Investment: Real estates, shares, cars & co. – Invest money!

Capital investments come in many different facets. Time deposits or overnight money for the small saver, shares, car funds, jewellery and art for capital investments up to 100,000 euros or land and real estate. What is a capital investment? What is the safest capital investment? With which form of investment do I get the highest return? In cooperation with FIV Magazine we have written a large investment guide. Here you will find the most important basics for your own private assets. From the first forms of investment to big money, here you will find everything important:

Savings book – The classic

The savings book offers, especially for young people, a good start through the mental obligation to regularly deposit money. The big disadvantage is that interest rates are currently low, even close to zero.

Facts about the passbook

The 3 most important facts about the savings book:

- Possibility to invest the first capital stock

- No (extremely low) default risk

- Available for everyone

The savings book offers a secure investment and is a good option, without risk, especially for people who want to build up their first small capital stock.

Fixed-term money – binding term and yield

Money that you do not need to access for the next 1 to 3 years can be invested in a term deposit account. The longer the term, the higher the interest.

Facts on fixed-term deposits

The 3 most important facts about time deposits:

- For capital that is not essential needed

- Obligatory term (previous exit only with losses)

- Fixed return after time

Overall, fixed-term deposits are suitable for people who can do without part of their capital for a certain period of time. This is invested with a fixed term, in return for which you receive a fixed return.

For those who want to calculate their possible interest payments themselves, there are very simple formulas available for calculation. The two most important are these:

- Interest per year

- Interest per year = (investment capital x interest rate) / 100

- Daily interest

Interest for t days = (investment capital x interest rate x t) / (100 x days per year)

Daily allowance – flexibility and security

Overnight money is absolutely easy to set up, often the offer is included ready in the opening of the account. Your deposited capital is available at any time, unlike the investment on a fixed-term deposit account with a binding term. You only need a small amount of investment income or income to start with overnight money.

Facts on overnight money

The 3 most important facts about the daily allowance:

- Available to everyone

- Permanent availability of your money

- Low return

Overnight money is a flexible reserve option for small savers. You can access your money at any time, but the returns are more moderate than with a time deposit.

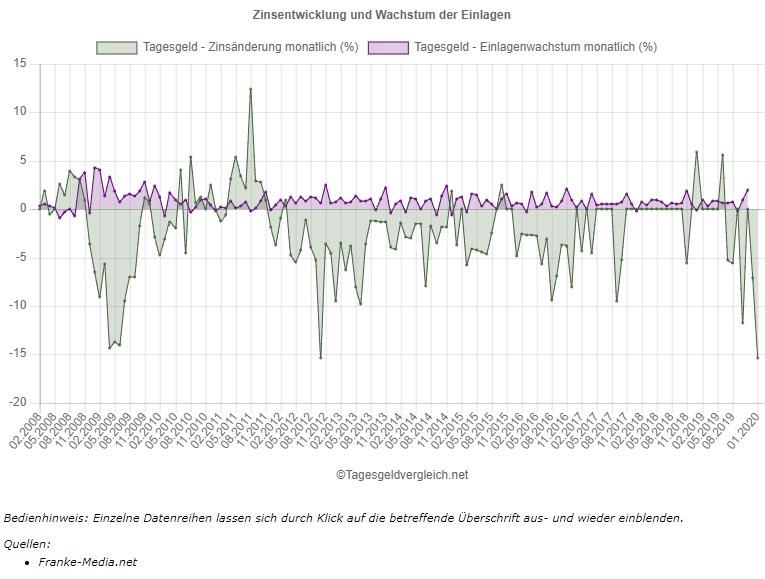

In the chart you can see how the interest rates on overnight deposit accounts have been falling steadily since the beginning of 2012, but the amount of deposits of private households with daily maturity almost always increases.

Building society contracts – house purchase, construction and conversion

When you save with a building society, you benefit from various support options such as premiums from the state. You can use your building society contract for the construction, purchase or conversion of a house. However, a bauspar contract is also interesting for real estate owners, for example to finance modernization measures. The respective costs depend strongly on the provider.

Facts on building saving

The 3 most important facts about the building society contract:

- No equity capital required

- Support through premiums from the state

- Earmarked (according to strict regulations) for house construction, purchase and reconstruction

Building society savings really pays off for everyone. The conclusion is simple, the plan has a clear goal. No matter whether it is rent-free living or old-age provision, building saving is a real must in order to build up equity.

Real estate – capital investment and retirement provision

The great advantage of real estate as a capital investment is its long-term value and, in addition, the corresponding increase in value in a good location. If you are looking for an exclusive property, you do not need a normal real estate agent but a luxury real estate agent with specific knowledge and a good network. Many of these objects will never appear in the usual real estate portals.

Facts on real estate

The 3 most important facts about real estate as an investment:

- Requires a lot of equity from the saver

- Long-term capital commitment

- Requires know how when buying (object, location, etc.)

Real estate is advisable for laymen, like stocks, at the first purchase only with the help of experts (e.g. real estate agents). It is a long way from the first research to the inspection and the purchase contract as well as the subsequent property management.

Access to shares is easy for everyone, online or in the bank branch. Every bank offers such accounts, some also charge custodian fees.

The 3 most important facts about shares as a capital investment:

- Know How required

- High risk (even complete failure possible)

- Purchase fees must be taken into account in the volume

Equities offer great returns, as we also show in the dividend payout in the example on our article. It is only important that you take a close look at shares before you make your first purchase. We tell you what you need to consider in the first steps.

Funds (ETF) – Less risk and return

ETFs are bundled shares, which reduces the risk (default, profit and loss peaks). The A&O in the balancing process. ETFs are associated with fixed terms.

Facts on funds

The 3 most important facts about funds as capital investment:

- Binding maturity (earlier exit associated with losses)

- Minimized risk through bundled individual values

- Purchase fees must be taken into account in the volume

For those who can save money, funds are an excellent alternative to individual shares. Bundled funds are less sensitive as they contain many players that are more stable overall. Returns are correspondingly more moderate than for equities, but as you can quickly see in our best practice of dividends, it is worth investing in. In the last 15 years alone, dividends have tripled, from 2004 to 2019, which is 15 years, bringing an additional annual payout of 27.8 billion euros. An increase of 271.15 % over the previous year.

If you are interested in buying an ETF fund, you will find many different pricing models on the internet. Here the individual prices per trade depend on the online broker. The standard fees are usually five to eight, with a maximum of ten euros. In addition, there is a fee of 0.25%, depending on the amount traded. The fee per purchase is typically limited to an upper maximum amount.

First purchase: 100, 1,000 or 10,000 euros ?

Purchase of 100 Euro Ø 6.5% loss

plus 0.25% trading fee

For a package of 1,000 euros that you buy, a trading fee of an exemplary 5-8 euros is much less significant. With a purchase of 1,000 euros, you will keep 992-995 euros in value. Accordingly, the loss in value is reduced to only 0.5% – 0.8%.

Purchase of 1.000 Euro Ø 0.65% loss

plus 0.25% trading fee

With a package of 10,000 euros and an order fee of 5-8 euros, the loss in value is directly reduced to 0.05% – 0.08%.

Purchase of 10,000 Euro Ø 0.07% loss

plus 0.25% trading fee

Therefore it is worthwhile to buy larger packages directly. In addition, there is the aforementioned purchase fee of about 0.25% of the traded package. Of course, the administration fee for your portfolio is just as favourable. The more value you hold, the smaller the effect on your portfolio.

Bonds – yield and rating

Government bonds, or treasury bonds, are usually available in the local currency. In contrast to treasury bills (2 years), German Government securities have a relatively long maturity. This maturity is for example 10 or even 30 years.

Facts on government bonds

The 3 most important facts about government bonds as a capital investment:

- Government bonds are used to finance government spending, so you lend the government money when you buy bonds

- Government bonds pay a fixed interest rate annually to the investor, the so-called coupon

- The interest rate and the price of the government bond issued is based, for example, on the current credit rating of the issuing country.

Government bonds are a safe bank for money. Whoever deals with the current inflation will quickly see that government bonds do not currently yield any income.

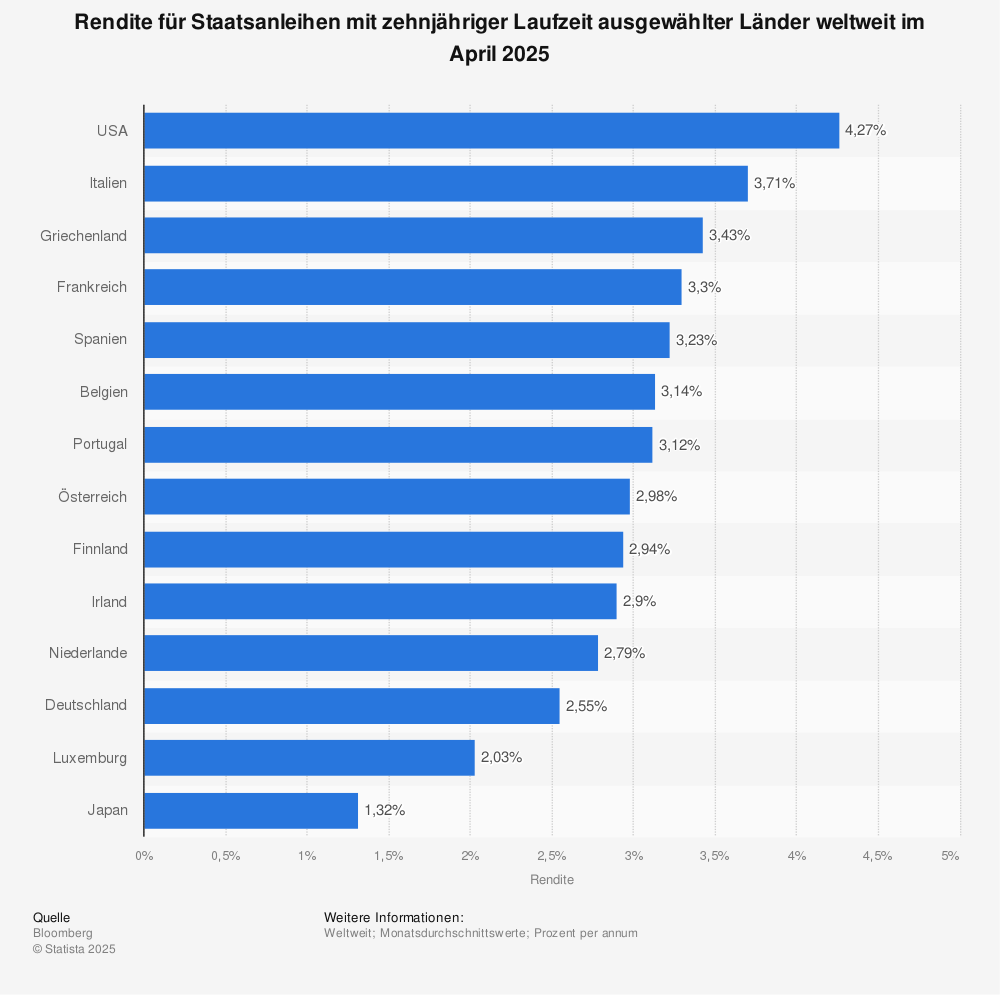

Yield with 10-year maturity

Yield on ten-year government bonds of selected countries worldwide in October 2019.

Positive interest income

- USA with 1.7 %

- Greece with 1.34

- Italy with 0.92 %

- Spain with 0.22

- Portugal with 0.19

- Ireland with 0.02

Negative interest income

- Germany with – 0.45 %

- Luxembourg with -0.39 %

- Lowland with -0.3 1%

- Austria with -0.2 %

- Finland with -0.2

- Japan with -0.16 %

- France with -0.14 %

- Belgium with -0.14%

Source: Statista

Precious metals – gold, silver, platinum & palladium

Gold, silver, platinum & palladium and the current price – here you will find everything about precious metals as an investment. Gold in particular is regarded as the investment form during and outside of crises. Did you already know? The purchase of investment gold is exempt from VAT.

Facts on precious metals

The 3 most important facts about precious metals as a capital investment:

- Gold is mainly bought in times of crisis, so the price development is often contrary to the stock prices (accordingly predictable)

Platinum is particularly rare and valuable (as seen in cars as an investment or in art as an investment, rarity is a top indicator), accordingly palladium is such an interesting substitute - Palladium is very interesting because it can replace platinum in the industry

- The big advantage of precious metal is that you can always follow the current prices and thus have a solid assessment of value and appreciation (when looking at the current prices and also history)

Diamonds – Valuation & Certificate

Diamonds offer protection against inflation, bank failures, stock market crashes and currency reforms. Not only that, anonymity also plays a major role for many investors. There is no registration of the investor for diamonds, no state access. Diamonds are not only anonymously obtainable for buyers, they also offer the unbeatable advantage that they are easily convertible worldwide.

Cartier jewelry (even the finest particles are used):

Facts on precious metals

The 3 most important facts about precious metals as a capital investment:

- Protection (inflation, bank failures, stock market crashes and currency reforms)

- Anonymity of the buyer

- Worldwide convertibility

Diamonds are an excellent choice as part of your own portfolio. As we have already described in the introduction of the article, a good portfolio should consist of one third each of fixed-interest investments or securities, real estate and mobile tangible assets, such as art, designer fashion or even diamonds.

Jewellery – value investment

Jewellery is extremely different. On the one hand, there is the well-known costume jewelry from the city centers and from online mail order companies. Even at the beach promenade around in the supermarket there is costume jewelry to buy. On the other hand there are special and exclusive pieces from brands like Cartier, Chaumet, Bvlgari, Patek Philippe, Rolex and Tiffany.

Facts about jewellery

The 3 most important facts about jewellery as an investment:

- Equity capital required (entry 5 to 6 digits)

- Moderate, long-term return (stable to slightly rising) / commitment if desired

- Anonymous purchase and trade

With such high purchase sums, which as described also quickly reach a 6-digit value, jewelry is an investment for wealthy people and heirs. For the private, smaller investor the later resale is not easy and in most cases it is loss-making.

Art – Durable investment without a fixed sales value

Access to the established art market is possible for newcomers via galleries or auctions. For buyers with capital, art is certainly attractive as an investment.

The most expensive works of art in the world

- Leonardo da Vinci – Salvator Mundi for 450.3 million US-$

- Pablo Picasso – Les femmes d’Alger for US$179.4 million

- Modigliani – Nu couché for 170.4 million US $

Designer fashion – shoes, jackets and bags

Designer fashion as a capital investment? Shoes, jackets and expensive bags, high fashion is not only conquering the world’s metropolises, more and more investors are also turning to designer pieces. Haute couture is at the top of the list in New York, Dubai and Beijing. The leading luxury brands earn billions. We take a look at the most popular high fashion designers and potential investment objects.

Facts on designer fashion

The 3 most important facts about fashion as an investment:

- Availability for everyone

- Anonymity at purchase

- Risk of loss of value due to trends, news

On average, humanity is becoming increasingly wealthy. Especially countries like China and India want more and more luxury goods. So the prices for special pieces are rising. Expensive handbags, noble dresses and shoes are making high profits.

Cars – oldtimers and sports cars

In addition to the three basic rules of rarity, original condition and patience counts, the increase in value must exceed the running costs of the value investment car. Sports cars, youngtimers and oldtimers can be easily purchased and acquired by everyone via the used car market, so getting started is easy. However, it is extremely important that specialist knowledge is available. Experience in the field is absolutely necessary, for laymen completely unsuitable and also in the risk medium to high, without knowledge.

Facts about cars and vintage cars

The 3 most important facts about cars as a capital investment:

- Attractive increase in value (important: increase in value only in original condition)

- A lot of experience and know how for the valuation and the purchase is a prerequisite

- Active enjoyment of the object instead of ‘just’ investing

If you want to buy cars as an investment, you have to take a lot into account. In addition to the three basic rules of rarity, original condition and patience, the increase in value must exceed the running costs of the car as an investment (sports, youngtimers and classic cars). For laymen, the investment in cars and classic cars is therefore rather unsuitable.

Private lending – duration, costs and comparison

What are the advantages of a personal loan from my bank? Can I get the credit without SCHUFA? There are many questions, we have the first important answers. For all other questions, it is best to contact your bank advisor or a renowned comparison portal for loans. So you are available through various credit mediation portals. The current rate of return on personal loans is mediocre and the risk of personal loans is therefore also not high. Private lending enables simple investment opportunities via various credit brokerage portals.

Questions about personal credit

What are the advantages of a personal loan from my bank?

Is a given personal loan earmarked?

Is a prior credit check obligatory in Germany?

Life insurance – risk & asset accumulation

Life insurance policies can basically be divided into two types, term life insurance and endowment life insurance. Life insurance policies stand out above all as the best protection for partners and children (term life insurance). However, they can do more, for example asset accumulation for old age (endowment life insurance).

Facts on life insurance

The 3 most important facts about life insurance as an investment:

- Capital Security

- Protection for survivors in the event of death

- Capital accumulation (for endowment insurance)

Depending on your personal family and professional status, different life insurance policies are possible. In principle, however, anyone who has a young family or close relatives should think about them.

Investment management – Private asset managers

Asset Management – Asset managers help their clients to find their way in the complex and increasingly digital financial world. Through conversations and trust we analyse the financial situation of the client in detail, so trust is central to our work together. Your personal current circumstances and long-term goals are taken into account in the planning. The result is a detailed, personal asset planning, individually developed for the client. Well-founded and high-yield asset management is possible for both financially strong investors and small savers. More about costs and minimum investment amounts later.

The most popular investments

Which of the following investments are currently the most popular? These statistics from the Federal Office are the result of a survey of over 1,000 respondents on the various preferred forms of investment in Germany. At the time of the survey, “about 27 percent of the people questioned owned a life insurance policy. In 2011, around 40 percent of those surveyed still stated that they had taken out a life insurance policy for old-age provision”.

13% fewer life insurance policies in 8 years.

Further information on statistics can be found at Statista

Reading tip: Free Podcast

Today I want to present you a book that will change your way of thinking: “Richer than the Geissen” by Alex Fischer. Now the book or the audio book is available for free on Spotify and iTunes. The chance for everyone to learn from Alex Fischer. Alex Fischer has become a multimillionaire with real estate, from 0 to 100. As the son of two teachers, he has made his own experiences, collected and learned. He was the first to combine the offline world of real estate with the online world of digital marketing. Learning from someone like him can only bring strong results! “Richer than the Goats” is a real box-office hit.

- In 5 years to the real estate millionaire – Richer than the Geissen (book)