Buy an apartment: Ranking – 10 most expensive cities in Germany

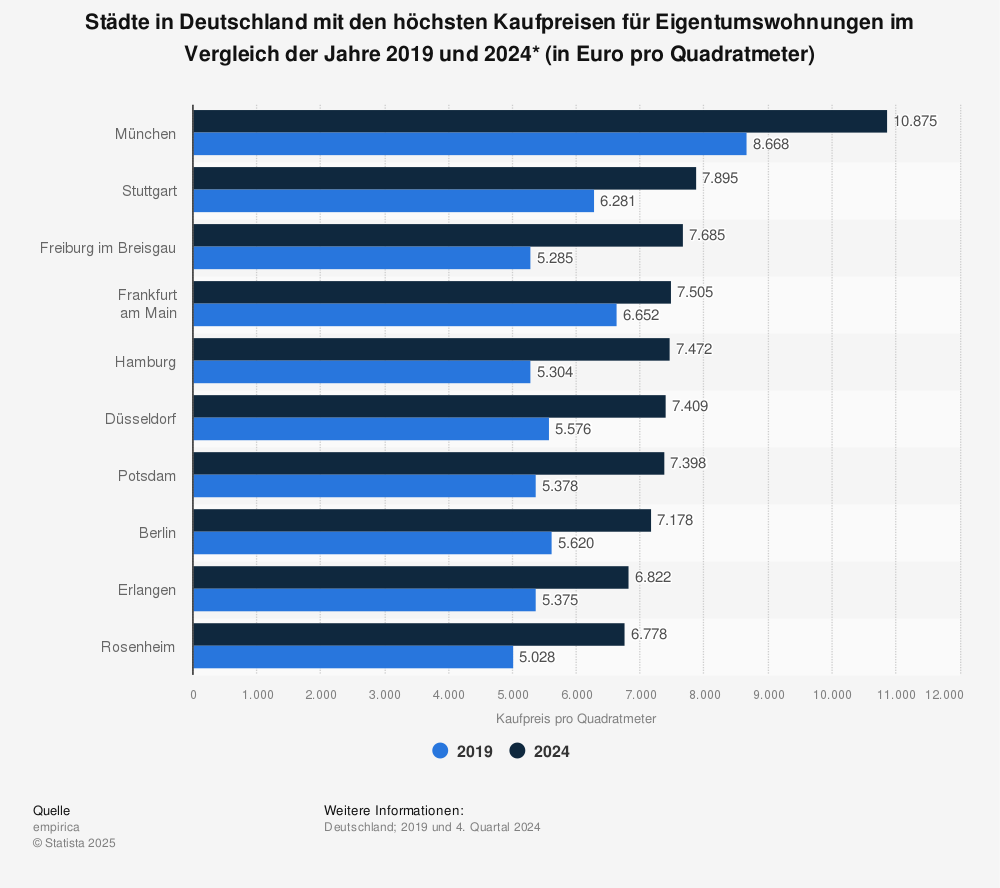

Which city in Germany has the highest prrice per square meter ? With 8,993 euros and an increase of +48.8% in only 4 years, Munich is right at the top. Closely followed by Frankfurt, Stuttgart, Potsdam, Berlin, Hamburg and Düsseldorf. We’ve sifted through the data for you and show you the top 10 most expensive cities in Germany. Here you can see the cities with the highest prices per square metre for condominiums in a comparison of the years 2015 and 2019 in euros per square metre. Further below a full rundown about everything you need to know about the current German real estate market, including comparisons, ownership ratios and more. Tip! Read more about renting an apartment and Building a house.

If you’re looking to invest in German real estate, you’ll need to know the ins and outs of the laws, how to save on taxes, and more. Check out our article

Munich with – 8,993 Euro (+48.8%)

Munich is the most expensive city in Germany for buying an apartment with 8,993 Euro per square meter. With a great quality of life, and rich cultural offering, it is no surprise people are willing to pay this much here. You want more facts and figures? Condominium, house, buy or rent: Prices Munich.

- Price 2019: 8.993 Euro / square meter

- Price 2015: 6.043 Euro / square meter

- Increase: + 2,959 Euro

- Increase in percent: 48.81 %

Frankfurt am Main – 6,701 Euro (+75.7%)

Germany’s biggest airport, and financial centre. Arguably Germany’s only city with a ‘skyline’ ranks second in the most expensive cities in Germany for buying an apartment. Condominium, house, buy or rent in Frankfurt am Main: Prices Frankfurt am Main.

- Price 2019: 6.701 Euro / square meter

- Price 2015: 3.814 Euro / square meter

- Increase: + 2,887 Euro

- Increase in percent: 75.69 %

Stuttgart – 6,324 Euro (+49.2%)

Stuttgart is not necessarily the most known city abroad, but it is home to the automotive giants known all around the world. It is the third most expensive city in Germany, which makes sense given its shopping and luxury connotations within the country.

- Price 2019: 6.324 Euro / square meter

- Price 2015: 4.238 Euro / square meter

- Increase in Euro: + 2,086 Euro

- Increase in percent: 49.22 %

Potsdam – 6.1.64 Euro (+85.6%)

Most people don’t know much about Potsdam other than as a daytrip when visiting Berlin. Home to the government buildings of the Bundesland Brandenburg, it is also home to considerable cultural marvels. In the North of the city, there is Alexandrowka, a ‘city’ modeled after Russian villages. There is also the regal Sanssoucie (translated = without worries) and much more to see here. The perfect spot to live the high life without the inner city atmosphere of Berlin.

- Price 2019: 6.1.64 Euro / square meter

- Price 2015: 3.322 Euro / square meter

- Increase in Euro: 2,842 Euro

- Increase in percent: 85.55 %

Berlin – 5,578 Euro (+68.9%)

Berlin is known all around the world. Youth culture with Techno and other nightlife, Museums which are home to some of the world’s masterpieces, and the place of government for the whole German country. This is where things are happening. Rent, buy, live in Berlin! You want more facts and figures? Apartment, house, buy or rent: Prices Berlin.

- Price 2019: 5.578 Euro / square meter

- Price 2015: 3.303 Euro / square meter

- Increase in Euro: + 2.275 Euro

- Increase in percent: 68.87 %

Hamburg – 5,507 Euro (+42.4%)

Hamburg is Germany’s second most populous city. It is home to one of the world’s busiest ports, and the Elbphilharmonie. The rich, cultured, and stylish prefer Hamburg over most other German cities. You want more facts and figures? Condominium, house, buy or rent: Prices Hamburg.

- Price 2019: 5.507 Euro / square meter

- Price 2015: 3.868 Euro / square meter

- Increase in Euro: + 1.639 Euro

- Increase in percent: 42.37 %

Düsseldorf – 5,470 Euro (+45.2%)

The German capital of fashion, and close to one of the four big players in German real estate, Cologne, this is a city for models and shopping. You want more facts and figures about Düsseldorf? Condominium, house, buy or rent: Prices Düsseldorf.

- Price 2019: 5.470 Euro / square meter

- Price 2015: 3.767 Euro / square meter

- Increase in Euro: + 1,703 Euro

- Increase in percent: 45.21 %

Erlangen – 5,416 Euro (+53.3%)

- Price 2019: 5.416 Euro / square meter

- Price 2015: 3.534 Euro / square meter

- Increase in Euro: + 1,882 Euro

- Increase in percent: 53.25 %

Regensburg – 5,411 Euro (+49.2%)

- Price 2019: 5.411 Euro / square meter

- Price 2015: 3.628 Euro / square meter

- Increase in Euro: + 1,783 Euro

- Increase in percent: 49.15 %

Freiburg im Breisgau – 5,349 Euro (+16.8%)

- Price 2019: 5.349 Euro / square meter

- Price 2015: 4.580 Euro / square meter

- Increase in Euro: + 769 Euro

- Increase in percent: 16.79 %

Source: Cities with the Highest Prices per Square Meter

Summarizing the list above, here a graph detailing the most expensive cities for apartments in 2015 and 2019 (in euros per square meter).

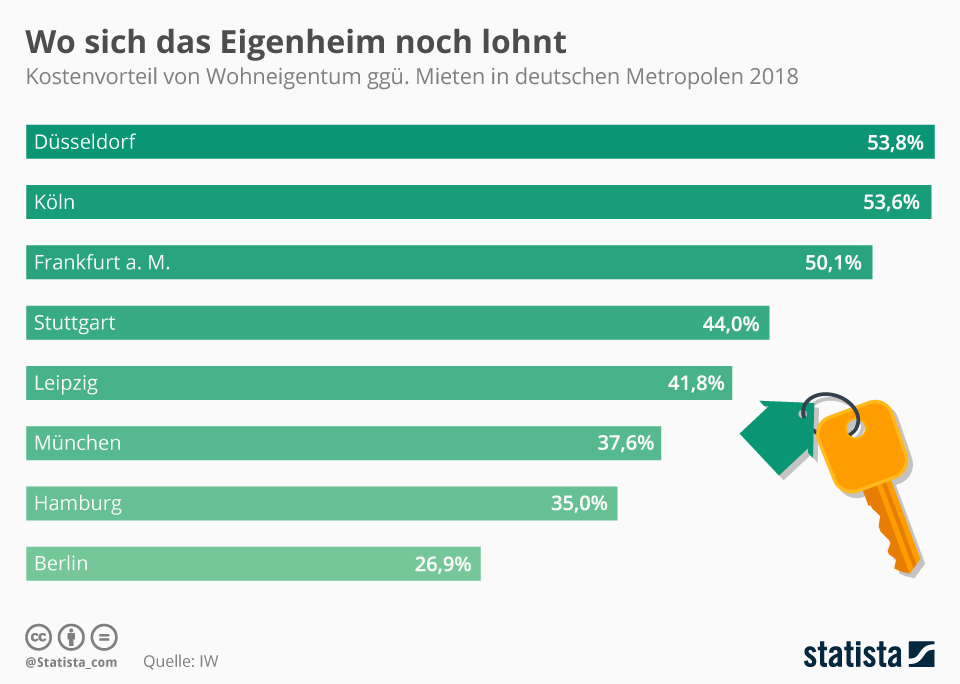

Where is it Worth Buying? Comparison

Where is it worth buying a property (house, semi-detached house, condominium, etc.)? In comparison, one sees the potential in NRW and Hessen. To know whether its worth investing in a property to rent out, this chart shows the cost advantages of home ownership compared to rents in German metropolitan areas in 2018.

- Düsseldorf with 53.8%

- Cologne with 53.6%

- Frankfurt with 50.1%

- Stuttgart with 44.0%

- Leipzig with 41.8%

- Munich with 37.6%

- Hamburg with 35.0%

- Berlin with 26.9%

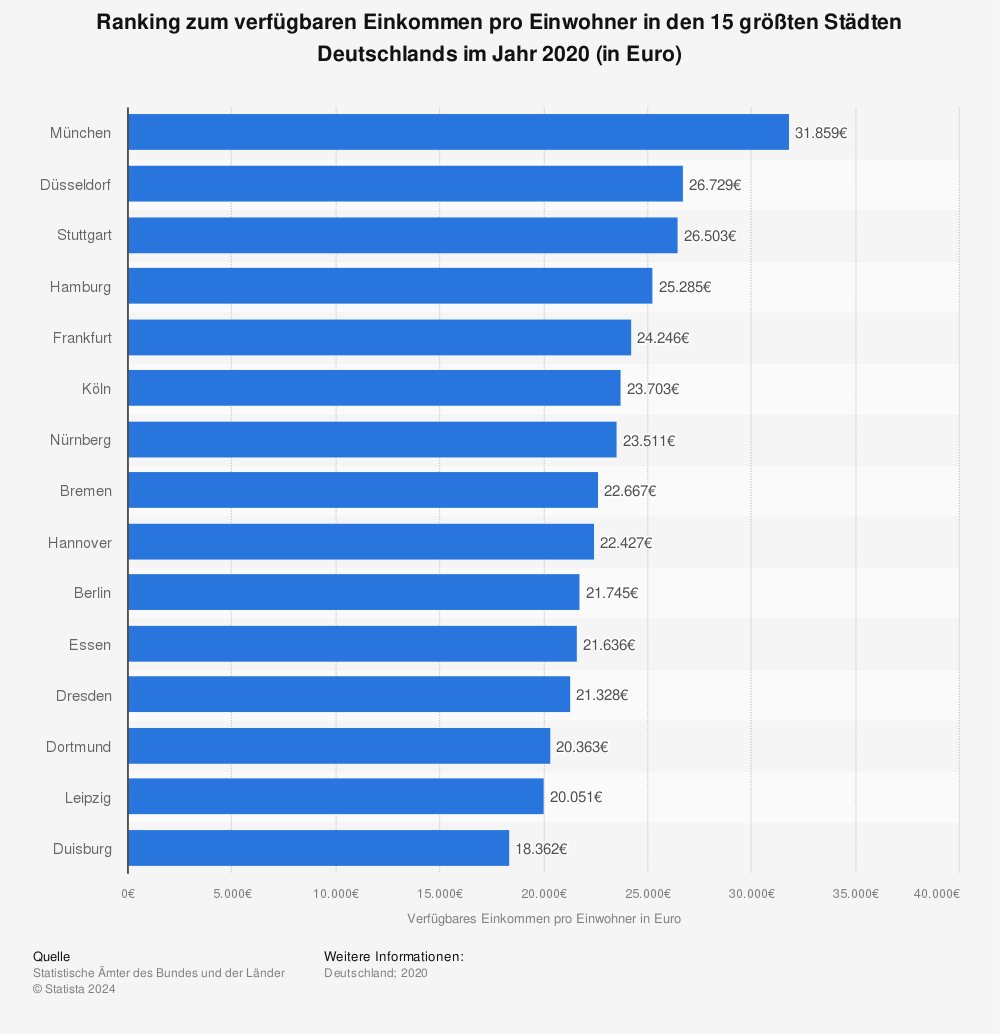

Purchasing Power by City

The chart shows the districts and cities with the highest purchasing power as a percentage of the national average. Note that in Germany, there is a distinction between Bundeslännder (the equivalent of states in the USA) and Landeskreise (equivalent of counties in the USA), also abbreviated to LK.

More statistics can be found at Statista

More statistics can be found at Statista

Ownership Ratio in Germany

Ownership rate in Germany in the period from 1998 to 2018 by Bundesländer.

| 1998 | 2002 | 2006 | 2010 | 2014 | 2018 | |

|---|---|---|---|---|---|---|

| Baden-Württemberg | 48.3% | 49.3% | 49.1% | 52.8% | 51.3% | 52.6% |

| Bavaria | 47.6% | 48.9% | 46.4% | 51% | 50.6% | 51.4% |

| Berlin | 11% | 12.7% | 14.1% | 14.9% | 14.2% | 17.4% |

| Brandenburg | 35.5% | 39.8% | 39.6% | 46.2% | 46.4% | 47.8% |

| Bremen | 37.5% | 35.1% | 35.4% | 37.2% | 38.8% | 37.8% |

| Germany total | 40.9% | 42.6% | 41.6% | 45.7% | 45.5% | 46.5% |

| Hamburg | 20.3% | 21.9% | 20.2% | 22.6% | 22.6% | 23.9% |

| Hessen | 43.3% | 44.7% | 44.3% | 47.3% | 46.7% | 47.5% |

| Mecklenburg-Vorpommern | 32.2% | 35.9% | 33.2% | 37% | 38.9% | 41.1% |

| Lower Saxony | 48.9% | 51% | 49% | 54.5% | 54.7% | 54.2% |

| North Rhine-Westphalia | 37.4% | 39% | 38.7% | 43% | 42.8% | 43.7% |

| Rhineland-Palatinate | 55% | 55.7% | 54.3% | 58% | 57.6% | 58% |

| Saarland | 58.1% | 56.9% | 54.9% | 63.7% | 62.6% | 64.7% |

| Saxons | 28.7% | 31% | 29.5% | 33.7% | 34.1% | 34.6% |

| Saxony-Anhalt | 36.5% | 39.6% | 37.9% | 42.7% | 42.4% | 45.1% |

| Schleswig-Holstein | 46.8% | 49.4% | 47.1% | 49.7% | 51.5% | 53.3% |

| Thuringia | 39.2% | 41.8% | 40.6% | 45.5% | 43.8% | 45.3% |

All further information on statistics can be found at Statista

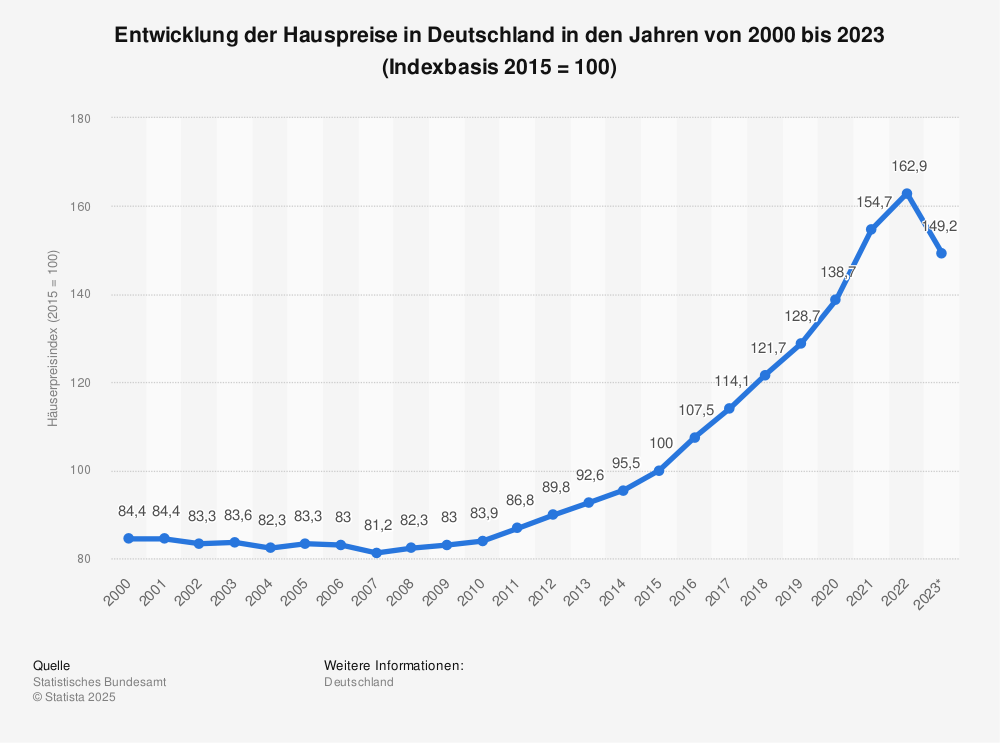

House Price Index: Development of House Prices

Development of house prices in Germany in the years from 2000 to 2018 (2015 = Index 100).

More statistics can be found at Statista

Cities with Highest Real Estate Loans

The chart shows a ranking according to highest average mortgage loan in the 20 largest cities in Germany based on a current evaluation of the comparison platform Check24. Loans of 500,000 euros are compared here, for 101 square metres of living space.

- Munich – 504,000 euros

- Frankfurt – 417,000 Euro

- Hamburg – 384,000 euros

- Düsseldorf – 374,000 euros

- Stuttgart – 373.000 Euro

- Münster – 358,000 euros

- Bonn – 344.000 Euro

- Cologne – 329,000 euros

- Berlin – 327.000 Euro

- Nuremberg – 295,000 euros

More statistics can be found at Statista

More statistics can be found at Statista

How much m² for 800.00 Euro? Comparison Worldwide

Where is Germany in a global comparison? Here we have another excellent infographics from the Federal Statistical Office, how many square meters are available for 1 million (or approx. 800,000 euros)? The chart shows the average size of premium properties at a price of 1 million US dollars in selected cities. In Berlin you can currently get 78 m² for 800,000 Euro.

- Berlin – 78 m² (comparative value)

- Monaco – 16 m²

- Hong Kong – 22 m²

- New York – 25 m²

- London – 28 m²

- Paris – 46 m²

- Los Angeles – 58 m²

- Tokyo – 77 m²

- Miami – 78 m²

- Dubai – 98 m²

More statistics can be found at Statista

More statistics can be found at Statista

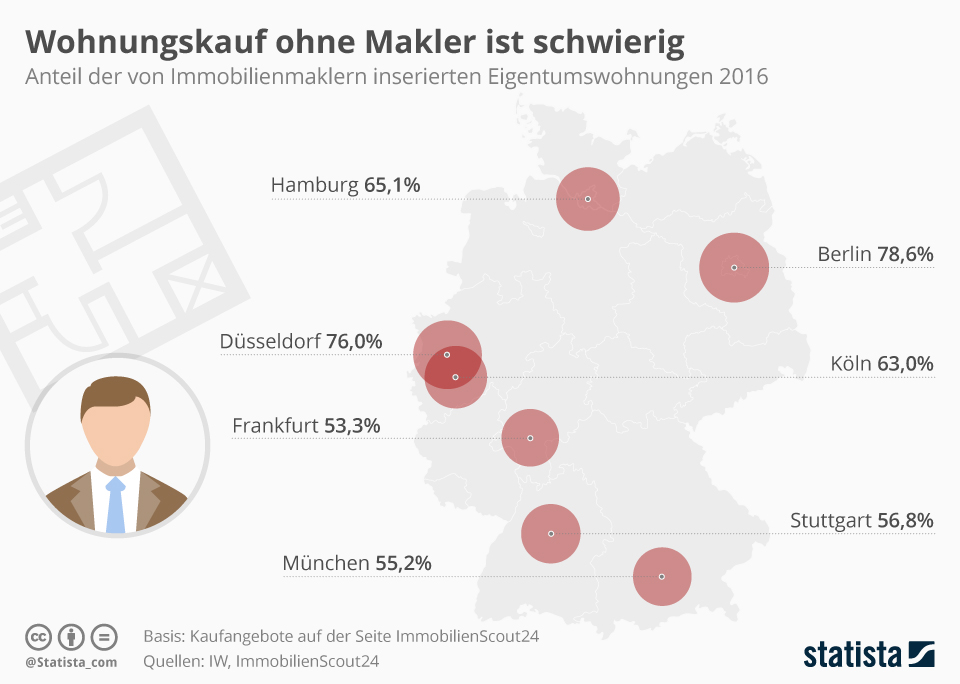

Purchase of an Apartment Without an Agent

The chart shows the percentage of condominiums advertised by real estate agents in 2016, which clearly shows that the majority of the market is in the hands of experienced real estate agents. High-quality and good properties are always sold with the help of an estate agent. After all, it is not “only” about viewing. Buyer acquisition, network, negotiations, credit assessment, purchase contracts, all this belongs to the profession of an estate agent.

- 78.6% of Berlin’s condominiums through real estate agents

- Düsseldorf ETW at 76.0% via brokers

- Hamburg ETW 65.1% via brokers

- Cologne ETW at 63.0% via brokers

- Stuttgart ETW at 56.8% via brokers

- Munich ETW at 55.2% via brokers

- Frankfurt ETW at 53.3% via brokers

More statistics can be found at Statista

More statistics can be found at Statista

Earning Money with Real Estate in Germany

- Letting a property – housing requirements

- Turnover with real estate: purchase, sale, mediation and administration

Housing Requirements

You can live in your own property yourself or you can rent it out. With the current housing shortage, this is a good prerequisite for increasing rental income. Because as always, supply and demand. The chart shows the share of annual building completions in 2016-2018 in the annual demand in the period 2016-2020.

- Hamburg and Düsseldorf Coverage / year at 86%

- Frankfurt am Main Coverage / year at 78%

- Berlin coverage / year at 73%

- Munich Coverage / year at 67%

- Stuttgart Coverage / year at 56%

- Cologne Coverage / year at 46%

Turnover with real estate: Purchase / Sale, Mediation and Administration

The chart shows the turnover in the real estate services sector in Germany (in billion euros). The largest turnover in real estate is currently generated by property management, at 11.12 billion euros.

Purchase and sale of real estate

- Purchase and sale – 8.84 billion Euro

- Comp. 2014 – 7.21 billion Euro

- Increase of 22.6% (1.63 billion euros)

Residential property brokerage

- 8.49 billion Euro/li

- Comp. 2014 – 6.69 billion Euro

- Increase of 26.9% (1.8 billion euros)

Management of residential real estate for third parties

- Administration – 11.12 billion euros

- Comp. 2014 – 8.34 billion Euro

- Increase of 33.3% (2.78 billion euros)

More statistics can be found at Statista