Understand, Convert & Build Assets: Tax Optimization, Tax-Free

Converting taxes into private assets – Here you will find links to articles on tax optimization. For beginners and of course for you, if you are already an entrepreneur. I want to give you a first, small overview of what tax optimization means, from the first step to learning from experts, or their experiences and mistakes. The goal: Transforming taxes into private assets.

More knowledge, Less Tax Burden

Basically, the more knowledge you acquire in terms of finances, taxes and individual tax situations, the better you can design your taxes. As I already mentioned in the article “Billion-dollar gift for Springer boss: Shares are tax-free?”, financial optimization is all about understanding and knowledge: Knowing that your tax advisor does not have and will never have. If he or she did, then he or she would be an investor himself.

Operationalization of the Tax Saving Elements

The second step is the operationalization, i.e. the practical application, specifically adapted to the particularities of your company. The industry does not matter, real estate investor, financial intermediary, lawyer or even tax advisor itself. If you know the legal methods and ways of tax optimization, you can instruct your tax consultant to do the right things. The tax consultant should then take care of the operational work. Everything strategic, methodical, you should master.

Tax model: Individual Methodology from Tax Tools

The ultimate goal is an optimal tax model that fits exactly to your individual constellation. Just like the US President. According to research of the New York Times he pays only $750 income tax. Many factors play a role here. In the area of real estate, companies, inventory and also private aspects such as family ties play a major role. As a young real estate investor it is still easy to add a second city to your portfolio, for example Hamburg and Berlin. As soon as the family is there, at the latest children, one’s own sphere of activity is naturally limited.

Factors for tax models, which your tax advisor will never be able to fully grasp with increasing complexity, are manifold. These would be just examples, which can also change depending on how your own portfolio is spread.

Tax model factors that influence the choice of methodology:

- Company and industry(ies)

- Real estate portfolio

- Income from capital and investment portfolio

- Strategic business planning

- Private factors (partner, children, etc.)

Control Optimization: Process and Knowledge Build-Up

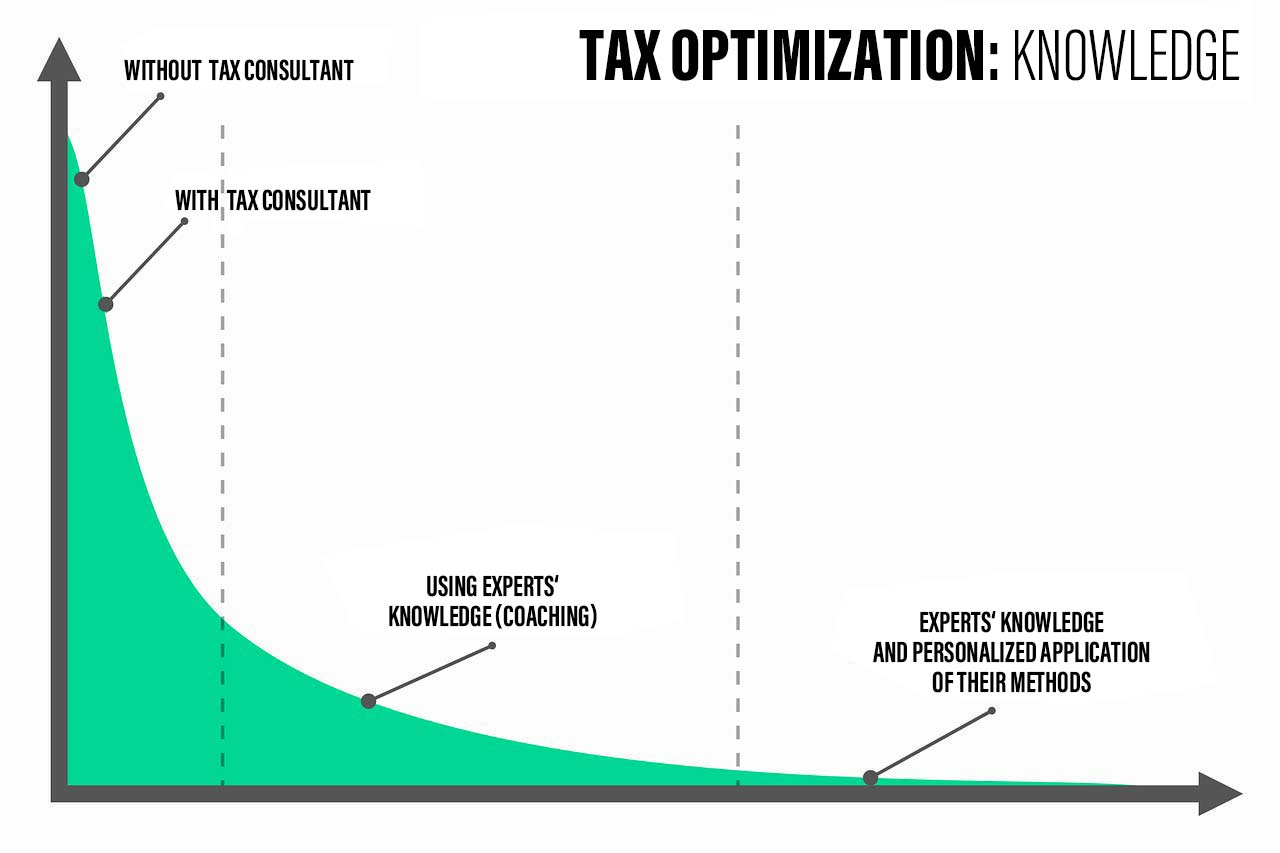

In this small, exaggerated infographics you can see how effective your knowledge, your tax burden will be gradually reduced.

Of course it is not as “extreme” as in this graphic in all areas. But in many it is possible. Just take a look at the example of the almost tax-free share donation.

Finance Basics: From Founder to Millionaire Entrepreneur

Here are my basic tips if you want to go from a solid foundation to a strong millionaire entrepreneur.

- Submit tax return (mentioned for completeness)

- Tax consultant (list with recommendations is also included)

- Tax Coachings (only from professionals with best practice)

- Experience of other CEOs, CFOs, senior executives, etc.

Tip 1: Submit your own Tax Return

The tip sounds simple, but is the absolute foundation. Not everyone who reads this guide is familiar with taxes, entrepreneurship and financing. Many are at the beginning of their career, perhaps even in the start-up phase. For you, too, I want to give you first, valuable tips on tax optimization.

In general, everyone who submits a tax return saves money. As a small motivation for your first tax saving, on average every citizen who submits a tax return gets a refund of 1,007 Euros.

I have done my tax declaration myself for many years, so I always knew about every item, about allowances, about duties and taxes. Today, this small-scale knowledge helps me to decipher complex processes in detail.

Or in short and simple terms: Nobody can fool you. Or only very, very, very few who have even more knowledge about legal tax models.

Tip 2 for Everyone: Tax Consultant

Work together with a tax consultant. This will allow you to take advantage of all the benefits that are regularly available or simple. This includes for example tax allowances.

A tax consultant is perfect to “seal the deal” with your accounting. But from experience you will never get proactive, really efficient tax tips. Tax consultants have many clients.

Nevertheless, you need a good tax consultant or a good tax office.

Tip 3 for Business Owners: Tax Coachings

So at some point you come to the point where you have to turn directly to experts. For this, there are either YouTube channels or books or tax coaching. Of course, I have tested all of them, but in the end, tax coaching is the most effective way.

The advantage of tax coaching as an online course: You combine different learning factors. You watch videos, perceive contents audiovisually, have checklists for in-depth application.

- Free courses are free of charge because they do not offer assets (content)

- Paid online courses offer know-how that not everyone should know

- PS: Please buy such courses only from tax experts with references

- Multimedia learning

- Contents repeatable

Tip 4 for Tax Savers: Experiences of Other CFOs, …

Experience of other CEOs, CFOs, senior executives, etc. with reputation and successful, lasting business At the latest after step 3 and your own, first years, you know immediately what that means.

In fact, I have also traveled a lot. Because especially from friends, i.e. “entrepreneur friends”, you learn the most. The big question is then always:

How do you do that?

No matter if it is about buying ETF packages in the savings plan (2.5% tax saved) or buying real estate without equity (yes, you only need to be able to hold equity if you do it skillfully).

You notice, I could tell you a lot about the tax return. Also to the tax consultant. But as soon as it comes to tax optimization, the matter becomes very dense. Knowledge cannot be put into a few words. Therefore, repeated briefly, take all tips to heart. If your assets grow, always remember to follow tip 3 & 4. The factor “tax” is getting bigger and bigger and the knowledge of how to deal with it, or rather how to structure it, transforms taxes into private assets.

Tax is like being an “entrepreneur”, a constant journey. The good thing is that every new destination is worth the adventure!

Reading Tips: Asset Building & Co.

Here I have some reading tips for you:

- “Billion-dollar gift: shares largely tax-free”

- Taxes & Assets: learning from investor experiences

“Billion dollar gift for Döpfner – largely tax-free?” – this headline is not from me, but from the morning mail. In fact, Matthias Döpfner has turned the publishing house upside down as boss. While owner Friede Springer stands confidently behind his decisions. Print shares were sold, new online media such as Business Insider, Idealo, Immowelt and StepStone were acquired. Already in 2012 Döpfner has received a big share package for more than 70 million Euro, now a “billion-dollar gift” for the Axel Springer boss is going to go, according to Manager Magazin. The 57-year-old media manager is increasing his previous stake in Axel Springer SE from just under three percent to a total of around 22 percent.

Tip! How does it work that you can get a block of shares almost tax-free? A little further down in the article I explain the methodology, or rather the law behind it.

- Give away shares: largely tax-free?

The President of the USA only Pays 750 Euro Income Tax: How does it work?

According to the New York Times, Donald Trump paid only 750 Euro income tax. It gets even better, according to the New York Times, Trump paid no income tax in 10 of 15 years starting in 2000. Are these questionable tax saving strategies or simply tax optimization? All the methods he uses are legitimate and legal. How does he do this?

- US President pays 750 Euro income tax