Halve your taxes, double your assets: save taxes, legal tricks & practical experience

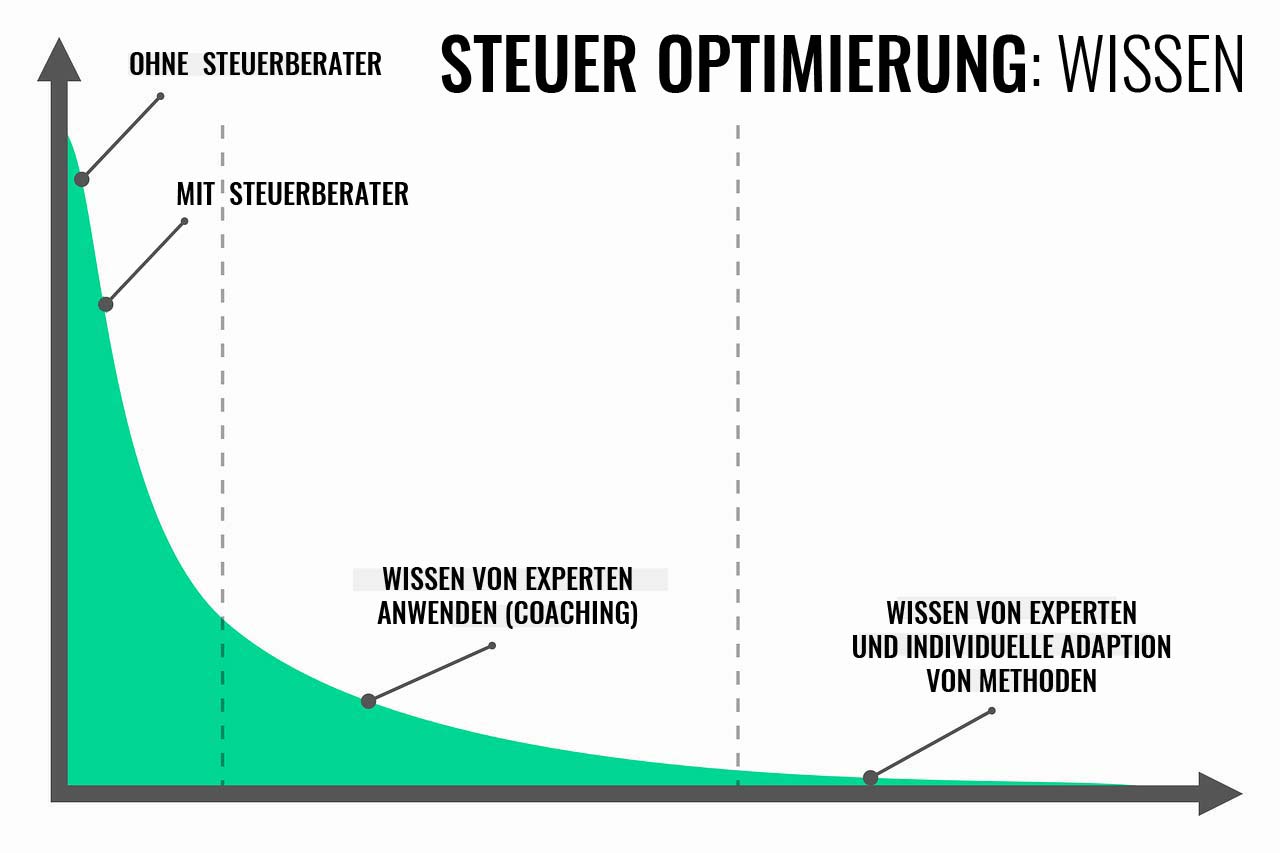

Are you looking for ways to minimize your tax burden and significantly increase your wealth at the same time? Then you now have the opportunity to learn how to do this with the help of Alex Fischer’s practical webinars. Everyone can take care of their own taxes, hire tax advisors (although in my experience 95% of them provide absolutely no input in the area of tax optimization) or take part in coaching with people who pass on their knowledge from their own practice. Alex Fischer is an expert in the field of tax optimization and shows you in his regular webinars how you can use legal, highly effective strategies to reduce your taxes and build wealth at the same time. Register directly with Alex Fischer.

Halve taxes, double assets 2026: Register now

In this webinar, you will learn how to apply the tax strategies used by major international corporations – all without complicated tax structures or having to go abroad. Everything Alex Fischer teaches is completely legal and can be implemented without unnecessary stress. These methods are suitable for both private individuals and entrepreneurs who want to effectively reduce their tax rate.

- Halve taxes, double assets

- Directly to the registration with Alex Fischer

Why Alex? Why this live webinar?

100% legal, in Germany, without abuse of tax planning and without having to emigrate.

What are you learning here?

Honestly, first things first, what are you learning?

- Minimize the tax rate: Tips and tricks

- Claiming private expenses for tax purposes

- Tax reduction: step-by-step process

- Reduce bureaucracy, benefit from advantages

- Wealth accumulation: Strategically optimize your finances

Why should you take part?

If you are looking for ways to significantly reduce your tax burden, you should definitely take part in one of Alex Fischer’s webinars. Not only will you receive valuable tax tips, but you will also learn how to build wealth while optimizing your taxes in a legal way. Alex Fischer shares his proven methods, which are not only applicable for large corporations, but also for private individuals and medium-sized entrepreneurs.

True to Alex’s motto:

“Taxes are a matter for the boss”

Taking part in the webinar is completely straightforward and offers you the chance to significantly expand your knowledge of taxes and wealth accumulation in a short space of time. You will learn how you can achieve significant financial benefits with intelligent tax strategies.

Advantages of participating: 5 good reasons

In Alex Fischer’s webinar, you will learn how to drastically reduce your tax burden. The methods you will learn here are legal and will ensure that you can keep more of the money you earn. There is no reason to use complicated tax constructions or tax tricks that are legally questionable. Alex Fischer’s strategies are based on a sound knowledge of tax laws and are safe to use.

- Drastically reduce your tax burden: efficiently and legally

- Increase your wealth: Through strategic wealth accumulation

- Stay in Germany: no need to emigrate

- Simple implementation: Clearly structured processes without complexity

- Immediate results: You can implement the first measures directly after the webinar

Contents of the webinar

In his webinar, Alex Fischer teaches you the most important techniques for tax optimization and wealth accumulation. The best thing about it: everything you learn is legal, safe and comprehensible. The strategies are based on the same principles that major international corporations use to minimize their tax burden – but presented in a way that makes them applicable to everyone.

Example 1: Use of international tax strategies

Large international corporations use special techniques to keep their tax rate as low as possible. Alex Fischer shows you exactly which of these methods are suitable for you and how you can use them successfully. Terms such as profit shifting, tax optimization through affiliated companies and the use of low-tax countries are explained in more detail. You will learn how to legally integrate these mechanisms into your own tax concept.

You will also learn why SMEs often do not use the same tax strategies as large companies, even though they are available to everyone. Alex will show you how you can break through these barriers and secure the same tax advantages.

Example 2: Making private expenditure operational

Another key point of the webinar is to understand how you can shift private expenses to the business area without breaking the law. Alex Fischer explains, for example, how you can make the most of the 1% rule for company cars and avoid the annoying hassle of logbooks.

Alex also looks at other ways of making private costs business-capable. You will learn how you can claim private expenses, such as office supplies or telecommunications, for tax purposes. The trick is to legally transfer these expenses to the business sphere so that you benefit from them for tax purposes without having to deal with more administrative work.

Example 3: The 5-step process for tax reduction

At the heart of the webinar is the 5-step process developed by Alex Fischer. This process enables you to reduce your tax burden by up to 50% within three months – all without creating more stress or complexity in your life. Alex takes you through this process step by step and shows you how to maximize tax benefits without having to set up complex tax structures.

It explains in detail how to correctly use the deductibility of business expenses, how you can use the investment deduction amount (IAB) for yourself and which tax write-offs you can use specifically to reduce your tax burden. By following these clear and actionable steps, you can ensure that you take full advantage of all legal opportunities for tax optimization.

What will you learn in the webinar?

Here again a small overview:

- Minimizing the tax rate: Learn how large corporations minimize their taxes and how you can implement this for yourself

- Business use of private expenses: Find out how you can claim private expenses, such as the company car, for tax purposes

- Step-by-step guide: A clear, comprehensible process for tax reduction

- Less administrative work: learn how to reduce bureaucracy and still enjoy tax benefits

- Strategic wealth building: discover how to optimize your finances to grow wealth in the long term

Next webinars: coming soon!

If you are now curious and want to effectively reduce your tax burden, you will soon have the opportunity to take part in one of Alex Fischer’s regular webinars. These webinars are ideal for you if you are an entrepreneur, investor or simply interested in structuring your finances better. These events will provide you with all the information and tools you need to optimize your tax rate and build long-term wealth at the same time.

How can you take part?

Participation in one of the webinars is free of charge and completely non-binding. You can simply register with Alex Fischer and receive all the information you need to participate. The webinar itself takes place online, so you can take part from the comfort of your own home. You can put the strategies taught into practice immediately after the webinar to achieve immediate financial benefits.

- Halve taxes, double assets

- Directly to the registration with Alex Fischer

Alex Fischer: Short portrait

Due to my regional proximity (Cologne / Düsseldorf), I naturally also learned a lot from Alex Fischer. His book “Reicher als die Geissens” has reached over 200,000 readers, including me. Alex Fischer is a real estate investor from Düsseldorf. With over 100,000 followers, he is one of the most successful YouTube channels on real estate and taxes. There are also media reports on Ntv, FIV and Wallstreet Online.

Due to my regional proximity (Cologne / Düsseldorf), I naturally also learned a lot from Alex Fischer. His book “Reicher als die Geissens” has reached over 200,000 readers, including me. Alex Fischer is a real estate investor from Düsseldorf. With over 100,000 followers, he is one of the most successful YouTube channels on real estate and taxes. There are also media reports on Ntv, FIV and Wallstreet Online.

But much more excitingly, he holds over 20,000 m² in Düsseldorf alone and spends a lot of time in Mallorca. More practice is not possible, is it?

Now, not every real estate investor tells his tax tricks, Alex Fischer is more open and likes to pass on his knowledge. Now also in the new course:

Halve taxes, double assets? My conclusion

Alex Fischer’s webinars are a great opportunity for anyone who wants to significantly reduce their tax burden and build wealth at the same time. With his proven 5-step process and in-depth expertise, Alex will show you how to reduce your taxes legally and efficiently – without any added complexity or risk. If you’re ready to take your finances to the next level, be sure to sign up for one of the upcoming webinars.

As I said at the beginning:

“Everyone can take care of their own taxes, hire a tax advisor (although in my experience 95% give absolutely no input in the area of tax optimization) or take part in coaching with people who pass on their knowledge from their own practice.”