Build a house: Prices, costs, plot and property tax – plan your construction

Building a house – When building a house there are many questions. As real estate agents, we repeatedly receive e-mails and phone calls from future builders: “How much does it cost to have a house built?”, “How much does a cheap house cost?” to more specific questions, such as “how long can you live in a prefabricated house (keyword substance)?”. – we have answers to your most important questions. Tip! Read more about New construction and Buying an apartment here.

House development: property, construction and costs

- What do you associate with it?

- Building land drives up the price (land prices)

- Building land becomes more expensive (+79.6%)

- Price development in comparison: regions

- Ground tax in comparison

- Price development of agricultural land

- Development of construction investments in Germany

- Prefabricated construction: Approval volumes

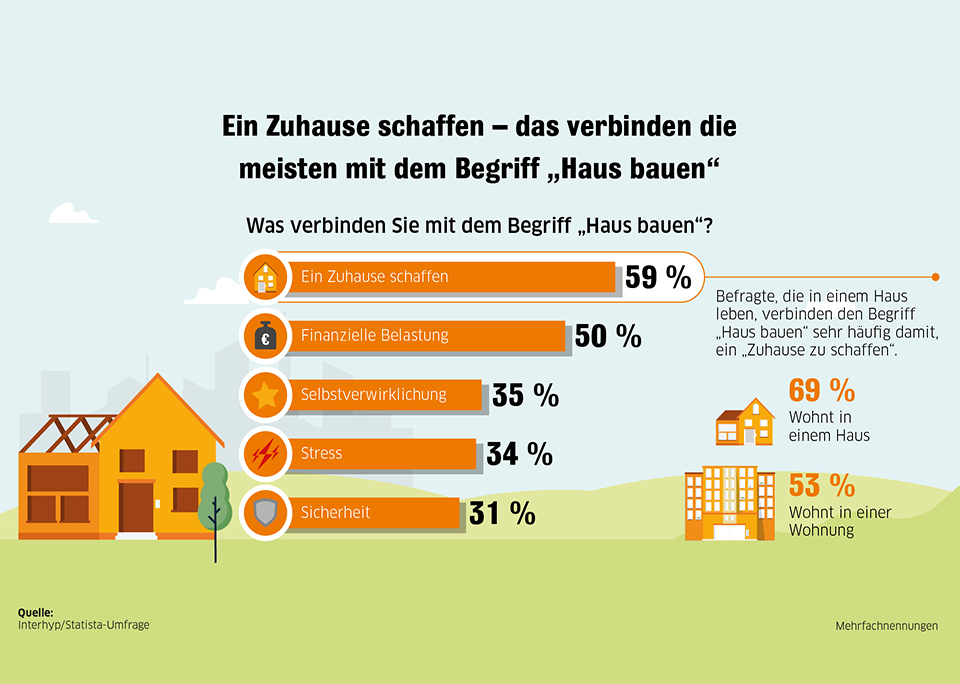

Home construction: What do you associate with it?

For most people, building a house means making a home for themselves; for 35%, self-realization is the main focus. The chart shows selected data on the topic of “house construction”.

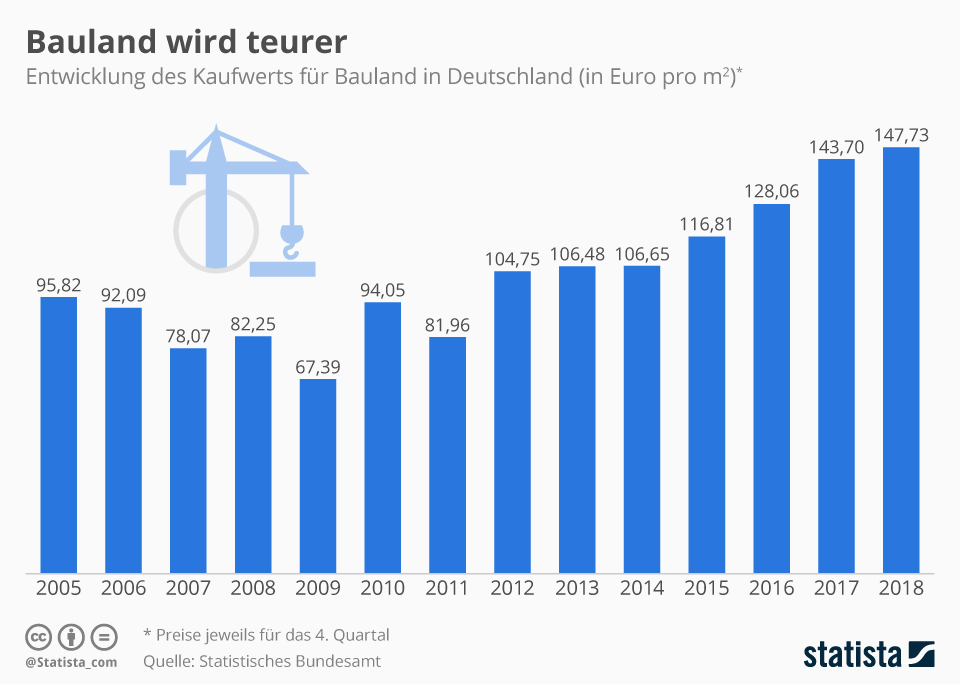

Building land drives up the price (land prices)

The chart shows the development of land prices for plots of land for individual development.

More statistics can be found at Statista

More statistics can be found at Statista

Building land becomes more expensive (+79.6%)

According to current data from the Federal Statistical Office, prices for building land in Germany will rise again in 2018 – for the seventh year in succession.

- 2005 – 95,82 Euro / square meter

- 2008 – 82.25 euros / square meter

- 2010 – 94,05 Euro / square meter

- 2013 – 106,48 Euro / square meter

- 2015 – 116,81 Euro / square meter

- 2018 – 147.73 Euro / square meter

- Increase over the last 10 years + 79.61% (2008-2018)

More statistics can be found at Statista

More statistics can be found at Statista

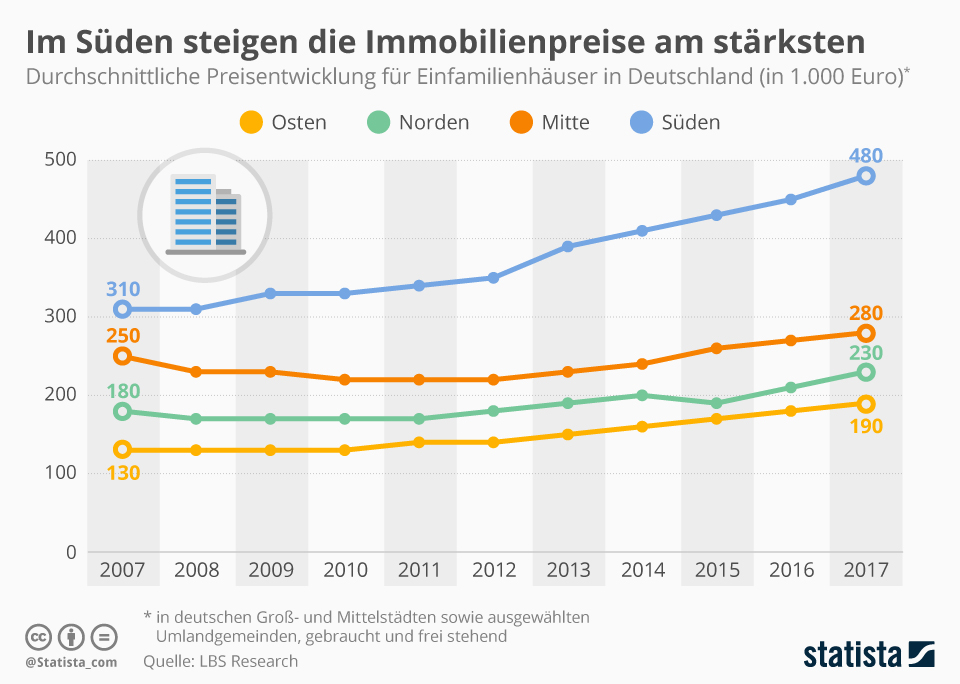

Price development in comparison: South, East, North & Middle

In the south, real estate prices for single-family homes are rising most strongly, from 310,000 euros (2007) to now 480,000 euros (+ 54.84%). Average price development for single-family houses in Germany (in 1,000 euros).

- South – 310.000 Euro (2007) high to 480.000 Euro

- Increase in the south of 170,000 Euros / + 54.84%

- Middle – 250,000 Euro to 280,000 Euro

- Increase in the middle of 30,000 Euro (+12%)

- North – 180.000 Euro on 230.000 Euro

- East – 130.000 Euro on 190.000 Euro

More statistics can be found at Statista

More statistics can be found at Statista

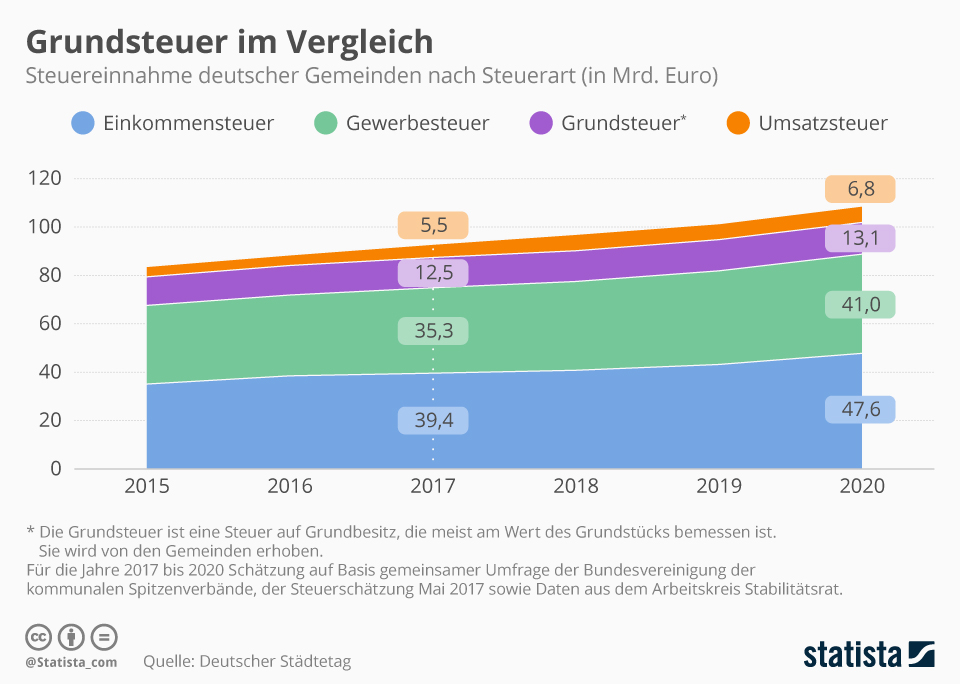

Ground tax in comparison

The property tax is levied on property, but also on hereditary building rights to land, the so-called substance tax. The assessment basis for the land tax is usually the value of the property. The tax rate is usually set at the municipal level. This infographic shows the tax revenue of German municipalities by type of tax (in billion euros).

More statistics can be found at Statista

More statistics can be found at Statista

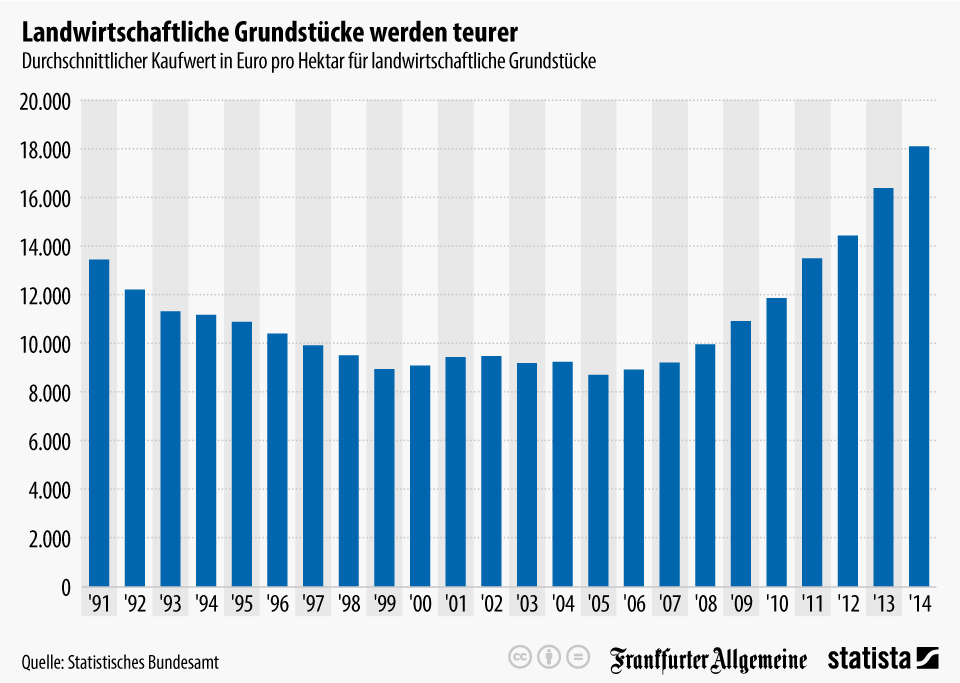

Price development of agricultural land

The chart shows farmers the average purchase value in euros per hectare for agricultural land in Germany. The increase from 1994 to 2014 is +63.6%, or 7,000 euros per hectare of land.

- 1994 ~ 11,000 Euro

- 1999 ~ 9,000 Euro

- 2004 ~ 9,500 Euro

- 2009 ~ 11,000 Euro

- 2014 ~ 18,000 Euro (+63.6%)

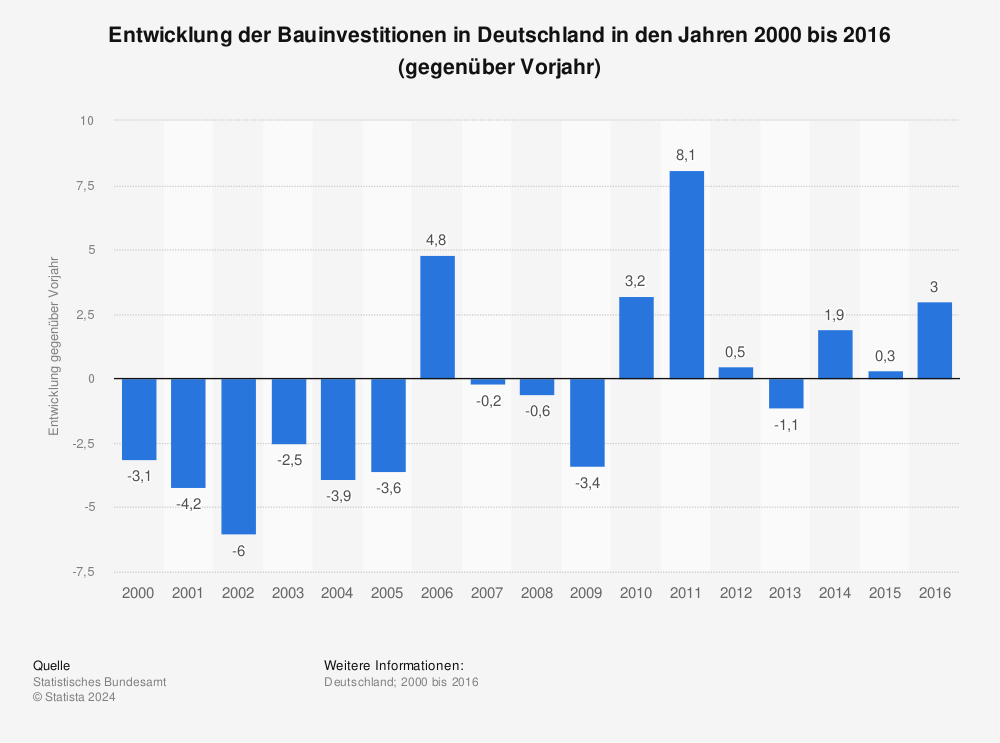

Development of construction investments in Germany

Development of construction investments in Germany in the years 2000 to 2016 (compared to previous year).

More statistics can be found at Statista

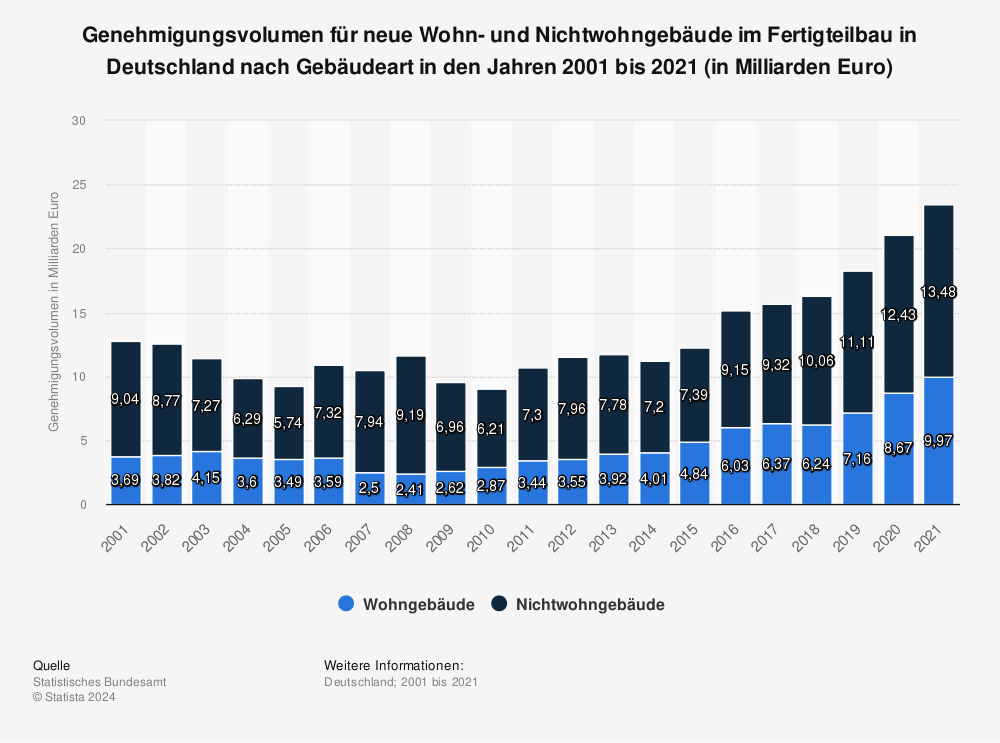

Prefabricated part construction: Approval volume

Approval volume for new residential and non-residential buildings in prefabricated construction in Germany by type of building in the years 2001 to 2018(in billion euros).

Residential buildings

- 2001 – 3.69 billion Euro

- 2018 – 6.24 billion euros

- Increase of EUR 2.55 billion (+69.1%)

Non-residential buildings

- 2001 – 9.04 billion Euro

- 2018 – 10.06 billion euros

- Increase of EUR 1.02 billion (+11.28%)

You can find more statistics at Statista

Financing

For as long as she works for your home

This chart shows how much net annual income one would have to spend on 100 square metres of residential property in the ten largest German cities.

More statistics can be found at Statista

More statistics can be found at Statista

Cities with highest real estate loans

The chart shows a ranking according to highest average mortgage loan in the 20 largest cities in Germany based on a current evaluation of the comparison platform Check24. Loans of 500,000 euros are compared here, for 101 square metres of living space.

Munich in 1st place: Here you have to invest the most for good living space.

- Munich – 504,000 euros

- Frankfurt – 417,000 Euro

- Hamburg – 384,000 euros

- Düsseldorf – 374,000 euros

- Stuttgart – 373.000 Euro

- Münster – 358,000 euros

- Bonn – 344.000 Euro

- Cologne – 329,000 euros

- Berlin – 327.000 Euro

- Nuremberg – 295,000 euros

More statistics can be found at Statista

More statistics can be found at Statista