Real estate price overview: calculation, procedure, costs and market value assessment

Real Estate Price Overview – With the lowering of the prime rate, many people have decided to purchase real estate property. For some years the real estate prices rise rapidly and are hardly financeable straight in metropolises and population centers by normal earners. Those looking for residential property are not infrequently annoyed by the “greed” of owners who, in the opinion of potential buyers, value their property too highly.

The real estate price calculation

The market makes the prices, as can be seen in the real estate valuations. Where demand is at its highest and supply at its lowest, prices rise and the purchase of houses or apartments becomes rapidly more expensive. Whether a purchase is worthwhile depends on the individual case. The fact is that real estate property is always a good retirement provision and a stable value investment in tangible assets. Therefore, both owner-occupiers and capital investors are well advised to invest in property. Because what must not be overlooked is that rental prices are rising just as rapidly and there is no end in sight. Affordable living space is hard to find. For this reason alone, the purchase of a house or an apartment is worth considering, despite rising real estate prices.

- Do you have a condominium? Read more about apartment valuation here.

Professional valuation must be commissioned

As a rule, the owner commissions a market value appraisal. If you are selling privately and want to save the costs of the valuation, you should by no means react negatively to the market value appraisal in the case of enquiries from interested parties. As a prospective buyer you can ask for the calculation basis of the property price and commission a valuation with the knowledge of the owner. If you suspect an ideal, emotionally determined offer price, this measure can prove to be a cost-reducing strategy.

Determination of market value by experts

As an owner, you should bear in mind that a buyer is making the biggest purchase of their life and therefore wants certainty in terms of a neutral property price. If a property is sold through a real estate agency, in most cases a market value assessment has been carried out. This means that the property price reflects the current factors and was determined on the basis of the equipment, property size and location, the infrastructural integration and on the basis of a detailed market analysis. If you base your property prices on a market value assessment, the buyer is less likely to doubt the property price and more likely to make the decision to buy without a longer term negotiation. If you have dispensed with the valuation, you may well do so retrospectively.

Influence on owner-occupiers and capital investors

As an owner-occupier of a property, you have to weigh up whether the price plus the ancillary purchase costs and interest on the loan is adequate for you. To determine this quotient, take your rent payments over the past 20 years (with a repayment period of 20 years) as a basis and compare the two values. If you have paid more rent or rent that is identical to the purchase price of the property, buying is the best decision for you. If your rent payments are significantly less than the property price, continuing to live in rented accommodation may prove to be a better solution.

Capital investors use a different method of calculation. Here, the profitability of the purchase can be determined by whether the management and maintenance costs are lower than the existing or possible rental income after re-letting. If there is no difference with a prospect of return, the investment is not a good capital investment.

If you are buying a property as a family residence, make sure first and foremost that you repay the financing with a fixed interest rate and are debt-free before retirement. The selection criteria are based on the aspects that you personally consider essential. Set yourself a maximum budget that fits your income and the monthly repayment amount of the financing. Fact is: due to the very high real estate prices, especially in metropolitan areas, the amount of financing for the purchase increases. It is therefore all the more important that you calculate the purchase price of the property including the annual percentage rate of charge and bear in mind when repaying that the bank’s claim is higher than the loan amount.

Selling real estate – How to determine the right price

Are real estate prices negotiable?

The asking price of a property is not a static figure. Even if it has been determined on the basis of a market value assessment, there is a certain amount of room for negotiation in most cases. As a potential buyer, you should therefore ask whether and to what extent a price reduction is possible. Negotiations are more successful with older properties, as you will be in a good negotiating position when you inspect the property and discover any minor defects. However, you should also bear in mind that the owner or the real estate agent acting on behalf of the owner does not have to negotiate. Property prices have risen very sharply in recent years. If you are interested in a property in locations with immense demand, your position in price negotiations is less good.

Skill and tactical strategies in negotiation

If, on the other hand, you decide to buy a property in a rural area, there is definitely room for manoeuvre that you can use to your advantage with a little skill and tactical strategies. When you enter into a negotiation, proceed with caution and empathy. Especially in the case of properties from private sellers, the asking price is not infrequently based on idealistic values and memories of pleasant moments spent in the property. In most cases, a too brash and demanding approach has the opposite effect and can lead to the owner not wanting to sell to you at all. As an owner as well as a potential buyer, you should know that negotiations are definitely part of the business. With expertise and tact, negotiating the price of a property increases the buyer’s interest and the seller’s comfort level. If you don’t like to negotiate yourself and feel uncomfortable in such discussions, you would be well advised to use a real estate agent. Negotiation skills and expertise in market prices are an advantage if you are not acting privately as a prospective buyer, but are having the property search done.

Will real estate prices fall anytime soon?

Some industry experts assume that property prices will fall within the next three to five years. This is conjecture, as there is no real reason to make a firm assumption. Currently, demand is rising while supply is tightening. This fact alone precludes you from paying less high property prices in the foreseeable future. An increase in the prime rate and the associated tightening of monetary policy is also neither under discussion nor in prospect.

Buying residential property and investing in real estate

If you are looking to buy a home or invest in the real estate market, don’t rely on guesswork and put off your purchase with hopes that real estate prices will drop. Remember: buying a house or purchasing your home is a way of securing your retirement and a decision you are making for yourself and your family. Real estate prices have been rising rapidly for the past few years and the trend is that the increase will continue for quite some time.

If you find your dream house or apartment that meets your criteria and convinces you at first sight, you have various options for negotiating the property price. Waiting, on the other hand, is not recommended, but ensures that your dream property finds another owner. Already two years ago, critics held that there is a real estate bubble. But the reality is different. The market is booming and the current high real estate prices are a result of increasing demand, reduced supply and the continuously growing interest in buying real estate. So if you are waiting for an opportune time, you should act now and not rely on realizing your dream at lower real estate prices in a foreseeable period of time.

Property price as a criterion for the purchase decision

Are you necessarily getting “less house for a higher property price” today? Even if many potential buyers have the feeling, this thought is not fundamentally true. Do you have a concrete idea of the real estate price and are you looking for a property that you can purchase for the sum you have budgeted?

Lukinski can assist you in your real estate search. You want to sell a house and set the right real estate price? We determine the market value and support you in your sales project!

Lukinski is your core competent real estate agency with whom you can invest properly and rely on a smooth process of your project. We are happy to advise you on “how much real estate you can afford” and the optimal amount of financing based on your basics. Give us a call and choose a strong partner who will help you with your real estate project and work for you with expertise.

Facts & Figures: Statistics on home ownership in Germany

Statistics: Residential property in Germany

How high is the ownership rate in the individual federal states? Here are the “latest” figures from the Federal Statistical Office. There has been no new survey after 2014 so far. As soon as new data is available, we will include it here! Here you can see the ownership rate in Germany in the period from 1998 to 2014 by federal state.

© Statista 2019 – Source: German Federal Statistical Office

| 1998 | 2002 | 2006 | 2010 | 2014 | |

|---|---|---|---|---|---|

| Saarland | 58,1% | 56,9% | 54,9% | 63,7% | 62,6% |

| Rhineland-Palatinate | 55% | 55,7% | 54,3% | 58% | 57,6% |

| Lower Saxony | 48,9% | 51% | 49% | 54,5% | 54,7% |

| Schleswig-Holstein | 46,8% | 49,4% | 47,1% | 49,7% | 51,5% |

| Baden-Württemberg | 48,3% | 49,3% | 49,1% | 52,8% | 51,3% |

| Bavaria | 47,6% | 48,9% | 46,4% | 51% | 50,6% |

| Hesse | 43,3% | 44,7% | 44,3% | 47,3% | 46,7% |

| Brandenburg | 35,5% | 39,8% | 39,6% | 46,2% | 46,4% |

| Germany total | 40,9% | 42,6% | 41,6% | 45,7% | 45,5% |

| Thuringia | 39,2% | 41,8% | 40,6% | 45,5% | 43,8% |

| North Rhine-Westphalia | 37,4% | 39% | 38,7% | 43% | 42,8% |

| Saxony-Anhalt | 36,5% | 39,6% | 37,9% | 42,7% | 42,4% |

| Mecklenburg-Western Pomerania | 32,2% | 35,9% | 33,2% | 37% | 38,9% |

| Bremen | 37,5% | 35,1% | 35,4% | 37,2% | 38,8% |

| Saxony | 28,7% | 31% | 29,5% | 33,7% | 34,1% |

| Hamburg | 20,3% | 21,9% | 20,2% | 22,6% | 22,6% |

| Berlin | 11% | 12,7% | 14,1% | 14,9% | 14,2% |

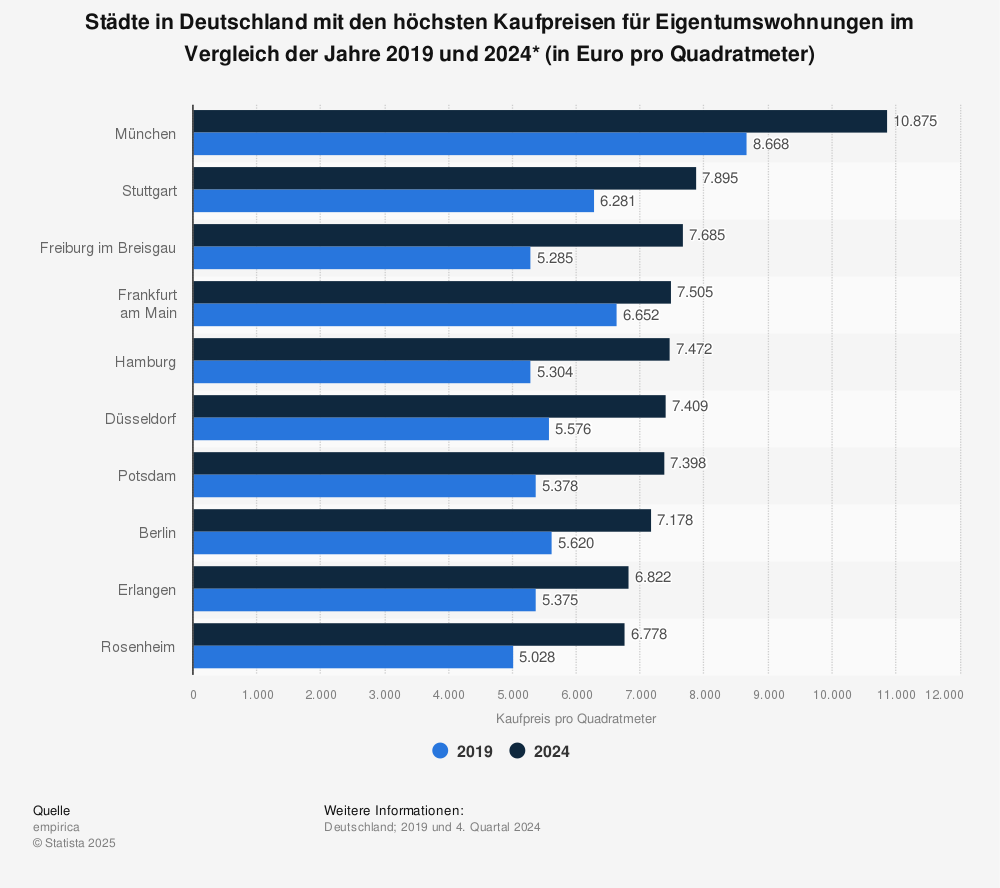

Price per square meter for condominiums

You want to sell? Of course, as a property owner in the wider metropolitan area, you will also benefit from the rising purchase prices. Here you can see the cities with the highest prices per square metre for condominiums in a comparison of the years 2010 and 2018* (in euros per square metre).

- Munich (Bavaria) at 8,342 euros per sqm; up from 6,737 euros per sqm in 2014; up 1,695 euros per sqm in 4 years.

- Stuttgart (BW) at 5,925 euros per sqm; up from 4744 euros per sqm in 2014; up 1,181 euros per sqm.

- Frankfurt am Main (Hesse) at €6,060 per sqm; up from €4,373 per sqm in 2014; up €1,687 per sqm

- Freiburg im Breisgau (Bavaria) at 4,943 euros per sqm; up from 4,740 euros per sqm in 2014; increase of 203 euros per sqm

- Ingolstadt (Bavaria) at €4,969 per sq m; up from €4,287 per sq m in 2014; increase of €682 per sq m.

You can find more statistics at Statista

Your advantages: Real estate agent

✓ national customers and regular customers (direct purchase possible!)

✓ Decades of experience and a well-coordinated team

✓ 100% free valuation and analysis of your property

✓ independent of banks and online portals