Your Inheritance: Distributing Real Estate and Property

Your Inheritance – A death in the family is often the trigger for a bitter dispute over the estate. A will can remedy this problem by providing clarity about the estate during one’s lifetime. You can find out what needs to be considered and how real estate can be included in a will below.

Please note, this article is written with a focus toward the German market, but very similar laws apply everywhere.

Testament – Inherit the assets correctly

Without a testament, the estate will be distributed according to the provisions of the legal succession. However, this is not always in the interest of the testator. If a will exists, the assets can be distributed differently than the law requires and non-blood relatives can also inherit. The making of a will is therefore not only important to regulate the last will and testament exactly, but also to avoid disputes in the family.

- Learn more about: Correctly inherit

- Exemptions and Inheritance Tax

The Content – What can be regulated in a will?

A will overrides the legal succession and can thus determine a new succession. The testator determines who is to take over the inheritance. If several persons are named, the assets are usually divided according to quotas. Writing a will also allows the testator to leave individual items to certain persons, such as a car, jewelry or real estate. However, these are legally not considered as inheritance but as bequest. To avoid disputes about the estate, the estate can be distributed in a will in such a way that no points of contention can arise.

Setting up – the notary helps

Wills can be drawn up with or without a civil law notary. If a will is drawn up without a civil law notary, a few things must be taken into account. The author must be at least 16 years old and “testable”, i.e. in full possession of his mental powers. The testament must be written by hand, because printouts written on the computer are not sufficient as a valid testament. If the will is several pages long, each page should be numbered, stapled together and each page should be dated and signed in a uniform manner. A unique heading, such as “Last Will and Testament” or “My Last Will and Testament” is recommended to make the purpose of the writing clear.

If, however, a will is drawn up with the help of a civil law notary, this means that the testator has verbally recorded his last will and testament with a civil law notary. This is particularly important when real estate is part of the estate, because either a certificate of inheritance or a notarial will is required for transfer to the land register. If a notarial will exists, the heirs are spared the costly and time-consuming inheritance certificate procedure.

Assigning Real Estate in a will – avoiding community of heirs and disputes

If there is no will and a property is part of the estate, it becomes the property of the heirs. In most cases, a community of heirs is then formed in which no one can dispose of the inheritance alone. When such a property is sold, all heirs must agree. This fact can often lead to disputes within the community of heirs. In addition, the costs incurred for a notarial will are usually only half as low as the costs for a certificate of inheritance that the heirs have to pay if no will exists. In a will, the last will and testament can regulate the last will and testament about the real estate in detail and save disputes and unnecessary costs for all parties involved.

Debts in your estate – Protect your private assets

The heir to an estate takes over not only the assets but also the liabilities of the deceased. In general, an heir must reject a debt inheritance within six weeks, otherwise the heir is liable for the debts with his private assets. If it is clear from the outset that it is a debt inheritance, the inheritance can be rejected within the six-week period. If it only becomes apparent later that the estate is burdened with debts, an application for bankruptcy can be filed. The private assets of the heir are thus protected and the debts must only be repaid from the estate.

The traps – What to pay attention to

Particularly when it comes to the question of how best to inherit the estate, mistakes often occur in the correct implementation that limit the last will and testament.

No will

Without a will, the legal succession automatically takes effect. This can lead not only to disputes within the family, but also to the fact that loved ones are left empty-handed

No replacement heir

If the designated heir is already deceased at the time of death, the legal succession takes effect, which is not always in favour of the testator. The nomination of a substitute heir is therefore very important to avoid legal succession.

Non-marital partners

Non-marital partners must be clearly named in the will, as they are left empty-handed according to the legal succession

No children

Childless married couples without a will do not inherit completely to the remaining spouse, but also to parents or siblings. If the spouse is to administer the estate, this must be named exactly.

No clarity

A testament should always clearly state what the last will and testament is. If it is not clear how the estate is to be treated, errors may occur.

Legal succession – this happens without a will

If the deceased leaves children and a spouse, the spouse receives half of the assets according to the legal succession. The other half is divided between the children. If the deceased has no children, the spouse receives 75 percent of the assets and second-order relatives, such as siblings or parents, receive the remaining part of the inheritance.

In general, the spouse always inherits. Apart from this only heirs of one order can inherit, for example the children. If there is a first-order heir, such as a child, no one inherits from the second or third order.

Please also inform yourself about the topic: compulsory part in the inheritance!

Statistics: Inheritance in Germany

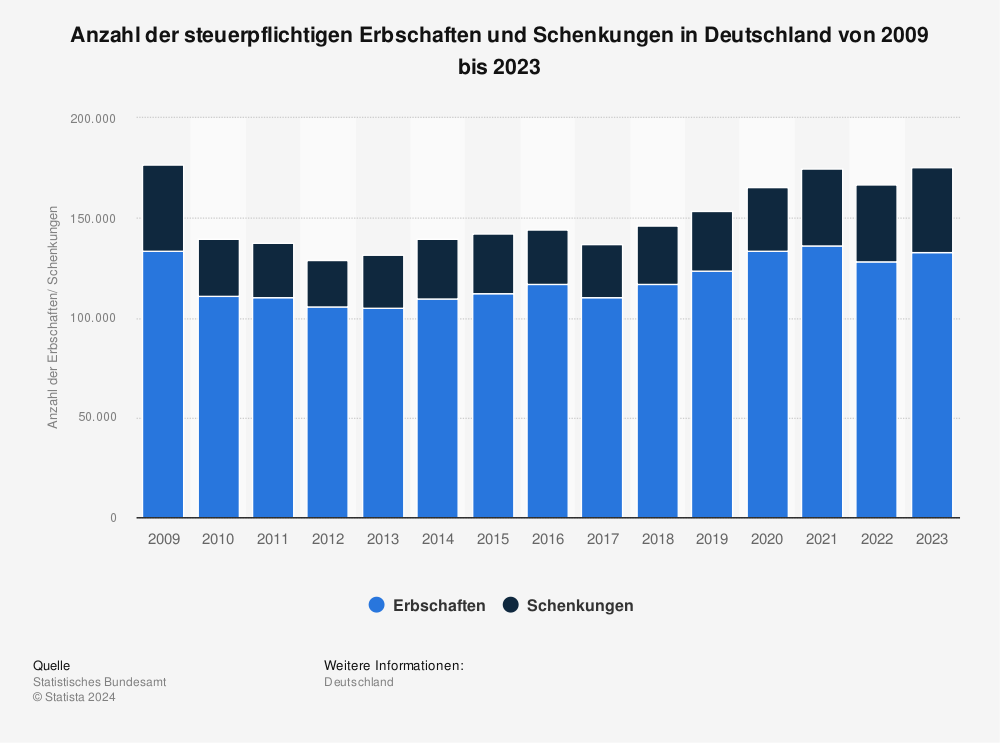

Here you can see inheritances and donations in Germany. The survey ranges from 2008 to 2018 and shows that over 110,000 inheritances are distributed annually. Great potential for dispute if the community of heirs does not agree.

You can find more statistics at Statista

How much money is inherited?

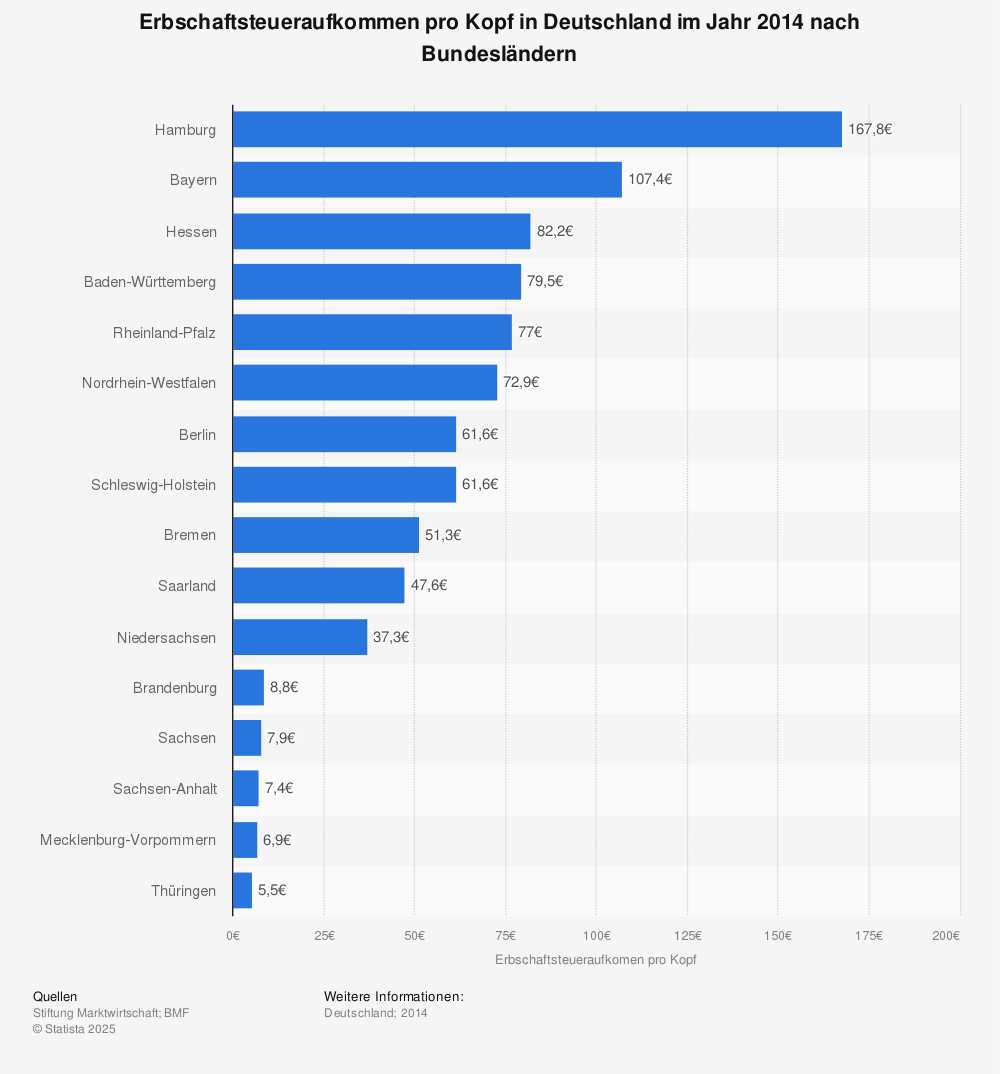

Since 2014, Hamburg in particular has been the leader in Germany. Hamburg is currently at the top with 167.80 euros. In no other city is so much inherited. With a population share of 2.19% of total Germany (1.82 million of 82.79 million), a total volume of 305,731,600 Euro is inherited annually.

- Population share Hamburg 2.19%

- Inheritance in Germany (comparison year) 109,635; statistically 2,401 inheritances in Hamburg

- Total inheritance (Hamburg / year) 305,731,600 Euro

Sell your inheritance? House prices in Germany

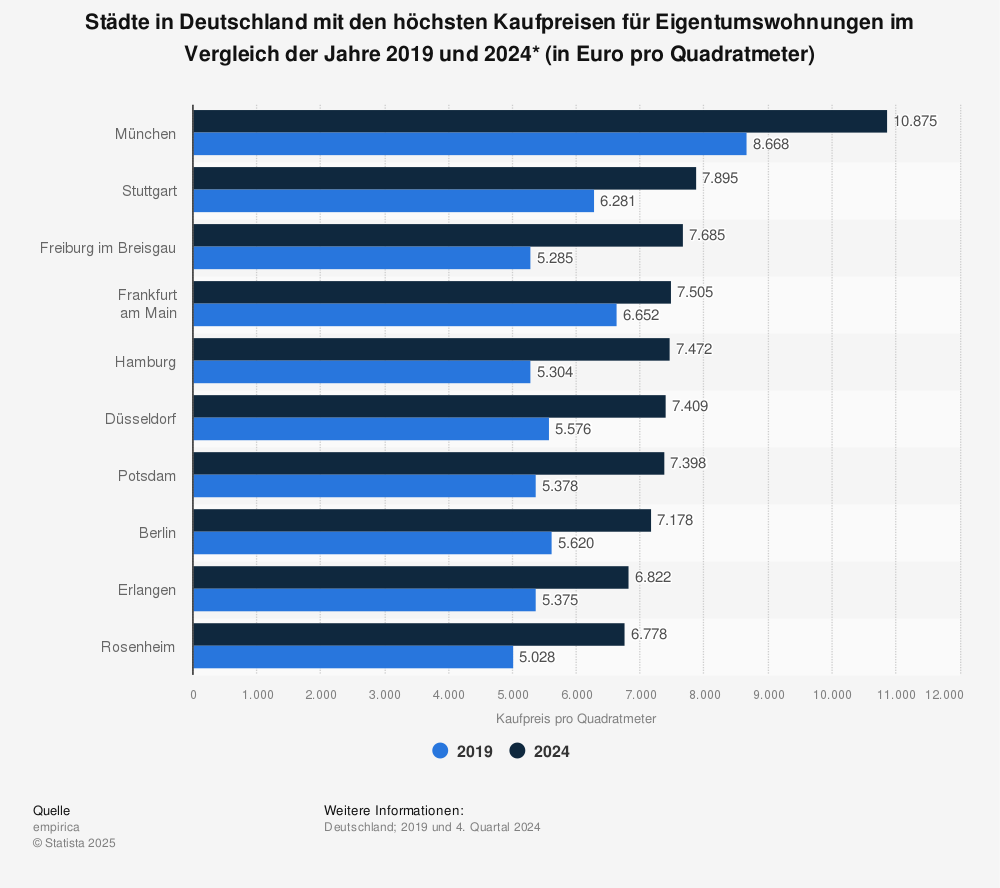

Here you can see the cities with the highest prices per square meter for condominiums in a comparison of 2010 and 2018* (in euros per square meter).

-

- Munich (Bavaria) with 8,342 euros per square meter; from 6,737 euros per square meter in 2014; increase of 1,695 euros per square meter in 4 years

- Stuttgart (Baden-Württemberg) with 5,925 euros per square meter; from 4744 euros per sqm in 2014; increase of 1,181 euros per sqm

- Frankfurt am Main (Hesse) with 6,060 euros per square meter; from 4,373 euros per square meter in 2014; increase of 1,687 euros per square meter

- Freiburg im Breisgau (Bavaria) with 4,943 euros per square meter; from 4,740 euros per square meter in 2014; increase 203 euros per square meter in 2014; increase 203 euros per square meter in 2014

- Ingolstadt (Bavaria) with 4,969 euros per square meter; from 4,287 euros per sqm in 2014; increase 682 euros per sqm

You can find more facts and figures on this topic at: Statistics Heritage.

The most important questions: Will and correct inheritance

In order to avoid family disputes and ignorance about the estate, it is important to settle the inheritance during your lifetime. Our experts have answered all important questions on this subject for you.

When is a donation tax-free?

Parents can give their children something from their inheritance and this is tax free. This possibility facilitates the inheritance taxes that are due on the inheritance. Parents may give their children a tax-free gift of 500,000 euros, while the amount is limited to 20,000 euros. .

Can I sign over my child to my house?

If you would like your child, or one of your children to receive your property, you can sign over the property while you are still alive. However, this is considered a gift, which is why your descendant will own ten percent of the property with every year you live after the gift.

How is an inheritance divided without a will?

Without a will, the inheritance is distributed according to the legal succession. In the first place, this succession takes into account the spouses and children. Other relatives are usually not taken into account.

What does the transfer of a house cost?

The cost of transferring a house depends on the value of the property. As a rule, the value is determined by the comparative value method.

Is a donation taxable?

A gift is taxed in the same way as an inheritance, but the same tax allowances apply to gifts as to inheritance.

What is meant by a gift?

A gift is a donation by which someone enriches someone else from his or her assets without demanding a monetary contribution.