Inherited parental home – sell, rent or use yourself?

Inheriting your parents’ house – Sooner or later, as the child of property-owning parents, you will be faced with the question of whether to sell, rent or keep the house. The sale of the parental home is not always directly linked to an inheritance. If your parents become dependent on care and can no longer keep and manage their home themselves, a sale is often the best and only solution. However, there are numerous emotions and memories in that house that affect your entire childhood, making a rational decision impossible. It is not uncommon for the placement of one or both parents in a senior residence to have to be financed through the proceeds of the sale of the property. If you own a property yourself, self-occupancy is not on your agenda in most cases. Also, the location of the property or differing opinions with your siblings as co-heirs may necessitate selling it as the only option.

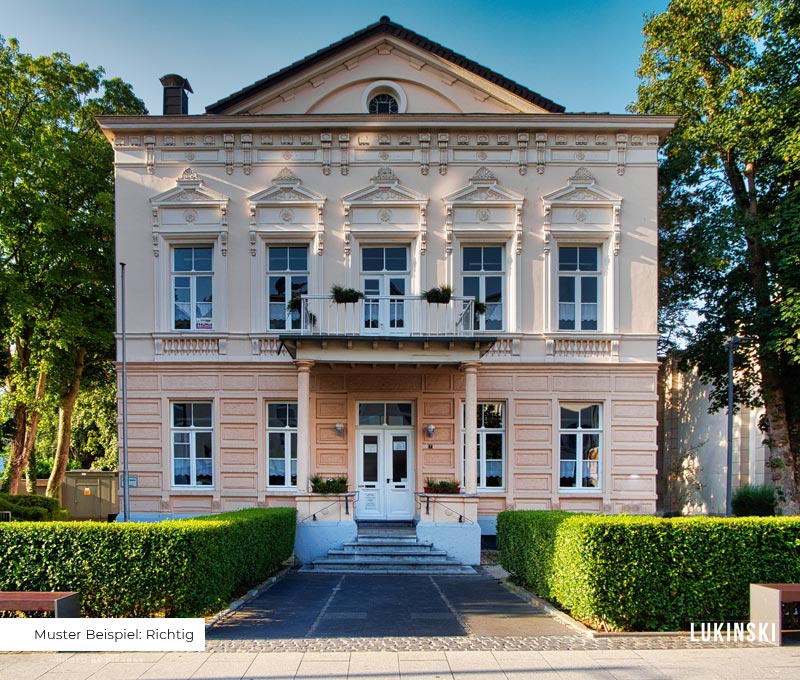

What is important when selling the family home

Before the real estate agent can act, some basic facts must be clarified. Only those who are listed in the land register and are therefore the legal owners of the parents’ house are allowed to sell. In most cases, both parents are listed as owners in the land register, so that in the event of death, the surviving parent counts as the sole heir and decides how to deal with the property. If both parents are deceased, you as the children are the next heirs and can decide to sell the parental home, provided there is agreement.

In advance, a change in the land register entry is necessary, as your regular ownership is the basic requirement for the sale of the parents’ house. It becomes very complicated if one parent is already deceased and the other parent is no longer legally capable. In this case, if there is no general power of attorney and the surviving parent does not want to sell the property, only a guardianship court can decide on the sale.

Make arrangements in good time!

We recommend that you make such arrangements at a time when your parents and property owners are legally capable. A notarial power of attorney or a gift of the house during your lifetime simplifies your ability to act in the event that you have to sell your parents’ house and use the proceeds to finance, for example, the accommodation of your parents in a nursing home. Once all necessary matters have been clarified in advance, we can sell your parents’ house promptly and at the real market value on your behalf.

Selling your parents’ house? The process in detail

More information about inheritance:

Inheritance settlement

Properties inherited in community pose a particular difficulty when selling. Within the framework of a community of heirs, there are several owners in the land register. This circumstance has a detrimental effect on the interest of potential buyers and makes the sale process more difficult. There is a solution to simplify the settlement and at the same time provide for a clear guideline of all heirs with equal rights. The settlement of an estate refers to the dissolution of a community of heirs, which is carried out on the basis of clear contractual regulations and is not bound by any particular form. Everything you need to know about

Community of heirs

From practice it is known that a community of heirs rather rarely agree. But from the disagreement and open disputes in relation to a real estate inheritance arise losses that you can avoid with prudence. Avoid conflicts about the estate by consulting an estate agent and finding the best way with support. If the will does not provide otherwise, all co-heirs are equally entitled and obliged. This means that a sale is often the best solution and gives you the opportunity to divide the proceeds of the estate between all the co-heirs, thus avoiding the problem of an inheritance dispute. Learn more about the

Certificate of inheritance

You are registered in the will as the sole heir of the parental home. If the will is notarised and legally valid, your inheritance will not be challenged. Nevertheless, without an additional certificate of inheritance, you will face a problem at the latest if you become the owner of the property as a result of the correction in the land register and wish to sell it on, for example. You should have a certificate of inheritance issued irrespective of the will and thus protect yourself when inheriting houses or apartments. Everything about the