Real estate in Darmstadt: Frankfurt’s Speckgürtel offers capital investment with a future

Capital investment Darmstadt – Darmstadt is located at the southern end of Hesse, which recently likes to officially call itself a “science city”. This is not only due to the “Technical University”, but also to the numerous technology companies that have been specifically located there. We talk to a real connoisseur of the city and the region about the opportunities available to real estate investors in Darmstadt and the surrounding area: real estate as an investment. Back to overview: Real Estate Frankfurt. Back to overview: Real Estate Frankfurt.

Darmstadt real estate market: Demand clearly exceeds supply

Question: You are mainly active as a real estate consultant and investor in Darmstadt and the Rhine-Main region. In your experience, what is the development of the real estate market in this region in Germany?

Darmstadt occupies a truly special position in the Rhine-Main region, if Darmstadt is to be included in this region at all. As a university city, Darmstadt already has a stronger influx than other cities of its size. On the other hand, the city has very successfully tinkered with its image as a “science city” in recent years. Numerous companies with a technology focus have their headquarters there, or at least large branch offices. This means a corresponding number of mostly very well-paid jobs and the desire of these people to also live in or around the city.

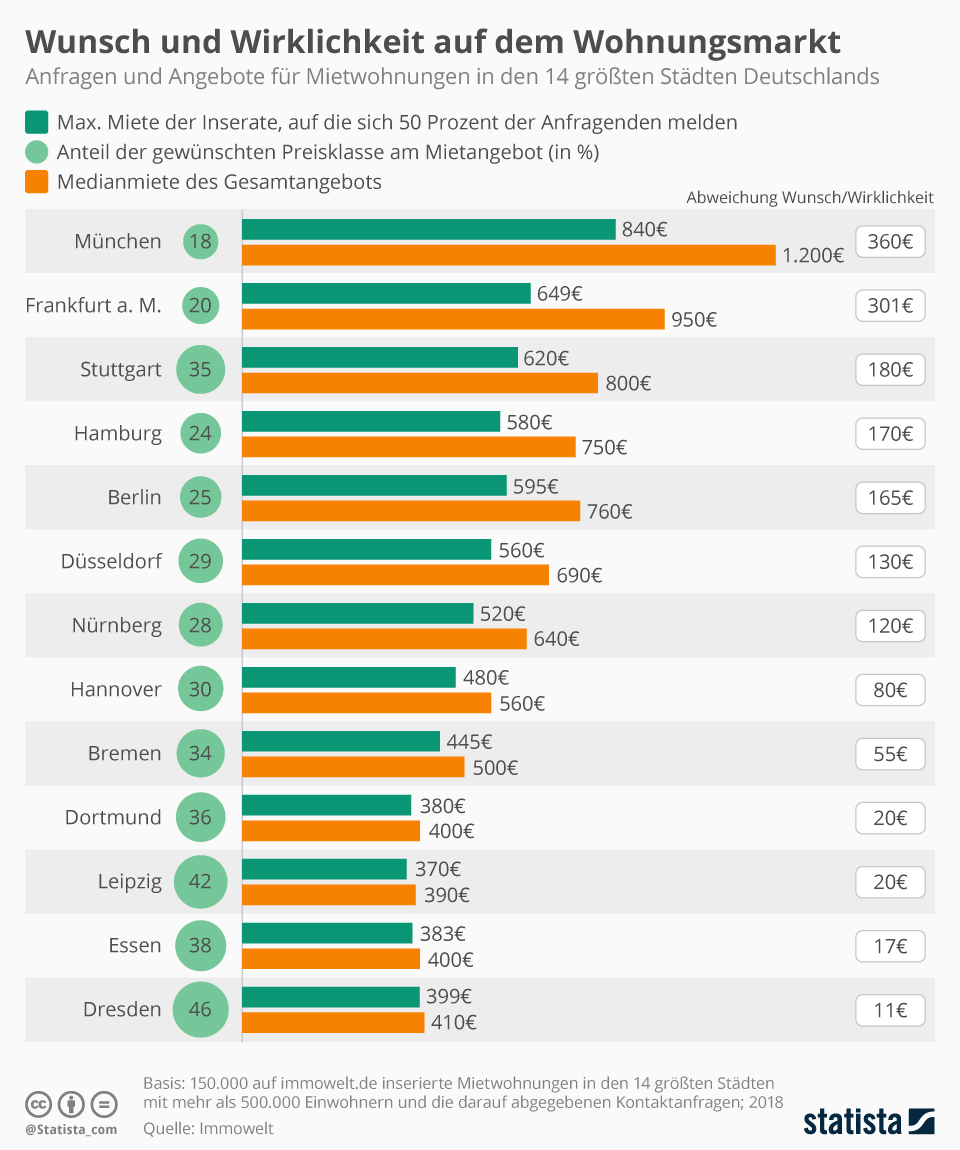

How supply and demand regulate prices in the housing market

You can find more infographics at Statista

You can find more infographics at Statista

This development will continue, especially because the technologies developed in Darmstadt in terms of “artificial intelligence”, climate research, etc. are real technologies of the future with increasing demand for employees. Of course, this is also reflected in the prices of houses and apartments. Within just a few years, the rates of increase have reached double digits. The number of building permits applied for for residential buildings in Darmstadt is still well below demand.

On the other hand, Darmstadt already has a visible number of vacant apartments with a dramatic refurbishment backlog. Bessungen, Martins- and Johannes-Viertel are just a few examples. It is really incomprehensible that the owners of these houses do not take capital into their hands, bring the flats up to scratch and thus ease the situation on the market. I am very sure that nobody has to calculate with sinking rent incomes and purchase prices. The rent level is already absolutely comparable with Frankfurt, Wiesbaden or even Munich.

Yield calculator online: Just the right tool to get you started

Question: Which of the countless online calculators do you find helpful for real estate investors or those on their way to becoming such?

I’ll start with the loan calculators: I can’t see anything being done wrong there. That’s why I won’t recommend any computer in particular. The calculators of Stiftung Warentest or a reputable online newspaper are certainly not suspicious with regard to a hidden forwarding of the user’s data. Basically, such an online calculator can only be an initial source of information. For example, for my question, what I have to pay monthly for my real estate loan with regard to the interest and repayment rate. I can also go about it the other way round and ask: if I have a sum x available each month, what loan amount can I afford to buy a flat?

On the other hand, I don’t know of any loan calculator – not even that of a financial institution – that calculates the interest rate I have to pay for my loan in view of my equity and other collateral. That is always a matter of personal discussion with the bank. That’s why calling up and using various loan calculators on the internet doesn’t help. The best loan calculator with the most accurate information and the safest result for me is still the conversation with the financier himself. You should be quiet from different banks give an offer. There are sometimes really spraybare differences in the interest rate offered.

Anyone thinking about real estate as an investment naturally wants to know what return their property will yield. In other words: how much money will I earn with my investment? For this purpose, there are of course many tools on the Internet. The yield calculators for real estate are usually linked to a real estate agency or financial institution. This is not a disadvantage, you should just know it. Because the vast majority of online calculators for property yields can not take into account every detail of the property. That is why it is always much better to get an overview via the online calculator in order to then seek a personal discussion on the basis of a real property.

Overall, there is a pretty good overview including deposited calculators on the portal finanzrechner.org. As I said, these calculators offer really good guidance. Everyone should definitely make an individual calculation with their personal financial advisor or tax expert.

Become a real estate professional – but how?

Question: How do professional real estate investors finance the purchase or new construction of a property?

Anyone who invests in real estate professionally has usually been in the business for a very long time. This means that such a person firstly has very good bank connections and secondly has a fair amount of experience in the business. He or she then always has the right “nose” for well realizable projects or real estate offers and enjoys the confidence of the banks to get smooth financing.

Because basically, however, it is the same whether you enter the market as a professional or a beginner. The principle remains the same: One buys the first property, should have a certain amount of equity for this and rents it out. With the rental income can be raised in the best case the entire debt service, but at least it should be a large part of the annuity from interest and repayment. If you have paid attention to the right location, equipment and condition of your property, you will soon profit from the increase in value. Since the saying “a property is not a property” also applies to real estate, the becoming real estate investment professional can now use this increase in value to purchase and finance his second property. This is called the “leverage effect”, and it can be continued almost indefinitely.

In Darmstadt, for example, you could start with a small student apartment. After a few years, you could then add a rentable multi-room apartment, until you perhaps even add one or two complete apartment buildings to your portfolio. What I strongly advise against as a real estate investor is the purchase and rental of single-family homes. Certainly the renting in Darmstadt and surroundings would be no problem, also nobody must fear there rent failure times. But tenants of single-family houses are usually very demanding tenants. In order to maintain the desired condition of the house, the owner usually has to invest significantly more and more frequently than in the case of an apartment or a multi-family house.

A special case among real estate investors is the property developer. They buy land or old buildings with the aim of building new or modernising them on a large scale. The apartments that are then built are usually sold as “turnkey” properties. In addition to a great deal of experience, the property developer also needs the unconditional trust of his banks, as he sometimes has to pre-finance the costs of purchase, construction and renovation over a long period of time. Furthermore, he needs a pool of good craftsmen for all trades that are necessary for the exterior and interior of the building. Buying and renting is absolutely the easier way.

Investing where spring starts early

Question: What is the quality of life like in Southern Hesse and Darmstadt? What attractions and events make the city and region interesting to live in, to live in and to invest in?

Darmstadt is the northern end of the Bergstrasse in southern Hesse. This is one of the regions in Germany where spring comes particularly early. In addition, there is the winegrowing and the location at the foot of the Odenwald. This means that local recreation is well catered for. Art lovers get their money’s worth in Darmstadt. With the Mathildenhöhe, Darmstadt is home to one of the most important centres for Art Nouveau art. In summer, the “Heiner-Fest”, the largest folk festival in Hesse, starts. The whole city centre is one big festival mile. For friends of high culture there is even a state theatre with a varied programme of opera and theatre – rather unusual for a city of this size.

The good supply of highly qualified jobs together with the truly diverse range of leisure activities makes Darmstadt really very attractive to live in – and for all those who provide the necessary living space with their investments.

Investment alternatives to concrete gold

Question: In Darmstadt, people don’t just think about real estate when they invest. Interesting companies are located there – especially due to the proximity to Frankfurt. Which three investment opportunities make the most sense in your opinion and what are the disadvantages?

First of all, I recommend that anyone who wants to invest their money profitably should ask themselves. And indeed questioned about their own willingness to take risks in terms of profit and loss. Because the capital investment must always fit the respective person and his goals. The one investor looks for a maximum of security, the other again has with risk and Verkust no problem. Then there are people who literally want to see what they have invested their money in, which again other investors do not care about at all.

Those who are not afraid of the big risk can invest their money in commodities or rare earths, for example. This is a form of investment that is not yet very widespread, but is becoming increasingly popular. There are people at some major banks and also on the consultancy market who are quite knowledgeable about this. As I said, it’s not for the faint-hearted and, by the way, it’s also a form of investment that should run for several years in order to compensate for price fluctuations.

For pure security fanatics – to mention the completely other side – there are funds whose profit is capped, but which are also protected against loss. Such funds are offered by banks and insurance companies. However, many find them very boring.

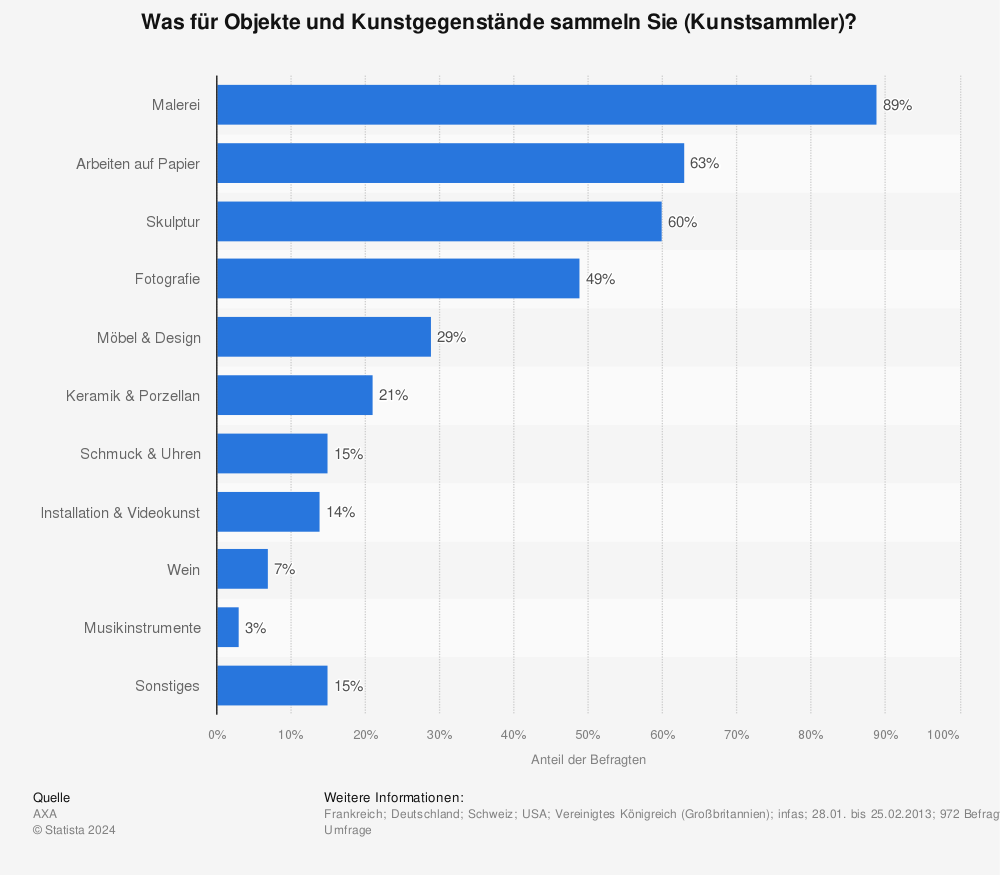

You can find more statistics at Statista

If you are looking for a more unusual form of investment, you should take a look at art objects. In the art nouveau city of Darmstadt, this is certainly a conceivable alternative, especially as there is a market for it locally as well as a lot of expertise. However, I am not an expert in this field and cannot say much about the value of the different art forms. But if you look at serious and official statistics on this, you will quickly see that there is a lot going on in the art market. You certainly don’t have to be an art historian to invest your capital in this market correctly – i.e. profitably. But knowledge and experience are necessary. And even then you are not safe from fakes!

What can funds do better than owning your own property?

Question: Many investors are particularly attracted to funds as an investment option because they are considered to be less risky than other forms. You have just mentioned them yourself. What are your arguments for and against investing in funds?

First of all, we need to clarify which funds we want to talk about. Let’s start with the classic investment funds consisting of equities and/or government bonds. These have been real classics on the market for years and are intended for all those who would like to participate in the development of corporate and government investments, but who shy away from their own “equity management”. Whether as a savings plan or as a one-off investment, these funds are more or less risky depending on the composition of their securities. Regardless of the risk of loss, which you can usually offset by investing for a long time, these investments cost money. They cost money through the issue premium, which is levied with each capital contribution, in addition, the generated investment income is taxed and in addition, one has ongoing custody fees. All this has to be deducted from the profit made or achievable.

As a real estate person, you naturally immediately think of real estate funds.

Open-ended real estate funds enable investors to invest relatively small amounts in real estate in various cities, regions and countries. There, the fund managers mostly invest in commercial properties – primarily office complexes, but also hotels and shopping centres. Investors can invest in these properties by buying shares, and then benefit from their rental income and increases in value. The disadvantages are then similar to those of equity funds. This is because if the properties invested in do not have any rental income for a longer period of time, or if the property value deteriorates due to market developments, this lowers the return while costs remain the same.

The risk diversification is higher for open-ended real estate investment funds than for closed-ended ones, consequently the return prospects of open-ended real estate funds are lower. Extraordinary performance is possible with closed-end real estate funds. The range extends from a tripling of the capital investment to a total loss of the investment. In the past, however, only a few real estate funds brought their investors a huge profit, with quite a few closed investments the investors suffered losses. The prospects of considerable returns are always associated with great risks. The letting of commercial properties is usually subject to more imponderables than the acquisition of residential properties. Closed-end real estate funds are therefore again not for investors with weak nerves and limited capital reserves.

Buying real estate in the Darmstadt area

Question: If someone of our readers is now as a real estate investor in the Rhine-Main region on the search near houses, apartments, etc.: What is your insider tip for them for a worthwhile real estate investment?

First and foremost, I would mention the Odenwald. In addition to inexpensive building land, there are also correspondingly low rents and purchase prices for houses. Depending on how far away from the major city of Darmstadt, the risk of loss of rent increases. Because the connections from the Odenwaldorten into the Rhine level is – all the same whether road or rail – usually not bsonders well. Those who are not afraid of driving and prefer to live in nature will always prefer a living space in the Odenwald. This is then the potential for real estate investors. Not quite as inexpensive, but still favorable are some communities in the surrounding area of Darmstadt. Büttelborn, for example, or other places in the Ried are my tips.