Frankfurt real estate market: tips from the experts – renting, buying, living, capital investment

As the fifth largest city in Germany, Frankfurt is also one of the most expensive places to live. For many years, purchase prices and rents for residential and commercial properties have been rising in Frankfurt. Actually ideal conditions for all those who want to invest their money in real estate. We talked to Sebastian Mathias, a real real estate expert of the scene about buying and living in Frankfurt, about alternative forms of investment and the influence of foreign capital investors on the Frankfurt real estate market. Back to overview: Real Estate Frankfurt.

Right at the top in Germany: living in Frankfurt am Main

Question: You are mainly active as a real estate investor in the Frankfurt area. In your experience, what is the development of the real estate market in the region?

I’ll answer with a bold statement: Frankfurt’s real estate market is currently the most attractive in Germany! At least that is what the figures show when I look at the total investments in the real estate market. For some years now, private and institutional investors in Frankfurt have been investing more in the real estate market than anywhere else in Germany.

The question is where the money goes, i.e. what kind of properties are built or bought with it. Essentially, it is commercial real estate, i.e. office space. But also in the residential sector, Frankfurt has overtaken the other major cities in Germany. While around €1.2 billion was invested in the residential market in Frankfurt in 2018, this figure was only €0.5 billion in Munich, for example.

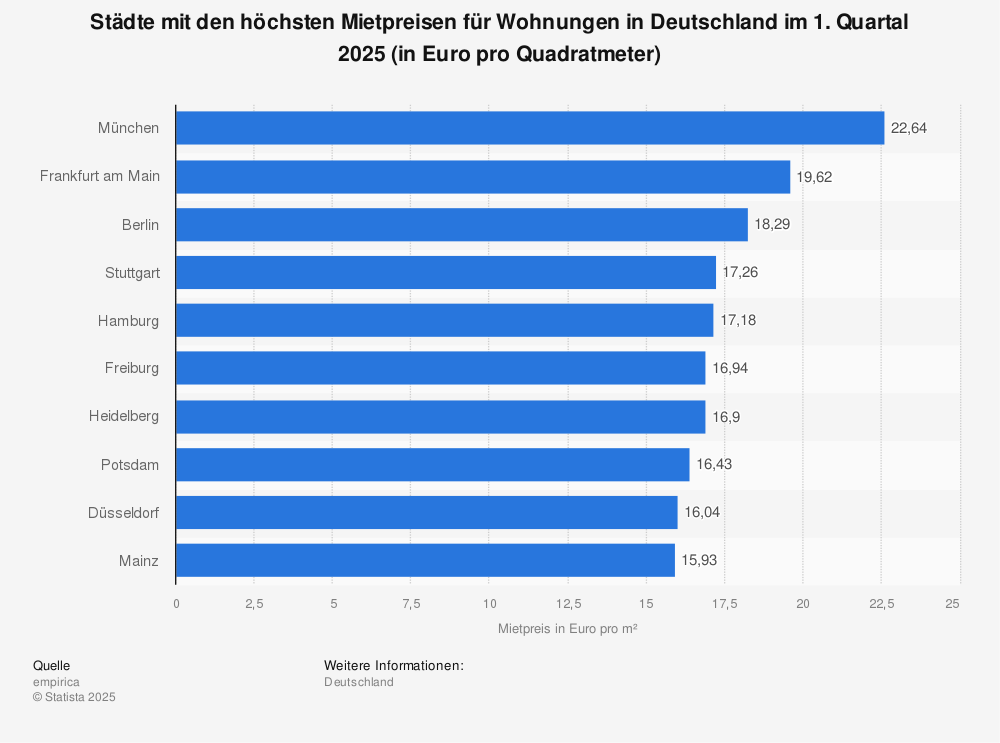

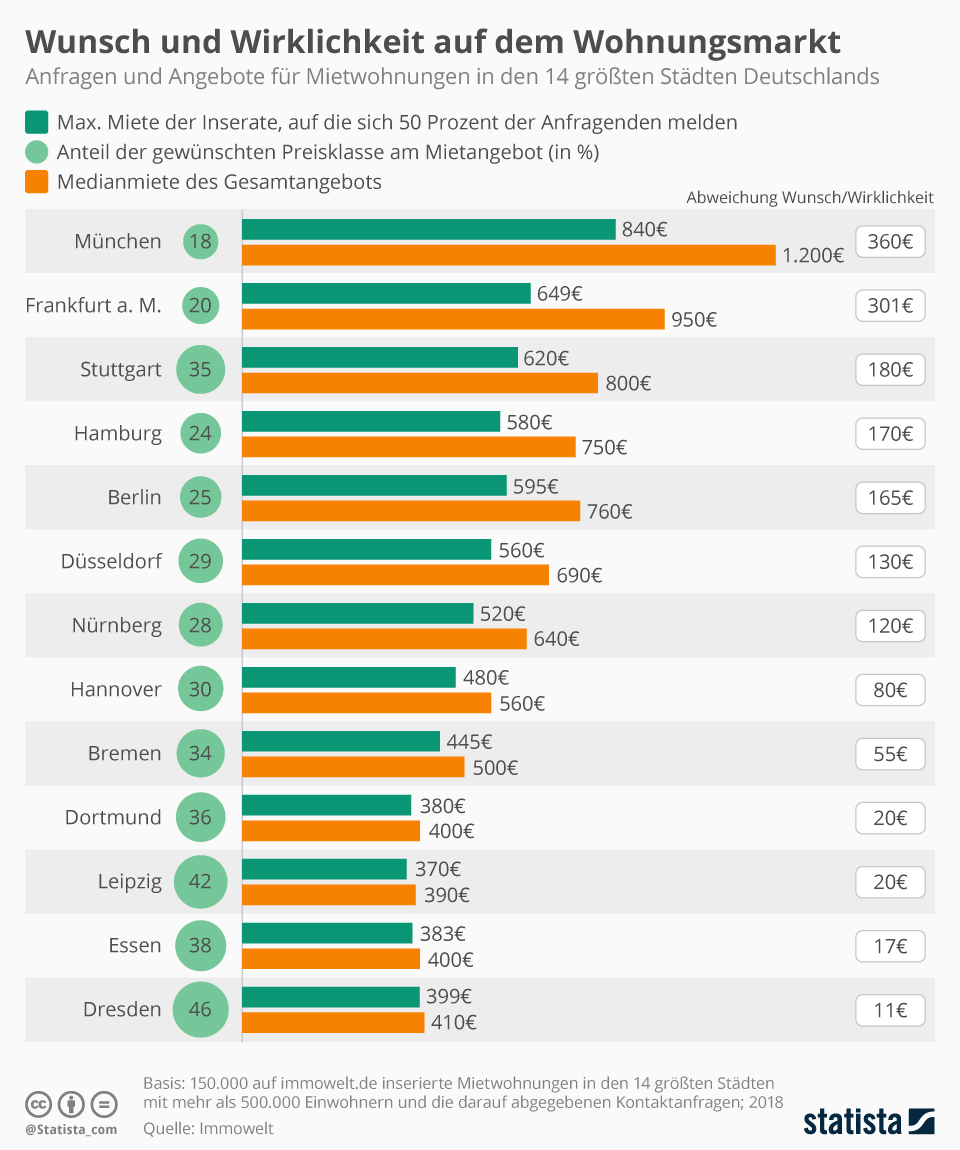

You can find more statistics at Statista

If you now add to this the fact that Frankfurt’s current population of 750,000 is expected to rise by around 100,000 in the next ten years, then it quickly becomes clear to everyone: apartments are needed here! And because this development has been going on for some years now, property prices in Frankfurt have also risen rapidly. If you look back at the past ten years alone, the prices for houses and apartments have increased annually by more than ten percent in some cases. A house or an apartment in Frankfurt and the surrounding area costs almost twice as much today as it did years ago. This can also explain the fact that the turnover in the real estate industry is increasing, but the absolute number of sold properties in Frankfurt is decreasing somewhat: there are simply less and less houses and apartments for sale. Hence the high amount of investment I mentioned above. Politicians make sure that new residential areas and housing developments are approved – if there is any space left at all.

Trend: purchase prices rise more strongly than rents

Question: Does it then make sense for you to trade in real estate at all?

My job is to find suitable properties, land, etc. – and to do so in good time – in order to make them usable for my clients. After all, I don’t keep the houses and apartments for myself. So if you want to invest in real estate in Frankfurt, you have the best prospects in terms of appreciation, capital investment! It is also clear, however, that everyone who is willing to buy is entering the market at a purchase price level that is meanwhile really high. Of course, the rents have also developed further upwards, so that I still have good opportunities to have the purchase of my property financed by the rent. But the truth is also that especially in the big cities the real estate purchase prices have risen much more than the rents. This will probably remain so. So you have to calculate very carefully.

One final thought on this: There are real estate experts who warn of a price bubble. It is hard to say if and when the prices for apartments and houses will stagnate, maybe even go down again. But I think that with the forecast population development for Frankfurt, real estate prices will also continue to go up. Maybe just not as strongly.

Selling real estate once differently – Diskret broker offers insight

Question: You yourself describe the Lukinski brokerage office as a discreet broker. What does that mean exactly?

This means that we offer the properties offered to us without the classic – let me call it – “market writing”. For the seller this means: he can be sure that no one in the immediate vicinity will notice his intention to sell. The usual advertising signs in the windows or in the front garden are not necessary. Our vehicles are kept inconspicuous and are completely neutral in colour.

The exposés are only sent to customers who we have contacted beforehand and included in our database. Of course we also use real estate marketing portals, but our appearance or the appearance of the property is designed so that hardly anyone can draw conclusions about the location of the property. So if you want to offer your property on the market with maximum discretion, for example because you want to avoid annoying discussions with neighbours or friends, a discreet estate agent like Lukinski is the right choice for you.

For the buyer, this also means maximum discretion. This is particularly important if you value serious negotiations without the often usual “price gouging” by a rush of interested parties. The buyer can be sure that his person remains behind the scenes. Only after moving into the new home will his identity become public with the new neighbours.

The truth about internet tools in real estate

Question: What tools are there for real estate investors on the Internet that are also helpful for newcomers to the real estate market from an expert’s point of view? What do you think of investment calculators, for example?

Clear answer: It depends! That’s how the lawyers always answer. But in fact it is very similar in the real estate market. Before I use a tool, I have to think about what I want to use it for. That’s what matters!

If I want to get an overview of how much my property is worth, for example because I want to sell it or borrow against it, there are sometimes quite good valuation calculators. Loan calculators, also sometimes called financing or mortgage calculators, can help to get an initial overview of the costs of buying a property. So can a budget or feasibility calculator. And then there are the quote comparison calculators. With these, I can compare loan offers when I need a loan for my real estate investment.

For the quick overview and the feeling for numbers and relationships, such calculators are really quite good. However, as a rule, no individual circumstances and wishes can be entered into these calculators. This includes the consideration of fluctuations in the capital market, tax circumstances, etc. A full consideration of real estate investments with rental income, ancillary costs, taxes, etc. you do not get with an online tool.

I have made the experience that the personal and individual advice in real estate investing is not replaced by anything. It’s like at the doctor’s: I can also get to my problem with an Internet search, but I usually come out with completely different results. As with health, I should also better go to the personal conversation with the expert when investing.

Rental prices: Measuring pays off!

Question: How exactly is the price per square metre calculated for the tenant of an apartment or house in the end?

Sounds simple at first, but it is not necessarily so. Because with the square meter price the question always arises, what actually belongs to the living space? Which square meters may I calculate and how? The calculation as such is quite simple: I divide my rent by the square meter number, as it is specified in the lease. If I add the ancillary costs, then I have my square meter price “warm rent”.

According to generally applicable rules, all living rooms, bedrooms, dining rooms, as well as kitchen, corridors, bathrooms, but also pantry count 100% to the living space according to the living space ordinance. Balcony and terrace are considered to one quarter each. Cellar and garage are not considered. In the case of sloping roofs, only those areas with a ceiling height of more than two meters are considered 100% living space. Room parts with a ceiling height of one to two meters are calculated at half and everything less than one meter is not calculated at all.

And now here are a few nice little things! Everyone should know these before running through the apartment with a folding rule and starting to measure: fireplaces, stoves, built-in furniture and bathtubs count as full living space. Stairs with more than three steps are deducted from the living space, as are free-standing columns and brick protrusions from chimneys.

Instead of a folding rule, I recommend a precision tool, such as a laser measuring device.

Measuring is worthwhile in any case. Now seen from the perspective of the real estate investor, i.e. the future landlord, this means: I save myself later disputes with the tenant if he measures accurately himself and encounters discrepancies. Service charge statements, insurance premiums, etc. are also based on the square metre figure. So it should really fit.

Living in Frankfurt: Something for everyone!

Question: How do you rate the quality of life in Frankfurt compared to other major German cities like Hamburg, Berlin and Munich? Which sights and events make the city attractive for real estate investors and tenants?

Fortunately, I am not a native of Frankfurt. That’s why I can approach this tricky question somewhat objectively. If you take the annual city ranking of the “Institut der deutschen Wirtschaft” (Institute of the German Economy), Munich is already in first place for the seventh time, with a clear lead over Frankfurt, for example, which comes in fifth in the overall ranking. At least the Main metropolis has improved its ranking by one place compared to the previous year.

I also don’t believe that Frankfurt will ever manage to displace Munich from first place. Unless, of course, “Äppelwoi” and the Taunus will one day outrank the Alps and wheat beer in people’s favour as leisure destinations. Frankfurt is a completely normal “everyday city”. With its opera, theatres and museum mile, it has everything that high culture needs. In addition, there is a good gastronomic scene that has no comparison in the world when it comes to internationality. There are beautiful parks in the city, as well as the zoo and the Palmengarten, so that you don’t have to leave the city for a short rest. The Mainufer invites you to stroll along the Main, as well as the chic shopping galleries. The skyscrapers are also an attraction in themselves. And if you visit one of the numerous festivals in summer, it’s hard to get away from the view of the skyline. Frankfurt does not have an Oktoberfest, nor does it have anything comparable to the “Volkstmliches”. But the wine-growing areas of Rheinhessen, Rheingau and the Bergstrasse are only a short distance away. With the new development at the “Römer” the city centre has got another highlight. So all in all a city where there is something for everyone.

Not everything shines: investing in gold

Question: Gold has been present as a means of payment all over the world for almost thousands of years. Gold has also been very popular as an investment for a long time. How do you see this topic – gold as an investment? Tell us three advantages and three disadvantages of this form of investment.

According to unanimous expert opinion, gold is a currency for times of crisis. This has always worked in the Roman Empire as well as in the Middle Ages or in modern times. Those who had no money, but gold bars or coins, could always afford something to live or survive. The value of gold basically lies in the fact that it is rare and has to be mined with a certain amount of work.

This already mentions one advantage: Gold has a basically constant value, even if the gold rate fluctuates. The rate only comes into being when it is converted to a concrete current currency. If you have a gold ounce from, say, 1870, you can use it to buy today just as you could back then. Try that with a Reichsmark note from the same time.

Second advantage: Gold is quite easy to understand as an investment. Unlike shares or other financial market products, it is literally tangible. It is enough to have your gold in a safe deposit box and to follow the gold price.

The third advantage arises in times of economic or political crises, which hopefully remain rare. For example, when a country’s currency loses value, people buy precious metals. The demand increases the value of the gold.

And with that we already have the disadvantages on the table. Unlike other investments, whether real estate or shares, etc., the profit of an investment in gold only results when the gold is sold. And that too only under certain circumstances. Interest, dividends, rental income etc. do not apply to gold. If you look at the price of gold over a long period of decades you will find that it fluctuates much more than stocks. Finally, with the gold rate, you always have to keep an eye on the exchange rate of the currency in question. Gold is traded in dollars. If the gold price moves upwards but the dollar loses value against the euro, you actually make a loss when you sell the gold.

My tip: If you have enough money and are looking for investment opportunities, you should only invest a small part of your capital in gold.

What else is available as an investment – alternatives to real estate

Question: In Frankfurt, not only real estate is traded. As the headquarters of numerous banks, including the ECB and other major domestic and foreign banks, many other investment opportunities also play a role there. Which three alternatives to real estate do you see and what is the biggest disadvantage in each case?

I have already said a few sentences above about shares and other securities investments. In principle, this is always an exciting and, depending on the form of the investment, also profitable form of investment. As an alternative to real estate, I might mention direct participation in companies in the form of shares, participation in several companies via a share fund or investment in government bonds, so-called “annuities”. In contrast to gold, for example, all these forms have the chance to bring the investor a profit through the price development, not only when the “notes” are sold. As long as the shares, securities etc. are in my possession, I get something similar to interest. So I notice already during the term of my papers that I get something out of it – namely money.

The disadvantage, however, is that the more security I want for my investment, the less profit I can make. Government bonds are considered a very safe investment, but hardly any country is currently paying me much interest for the money I lend it – in whatever form. At the moment, interest rates are particularly low because governments can borrow their money from banks almost for free. With direct company investments in the form of shares, I usually have to invest a lot of time to make up for large price falls by selling and buying again. Compared to real estate, the biggest disadvantage of these types of investments is that I can’t live in them myself if I want to. In addition, it is much easier to generate further capital via the appreciation of real estate. This is because I can earn additional equity through the increase in value, which I can then use to obtain favourable loans from banks for the purchase of further real estate.

- More about Investment Alternative

New competition – real estate buyers from abroad

Question: Is there an impact on the Frankfurt real estate market due to the international airport? Is there a greater number of foreign real estate investors specifically for Frankfurt as competition to the local investor?

Of course there are effects. However, it is very difficult to measure them. Because basically it is the case that proximity to an international airport also makes the place of residence interesting for foreign employees who are sent to Germany by their company. For foreign investors in the real estate market, this is ultimately not quite so important. There it is more a matter of the investment location being fundamentally a growth market. This development can be favoured by the existence of an airport. This is certainly the case in Frankfurt. In addition, Frankfurt as a service city with a focus on banks is attractive for an international clientele anyway.

It is not yet possible to say for sure what the impact of Brexit will be. There are various statements on this. In fact, it is exciting to observe how the real estate market has changed with regard to investors without German citizenship. Recently there was a report that in the meantime about every third investor – also on the market for residential real estate – has no German citizenship. That is an increase of about 13% on the previous year. Some attribute this to the broad. For capital investors from Germany this certainly means a tension in the market.

Where do the kickers of Eintracht Frankfurt live?

Question: Also in Frankfurt many citizens stand behind their football club in the Bundesliga. Where does a well-earning professional footballer of the “Eintracht” buy his more or less luxurious home if he wants to live in the area?

I honestly don’t know where Frankfurt’s professional footballers live. I assume that they are like all other people. The place of residence depends on the need. People who are looking for the hustle and bustle of the big city will certainly not move to the countryside and vice versa. With the new Henninger Tower, we certainly have a property that suits the wallet of one or two footballers. Frankfurt’s hippest districts include Bockenheim, the Ostend and Griesheim, and perhaps the northern Westend. The apartments at the harbour in the “Gutleutviertel” also offer everything the heart desires for the most upscale demands.

But I also know of a professional footballer from Hertha BSC who has made his dream home in Hunsrück come true. That is certainly not intended for normal everyday life. Because for the way to the workplace “Stadtion” should certainly not be too far. None of the guys will stand in front of the S-Bahn in the morning or in a traffic jam. And that brings us back to the immediate Frankfurt city area. But I don’t think that apartments bought or rented by a professional footballer are in the sights of the average real estate investor. They are therefore just as much ruled out as a target tenant group as they are as a competitor in the investment property market.

Living in Frankfurt’s soft area – tips from the experts

Question: If you are looking for a property in the Frankfurt area, you can certainly find one in the surrounding area. Do you have an insider tip for worthwhile properties in the Frankfurt area?

Of course: I’m very happy to talk about Rheinhessen. The area south and west of Mainz is very interesting as an investment for real estate buyers. This is due to the fact that the square meter prices for purchase are still affordable, and the rental income to be achieved is also good in relation. As an area of migration for the Rhine-Main region, value development and rent price stability are also guaranteed in these areas. Since the traffic connections in the direction of Bingen, Worms and ALzey are also very good, you should direct your eyes to these regions. It is certainly worth it!