Pareto principle, making money and wow real estate – “Richer than the Geissens” strategies by Alex Fischer

Pareto principle, earn money and wow real estates – In the free audio book of “Richer than the Geissen” you learn, how you can earn money successfully with real estates in 5 years without own capital funds. Big goals are reached by small steps. I want to take you with me today, in a few episodes of the podcast from Alex Fischer!

Richer than the Geissen: The audio book

Important: Currently the book is only available in Germany! I speak German and discovered this book or audio book two weeks ago. Even if you wouldn’t understand a word in the podcast, I wanted to introduce some of the methods and strategies to you!

I have heard the podcast 2 or 3 times by now, there is simply a lot to learn! The first chapters and episodes of the audio book are not about “making money”, but about the preparations for it: Your mindset. If you want to be successful with real estate, you basically have to know the principles and strategies that are timeless. What fascinates me about the podcast? Especially the new way of looking at the well-known Pareto principle, now thanks to Alex Fischer I see it for the first time as a mathematical formula. What this changes, I’ll show you right away! In addition, I want to introduce you to two of the over 70 episodes: The “Reference to Money”, but also the selection of projects using an example from Alex Fischer, the “Wow Real Estate”.

What is the book and podcast “Richer than the Geissen” by real estate millionaire Alex Fischer about?

“In 5 years without equity to become a real estate millionaire”

The content – the book or podcast basically consists of three parts, with personal stories and examples to illustrate the strategies and principles. In part 1 you will learn how to develop your mindset. You will also learn the basics for installing your own “money magnet” and many other principles that will help you manage your life successfully.

Exactly this includes the understanding of the Pareto principle (at least for me one of the many wow moments was in the podcast), the reference to the topic of money and the project selection using the personal real estate example of Alex Fischer.

The second part then deals with the tools you need to be really free. The third part is about earning money. You will learn how to build a money machine, how to build up your own capital, how to buy your first property and what you have to consider when doing so. Afterwards, it goes much deeper into the matter, including instructions on how to use real estate as an investment tool.

The book and audio book “Richer than the Geissen” summarized:

- Part – How to develop the mindset to attract money and success like a magnet.

- Part – What tools you need to be truly free.

- Part – How to set up a money machine that works for you day and night while you sit back and enjoy.

If you want to watch the whole free audiobook, you can find the podcast on Spotify and iTunes here!

As I said, one of the most interesting learnings for me was the completely new view of the Pareto principle as a mathematical formula! Take a look at what results from this completely new view and how it makes your decisions and your life extremely efficient.

Pareto-principle: Thinking ahead

This is a small excerpt from the “Richer than the Geissen” episode 13: If you do the same as everyone else. The Pareto principle is named after the engineer, economist and sociologist Vilfredo Pareto. He lived from 1848 to 1923, the same age as Henry Ford, for example. Almost 100 years after his death, his principle is just as relevant. Every businessman and woman knows it. By definition, the Pareto principle says that 80% of the results are achieved with 20% of the total effort. The remaining 20% of the results require the most work with 80% of the effort. Conversely, this means for you, concentrate on the 80% that you can achieve with 20% of the work.

The Pareto principle, according to Alex Fischer, also applies to assets: 20% of people own 80% of the assets. The remaining 80% of people own only 20% of the total world wealth. 20% of the rivers of this world carry 80% of the water, but the other 80% of the rivers carry only 20%. Surely you will quickly understand an example as an entrepreneur: 20% of your customers account for 80% of your business, but the other 80% of customers only account for 20% of your turnover.

Calculation: Pareto as formula

Alex Fischer goes into this principle and – for me – looks at it from a different perspective for the first time. Because, more precisely, it is not a principle, but a mathematical formula that does not end at step 1 (80:20). Now it becomes ingenious, because as I said, the principle is actually a mathematical formula. Also to the already divided 80:20 can be separated individually again into 80:20.

- Step 1: 20% of the work provides 80% of the result

In the second step, you take both results and divide them again in a ratio of 1:5 or 4:5, so that you get 4% (20% : 1/5) from the 20% and 64% (80% : 4/5) from the 80%.

- Step 2: 4% of the work provides 64% of the result

In the third stage, therefore:

- Step 3: 1% of the work provides 51% of the results

You can find out more directly from Alex Fischer in episode 13: If you do the same as everyone else.

Digression – How did Pareto come up with this ingenious principle? Vilfredo Pareto studied the distribution of land ownership in Italy at the beginning of the 20th century. During the calculations, he discovered that 20% of Italian citizens owned 80% of the state property. Conversely, he concluded that Italian banks covered 80% of their customers with only 20% of their time. His rule was later confirmed, among other things in the distribution of wealth just mentioned. In 1989, it was indeed established that 20% of the world’s population owned 82.7% of assets. Amazing in how many areas this rule applies.

Pareto principle in private life

In Evolume 20: Am I a good life investor Alex Fischer deepens the insights into everyday life. Which activities are investments and which are expenses? Am I a good life investor?

According to the Pareto Principle, private life is also about sensible investments and less sensible, or rather unnecessary “expenses”, in order to concentrate on the important and correct ones.

As a small reminder of the Pareto formula:

- 20% – 80% of the result

- 4% – 64% of the result [2nd stage]

- 1% – 51% of the result [3rd stage]

One of the simplest and most memorable examples in a podcast or book is, for example, “Watching videos”: Watching two hours of television afterwards makes you feel even more inefficient than before. Two hours of YouTube, with a video from which you learn something, will take you further. Or even this example: If you invest time in sports, you feel energetic and can do other things faster. How do you invest your time? Listen to episode 20: I am a good life investor.

Pareto principle in entrepreneurship

Wow objects in real estate – How do you know whether you should really go for a project? Why does it make sense to analyze one’s own actions and then set up rules?

In episode 18: It’s a Hell yeah, Baby or a No after finding his own purpose, Alex Fischer returns to the Pareto principle using real estate he bought himself. After 10 years, Alex Fischer examined his purchased objects. Which properties did he finally buy and which not? For him there were always three types of real estate:

- Instant wow – all bought

- I can’t. Of course I can’t

- Yes, maybe you can make – consumed 90% of the time, none of the objects was finally bought

Retroactively, this resulted in the following rule, “Wow” objects are bought, “can you make” objects are not! In many ways, it’s like buying real estate. It’s either total enthusiasm or a “no.”

Generalist instead of specialist: Everyone is an entrepreneur

I myself have always been a big fan of “generalist instead of specialist”. The broader I am, the less risk there is. In Asia, this principle is described by a chair. With only one tree, it tips over easily. Two legs make it more stable, three legs make it extremely stable, four legs make it virtually “untippable”.

Alex Fischer brings an interesting concept here: Everyone is an entrepreneur and has to make important decisions. Even in their private lives.

“If you want to be successful in life, it would be smart to have the basic knowledge that will turn you from a chaotic person to a sovereign manager.”

In entrepreneurship you know that there is a department for everything. Decisions are clear in the management. Communication with people is the PR or personnel department. It is the same in private life. You also have to advertise for yourself, even if it is “only” conversation, so to speak your advertising department, etc. This applies on a small scale (private life) and on a large scale (company). So you are not only an entrepreneur, but also the entrepreneur of your life. Every activity, from a private party to a football club to a cosy dinner, every activity contains different departments that work together.

Of course there is external knowledge (family or consultant), but basically you are responsible to find the right strategies in life and business. Own knowledge for the important “departments”, for example about network building to production, but are essential for success. This and more you will learn in episode 19: You have more departments than you think.

Accordingly, Ale Fischer says: “if you want to be successful in life, it would be smart to have the basic knowledge that will turn you from a chaotic person to a sovereign manager. It is essential that, according to Pareto, in all areas or departments of life you acquire the knowledge to have that 20% knowledge that makes up 80% of the result!

Group psychology

There are exclusive jewellery dealers and producers such as Graff, Phillips, but also De Beers. Nothing happens by chance, much in our lives is subject to external influences. Here Alex Fischer gives many good examples. For example the diamond ring, for the sweetheart.

De Beers is known worldwide for the production of the finest engagement rings, wedding rings and other elegant diamond jewelry. In the 60’s De Beers and its marketing team asked themselves the question, how to sell more diamonds? The idea, a marketing campaign with the following content: “If you care about yourself and you really love your wife, you give her a diamond ring. The campaign worked extremely well, so well that there was even a second edition: “If you really care about yourself, invest at least a month’s salary for your mistress.” That second campaign worked extremely well, too. So De Beers went one step further: “If you really love your wife, you should invest 2-3 monthly salaries!” – It’s fascinating how marketing can change the way we think.

The principle: group psychology. Although things are installed artificially, after a certain time they seem quite natural to us. Alex Fischer provides many more examples, for example the Coca-Cola Santa Claus, which was actually only invented to give a positive association to the own brand colour. Remember: information does not become truer the more often it is repeated. Do not believe anything that has not been proven to you!

Alex Fischer explains in Episode 14: Know Your Why, from when it really started for him. Successful, happy and full of energy was Alex Fischer when he found his “Purpose”. Many also say “vision” or “mission”. That means, what motivates you so much, what brings you so much energy that work doesn’t feel like work anymore? An extremely important question that Alex Fischer raises here.

Personal note – Also in my lectures I always say: It should feel like playing football. If you manage to make a living from “kicking”, you’ll be on the pitch voluntarily at the weekend too – because it doesn’t feel like work.

The own goals: Find your purpose

In the following Alex Fischer describes various examples on the subject. For example of High Potentials. For a study, over 1,000+ participants were interviewed and their careers subsequently followed. At the very beginning they were asked what their primary goal was. 90% had the goal to earn money and 10% wanted to realize a vision. Who do you think made it to millionaire? In total, 135 of the high potentials made it to millionaire. Of the over 1,000 participants, only 1 (of the 90% with the goal of “making money”) made it to millionaire. At the same time, all of the 10% with “vision” (except 1) became millionaires. Wow.

So you must always have the sense of your work in your head. Then you are “unstoppable”. Your steps:

- What do I want as the final score?

- Why do I want that? What’s in it for me and those around me?

- Implementation (Reminder: Pareto rule)

Another prominent example comes from former US President Bill Clinton. You want to know? Hear more in Episode 14: Know Your Why. Here Alex Fischer also tells what kept him from finding his own Purporses at first. How to find your Purpose you will learn later in the book “Richer than the Geissen”. Start at the very beginning and listen to episode after episode. This is how you learn most of all.

Attention and earning money

What is the purpose of money? How was it created? Exchange is probably the earliest form of trade, in which two goods are exchanged for each other. But how did money come into being as a means of payment that can later be easily exchanged for desired goods? When it comes to money, there are many questions, how do you earn it? Does it make you happy? Is a lot of money good or does it harm your character? In the following, Alex Fischer discusses how to form a new understanding of money.

What is money, what is its purpose and how did the money system come into being?

The purpose of money

“What is the purpose of money and why do many people have none?” In a nutshell, the point is that money is a form of energy. Here are a few thoughts from episode 15: What is money and why do most people have none? First Alex Fischer says “Money is a voucher that gets its value only and exclusively through people’s trust in it”. The way to money is long if you get into its basics mentally.

Whoever thinks of money also thinks of banks. They live on the trust of the people – why do you find out right away. Trust means being firmly convinced of the reliability of a player. You get trust when you are able to foresee the actions, behaviour or laws. This trust and the resulting money replaced the direct barter of goods.

Banking system: Origin of money

How did the first banks emerge? After I heard this episode, I told them at least 10 times!

The answer to the question how the banking system was created lies with goldsmiths. Since they worked with precious metals anyway and had set up appropriate security measures, they were the perfect contact for people who wanted to keep their jewellery safe, for example during long journeys, which were still made by carriages at that time. They kept jewellery for people, like rings. People received receipts for their jewellery so that they could redeem them later. Traveling was much easier that way, “Receipts instead of a chest full of gold”.

When the goldsmiths noticed that never all people redeemed their vouchers at the same time, the idea was born to issue different vouchers for the same item – of course in the hope that never all of them would be redeemed at the same time and that everyone would want their gold back. These vouchers were issued against interest. This is how the credit system was born.

The blacksmith lends money that is not his own, in the hope of getting it back with interest.

Be of maximum value to your surroundings

An extremely interesting asset. Another small excerpt, which also conveys the spirit well. Alex Fischer says: “If I don’t have money, then I am not valuable enough for my surroundings”. So you have to find out how you can be of maximum value for your environment. Beautifully explained using an example from Steve Jobs (Apple), who was known for his clear answers. When asked by an engineer why he earns 30% less at Apple than at Google Jobs, Jobs said: “Ask your manager why he doesn’t think you are more valuable”. Wow.

Alex Fischer also goes deep into the subject, from barter to value creation in its original form, to the monetary system, i.e. a voucher that makes different goods easily tradable, to another interesting statement: “Why making money doesn’t work. How can you be of maximum value for your environment and what do you need to know to describe this path?

Extremely interesting insights, which are available in even more detail in Alex Fischer’s knowledge library in the members area. You can find the free member area here: Alex Fischer.

Success after Alex Fischer

In the podcast of “Richer than the Geissen” you will now learn that success, no matter from which area, essentially always consists of 3 parts. This includes your mindset and laws, management skills and knowledge as well as practice in using the tools plus your market niche. In the podcast itself, Alex Fischer goes much deeper into the individual points. Listen to the whole episode here (15): What is money and why don’t most people have any?

- Mindsets and regularities – How to think successfully? Which rules are successful? How do I recognize traps on the way?

- Management and its tools / techniques – How to manage things, in relation to the individual departments of life

- Market niche – How to recognize, build and operate a money machine (e.g. real estate knowledge with Alex Fischer, in a gold digger it would be the knowledge how to dig for gold and find gold veins)

The knowledge of point 1 and point 2 is generally valid. Point 3 is the specific market and product knowledge.

A chain is always only as strong as its weakest link. – Alex Fischer

You want more and deeper information about money, happiness and mindset? In addition to the podcast, Alex Fischer also has a large YouTube channel on which he regularly publishes new and interesting videos on the topics of success, real estate but also taxes. Now to: Alex Fischer Youtube.

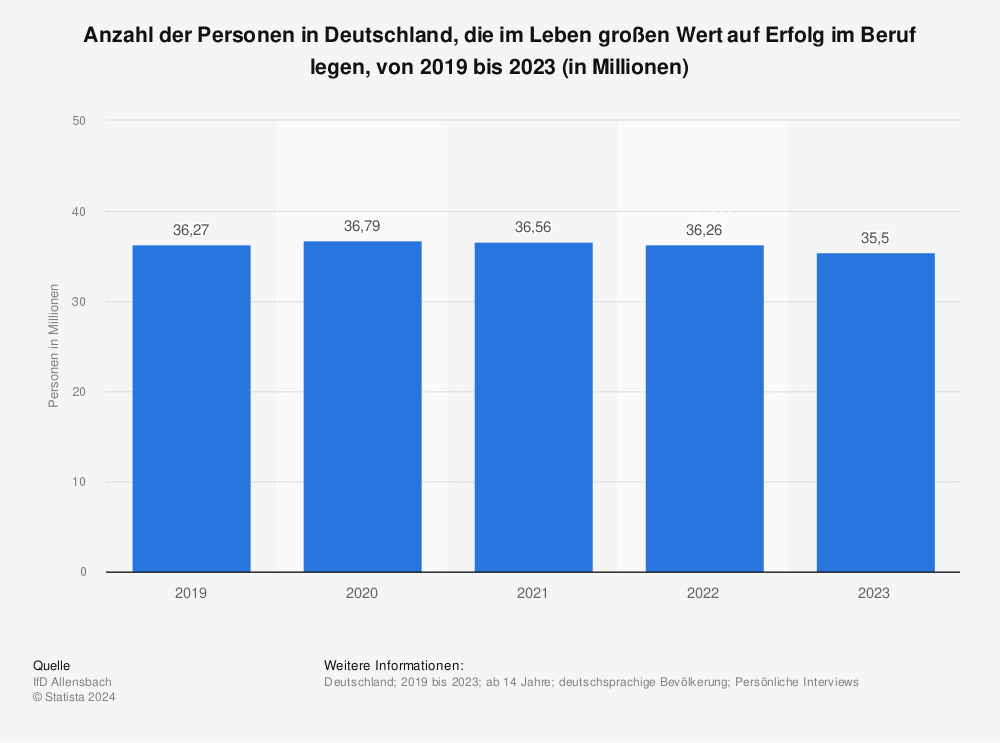

How large is the number of those who want to be successful and therefore attach great importance to this? At the time of the last survey, 81.45 million people were living in Germany; this puts the rate at 44.52%. It is also interesting to note that the number of people remains surprisingly stable. Finding: The competition is fierce. The sooner you work on understanding success models, the sooner you will stand out from the crowd. Here you can see the number of people in Germany who attach great importance to success in their career from 2015 to 2019 (in millions).

- Average value: 36.55 million

- In 2019, 44.52% consider professional success to be important

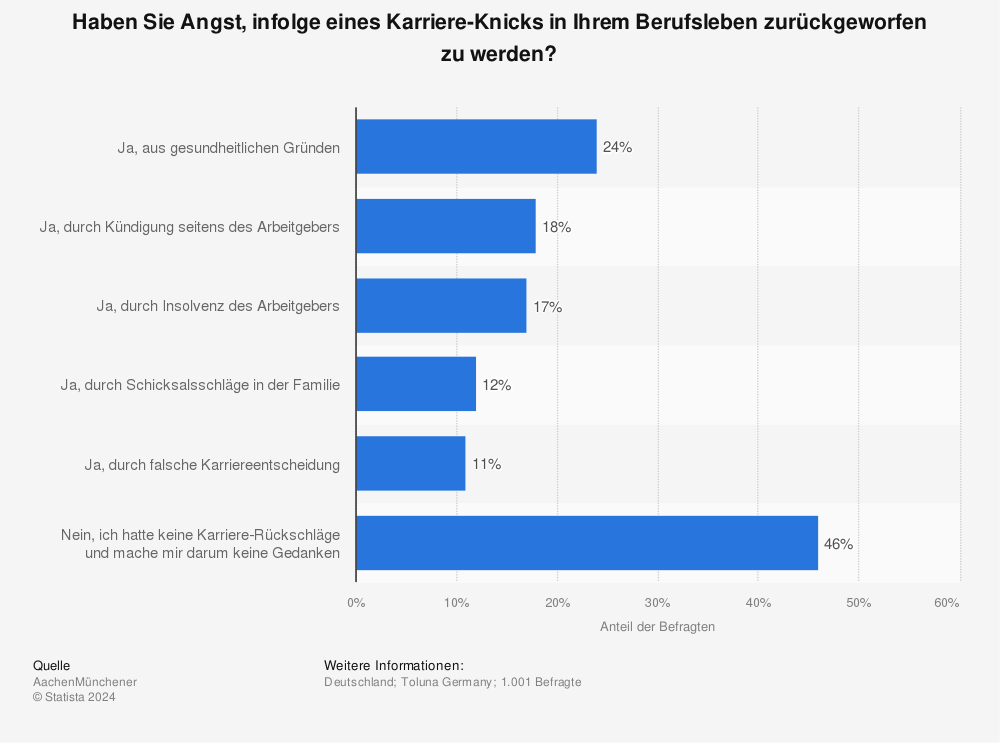

At the same time, many people are afraid of the risks, as can be seen here by the question: “Are you afraid of being thrown back in your professional life as a result of a career change? Risk factor number 1 is for 24% health reasons that scare them. This is followed by the dismissal of the employer (18%) and a possible insolvency (17%) of the employer.

- Yes, for health reasons – 24%

- Yes, through dismissal by the employer – 18%

- Yes, through insolvency of the employer – 17%

At the same time, 46% (corresponding to the finding that 44.52% attach great importance to professional success) say that they are not afraid of career setbacks.

You can find more statistics at Statista

Alex Fischer: Richer than the Geissen

“In 5 years without equity to become a real estate millionaire” – here you get the right and important tools for a happier and fulfilled life, also through financial freedom. Alex Fischer is living it up, with real estate he himself has already provided for a long time. His focus is on passing on knowledge, strategies and success stories. An extremely inspiring audio book. You want even more know-how? Become a free member of the Alex Fischer Community.

Alex Fischer: Learn more strategies

If you want to learn more principles, strategies and methods, you should take a look at Alex Fischer’s YouTube channel. Here you can find playlists sorted by topic to learn everything online. In addition, you can find links to slides and checklists here on YouTube – these documents are also completely free, without an email address. Tip! In the free member area you get the 27 strategies that Alex Fischer has extracted after more than twenty years of experience, compressed in an 11-page PDF as a checklist.

- Alex Fischer – Website & free members area

- Alex Fischer Youtube

“Richer than the Geissen”: Book and audio book

As a private person and/or as an entrepreneur, you will learn from Alex Fischer how to avoid these fatal mistakes and at the same time follow your passion – every day! The book contains hundreds of learnings that will help you to live a happier and more fulfilled life. Best of all, you can get the audio book for free on Spotify and iTunes!