hamburg in particular has been at the top in Germany. Hamburg is currently at the top with 167.80 euros. In no other city is so much inherited. With a population share 2.19% of total Germany (1.82 million out of 82.79 million), a total volume of 305,731,600 euros is inherited annually.

- Population share Hamburg 2.19%

- Inheritance in Germany (comparison year) 109,635; statistically 2,401 inheritances in Hamburg

- Total inheritance (Hamburg / year) 305.731.600 Euro

Selling an inheritance? Apartment prices in Germany

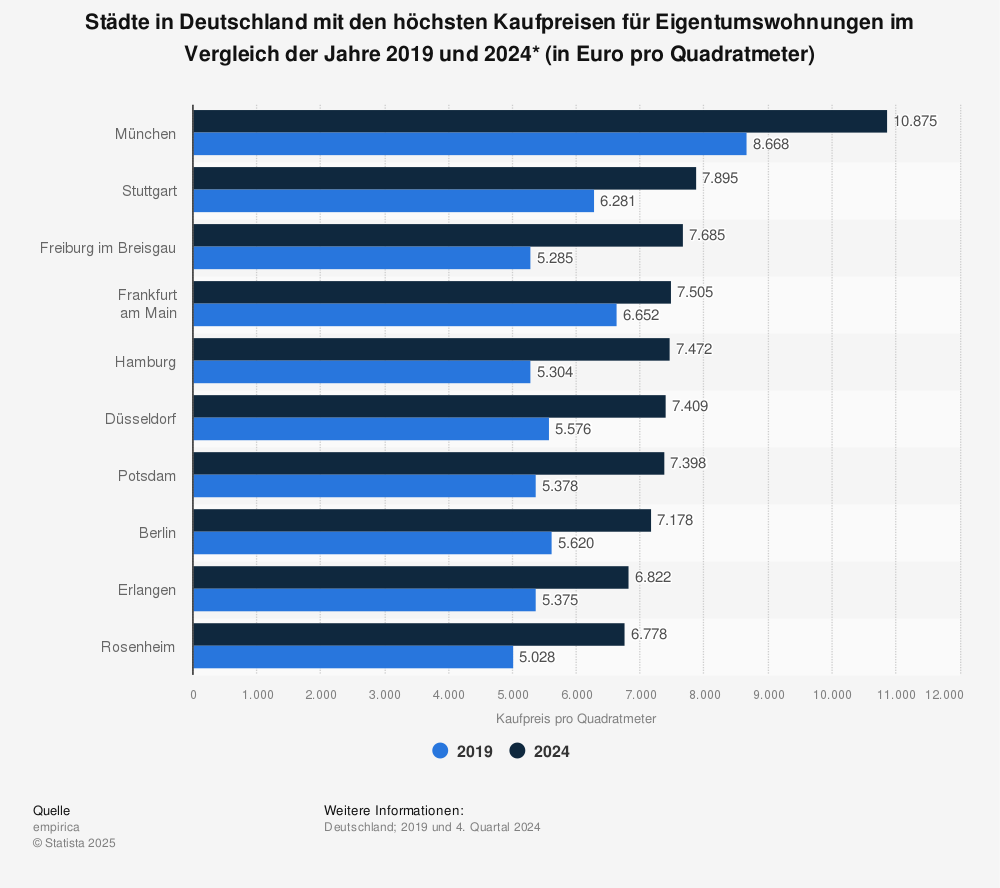

Here you can see the cities with the highest prices per square metre for condominiums comparing 2010 and 2018* (in euros per square metre).

- Munich (Bavaria) at 8,342 euros per sqm; up from 6,737 euros per sqm in 2014; up 1,695 euros per sqm in 4 years.

- Stuttgart (Baden-Württemberg) at 5,925 euros per sqm; up from 4744 euros per sqm in 2014; up 1,181 euros per sqm.

- Frankfurt am Main (Hesse) at €6,060 per sqm; up from €4,373 per sqm in 2014; up €1,687 per sqm

- Freiburg im Breisgau (Bavaria) at 4,943 euros per sqm; up from 4,740 euros per sqm in 2014; increase of 203 euros per sqm

- Ingolstadt (Bavaria) at €4,969 per sq m; up from €4,287 per sq m in 2014; increase of €682 per sq m.

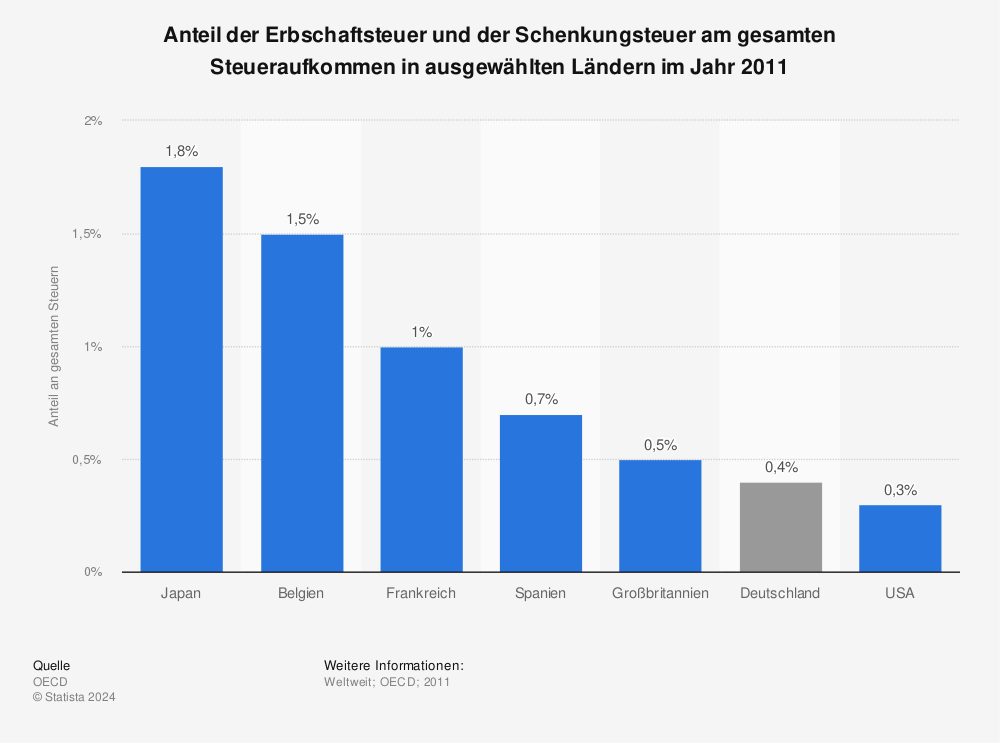

Germany in comparison: Inheritance in other countries

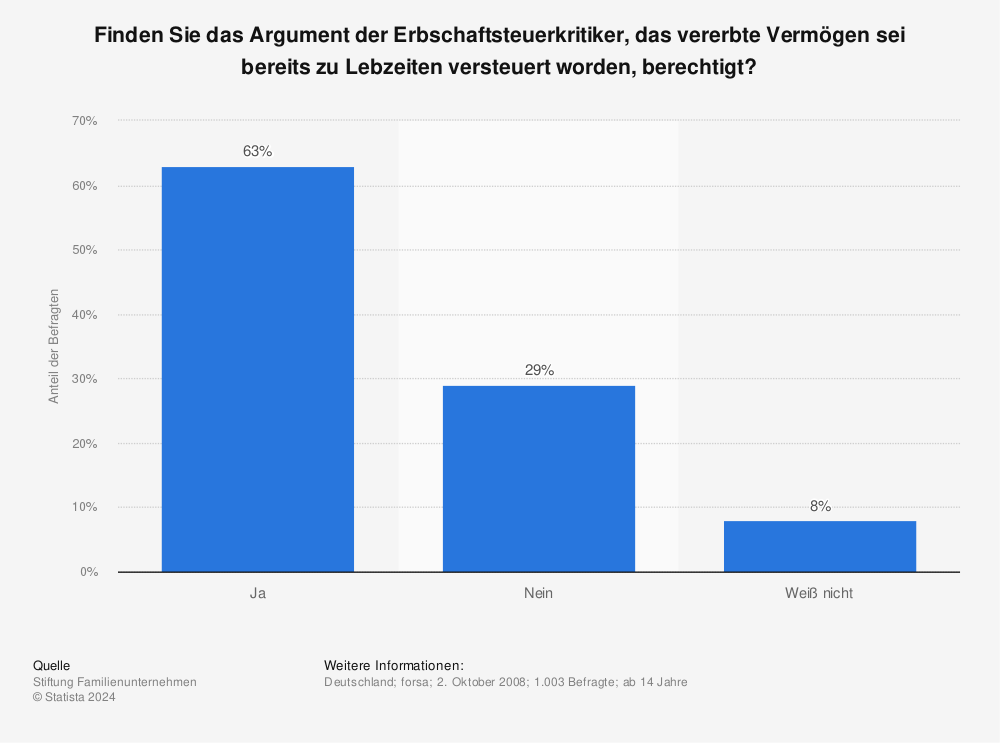

Inheritance tax critics: What do Germans think?

What is the opinion of Germans on the subject of inheritance and taxes? The question: “Do you find the argument of the inheritance tax critics that the inherited assets were already taxed during your lifetime justified?”

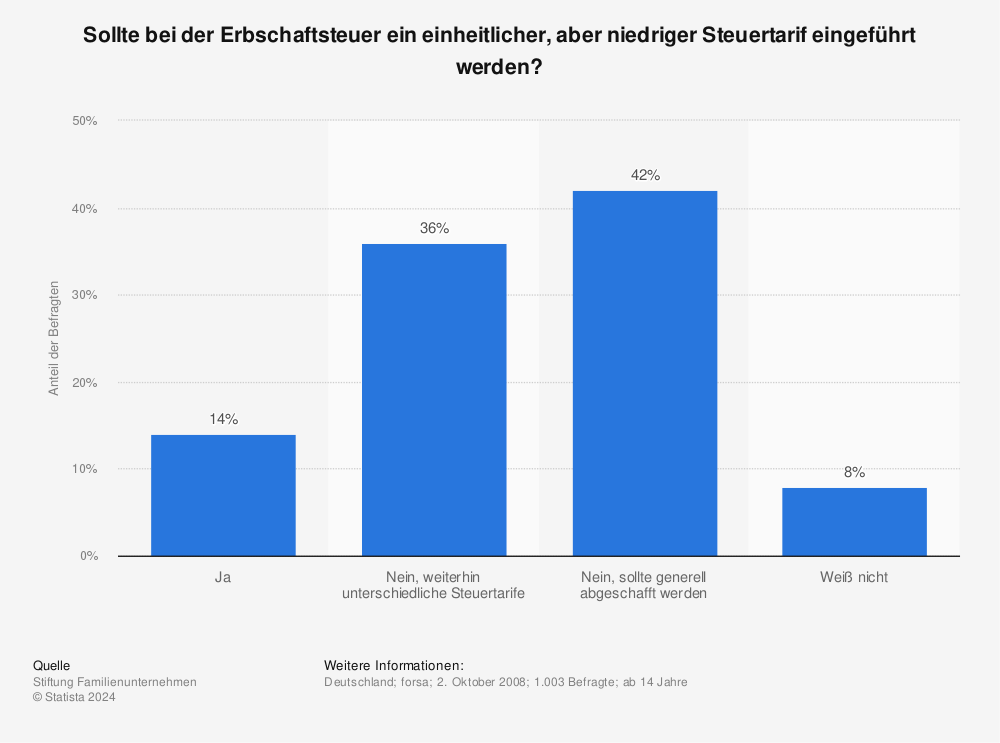

Uniform inheritance tax – Survey

Should a uniform but low tax rate be introduced for inheritance tax?

You can find more statistics at Statista

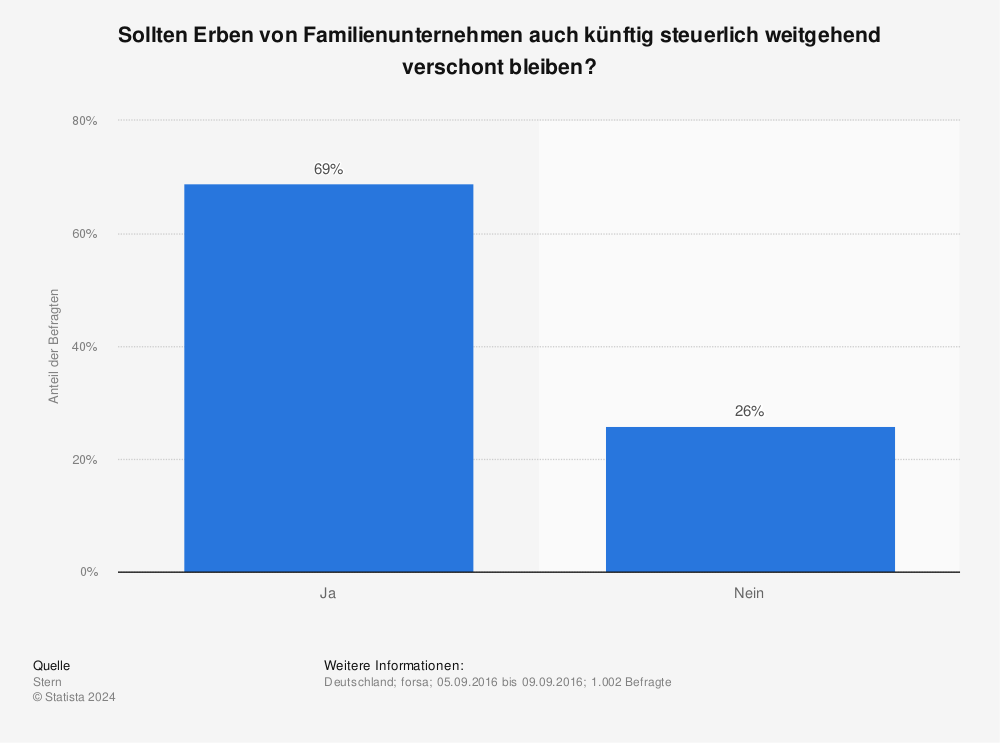

Spare the family business – Survey

Should heirs to family businesses continue to be largely spared from taxation in the future?

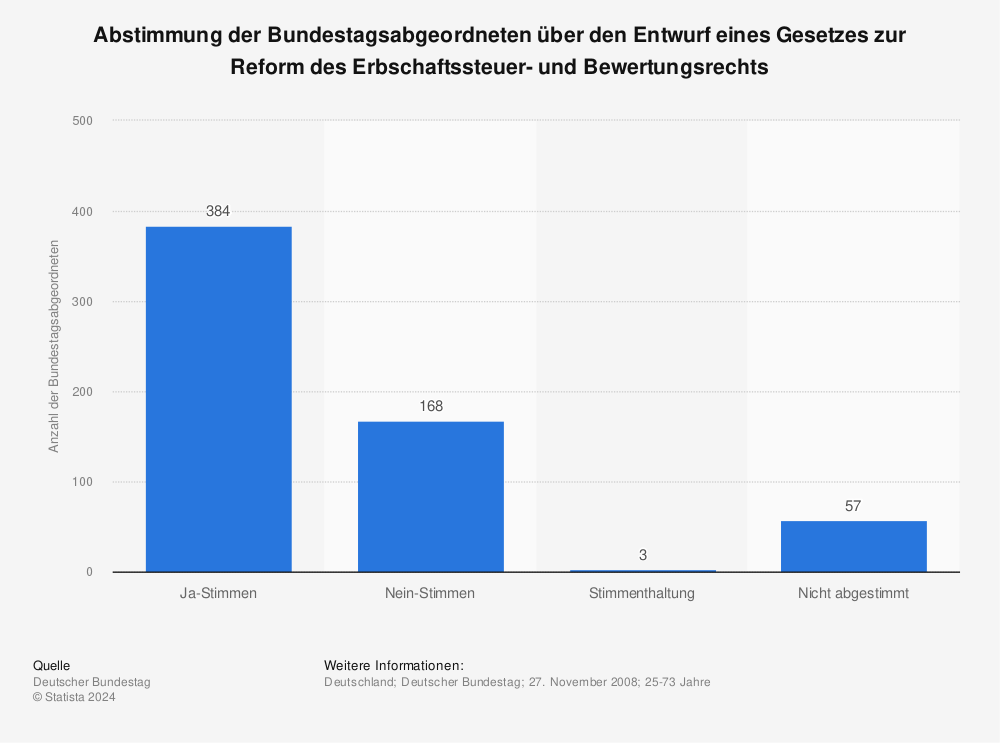

Reform of inheritance tax and valuation law

Vote of the members of the Bundestag on the draft law for the reform of the inheritance tax and valuation law

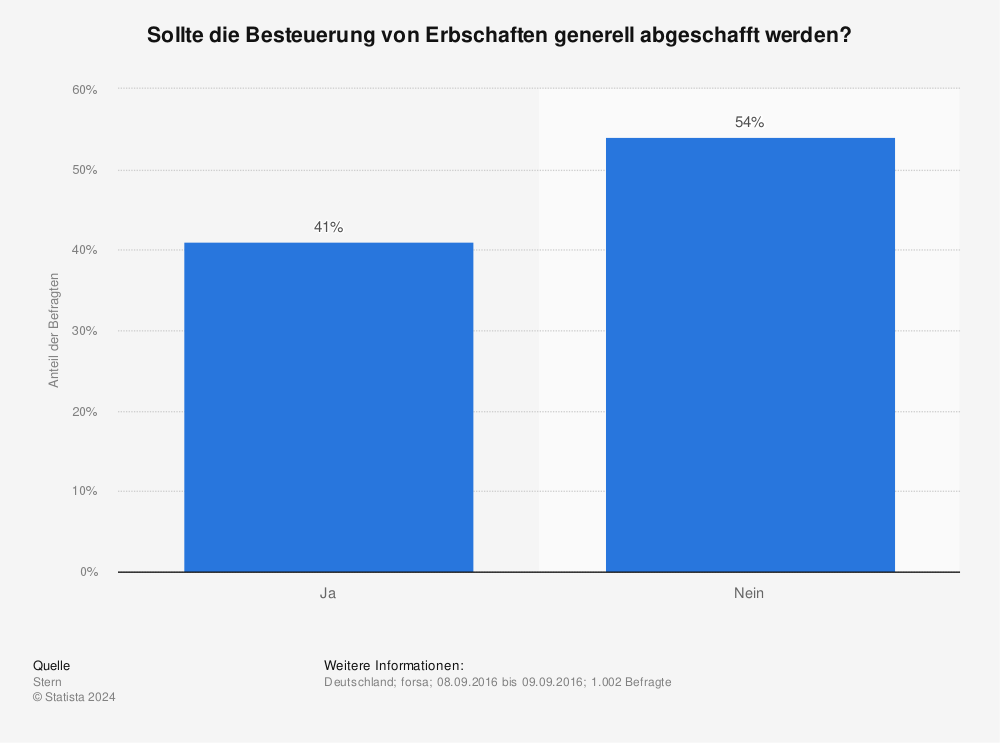

Abolish taxation of inheritances

Should the taxation of inheritances be abolished in general?

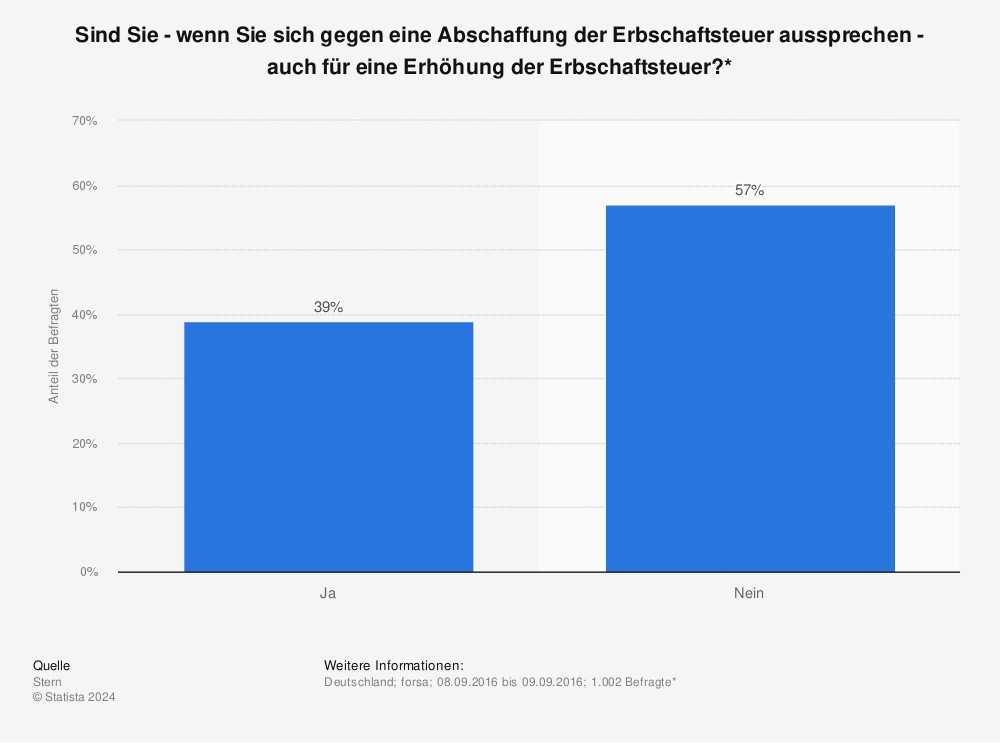

Against abolition same for increase of inheritance tax?

If you are against the abolition of inheritance tax, are you also in favour of an increase in inheritance tax?

Further studies and statistics can be found on the websites of the Federal Statistical Office and with us under: