Saving: Electricity, water, taxes, travel & Co. – Build up assets without working!

Saving – In the home, when traveling, shopping or driving, flying, moving or saving on electricity. Saving money can be easier than you think. With the right tips and checklists, you can save money in every walk of life to build your

Financial check

Financial Check: Saving – Who would like to save money should not start for it with things like clothes or the like. No, who would like to save correctly should do that with the finances! We have compiled a few tips for you with which it will certainly be easy for you to save more money in the future. The goal when it comes to saving money is always “Save like the Swabians”. So that you achieve exactly that, we have many different tips on dealing with your finances together. Even if you try to follow only 1 tip, you will notice changes.

Save in everyday life

Save money in everyday life – In this day and age, many things are becoming more and more expensive. For this reason, it is important to know how to save money properly and where it is really worth it. You don’t always have to make a specific plan to save money. Even small changes in everyday life like using different light bulbs, using services of trainees or other things can already contribute a big part to minimize the expenses.

Checklists: Save on subscriptions, shopping, household, electricity & Co.

We also have many individual areas where a lot of money can easily be saved. Every week, every month, so that a solid financial basis is getting closer and closer:

- Save subscriptions

- Save Shopping

- Save Driving

- Save free time

- Saving budget

- Save Travel

- Save electricity

- Save relocation

Subscriptions

Saving money through subscriptions is a nice option. But taking out a subscription is not always the right choice. In this article you will learn when a subscription is worthwhile and in which areas a subscription could be useful. A subscription is an agreement to purchase certain services for a longer period of time at a reduced price. These include not only gym memberships or the purchase of newspapers, but also the purchase of tickets, TV connections or music services. The purpose of subscriptions is to enable people to obtain certain services on a regular basis for a fee.

Shopping

When you hear the word shopping, you probably think of spending money instead of saving money. If shopping is still a big passion of yours and you want to learn how to save money, you should read each of our tips carefully. Buying used, bargaining, visiting outlets or making shopping lists are just a few of the ways we want to introduce you to. Shopping is one of the most important consumer goods for people. It is now no longer just about necessary purchases like food or clothes, but nowadays you can also go shopping to pass the time. The tips on how and where to save money on shopping have been recorded for you below.

Driving

You think there is no alternative to leaving your car at home, except using public transport? Wrong guess. This article proves you wrong and provides 18 other options. Besides public transportation, you can walk, bike, carpool, or compare gas prices. If you want to save money on transportation, you don’t have to use public transportation directly. Of course, these are a cheaper alternative to the car, but in the following we have collected a few tips on how you can save money not only by giving up the car, but also the car itself.

Free time

Free time is an important part of a person’s life. You are not only free from any obligations, but you also have the opportunity to shape them as you want. There is a whole range of leisure activities but they are anything but easy on the wallet. Those who do not know how to spend their free time without spending a lot of money should have a look at the following suggestions. You not only have the opportunity to make new contacts, but you can also make new experiences. So it does not always have to be an expensive hobby that you pursue in his spare time, there are also a lot of cheaper or even free alternatives.

Budget

Saving money in the household – government grants, appliance use, environmentally conscious laundry, or waste separation. No matter in which household area: You can save a lot of money everywhere. We show you how, where and when you can save money and thus increase your wealth. You can just as easily save money in everyday life, at home, when shopping or in your leisure time. Your tax advisor will also be happy to help you save on your taxes.

Travel

It is always a nice thing to travel. Due to the fact that it is rather the rarer case that one travels monthly, it is often an exception when going on vacation. And although or just because it is an exception, you often spend a lot of money on many, often unnecessary, things just on vacation. For this reason, we have compiled a few important tips for you below, with which you can save money not only before your upcoming vacation, but also on vacation itself. 14 practical experiences from everyday life, especially for young families and people, with less budget. After all, it’s not about the money, it’s about the people you have with you, the experiences and the adventure, it doesn’t take much!

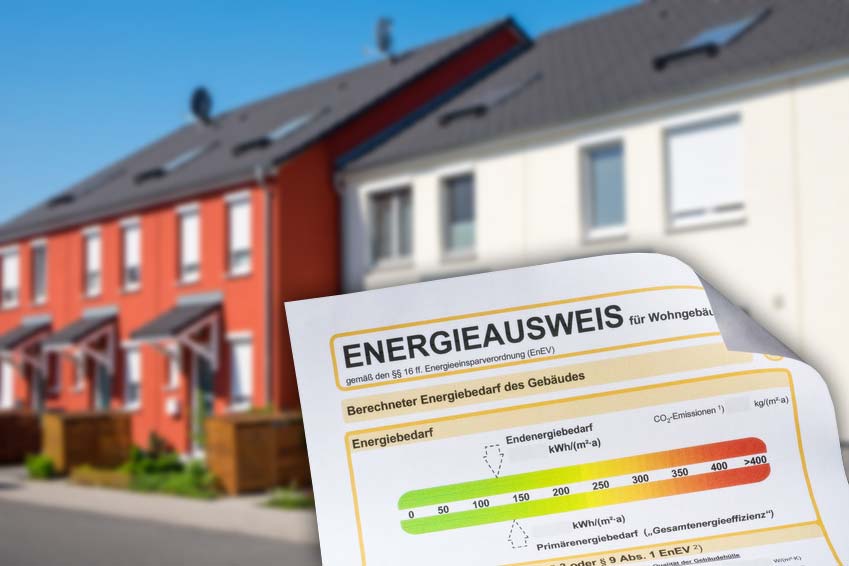

Power

Saving electricity is becoming increasingly important. Energy consumption in particular is responsible for high costs. If prices continue to rise, then it is always worth taking a closer look at the large energy consumption. Of course, a lot of money can be saved by changing the electricity provider, but you can also do a lot in everyday life, so that the electricity bill lowers. If you want to avoid high electricity costs, here are the most important tips at a glance! How to save electricity and money.

Move

The next move is coming up, whether you’re moving for the first time or you’ve already moved a few times, each time presents new challenges. There are a few organizational basics that will help you quickly and easily organize the move. In a direct price comparison with moving companies, it is worth moving on your own, which can save you money. How to organize your move, our guideline.

Wealth building: Real estate, stocks, cryptocurrency … ?!

When does it make sense to start building wealth through strategically intelligent investment? At 20, 30, 40 or even at 50? Is there a simple formula or tips for investing with good returns? What about risk, depending on the type of investment? Here’s an in-depth look at wealth building, for beginners. Without equity and with little equity. From the principle of effective trading (saving), calculation examples, investment impulses and first tips.

Long-term wealth accumulation does not start when assets are needed in a timely manner. That means, for example, shortly before retirement or shortly before a decision when money “must” be spent. For example at the end of the year or if it concerns larger investments, also before elections, for example the federal election (up-to-date with donation / WEG establishment). But – we want to stay at the very beginning.