Real estate LinkedIn: learn capital investment, investing explained succinctly

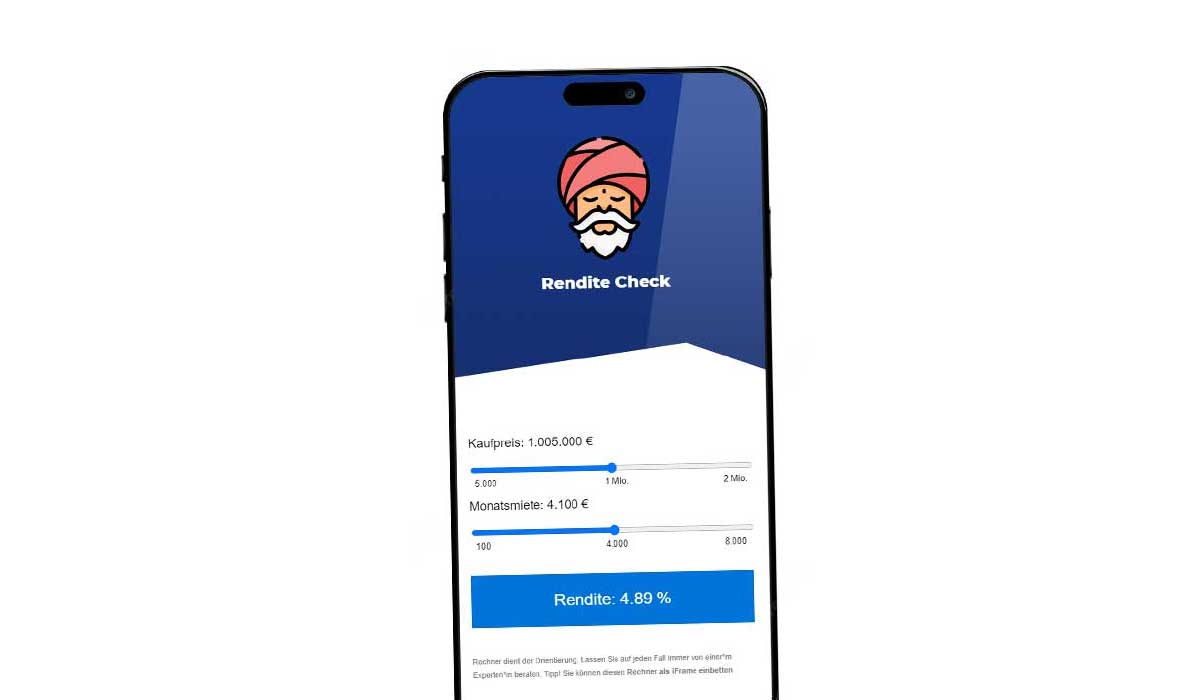

Real Estate 1×1 on LinkedIn – Your key to financial independence! ð¡ð¼ On my LinkedIn profile, I share in-depth insights into the exciting world of real estate as an investment. Whether you’re on your lunch break, looking for a moment of reflection, or traveling for work, you’ll find comprehensive information that will help you with your real estate investments. We offer free online courses that will give you insight into rental yields, financing, site selection and much more. We discuss how to calculate rental yields, calculate annual asking rents and make smart investment decisions. True to my motto: Lukinski, let’s go! Visit my LinkedIn profile to gain valuable real estate investment knowledge. ðð LinkedIn Real Estate Investment.

Examples: Detailed video explanations

Pictures say more than a thousand words! Here are some examples:

Passive income: Wealth accumulation through rental income

Passive income is the dream of many, and real estate can make this dream come true. Imagine earning 5,000 euros per month alongside your job without having to actively work. How would that feel to you? Many rely on real estate to achieve just that. One

- Your wealth grows thanks to rental income

- Additional income – passive income

- Sense of financial security

Real estate as inflation protection: value preservation

Over time, your money loses value due to inflation. But real estate increases in value, as does rental income. All the while, your monthly repayment remains constant. A great benefit you can learn about real estate investing on LinkedIn.

- Your property becomes more valuable in the long term

- Increase in rental income over time

- Stable repayment rate – your financial basis

Apartment vs. house: The advantage of an apartment

For beginners, a condominium is often the best choice. You become part of a homeowners association (WEG), which means that many costs are shared. For example, you only pay 20% of the common expenses if there are 5 parties in the apartment building. This means considerable savings.

- Be part of a homeowners association

- Share costs – e.g., heating system

Long-term financing of capital investments

Investors often finance over a long period of 30 or 35 years. This creates liquidity for further investments. Instead of paying 100% of the purchase price yourself, you take out a loan from the bank and usually contribute only 20% equity. This allows you to own several investment properties and profit from the returns.

- Creation of liquidity for future investments

- Inflation ensures rising assets while redemption remains constant

Work Life Balance: From the road

Little insights from my favorite places, cafes!

Subscribe now on LinkedIn!

Don’t forget to subscribe to my channel to stay up to date and benefit from valuable real estate investing tips.