Selling real estate: Inherited house / apartment – What you need to consider as an heir

Inheriting a property comes with a lot of responsibility. A number of questions regarding your inheritance and ownership must be clarified in advance. If you are the sole heir of the property, you can decide independently about a sale. The situation is different if there are co-heirs who may not wish to sell.

What is the sale process for real estate inheritance?

Inheritances are fundamentally associated with the most diverse emotions and grief. You are in a difficult position from which you can hardly rationally evaluate and sell a house or an apartment. In order to sell your property on behalf of a client, you must first be the legal owner in the land register. This means that you have to go to the land registry with the will from the notary’s office or with a certificate of inheritance from the probate court and have the ownership changed.

In addition, it is highly relevant that you check the property for freedom from encumbrances and find out whether there is a mortgage or other liabilities. Once the ownership situation has been clarified and you are the owner of the property, the preparation phase begins. All the necessary documents for the sale are organised, the exposé is prepared and the property is advertised.

Create a foundation for the sale of the house

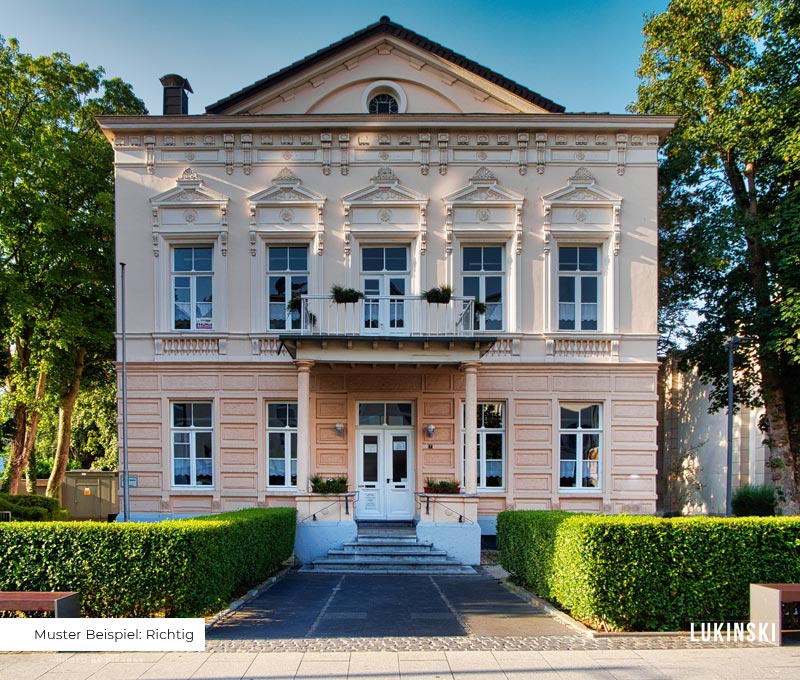

By entrusting the sale of your house to real estate agents, you will not have to deal with the sale yourself and you can be sure that the sale will be carried out in your interest, based on the market value. For accurate estimates: real estate appraisal. Before the sale, we recommend that you clear the property and thereby create a stable foundation for the house sale.

More information about inheritance:

Inheritance settlement

Properties inherited in community pose a particular difficulty when selling. Within the framework of a community of heirs, there are several owners in the land register. This circumstance has a detrimental effect on the interest of potential buyers and makes the sale process more difficult. There is a solution to simplify the settlement and at the same time provide for a clear guideline of all heirs with equal rights. The settlement of an estate refers to the dissolution of a community of heirs, which is carried out on the basis of clear contractual regulations and is not bound by any particular form. Everything you need to know about inheritance settlement.

Community of heirs

From practice it is known that a community of heirs rather rarely agree. But from the disagreement and open disputes in relation to a real estate inheritance arise losses that you can avoid with prudence. Avoid conflicts about the estate by consulting an estate agent and finding the best way with support. If the will does not provide otherwise, all co-heirs are equally entitled and obliged. This means that a sale is often the best solution and gives you the opportunity to divide the proceeds of the estate between all the co-heirs, thus avoiding the problem of an inheritance dispute. Learn more about the community of heirs.

Inheritance tax

For many heirs, grief, joy and sorrow are closely linked. When you inherit a house, this process is always linked to a painful, emotional loss. After some time, a slight joy spreads and you realize that you are a homeowner. At the same time comes the worry that the tax office will claim inheritance tax from you and you will only be able to pay this amount if you sell the house. You have an exemption amount, below which there is generally no inheritance tax. The amount of this allowance is based on your degree of relationship to the deceased. Spouses can inherit real estate tax-free up to 500,000 euros, children up to 400,000 euros. To ensure that you do not pay speculation tax, you should consider whether you would like to live in the inherited house yourself if it was acquired less than 10 years ago. Everything about inheritance tax.