Stocks, ETF, Forex, Cryptocurrency, Social Trading: My Experience and Mistakes!

Stocks, ETF, Forex, Cryptocurrency, Social Trading – Here’s a little list with a few learnings that cost me money but are so simple you should know them! You want to buy stocks, index funds, cryptocurrency like Bitcoin or Ethereum, foreign exchange (currencies)? You’re thinking whether house bank, direct bank, online broker or app? Trading all on your own at risk or new options like social trading via app? My experiences and mistakes!

Experiences and mistakes in trading – Preface

Important: I am not a financial trader, have no education in this field. I am an entrepreneur and invest part of the profits in financial products. Therefore, the article is for beginners, beginners, beginners: financial trading simply explained.

Here I collect only simple, basic experience for you.

That was expensive! First stock purchase, Bitcoin & Co.

How did I go about this experience? First, I set up a virtual account, here you can practice with virtual money, test and gain experience. Then I wanted to look at all the apps, in 48 hours, so to speak, the extreme comparison as an entrepreneur. In the process, I lost money. 1,500 euros on the first day, 3,200 euros on the second day. But, I also gained a lot of experience.

I’ve been active now since the beginning of 2019 and here are a few of the tips for you that you should definitely look at before you buy your first stock, your first bitcoin, your first ETF product, etc.

These tips will save you money, time, and most importantly, nerves!

Especially in the beginning, I so often sat cursing in front of the notebook, cursing in front of the app, depressed in front of the screen – it has to be done! If financial products were so simple, anyone could do it.

Trading: Stocks, currencies and apps

If you want to read more tips, in the blog you can find many more articles, like:

- Learn Currency Trading -Experience, Tax & Example

- Cryptocurrency & Block Chain – Simply Explained

- Buy Stocks: Direct Bank / House Bank

Trade only with play money

Certainly the A&O: risk awareness. So that your risk is as low as possible, always trade only with money that you “do not need”. No matter if currency, stock, ETF, for 99.99% of the investors it is not about ultra-short-term profits every hour, but about short-term to long-term, strategic investments.

If you have an initial, small fortune that you can invest, there are many, many avenues open to you. We focus in this article and others primarily on explaining:

- Share: Company

- ETF / Index: industry

- Currency / Forex: Economic regions

- Cryptocurrency: digital currency

Everything is subject to the principle:

demand / supply

That is, not only “hard” factors play a role, such as the concrete economic performance in numbers by balance sheet, psychology also plays a big role.

Example: car manufacturer closes plants 3 weeks

I had just invested a 5-digit amount in Tesla. Just before the Christmas season.

Overnight, an email went out to all company employees that the plants would be closed for 3 more weeks after the regular break. In the morning the share price was still stable, I hadn’t paid attention to the news yet.

2 hours later the price dropped and dropped and dropped. News (news) is an extremely important factor in stock trading. Accordingly:

Respect the risk

Price action: -10% in the morning

Always invest your money “for the long term”, mentally. If you panic now and sell, you immediately make minus. So trading also involves “confidence” and as I said, a lot of psychology. In the end, “the market” is just many, many people making decisions. Even the algorithms in high-speed trading are written by people who make decisions.

Here you can see the example of the car industry with price trend.

Of course, like everyone, with every deal I thought, “Great, bought cheap”. After the first jump I was very happy, but then I became disillusioned again and a few days later the price collapses by 10% in the morning.

Think short term now:

“Short term”: oh my god! Crap, -10%

Or are you thinking long-term. Let’s just look at this chart with 5-day in progression. If you look at just this one morning, it looks bad. But look at the entire 5-day progression, starting at round about 630 to currently 645.

“Long term”: buy on perspective

It’s just a small, very simple example, but important for you:

Always buy on perspective, don’t react frantically to short-term movements in the market.

Exchange opening hours

New York Stock Exchange example.

I noticed the fall of a stock too late (time difference). When I wanted to sell, the New York Stock Exchange was already closed. That means I have to wait the whole weekend to get my capital free again. I can’t sell again until Monday morning.

Always remember the opening hours of the exchanges

Opening Hours: New York Stock Exchange / NASDAQ

The New York Stock Exchange is open 5 days a week, Monday through Friday.

- CET (USA): 09:30 am to 4:00 pm

- MET (Europe): 15:30 to 22:00

Stop Lose / Take Profit: Automate

Execute trades on your own? That’s a 24-hour job if you want to trade financial products professionally.

Before we get to “Take Profit on ‘9”, first a look at the method:

Buy cheap, sell expensive

Because you can’t sit in front of the app yourself 24/7 waiting for the perfect time to sell, there are SL (Stop Lots) and TP (Take Profit).

Stop Lots: Minimize Losses

Let’s say you invest in a stock. Since Wirecard, we all know, it can also go down quickly and very clearly, especially for “normal” investment who do not keep a constant eye on the news and insiders.

Stop lots (SL) is a limit to the downside. You can say for example, I have invested 10,000 euros, should this single trade go below 6,000 euros value, sell this position. Likewise it goes upward. Here also immediately still another tip, TP on 9′.

What that means, you’ll learn in a moment.

Take profit: setting to full amount / you -100

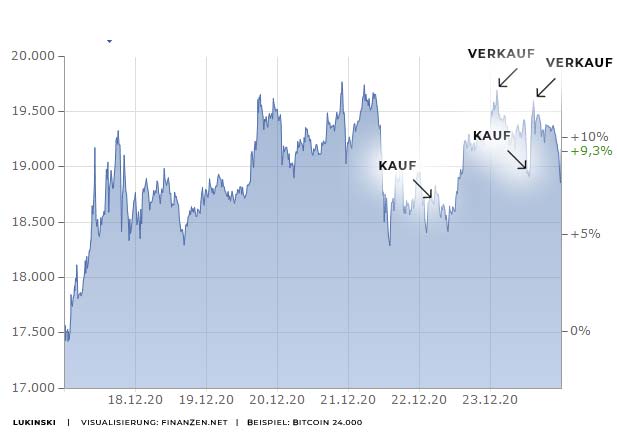

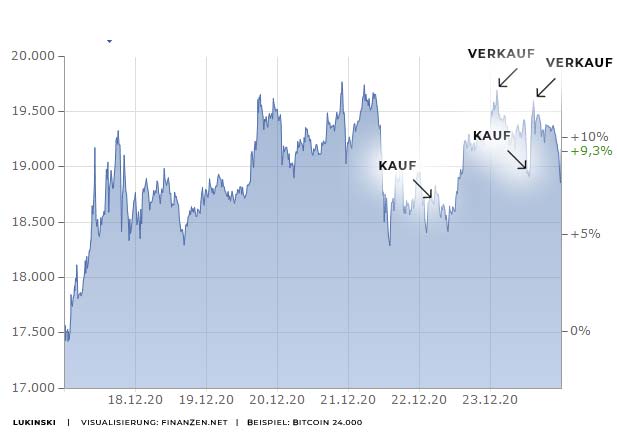

Who sets a TP (Take Profit), often goes to the full number, for example 24,000. In doing so, often larger traders descend just before and suddenly, the price goes into the basement and you have to wait again long until the price is at the old level.

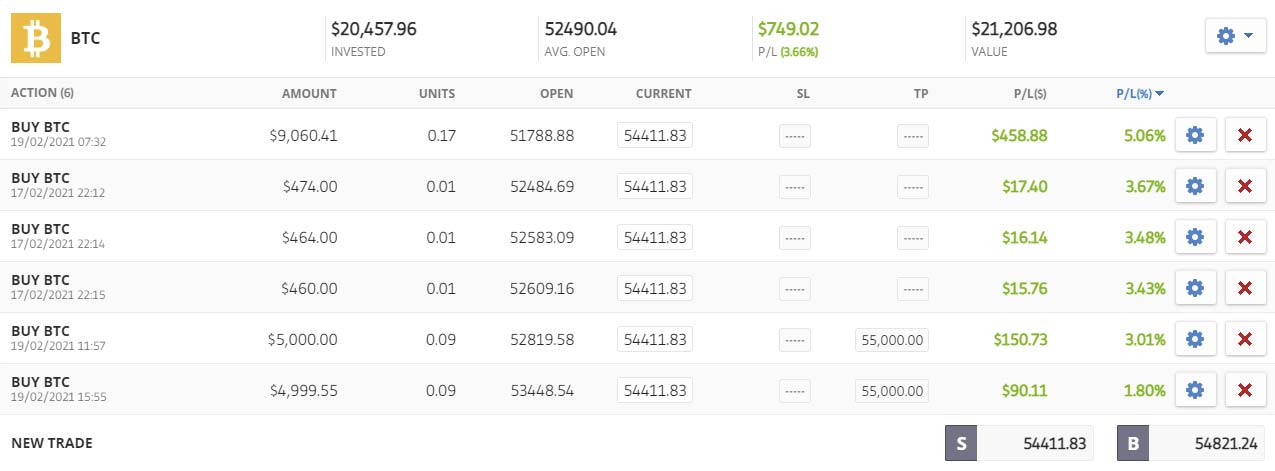

I will go into this graphic later. But here you can already see the principle. I have traded here the Bitcoin. Imagine now that you still during the time smaller jumps, between purchase / sale takes. This is not worthwhile at 1,000 euros in trading, but if you invest 100,000 and take 2.4%, you have 2,400 euros profit. If the price falls afterwards and you buy minus the spread a little cheaper, perfect. You will learn more about the spread (profit of the platform) in a moment.

The spread (i.e. profit) for the trader is 200 euros or ~ 1%. Through this shorter-term trade, you would have earned here so ~ 1.4% net profit, after new purchase.

5% wealth accumulation, in one day.

If you do this action on a day 2, 3, you already got 5% asset growth out, in one day.

Early Exit: Sell Before Peak

What does “take profit on ‘9” tell you?

Take Profit means you plan your sale ahead of time. Say you buy for 20,000, plan to sell at 24,000, then set your TP to 24,000, your bank, software, app will then automatically sell when the price reaches the TP of 24,000.

Conversely, this means – keyword “psychology in the stock market”, also crypto & Co. – even if traders have already dealt with the TP, which few actively do, then the following can happen:

You have set a sell point, however, traders go out before you, in the relevant volume, at 23,900, then the price will not reach the 24,000, at least not in the targeted period. The price drops and doesn’t reach the 24,000, so your package doesn’t get sold.

That’s why some trades make it worth my while if you set your setting like this:

- Take Profit (of many traders): 24,000

- Your TP: 23,900

Now comes the advantage, if you are not alone – and you will often notice this effect. The advantage, if the price drops already at 23,900, for example, to 23,100, you can already buy a new package. When jumping to 24,000, you make double profit.

Spread: This is what the trader earns

Often you hear:

“Trade bitcoin or stocks for free”

What is true is that no extra fee is charged. For example, once +10 euros on each trade. But you always pay a spread (spread between buying / selling), from this the platforms live.

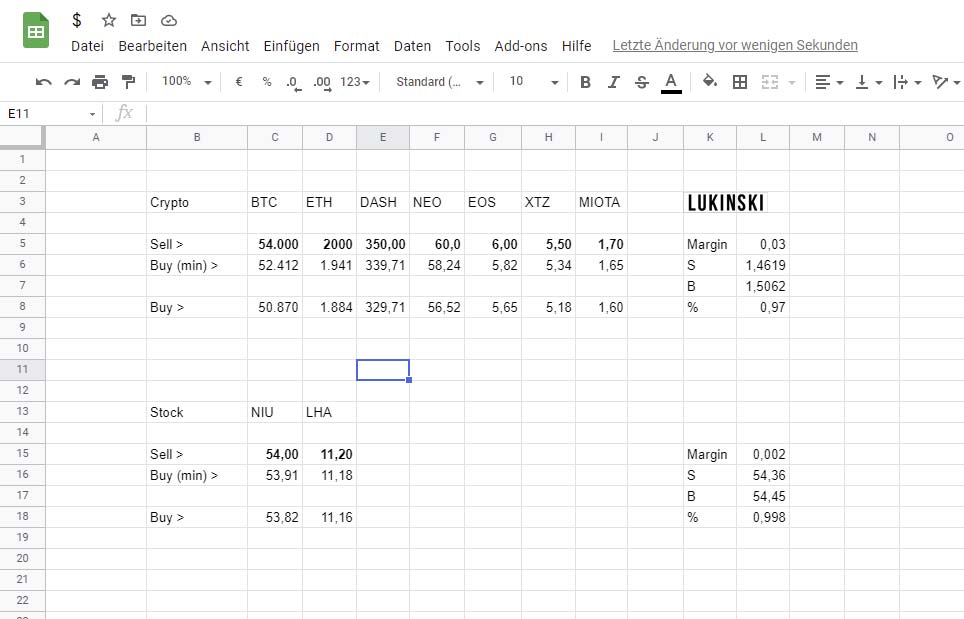

Example: spread on cryptocurrency

PS: Spread is the profit that traders take. Example from etoro:

- Bitcoin price: 23,189

- Sell bitcoin: 23,189

- Buy bitcoin: 23.364 (+ 0.9925%)

The spread (i.e. profit) for the trader here is 200 euros each, or ~ 1%.

Through this shorter-term trade, you would have here so ~ 1.4% net profit, after new purchase, earned.

Example: Spread in foreign exchange

In forex trading, for example with the app metatrader, you do not pay ~ 1%, but ~ 0.1%.

What is cryptocurrency, like bitcoin

I don’t want to mention technical terms now, like “block chain”, etc. Simply explained: cryptocurrencies are like commodities, for example gold as a precious metal. There is a finite amount of XY on earth.

Did you know? There are only 21 million Bitcoins

Theoretically, gold is worth nothing, but because people assign value to gold, it has value. The more people use this investment opportunity, the higher the price goes. Bitcoin almost the same way. There is a certain number and the more invest, the higher the price goes. If people sell their shares, so they do not trust the further price growth, the price falls again.

Fast and speculative.

- There is a fixed number of bitcoins

- Higher, faster profits / losses

- Much psychology, little news analysis

- Trading is possible 7-days a week

Higher frequency means more profit / loss

So of course you make “only” 1x profit. If you take the profit “more often”, you can increase the profit within the period.

Method / strategy in trading

You buy at the price low and sell at the next price high

Sounds simple, but many buy a financial product at the beginning and just keep it. This saves you a lot of nerves, short-term trading increases the profit for it.

For example, when I traded my first bitcoins, I sold and bought in between. So I can take small profits and then reinvest when the price is cheaper again. PS: In the hope that it will become cheaper.

My highlight was then the price high of 24,000 shortly before December 24. My last, active trading day. Since then I’m more into social trading, you can learn what that is here: Social Trading.

Slump, Gain: High at $23,900

What a thriller! After trading for a long time, the day now came when I wanted to sell. I ran 2 hours with my app through the city – of course, the sale was already preset, it was more of an emotional being there!

It also went high once again, as you can see in the chart here. The bitcoin rate is shown here in euros. The method is the following: You buy at the price low and sell at the next price high.

An important, important basis in trading financial products. The shorter and more extreme the periods are, the higher the profit, but also the risk of the trade.

- 2 additional purchases in 2 days

- 2 immediate sales

Graph in Euro:

Crypto Trading? A Fulltime Job

I can tell you this: if you don’t want to be intensely and constantly involved with your investments, don’t invest your money in cryptocurrency. But if you do, be there, as seen in the example above, the price does not jump for weeks, but in a few seconds and often several times a day.

Tip. Invest for the long term. There are 21 million Bitcoins, as long as people invest, its value increases. The skeptics of the first Bitcoin years have long been silenced. Buy, hold… hold. In 2, 3 years the price could have doubled again.