Capital investment Mainz: Buy and let property / land

Capital investment Mainz – a secret tip in the matter of real estate investment is the city of Mainz and its surroundings certainly not. But for it a genuine alternative for instance to the nearby Frankfurt. What Mainz has to offer in terms of real estate, what special features the city offers and what alternatives there are to capital investment with real estate, reveals our Lukinski expert. So we talked to a real insider of the Mainz scene: Real estate as a capital investment.

Real estate prices: Mainz ahead of Wiesbaden

Question: You are mainly active in Mainz and the surrounding area as an investor and financial advisor in real estate. In your opinion, what is the development of the real estate market in the region around Mainz?

Meanwhile, rents per square metre and also purchase prices for the residential square metre in Mainz are higher than in Wiesbaden or Cologne, for example. I think that says it all. In terms of rents, the €10 mark was cracked as the average rent per square meter at the beginning of 2019. When it comes to buying a condominium, Mainz is currently averaging just under €3,600 per square meter, about €10 more than its neighboring city. Everyone knows that the situation between Mainz and Wiesbaden is about the same as between Cologne and Düsseldorf. A mostly loving competition.

From the perspective of real estate buyers, especially those who want to use their property as an investment, this is a great development. There are serious statistics that predict a six-figure profit after 25 years, especially for the purchase of a non-owner-occupied condominium. Of course, you have to ask yourself what that’s due to.

Wiesbaden in comparison

In Wiesbaden, I think it can be said without envy, the premium sector is still in the foreground when it comes to real estate. So more or less luxurious houses and apartments at the corresponding prices. As a rule, these are also lived in by the residents themselves. In Mainz, on the other hand, there are numerous new large-scale housing projects. Most of the time it is also about upscale living, but certainly only rarely about luxury. I would mention the new residential area at the harbour, or the “Heilig-Kreuz-Areal”. Especially on the waterfront, living is very attractive. There are many people who compare this new quarter directly with a location in Nice – no joke!

These apartments are being built mainly because word has got around for workers from the Frankfurt area that it is good and – compared to Frankfurt – cheap to live in Mainz. This increases the demand for living space and also the price. If I now begin to speculate a little as to why this is better for Mainz than for Wiesbaden, I will say: Mainz is larger, more modern, perhaps also a little more lively and dynamic than Wiesbaden. But as I said, this is real speculation. It is based on what my customers tell me when they give reasons for buying in Mainz in particular.

- Read more: Investment Wiesbaden

Everyone can count on it: online tools for the real estate market

Question: Which Internet sites and offers are there for real estate investors, which are also useful and usable from the point of view of an expert? What do you think about the online loan calculators?

I’ll start with the loan calculators: I can’t see anything being done wrong there. That’s why I won’t recommend any computer in particular. The calculators of Stiftung Warentest or a reputable online newspaper are certainly not suspicious with regard to hidden forwarding of the user’s data. Basically, such an online calculator can only be an initial source of information. For example, for my question, what I have to pay monthly for my real estate loan with regard to the interest and repayment rate. I can also go about it the other way round and ask: if I have a sum x available each month, what loan amount can I afford to buy a flat?

On the other hand, I don’t know of any loan calculator – not even that of a financial institution – that calculates the interest rate I have to pay for my loan in view of my equity and other collateral. That is always a matter of personal discussion with the bank. That’s why calling up and using various loan calculators on the internet doesn’t help. The best loan calculator with the most accurate information and the safest result for me is still the conversation with the financier himself. You should be quiet from different banks give an offer. There are sometimes really spraybare differences in the interest rate offered.

Among the otherwise best-known websites for real estate investors are the well-known real estate portals. Here, too, I can neither recommend nor discourage. Who is seriously interested in buying a property, should always register at the same time on several portals. Because not only private people as salesmen of real estates, also brokers often have preferential portals. That leads to the fact that I find on different Internet sides also different real estate offers. I recommend besides to announce itself on the homepages of respectable real estate agents. About newsletter one always learns very promptly what is happening in the desired real estate market.

Anyone thinking about real estate as an investment naturally wants to know what return their property will yield. In other words: how much money will I earn with my investment? For this purpose, there are of course many tools on the Internet. The yield calculators for real estate are usually linked to a real estate agency or financial institution. This is not a disadvantage, you should just know it. Because the vast majority of online calculators for property yields can not take into account every detail of the property. That is why it is always much better to get an overview via the online calculator in order to then seek a personal discussion on the basis of a real property.

Not all returns are the same! What you should pay attention to when buying real estate.

Question: How do you calculate the rental yield of a property?

There are different methods. But first of all: why should a real estate investor even think about a yield calculation? The answer is quite simple, because only by a yield calculation I can compare a real estate investment with another investment in its value. In addition, different properties also have different yields. Just because I like an apartment or a house, it is not necessarily a good investment. With a yield calculation, properties in different locations and regions can be compared with each other. An example: if you absolutely want to buy a property in Mainz for investment purposes, you may quickly notice that it may be better to move to the surrounding area. For the same money you often get “more” property and a higher return.

But now to the different calculation methods. Let’s start with a basic decision as to which yield is meant at all when a real estate agent claims that the property has a yield of xy%. For example, in the case of the gross yield, only the purchase costs and incidental acquisition costs of the property are calculated against the rental income. In the case of the net yield, the running costs for maintenance, administration and taxes are also included in the consideration.

Yield calculator: An example

Return on equity – also a frequently used term: here the interest that I may have to pay for a real estate loan is included in the current expense of the net return and put into relation with the amount of equity used for the real estate purchase. If interest rates are low – as they have been for years – the interest item in the calculation is very small, and the return on equity is then naturally correspondingly high. By the way, repayment amounts or increases in the value of the property are not taken into account here. This is especially important with regard to the repayment, because by repaying the loan I increase step by step – like in a piggy bank – my equity. With regard to the income from the apartment, if the rent does not increase, my income and my return on equity would decrease. Conversely, the increase in value of the property also means an increase in equity. This would show up as an increase in yield if I can sell the property at a profit or – for example when buying another property – give myself an interest rate advantage when financing by mortgaging the first and now more valuable property.

I admit that these are already very detailed calculations. For the beginning, the pure property yield is sufficient. Here it is pretended that the property is paid completely from equity. All incomes and expenditures to the object are seized and with the purchase price in the relationship gestzt. So I can easily calculate the pure return of the object.

Finally, a very important aspect must be taken into account when calculating the return: namely the investment period! Real estate returns should also be calculated over a period of at least 10 years. Here, the development of rental income, but also an increase in value are included in the calculation. Maintenance costs over the years must also be included. Here, at the latest, you need either very good market knowledge of your own or the advice and knowledge of a good expert.

As a rule of thumb, I’ll conclude with this calculation: If you paid about 25 times the net annual cold rent for the property when you bought it, you can multiply the corresponding rental income by 25 again after an imaginary period of 10 years and an average rent increase of about 1% to calculate the value of your property in ten years. If I also include about 20% of the rental income for maintenance etc., I can again apply my yield calculation from above for the scenario ten years later.

Not everything shines here: gold as an investment

Question: Gold has long been a popular investment. Please explain to our readers three reasons for and against gold as an investment.

I can do that – I think – very briefly: If you are afraid of a total currency crash, you should buy gold for your money. Because gold will always have a certain value due to its limited occurrence.

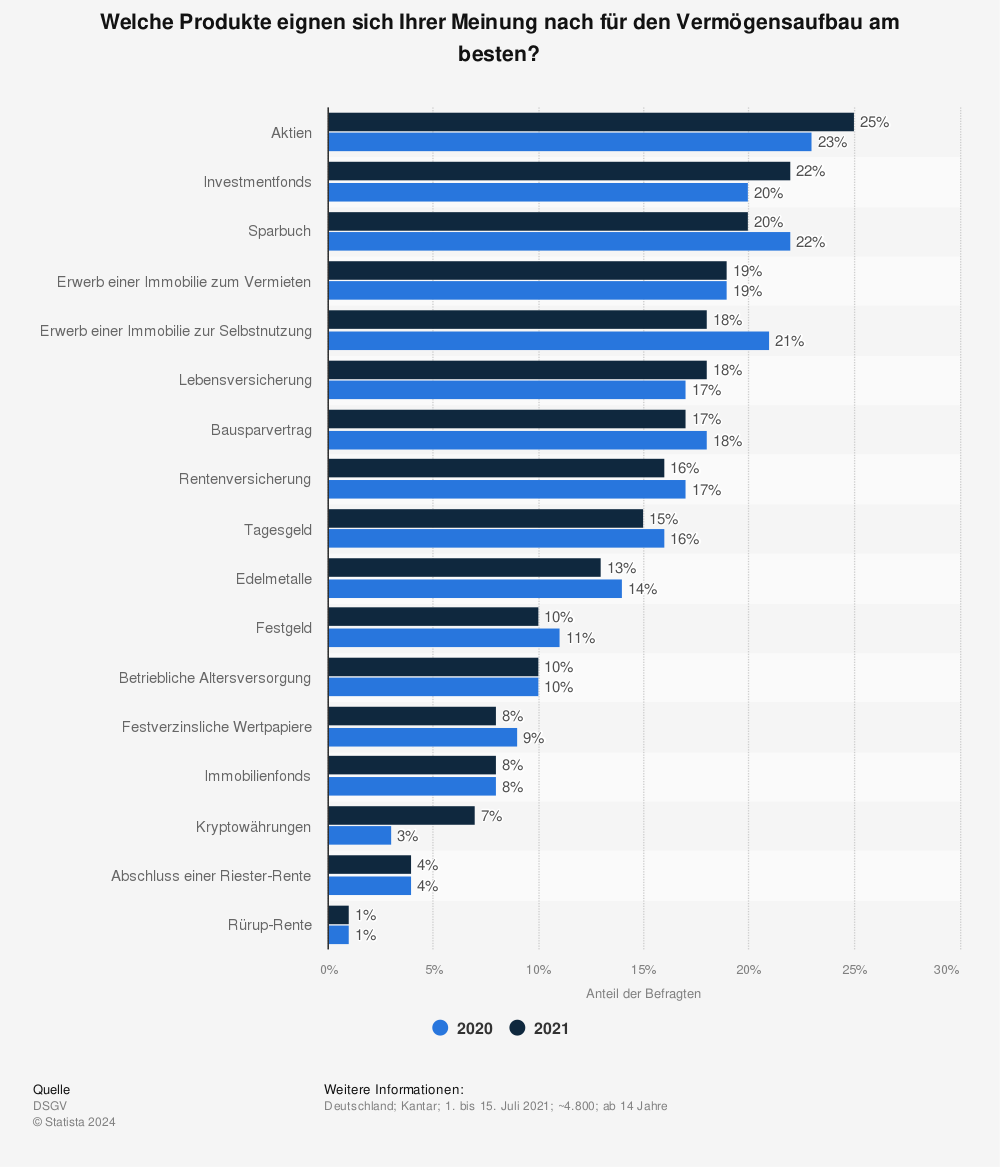

But that is all that speaks for gold as an investment from my point of view. In the long term, gold is exposed to much higher fluctuations in value on the capital market than many shares or equity funds. The second reason against gold as an investment is that gold is traded in dollars. So with gold I not only have to assess the performance as such, the exchange rate between the dollar and the euro is also important. For example, if gold has appreciated in value, a weak exchange rate can have a much smaller impact. Thirdly, I need to store gold either in a bank deposit, or very securely at home. Both of these incur costs. After all, only about 16% of the population say gold is a good investment to build wealth. A property to rent out is trusted by 27% to be good for wealth planning. I can only agree with that.

My conclusion: If you want to avoid short-term capital market weaknesses, you are welcome to invest in gold for a limited period of time. In the longer and long term, there are much more valuable forms of investment. By the way, this is also what consumer protectionists say.

You can find more statistics at Statista

Question: In your experience, which three investments are the best?

There is certainly no such thing as “the” best investments. Because the investment must always fit the individual and his goals. One investor is looking for maximum security, while another has no problem with risk and loss. Then there are people who literally want to see what they have invested their money in, which again other investors do not care at all.

At least for all people who want to see where their money has gone, real estate is the best form of investment. If you do it right with real estate, you also have a stable and decent performance. And finally, I can also live in my investment myself later on.

On the other hand, if you are not afraid of the big risk, you can invest your money in commodities or rare earths, for example. At some major banks and also on the consultancy market, there are people who know their stuff quite well. As I said, it’s not for the faint-hearted and, by the way, it’s also an investment that should run for a little longer.

For pure security fanatics who would rather do without spectacular profits, there are funds whose profit is capped, but which are also protected against loss. But there we are actually quite close to good real estate again.

Mainz offers big city life with small town charm

Question: In your experience or that of your clients, what is the quality of life like in Mainz? Which sights and events make the city attractive for tenants and investors?

Mainz is a big city with the charm of a lovely small town – at least that’s what everyone who loves living in this city says. By the way, I also think that you don’t notice the city’s 220,000 inhabitants. This is certainly also due to the fact that the individual districts of today, such as Mombach, Gonsenheim, Hechtsheim, etc., have retained their own character. After all, they were all once independent communities. But even in the inner city, you’re not beaten to death by high-rise buildings, wide street aisles or anything like that. There is a cosy old part of town with a lot of half-timbered houses and other old, well-proportioned buildings around the cathedral. The cathedral itself is of course not a museum, but a lively inner city church.

That the location of the city is something special, knew already the Romans. Until today, the Roman theatre has remained as a witness of this time. Somehow, everything in Mainz has remained quite moderate. Although Mainz has been playing in the first Bundesliga for years, the new stadium at the gates of the city near the university is not a giant arena. Mainz is a university town. And that includes – in addition to a thriving and loving pub scene – a correspondingly large cultural offering. The municipal theatre is a well-functioning three-part house that is known beyond the city limits.

Sure: and then there is the carnival, pardon: Fastnacht – as the Mainzers say. Without “Weck,Woi, Wurscht” – i.e. bread rolls, wine and sausage – one survives neither the “Fassenacht” nor city life in Mainz at all. Whether this culinary triad already existed at the time of Johannes Gutenberg – who lived and worked in Mainz – I don’t know.

Demand exceeds supply: Real estate in Mainz

Question: Which real estate is currently the most popular investment in Mainz?

Actually, all types of real estate that the market offers. From single-family homes on the outskirts of the city to old or new condominiums and apartment buildings, and even office properties in the city centre or one of the many business parks – Mainz offers something for every anal desire. As everywhere, it’s a question of price and that depends not only on location, condition and age but also on the overall offer. No matter what it is: I advise every prospective buyer to have clarified all questions about financing etc.. Because there are currently many more interested parties than offers. You have to act fast.

Bingen is a real alternative

Question: Let’s assume a reader is a real estate investor in the Rhine-Main region and is looking for new worthwhile properties. What is your insider tip for profitable properties in Mainz and the surrounding area?

Quite clearly: Bingen on the Rhine or the one or the other municipality bordering there. This has something to do with the fact that on the one hand the real estate prices here are significantly cheaper than in Mainz or the neighboring cities such as Ingelheim, Nierstein or so. Rents in the Bingen area are also lower than in the immediate metropolitan area, but again not that much lower relative to the purchase price. Thus the yield, about which we spoke above, is often clearly better with real estates more in the country. So it is well worth looking a little further afield.

How a Diskret broker works

Question: You yourself describe the Lukinski brokerage office as a discreet broker. What does that mean exactly?

This means that we offer the properties offered to us without the classic – let me call it – “market writing”. For the seller this means: he can be sure that no one in the immediate vicinity will notice his intention to sell. The usual advertising signs in the windows or in the front garden are not necessary. Our vehicles are kept inconspicuous and are completely neutral in colour.

The exposés are only sent to customers who we have contacted beforehand and included in our database. Of course we also use real estate marketing portals, but our appearance or the appearance of the property is designed so that hardly anyone can draw conclusions about the location of the property. So if you want to offer your property on the market with maximum discretion, for example because you want to avoid annoying discussions with neighbours or friends, a discreet estate agent like Lukinski is the right choice for you.

For the buyer, this also means maximum discretion. This is particularly important if you value serious negotiations without the often usual “price gouging” by a rush of interested parties. The buyer can be sure that his person remains behind the scenes. Only after moving into the new home will his identity become public with the new neighbours.