Florida as a tax haven: Benefits for businesses, real estate owners and investors – USA

Florida as a tax haven – Florida is not only known for its sunny weather and beaches, but also for its favorable tax environment, which makes it an attractive location for companies and investors. Florida, but also Delaware, are known

Tax advantages for companies in Florida

Florida offers a variety of tax incentives for companies looking to invest or relocate to the state.

Fact 1: No income tax on personal income

Florida does not levy state income tax on personal income. This means that entrepreneurs and individuals living in Florida can benefit from significant tax savings. This is particularly advantageous for German investors who wish to establish a holding company or a company in Florida.

Fact 2: Favorable corporate tax rates

Florida has a relatively low corporation tax rate of just 5.5% on corporate profits. This is extremely attractive compared to other states that charge higher tax rates. Furthermore, companies that serve certain industries can benefit from additional tax incentives.

Fact 3: Tax concessions and incentives

The state of Florida offers various tax breaks and incentives to attract businesses. These include programs to promote research and development, tax breaks for companies that create jobs, and special incentives for companies in certain geographic regions or industries.

Florida: Location in the USA

My recommendation for the first 10 properties

For the first two to ten properties, an LLC (see GmbH in Germany) is best suited to minimize liability risks and at the same time take advantage of tax benefits. The LLC limits the personal liability of the owners, while profits and losses are attributed directly to the shareholders, which avoids double taxation. In comparison, a Limited Partnership (see KG) offers more flexibility in terms of passive participation, but the general partner bears full liability. A

For the first two to ten properties, an LLC (see GmbH in Germany) is best suited to minimize liability risks and at the same time take advantage of tax benefits. The LLC limits the personal liability of the owners, while profits and losses are attributed directly to the shareholders, which avoids double taxation. In comparison, a Limited Partnership (see KG) offers more flexibility in terms of passive participation, but the general partner bears full liability. A

- More about the LLC

- All US legal forms

US-Firmengründung speziell für Tax-Lien-Investoren

US-Firmengründung speziell für Tax-Lien-Investoren. Dieses exklusive Paket wurde speziell für deutschsprachige Tax-Lien-Investoren entwickelt und enthält alles Wichtige, was ein Investor benötigt, um seine Tax-Lien-Investments erfolgreich umzusetzen:- Gründung einer LLC oder Corporation

- Registered Agent Service (gesetzlich vorgeschrieben)

- Geschäftsadresse

- Postservice

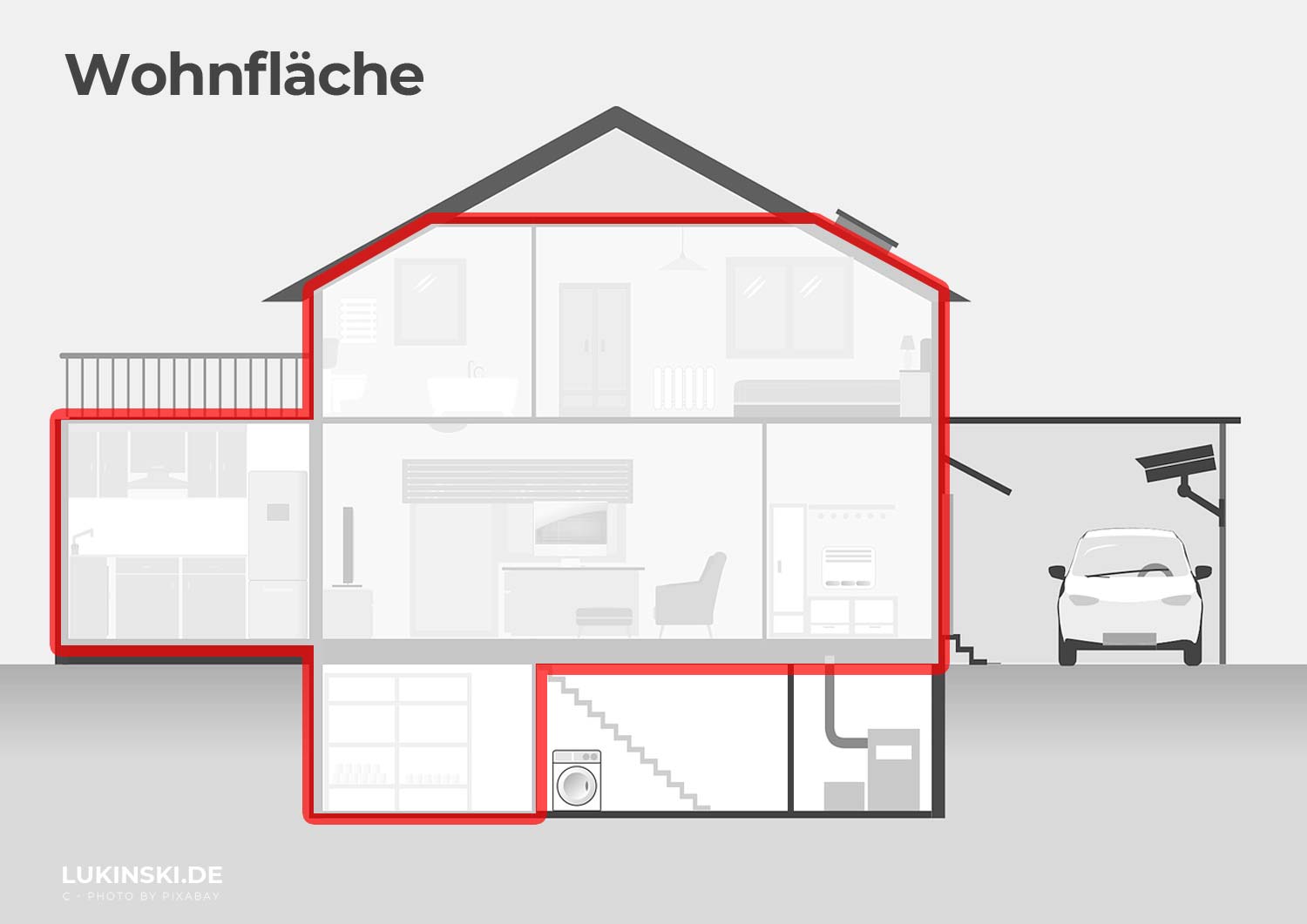

Real estate ownership in Florida

Florida is also a popular place for real estate investment, and the tax advantages make buying property there particularly attractive.

Fact 1: No inheritance tax

Florida does not levy inheritance tax or property tax, making it an ideal location for buying real estate for assets and estate planning. This is particularly advantageous for German investors who want to own real estate in the USA.

Fact 2: Favorable property taxes

Property taxes in Florida are relatively low compared to other states. This makes owning real estate in Florida economically attractive for investors and property owners.

Act 3: Real estate as a source of income

Rental prices in Florida, especially in popular cities such as Miami, Orlando and Tampa, have risen in recent years. Investors can benefit from attractive returns by renting out their properties. In addition, the tax deductions for mortgage interest and operating costs are also advantageous.

Tax advantages for German investors

For German investors, Florida offers unique advantages that facilitate real estate ownership and business start-ups.

The double taxation agreement

The USA and Germany have a double taxation agreement that is designed to prevent German citizens from paying taxes on the same income in both the USA and Germany. This enables investors to avoid double taxation and make their investments more efficient.

Access to a growing market

Florida has a fast-growing economy and attracts many international investors. German investors can benefit from a dynamic real estate market and a diverse business environment.

Florida has programs to support foreign investors, helping them to settle in the state and establish their businesses. This can be done through counseling services and networks specifically geared toward foreign investors.

My Florida tax conclusion

Florida has established itself as an attractive tax haven for businesses and investors, especially for German citizens. With its favorable tax system, absence of inheritance taxes and low property taxes, the state is an ideal place to own real estate and start a business. If you are a German investor looking to become active in Florida, it is advisable to find out about the specific requirements and advantages and possibly consult a professional to make informed decisions.

Delaware or Florida: Tax comparison

Delaware and Florida are both attractive tax havens in the US, but with different advantages. Delaware offers companies no state income tax on profits earned outside the state and minimal reporting requirements, making it ideal for holding companies and shell companies.

My conclusion: Both offer tax advantages, but Delaware is better suited for companies, while Florida is more interesting for private individuals.

Where to set up? More about:

Legal forms USA: Foundation & real estate

What types of company are there? If you want to set up your first