Wiesbaden: Investment apartment and house – invest now?

Investment Wiesbaden – “Nice of the North” is the Hessian capital Wiesbaden also like to call. Indeed, representative villas and town houses characterize the image of the city, in addition to avenues with high and old trees. The city was already popular with the Russian tsars as a thermal spa, and even today Wiesbaden is considered one of the most popular places to live in the Rhine-Main region. Whether the traditional city is also suitable as a destination for capital investments with real estate? What is important when investing in Wiesbaden real estate? We talked about this with an investment real estate insider in the region: real estate as a capital investment.

Real estate yields in Wiesbaden stable at a high level

Question: You are mainly active in Wiesbaden, the capital of Hesse, and the surrounding area as an investment advisor and investor. How do you think the real estate market in the region is developing?

I will first answer with two figures: Wiesbaden has about 290,000 inhabitants today. According to decent forecasts, this figure is set to rise to 300,000 within the next five years. These 10,000 people want and need to live somewhere. The necessary apartments have to be built and paid for by someone. So there are also numerous opportunities for investors in real estate.

However, we have a fundamental problem in Wiesbaden: there are relatively few opportunities for new residential construction. The old city villas only come on the market very rarely anyway. Here and there there is worthless old building fabric that is torn down and made available for new buildings. There are some new building projects on the outskirts of Wiesbaden. The greatest potential lies in unused military sites, some of which have already been developed and some of which are being over-planned.

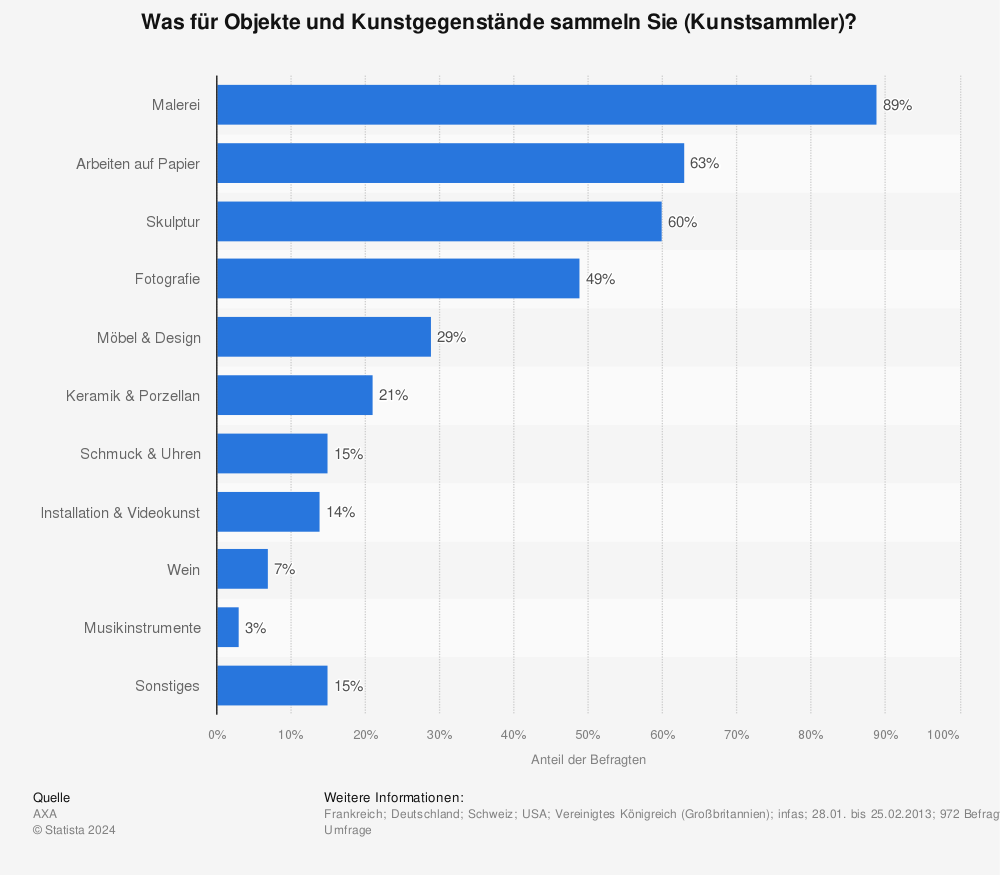

Real estate returns better than many other investments

You can find more statistics at Statista

In terms of yields, I do not expect any increase for Wiesbaden and the surrounding area, but I do expect a sustained sideways movement at a high level. Values of 5 % and more are realistic. An upward movement is therefore rather unlikely, because purchase prices and rents develop to the same extent upward and one needs already a really very long investment horizon, in order to be rewarded the high purchase price by a clear rent increase with a growing yield. On the other hand, there is of course also the profit from the later sale of the property. There, increased purchase prices would have a corresponding effect again.

Yield calculator online: The right instrument to start with

Question: Which of the various online calculators for loans, investments or returns do you find particularly helpful and why?

I’ll start with the loan calculators: I can’t see anything being done wrong there. That’s why I won’t recommend any computer in particular. The calculators of Stiftung Warentest or a reputable online newspaper are certainly not suspicious with regard to a hidden forwarding of the user’s data. Basically, such an online calculator can only be an initial source of information. For example, for my question, what I have to pay monthly for my real estate loan with regard to the interest and repayment rate. I can also go about it the other way round and ask: if I have a sum x available each month, what loan amount can I afford to buy a flat?

On the other hand, I don’t know of any loan calculator – not even that of a financial institution – that calculates the interest rate I have to pay for my loan in view of my equity and other collateral. That is always a matter of personal discussion with the bank. That’s why calling up and using various loan calculators on the internet doesn’t help. The best loan calculator with the most accurate information and the safest result for me is still the conversation with the financier himself. You should be quiet from different banks give an offer. There are sometimes really spraybare differences in the interest rate offered.

Anyone thinking about real estate as an investment naturally wants to know what return their property will yield. In other words: how much money will I earn with my investment? For this purpose, there are of course many tools on the Internet. The yield calculators for real estate are usually linked to a real estate agency or financial institution. This is not a disadvantage, you should just know it. Because the vast majority of online calculators for property yields can not take into account every detail of the property. That is why it is always much better to get an overview via the online calculator in order to then seek a personal discussion on the basis of a real property.

Overall, there is a pretty good overview including deposited calculators on the portal finanzrechner.org. As I said, these calculators offer really good guidance. Everyone should definitely make an individual calculation with their personal financial advisor or tax expert.

Not every square meter counts as living space!

Question: How do you calculate the price per square meter as a landlord of an apartment?

Actually a simple question, but with some small “devils in the details”. Because normally everyone knows the square footage of their apartment and what they pay monthly (not including utilities based on consumption). The rest is a simple division calculation of rent (or purchase price) divided by the total square meters.

The question remains: what can I include in the living space? For example, cellar rooms do not count as living space. The same applies to storage rooms outside the apartment. Balcony, terrace or a loggia are only calculated with half of their square meters as living space. You should also use a tape measure for the ceiling height. Everything below a height of one meter does not count as living space and rooms with a ceiling height of less than two meters only half. This is especially important for attic apartments. Very special rules also apply to pillars and stairs in the apartment. A proper real estate expert knows these regulations very well. Here too, simply ask for advice.

Investing your money successfully: Alternatives to real estate

Question: In Wiesbaden, there is no doubt that not only real estate is traded, but due to the proximity to the headquarters of various banks in Frankfurt, other financial products are certainly also in the focus of your customers. Please explain to our readers which three capital investments you would recommend besides real estate. Do these investments have any disadvantages?

You can find more statistics at Statista

First of all, I recommend that anyone who wants to invest their money profitably should ask themselves. And indeed questioned about their own willingness to take risks in terms of profit and loss. Because the capital investment must always fit the respective person and his goals. The one investor looks for a maximum of security, the other again has with risk and Verkust no problem. Then there are people who literally want to see what they have invested their money in, which again other investors do not care about at all.

Those who are not afraid of the big risk can invest their money in commodities or rare earths, for example. This is a form of investment that is not yet very widespread, but is becoming increasingly popular. There are people at some major banks and also on the consultancy market who are quite knowledgeable about this. As I said, it’s not for the faint-hearted and, by the way, it’s also a form of investment that should run for several years in order to compensate for price fluctuations.

For pure security fanatics – to mention the completely other side – there are funds whose profit is capped, but which are also protected against loss. Such funds are offered by banks and insurance companies. However, many find them very boring.

If you are looking for a more unusual form of investment, you should take a look at luxury watches. Watches are more difficult to assess as an investment object because, unlike shares or gold, there is no market that clearly and universally sets a price. The value of a luxury watch does not depend solely on its horological value and condition, but crucially on the demand for precisely this particular model. This demand is subject to fluctuations and cannot be objectively predicted. However, since the prices of luxury models have clearly developed positively in recent years, this investment can be very rewarding. Those who manage to buy a model that is in demand at a low price should take advantage of the opportunity.

Is it worth it to be a stock trader on your own account?

Question: In the meantime, shares have a long and partly successful investment history behind them. There are also many people who believe they can act as stock traders, tipsters and day traders themselves. But how does the reality of stock trading look like? Can quick profits really be made and what is the difference to real estate as an investment?

Of course, I was not active as a stock trader myself and – as far as I can tell today – I do not intend to do so. However, I have so much own experience with the share topic that I can say: who would like to care completely himself about his share package and the investments, needs a lot of knowledge and time. Especially if you really want to make quick profits. Because that means that I have to keep a constant eye on the company stocks and their bonds that I am interested in. In addition, always the phone handy, so that I can ask my proxy in a flash to buy or sell the shares.

Tax makes the difference: watch out for investments!

In any case, I warn against the countless guides that can be found on the Internet – like the yield calculators. If tipsters followed their own recommendations, Germany would have to be a nation of millionaires. The reality of the share business, as it is convertible for most of us, looks completely different. One should plan for a long period of investment so that price fluctuations are of little consequence. It is always advisable to spread the risk widely – i.e. over several company stocks, perhaps also government bonds, currencies etc.. With a little skill and good advice, you can put together a package with good performance yourself, or you can leave it to your money adviser.

The disadvantages of these and other investments do not always show themselves quite so clearly. This starts with the much-vaunted risk. After all, this is a less tangible factor that many investors like to ignore. According to the motto: what I can’t see doesn’t exist. Fluctuations in the value of shares, works of art, watches and government bonds depend on many external factors that only experts can keep track of. And even the experts can be wrong – as we have seen very often in the past.

Quite real and to be quantified are the running costs for financial investments – no matter if securities or other. Issue surcharges, custody account fees, ongoing capital gains tax, etc. reduce the return. On the other hand, the profit on the sale of rented property is tax-free after ten years. This amount must be added to the total return in any case.

Wiesbaden: Living with high recreational value

Question: What is Wiesbaden and its surroundings like to live in? What do your customers say? What places worth seeing, events etc. are there? What makes this region so interesting for investors?

The people of Wiesbaden themselves may forgive me if I now first point out the surrounding area. Immediately before the gates of the city begins the Rheingau with its nice small half-timbered and wine-growing villages Eltville, Oestrich-Winkel, Hattenheim up to Rüdesheim. There you will find the Eberbach Monastery and the Hildegard Monastery in Eibingen. In addition, the Rheinsteig begins as a hiking trail and of course the Rhine bike path. Wiesbaden is located at the foothills of the Taunus, so that beautiful hiking and in winter also cross-country skiing trails are quickly accessible.

Wiesbaden itself as the so-called “Nice of the North” offers a beautiful city center, a beautiful spa park with casino, the Nerobergbahn and the very famous Russian Orthodox Church from the Tsarist era. Very famous, not least because of its organ, is the classicist Marktkirche. Across the Rhine are Mainz and Germany’s largest wine-growing region, Rheinhessen. I think it takes more than a lifetime to have discovered this region completely. The leisure value is indeed very high, even if there are no Alps or the Mediterranean here.

I certainly don’t have to mention the proximity to Frankfurt. I would even include Darmstadt with its future-oriented companies from the IT sector. Because the good transport infrastructure of the Rhine-Main region means that even residents of Wiesbaden and the surrounding area can get to the region at the foot of the Odenwald quickly. No one in Wiesbaden and the surrounding area has to worry seriously about a lack of interest in renting, i.e. also about rental downtimes.

Good yield opportunities also in the surrounding area of Wiesbaden

Question: Do you have an insider tip for profitable real estate in Wiesbaden and the surrounding area?

With the insider tips in metropolitan areas it is such a thing. But for Wiesbaden, too, if you’re willing to drive a little further, you’ll get by quite well in the surrounding rural regions in terms of the purchase price and the amount on offer. Up to Bad Schwalbach or Taunusstein, for example, the roads are also well developed. But it is also not everyone’s cup of tea to join the commuter car queue every morning and evening. Potential tenants also think about that.

The opposite side of the Rhine also offers attractive real estate opportunities. This extends to Bingen, Bad Kreuznach or the gates of Worms. Basically, one must also look here, in how far the lower purchase prices are also accompanied by lower rents, so that the yield in these areas can be lower. In fact, the surroundings of Bingen, Ingelheim etc. offer quite good properties as capital investment. The purchase prices are somewhat lower than in Wiesbaden, but the rents are not to the same extent. In individual cases, one can therefore expect better returns than in the core area.

How do I get my own investment property quickly and safely?

Question: How can I tell which broker is the right one?

At least not on the brightly polished brass plate on the office door. Admittedly, that was a bit flippant. But actually it is with the right broker like with the right doctor. It is only during the consultation that I notice whether the person, with his qualifications and his manner, suits me. Of course, there are professional associations of brokers, as well as appropriate training and further education. All this is also very important.

But even more important is whether the broker knows his market. Can he show comparative prices? Does he have a larger number of reference properties in the region? Is his name not only known in the region, but does he have a good reputation? If it is important to you that the estate agent proceeds rather cautiously, you should attach particular importance to discretion.

Discretion when buying and selling a house?

Question: A broker works in public and needs many contacts to make the business work. How can you be discreet?

In fact: there are also real “discreet brokers”! Especially with customers who do not like to appear in public with their sales or purchase intentions, this kind of broker is in demand. A luxury villa in Wiesbaden or a great penthouse apartment can be sold much better if there are no screaming billboards in front of the house. Mostly, the owners and their property do not want to be identified either by photos of the house or location descriptions.

For the buyer this means: he can only get hold of such properties via one of these discreet brokers. They often appear only in the files of the broker. In the relevant real estate portals, you will find these objects rather not. If you go to a real estate agent, you can openly address the issue of discretion. I consider the discreet working method of a good real estate agent to be very important and still completely underestimated.