Minimize inflation risk & build wealth through real estate: Money investments in comparison

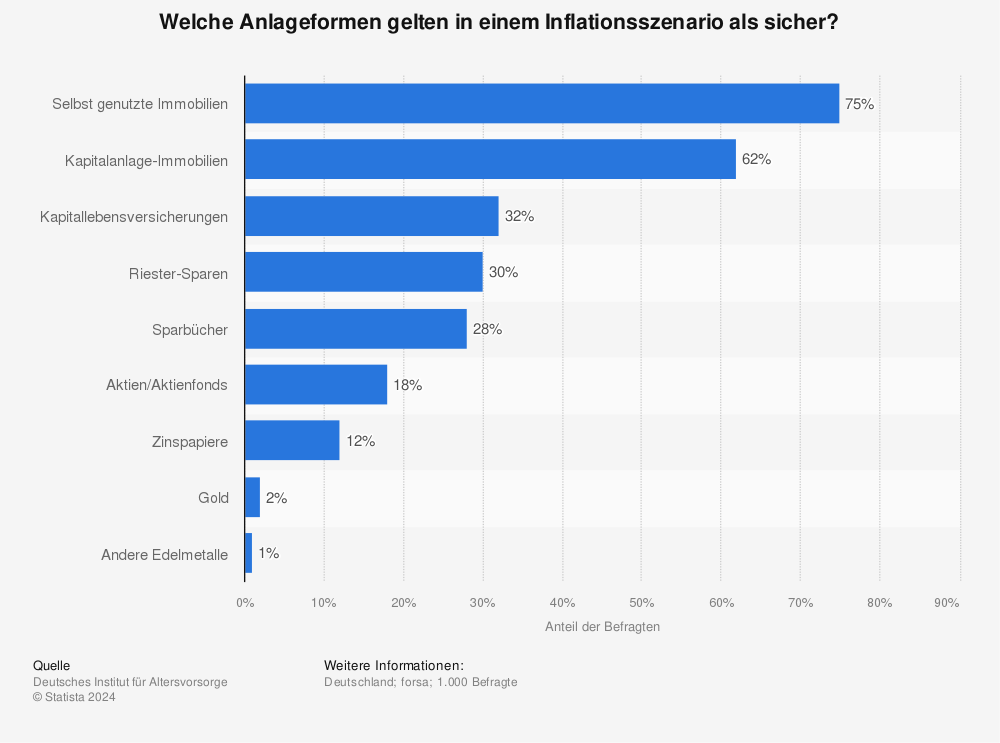

Minimize inflation risk & build up assets through real estate – There are many types of capital investments, from traditional savings books to Riester pensions. However, investing in real estate is not only particularly safe, but also particularly profitable in times of inflation. After all, inflation also means devaluation of money. According to the central bank, our money loses about 2% of its value every year. After a few decades, your savings will eventually shrink. But it is different with real estate. Here you can find out which advantages you can profit from with your real estate as a capital investment in times of inflation.

New! Especially for real estate buyers

Buying real estate from A-Z: preparation, search criteria, buying process and all that, free of charge and online, from experts.

Now on real estate-experience.com

Buying an apartment, buying a house, owner-occupation or capital investment, yield or investment property? On my new project Immobilien-Erfahrung.de you will now find everything you need to know for your successful real estate purchase! Learn everything you need to know about setting goals when buying real estate, location types(A-, B- and C-locations), real estate types, their yields and … all online and free of charge! Invest in real estate and build wealth even during inflation. Now on Immobilien-Erfahrung.de:

Real estate as an investment or savings account & Co.

Not only is the property itself considered a secure protection against inflation, but this also has a positive effect on the financing. The assumption that you have to save money in order to build up assets is therefore not entirely correct. On the contrary, if you invest conscientiously, inflation can actually play right into your hands.

Traditional investments in the face of inflation

Let’s take the classic savings book as an example. Here, you regularly deposit money to save it. Whether it’s for your pension, future investments, travel plans or the education of your children. If you have paid in 10,000 euros, for example, that sounds good at first. But what happens in the event of inflation? The money is devalued. Product prices rise. Life becomes more expensive. The 10,000 euros still remain in your savings account, but they are now worth less.

Savings account – If you had put the 10,000 in a savings account, you would still have 10,000.

The savings book as a classic investment may be safe, but you will actually lose capital in the event of inflation. Even the well-intentioned interest from the bank no longer makes much difference. The situation is completely different with real estate as a capital investment.

Invest in real estate: Advantages

Even in times of crisis, real estate is considered a safe investment. Its value is stable in the face of inflation, and even your loan can be positively affected by a depreciation in value. You can sell your property later for twice its value. If you have invested in an increase in the value of your property, for example through renovation and refurbishment, you can increase the selling price of your house or apartment even more!

Property – If you had bought a property for 10,000, in the example, you would later sell it for 20,000.

So here is a sample calculation:

- Buy property (today): 65,000 euros (~15% equity = your 10,000)

- Sell property (later): 130,000 euros

Loans: Fast and efficient repayment

With inflation, money is devalued. The value of your property increases steadily. With regard to financing, things are now getting exciting:

What happens to your loan?

So let’s stay with the example of the 10,000 euros. If you have taken out the loan today, it will still be 10,000 euros later. After all, we now know: The amount of money always remains the same.

Let us now assume that you have rented out your property in order to generate passive income. Due to inflation, you now receive more rent and continue to pay your installments:

- 2020 = 350 Euro rent / repayment 300 Euro

- 2035 = 460 Euro rent / repayment 300 Euro

Conclusion: Minimizing inflation risk

So you see: In contrast to traditional financial investments, real estate offers you some advantages that savings books, Riester pensions & Co. simply cannot promise. While your invested money loses value there, you can generate even more money with real estate as an investment in times of crisis. Your loan will also be repaid more quickly, especially if your rental income increases.