Market Comparison USA and Germany – Where to Buy Real Estate, Guide, Explanation for International Investment

Real Estate Markets – Real estate opportunities abound for American investors looking internationally to Germany for opportunities, while German investors will also find great succcess in building a business in the US. Both real estate markets show growth, and can be counted on for maintaining this growth in the coming years. For a high return on investment, increasing prices in both countries allow for optimistism and excitement.

Real Estate Market Comparison – Germany USA

What are the differences between buying a piece of real estate in Germany and the USA? What are the things you should be looking at? Below a full run-down of what you have to know about how real estate differs between the two massive markets!

Country Overviews – What do you Need to Know?

Both countries are known worldwide for their strong economy, and progressive markets. That means these countries are stable and can be relied upon for having a future from an economic as well as societal perspective. Germany especially is becoming more and more wealthy, with an average salary increasing, reaching almost $5.000 a month.

- Increases in average salary

Does Germany have a Strong Economy? Is the U.S. Economy Growing?

Yes, in Germany the GDP is growing by 2.5%, while in the U.S. by 2.3%. Both economies are strong and growing. If you want to find out about the strength of a country’s economy, the first thing to do is probably to look at the GDP per capita, meaning how much money is in the economy per person in the country. In Germany the GDP per capita is $50.800, while the U.S. is very similarly at $59.800. That means both of these economies are strong, even when taking into account the amount of people living in the country.

- Germany GDP/c: $50.800 (+2.5%)

- USA GDP/c: $59.800 (2.3%)

Population: Growing Markets?

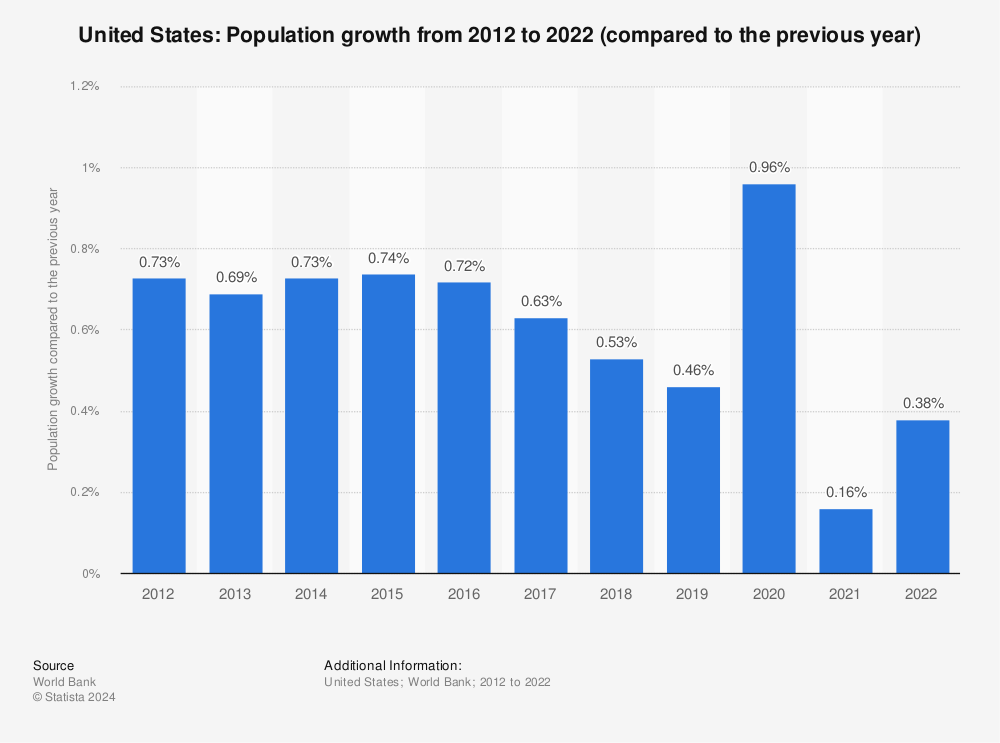

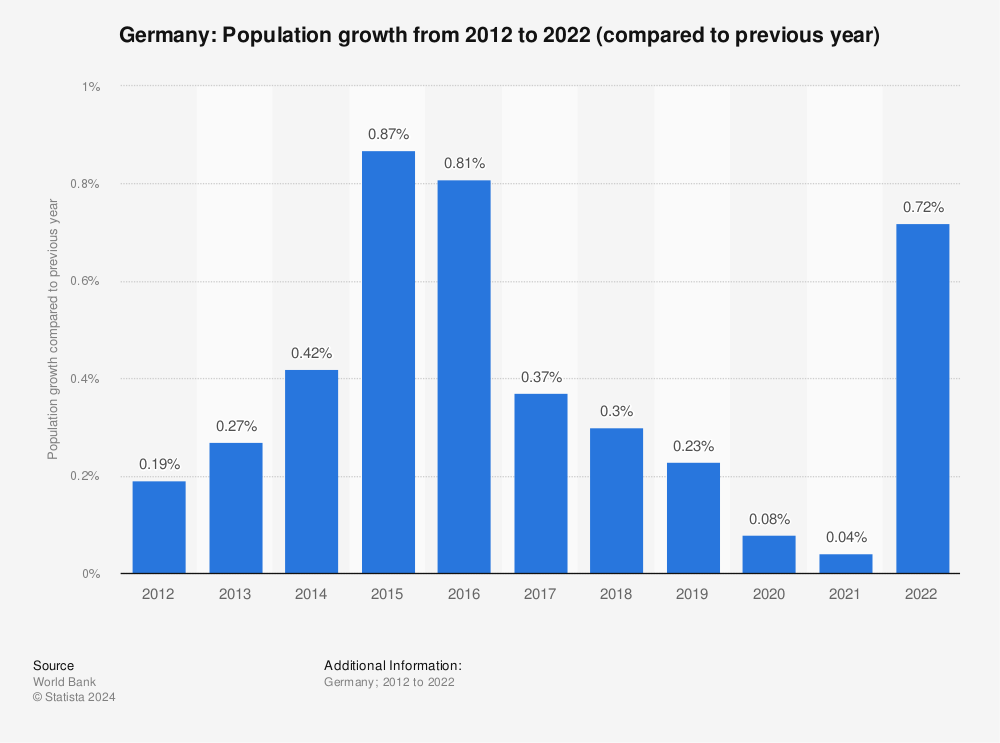

Increases in population demonstrate a healthy country, and therefore are a good information to support the decision of whether to invest in a country. The U.S. has demonstrated a clear tendency in increasing population.

- Pop. US: 328,2 mil.

- Pop. Germany: 83,02 mil.

In Germany, population growth has not been as strong or constant. This is of course related to the number of inhabitants, with Germany being a smaller country, deviations are more likely and look larger than they are. Despite this, Germany has, in the past years also shown increases in population, with the year 2015 and 2016 showing stronger growth than the USA had since 2010!

Should I Move to Germany? To the US?

One of the most popular emigration destinations for Germans is to the USA. This is evident in the numbers. Every year, 270.000 people move abroad, with 3.6% (9.780) of these choosing the USA. The favourite non-German emigration destination. This is likely due to the strong German heritage in the USA, and economic opportunities. Similarly, every year over 1 thousand Americans receive their German citizenship. This number is changing rapidly, increasing by over 33% last year. There are also 10.000 Americans studying at German universities thanks to the lower tuition fees, as well as high standard of living.

- 3.6% of German Emigrants move to USA

- Number of Americans moving to Germany increasing rapidly

- High number of American students in Germany

Corporation, Entity, Business – Real Estate Companies Germany and USA Comparison

There are of course many different ways to invest in real estate in different countries. Depending on whether you’re a big timer looking to upgrade, or a small partnership not sure of the direction you’re going to take. We take you through the respective real estate entities, investment forms and things you need to know if you want to build a big business in another country.

Germany Real Estate Investment – Types of Corporations, Business Forms, Structure

Germany has many forms of real estate investment businesses. The main types are the Immobilien GmbH and Familienstiftung. An Immobilien GmbH is a real estate company. Meaning a company that pursues the purpose of leasing, development, financing, realization or marketing. A Familienstiftung, strictly speaking, is a form of charity. It allows to save capital on real estate investments. Our simple english-language articles are excellent explanations of what you need to know about these forms of investment.

These are just a few of the ways that you can save money on your real estate investment in Germany.

USA Real Estate Investment – Types of Corporations, Business Forms, Structure

The USA has the much more famous forms of investment. Most everyone will have heard the term LLC or corporation. American company forms allow for much more liability protection, and much more freedom in execution. The typical forms are LLC, Limited Partnership, General Partnership, S Corporation, C Corporation, Multiple Entities, and REIT. Partnerships are generally less liability protection, while corporations will allow much more protection. LLCs are undoubtedly the most popular, and in most cases safest choice. Lastly, REITs are for big time invstors or retirees.

Prices – Where is it Most Expensive?

Comparing the prices of real estate is of course a bit difficult considering that the USA has a much wider spread gepgraphically as well as societally, where there are many properties valued very low in rural, or destitute areas as well as very low-income city districts. In Germany this spread is much smaller, with fewer very low-income regions. Below are the direct comparisons between the two countries.

- Germany and U.S. prices higher than other countries

Price-to-Rent Ratio – Should you Buy?

The price to rent ratio tells you whether it is comparatively cheaper to buy or to rent in a specific region. These ratios are often used to ascertain whether a housing market is ‘healthy’, i.e. whether the market is in a bubble, or well-valued. A very high price to rent ratio (if it is above 20), means that renting a house is better, as it is very expensive to buy a house, compared to just paying rent. On the other hand, a price to rent ratio below 15 means that rent is pretty high, and if possible you should buy because you’ll have it paid off comparatively quickly.

- Price-to-rent ratio >20 = Rent!

- Price-to-rent ratio < 15 = Buy!

Is Buying Real Estate a Good Investment?

These numbers indicate that Germany is a rife market. It is a good time to buy real estate in Germany according to this ratio. A price-to-rent ratio as high as can be taken with caution though, as in 2008 before the financial crisis, the very high price-to-rent ratios were indicative of a housing bubble. Nonetheless, you will find that Germany has vast opportunities for buying real estate, and buying in Germany is a sound investment. This is also heavily down to German rent prices being very high.

You should buy in Germany!

Is it Worth Buying a House in Germany? In USA?

It is a financially sound decision to buy a house in Germany on average, with a price-to-rent ratio over 28. In the USA, the ratio is below 13, meaning that you are better off renting than buying.The price-to-rent ratio in these countries is quite different. In Germany, the price-to-rent ratio is much higher than in the USA. You will find an extremely high price-to-rent ratio in the US cities of Naples, Florida (60,0), Santa Barbara, California (41,9), and Queens, New York (41,8). In Germany, the highest ratios are in Munich (41,7), Freiburg (35,2), as well as Hamburg (32,5) and Cologne (31,7).

- Highest USA: Naples, Florida (60,0), Santa Barbara, California (41,9), and Queens, New York (41,8)

- Highest Germany: Munich (41,7), Freiburg (35,2), as well as Hamburg (32,5) and Cologne (31,7).

USA vs Germany Comparion – Where to Rent, Where to Buy

It is a financially sound decision to buy a house in Germany on average, with the ratio being over 28. In the USA, the ratio is below 13, meaning that you are better off renting than buying. In city centres, price-to-rent ratios tend to be higher than outside the city as is also evident in these numbers.

- Ratio Germany (City): 30,8

- Ratio USA (City): 12,6

In more rural areas, the price-to-rent ratio is lower than within the city, meaning that it is typically better to buy here.

- Ratio Germany (non-City): 28,3

- Ratio USA (non-City): 9,4

Mortgage – How much is a Real Estate Loan?

Of course in different countries the mortgages are also differently high, and more or less difficult to get. This can also be compared across the two markets using the loan affordability index. This index takes into account many different components such as mortgage interest and gives you an accurate impression of the costs and difficulties of obtaining a mortgage. It is calculated by taking into account the mortgage as percentage of income.

Index = (100 / Mortgage as Percentage of Income)

Here, a higher score is better. You see that a loan is generally less financially debilitating in USA than in Germany.

- Index Germany: 1,83

- Index USA: 3,43

House Price Comparison – Where is it More Expensive to Buy a House?

When looking to buy, no matter what type of real estate, house prices give a fairly accurate representation of what the prices look like in a given location. The house prices in Germany as well as the US are showing increase. Meaning an investment here will pay dividends when selling. Importantly, the increase in housing prices is outpacing inflation along with other investments such as gold and many stocks.

House prices in both countries are higher than elsewhere thanks to being desirable places to live, and having a high standard of living. Although it is evident that in Germany the prices for a single-family home are slightly higher than in the U.S.

- Germany: $305.000 (€238.500)

- USA: $261.600 (€215.200)

Germany House Price Index

Germany’s house price index is steadily increasing, as the chart below demonstrates. The fact that this is a constant as opposed to explosive development speaks to the stability of the market, and strength of the general sector. Germany has shown increases in its housing prices by more than 1% in every quarter since 2015, and has not seen a decrease since 2013.

USA Housing Price Index

This index shows the month-over-month development of the American Housing Price Index. While this looks much more erratic, this is down to the nature of the graph (i.e. that it takes the change in index compared to the previous month). It also shows a strong market development.

Real Estate Market Analysis – Most Important Facts

Now that we know these are two strong markets, we take a look at what makes these unique, and how to handle each one.

US-Market – The Biggest Real Estate Market in the Western World?

Annually, almost six million residences are sold in the U.S., this is also in accordance with nearly a million homes being built each year. In the U.S., as in Germany, newly constructed homes are typically more expensive than their older counterparts.

- Many new residences being built

German Market – Investing in Europe’s Strongest Economy

The German market has been criticized for not supplying enough new homes, i.e. new constructions as residences. The amount of new constructions took a downturn shortly after 2010 thanks to new regulations and tax laws making it less financially viable and more difficult to build new houses. Although the number of new construction permits increased by 3,8% to 361.000 This doesn’t necessarily speak for the market in general. Last year, the volume of transactions again increased by 7%, which takes it to a massive $22,5 bil., the second-highest increase since beginning of records.

- Fewer new constructions

- New constructions are increasing

International Alliance with Economic Exchange

Germany and the USA are economically intertwined, with heavy import and export between the countries showing a strong relationship. Germany is the world’s third largest exporter, and a significant market for its exports is the USA.

- Strong relationship between the countries

Common Success – Economic Relationship of US and Germany

The U.S.-German Treaty of Friendship, Commerce and Navigation is a treaty between the two countries which allows for easier and better economic exchange. It grants U.S. investors national treatment as well as allowing for movement of capital without issue between the two countries. Additionally, sweetening the deal for American investors, taxation of U.S. companies within Germany is regulated such that double taxation is avoided.

Sectors of Economic Exchange

The most important financial sectors on which the U.S. exports to Germany are in Aircraft, vehicles, machinery, medical instruments, and electrical machinery.

- Aircraft – $8.9 billion

- Vehicles – $7.2 billion

- Machinery – $6.9 billion

- Optical and Medical Instruments – $6.7 billion

- Electrical Machinery – $5.5 billion

Meanwhile, Germany’s exports to the U.S. are similarly technology-related. With vehicles and machinery also being in the top 5.

- Machinery – $27.2 billion

- Vehicles – $25.4 billion

- Pharmaceuticals – $15.3 billion

- Optical and Medical Instruments – $10.6 billion

- Electrical Machinery – $8.8 billion

Political Relations

The political relationship between Germany and the USA has been strong since Germany’s reunification, thanks to mutually dependent support for economic and political relationships. On the state website of the U.S., Germany is very favourably positioned:

Germany is one of the United States’ closest and strongest allies in Europe. U.S. relations with Germany are based on our close and vital relationship as friends, trading partners, and allies sharing common institutions.

Summary – Positioned for Return on Investment

Looking at these two economies it is evident that both offer a strong position for investment. Exchange of goods, and international investments are frequent and supported. With many German realtors looking across the pond to the American market and vice versa. The two real estate markets should thrive in the coming years, with a strong flow of capital from one to the other. German real estate investors in America will find great success, as will American real estate investors in Germany.