Offer comparison calculator – advice & options

Offer comparison calculator – The offer comparison calculator is an important tool when it comes to choosing a partner for taking out a construction loan. Many builders are dependent on taking out a traditional loan at a bank or savings bank, because the funds from the equity, a building savings contract and a subsidized loan are not enough. Although the comparison possibilities of the indication by the Internet are very simple and transparent, many owners trust only in the offer of their house bank.

Possibilities of the offer comparison calculator

In principle, you are free to choose your lending bank. Prerequisites for the granting of a loan are, among other things, a very good credit rating and an income level that allows regular payment of the instalments. However, having a current account with the lending bank is not one of the requirements. So you can compare the offers on the market and put together a construction financing that suits your personal circumstances. Use an offer comparison calculator if you want to compare the costs and the term of two offers at a glance.

As the name suggests, the quote comparison calculator helps you compare two loan calculations. You call up the calculator on the Internet and enter two offers that you have researched in advance.

Interest, repayment and fees

The cost of a loan is made up of various factors. These include the interest, the repayment and the fees for the loan and the optional conclusion of an insurance policy that takes over the instalments in the event of an emergency.

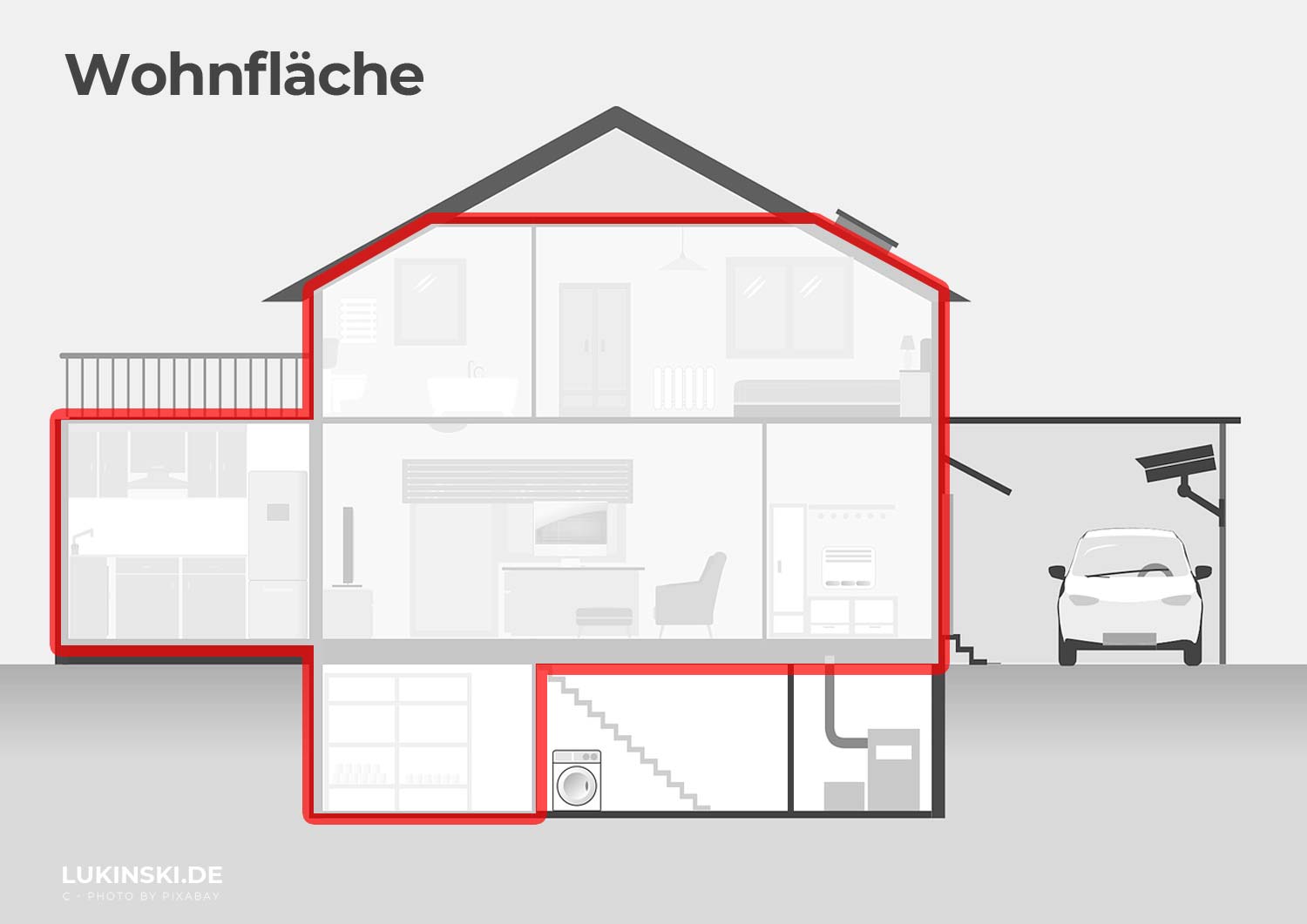

Before you can use the offer comparison calculator, you should have clarity about your financing amount. This includes the costs for the purchase of a property or the entire construction costs including the purchase of the land and the ancillary costs for the purchase, which are to be paid to the broker, to the notary and, in the form of land transfer taxes, to the city or municipality.

This is how the calculator works!

The offer comparison calculator calculates the costs of construction financing, if you decide on a classic loan. The bank loan is a pillar of many construction financing. It is the most expensive option, so the amount should be kept as low as possible. Before taking out a real estate loan, exhaust all other possibilities.

In the offer comparison calculator, you enter the required loan amount. Decide on two offers that you can compare with each other after entering them in the offer comparison calculator. To get a transparent result, it is important that you make some individual entries. In addition to the loan amount, this includes the loan term, the amount of the interest rate and the ancillary credit costs. After the input, you can see at a glance how high the installment you have to pay and how the total amount for your construction financing is calculated.

Simply change values in the quote comparison calculator

The advantage of the quote comparison calculator is that you can change the values quite easily. Find out what costs result from an extension of the credit period. An extension of the credit term does not always have a positive effect on the rates to be paid. There are banks that link a particularly favorable interest rate to a certain term. If you opt for a longer term, the interest rate increases and the rate does not change significantly. Since you will then be paying this rate for longer, you will not benefit from the extension of the term. You can also change the interest rate to find out how a few tenths will affect the rate and the cost of the loan. In this way, the offer comparison calculator helps you to find the best offer for your construction financing.

Calculator at a glance

Calculator – Exact planning of the construction financing

Calculators are necessary in relation to construction financing in order to accurately determine the cost of purchasing or renovating a property. A calculator is also used to determine the cost of the loan. The credit costs are composed of the interest and the repayment portion for the current loan amount. The interest plays an important role. Since the term of a real estate loan is usually ten years, the interest payment is spread over a long period. If an offer from a bank is only half a percentage point cheaper in their interest, you can already save several hundred euros a year. This is also due to the high loan amounts, which for most construction financing a six-digit amount. Before taking out a loan, an individual consultation is important. Often the construction financing consists of several pillars and not just a single loan. A building savings contract, equity capital and development loans come before taking out the classic bank loan. The reason for this is that these financings are significantly cheaper than the bank loan in terms of their costs. The calculator helps you to divide the financing into different elements and thus determine the costs with certainty.

- Learn more about the calculator.

Interest calculator – Construction financing

The interest rates are a very large item in a construction financing. It is recommended that you compare the various offers and conditions well in advance. In this way, you will find out which construction financing is particularly favorable. Since the interest is a very large part of the monthly loan payment, especially in the first years of real estate financing, it is important that you try to save costs.

- Learn more about the interest calculator.

Budget Calculator – Equity & Income

Before the purchase of a house, a comprehensive renovation or a new building can be planned, it is very important to determine the available budget. Construction financing is planned over a period of many years. Financing between ten and 25 years is possible. It is important that the financing is planned from the beginning on a secure foundation. The basis for the budget that is available to you for the conclusion of a construction financing is your income.

- Learn more about the budget calculator.