Self-disclosure explained: financing at the bank for house & apartment

Self-disclosure for the bank – You want to buy a property and this is to be financed by a German bank? More on Real Estate Germany. Whether Sparkasse, Volksbank, private banks, Postbank, Deutsche Bank or Commerzbank, banks want creditworthiness (risk minimization) and proof of it. This proof is called self-disclosure. Here you present your assets and your monthly income. In addition, you give the bank information about the property and the financing structure.

What does self-disclosure mean?

The self-disclosure is a proof of your creditworthiness. It includes your monthly income, expenses, assets and liabilities. The self-disclosure is completed either by you, as the sole applicant, or with a second borrower, your co-applicant.

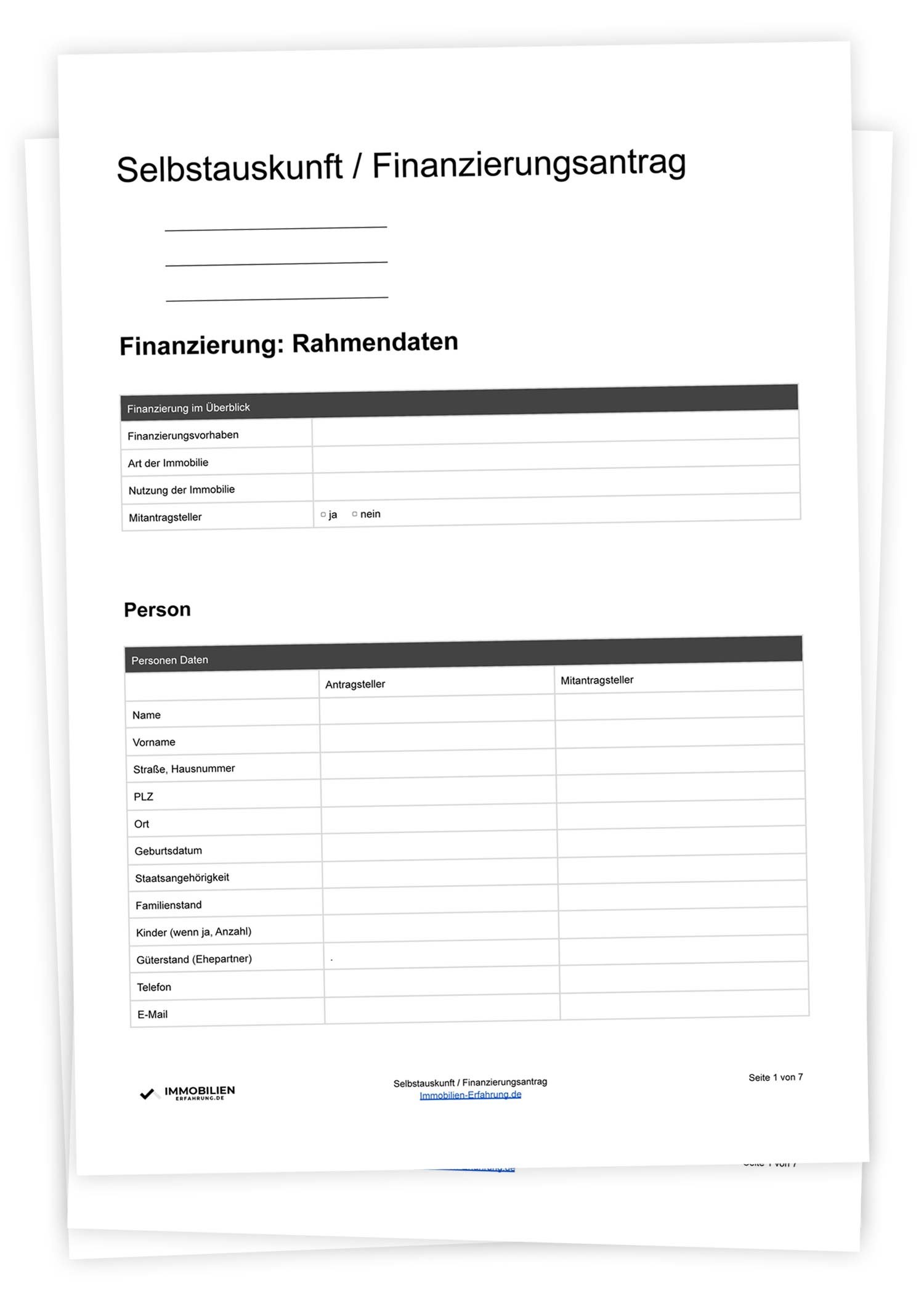

Download: Free Template

There is no official self-disclosure, for example from the tax office. The form and contents are freely selectable.

Here you can find the self-disclosure free of charge, as a good and complete PDF and Word template:

Structure of the self-disclosure

Before you get to know the individual steps, here is an overview of the structure of the (or this) self-disclosure.

- Personal data and activity

- Monthly income and expenditure

- Assets and liabilities

- Object to be financed and financing structure (repayment)

- Consent Schufa information

- Annex: Proof of income

All the information you provide here comes from yourself. Hence the name of the self-disclosure. It is important, and you should always bear this in mind, that all information must be verifiable.

Financing in brief: framework data ‘ Step 1

To begin with, summarize the framework data of the desired financing. Really, in extremely short form!

- Financing projects

- Type of property

- Use of the property

- Sole applicant or co-applicant

Personal details (borrower) – Step 2

In the second block, you provide information about your personal data. Either as the sole borrower or together with your co-applicant.

- Personal details

- Activity data

Credit rating: Income – Step 3

From the personal data and the activity you come in step 3 to the monthly income and expenses. Here you compare both blocks and calculate the sum. Your result should be a surplus and this surplus is your financial margin.

Monthly income

Monthly income includes income from wages and salaries, but also other variable, regular sources of income.

- Wage / salary (net)

- Recurring monthly variable income

- Income from self-employment

- Pensions and annuities

- Rental income (cold)

- Child benefit

- Maintenance

- Other income

Monthly expenditure

The monthly expenses include the warm rent, or the loan, or the amount of the monthly repayment.

- Housing costs; rent or loan

- Will there be no housing costs in future: Yes / no?

- Health insurance

- Other insurance (pension, building society, life insurance, etc.)

- Cost of living

- Loans

- Leasing

- Liabilities

- Child support obligations

- Other expenditure

Net worth (assets / liabilities) – Step 4

After listing your regular, recurring income and expenses, here is a list of your assets and liabilities.

Again, let’s take a quick look at an example of what belongs in the listing. Let’s start with the assets:

Calculate credit

In the section on assets and credit balances, list the following assets:

- Bank and savings accounts

- Securities (market value)

- Insurance policies (surrender value)

- Real estate assets

- Building savings balance

- Other assets

Calculate liabilities

On the liabilities side, then:

- Bank, instalment and leasing loans

- Guarantees

- Other liabilities

Real estate and financing: Use of credit – Step 5

In the penultimate, fifth step, you give your banker an overview of the property and the financing structure (repayment).

Property

First give your bank an insight into the property to be financed. Purchase price, type of property, type of use, here is all the important information for your bankers.

- Exact address (street, house number, postal code and city)

- Type of use

- Year of manufacture

- Real estate type

- Living space (m²)

- Plot (m²)

- Commercial (m²)

- Rented (m²)

- Undeveloped area (m²)

- Construction

- State

- Last modernization (year)

- Pitches

- Room (for apartment)

- Residential unit (no. according to declaration of partition)

- Location in the object (for apartment)

- Special features

Financing structure and loan amount

After you have described your financing wish, it goes to the amount and the repayment of the financing.

- Purchase price

- Property

- Conversion / Modernization

- Building costs (house)

- Outdoor facilities

- Incidental building costs

- Real estate transfer tax

- Own contribution

- Outdoor facilities

- Notary and land register

- Real estate agent

- Inventory

- Financing costs

In the area of loans:

- Amount

- Debit interest rate

- Redemption

- Rate

- Unscheduled repayment option

Schufa information and data protection – Step 6

Last but not least, you agree to a Schufa query and the privacy policy in your self-disclosure.

Tip. Once a year you get this self-disclosure free of charge:

- Schufa (external)

Supporting documents (income/tax return) – Step 7

Now you still prepare the appendix, your proof of income. For this you need the following documents, as an employee or self-employed.

Documents for employees:

- Last 3 pay slips

- Wage statement from December, previous year

- Last tax assessment

- If real estate assets, also income tax return

- Copy of identity card

- Schufa self-disclosure

Documents for the self-employed:

- Last 3 tax assessment notices

- Last 3 tax returns / balance sheets

- Ongoing BWA (business management analysis)

- Copy of identity card

- Schufa self-disclosure

Conclusion and 3 tips for buyers

Congratulations! You have created your first self-disclosure.

Download: Free Template

Here you can find the self-disclosure free of charge, as PDF and Word template:

Here are a few more important tips.

Tip 1: Bank details and good relationships

In each self-disclosure must be a bank account, or the banking institution. Choose a bank or a bank account of a bank with which you have a good relationship.

Tip 2: Step 5 with financial advisor

In the sixth step, you give your banker information about the property of your choice, as well as the financing structure. It is best to discuss this part with a financial advisor.

Tip 3: Accurate submission of documents

Really make sure that everything is submitted accurately, with all the important documents. If a mistake creeps in already here, this immediately reduces the chance of real estate financing by your bank.