Florida Property Taxes – Real Estate Taxes Explained, List of Counties

Florida Real Estate – We provide a guide to give you an overview and simple explanation of property taxes or real estate taxes in Florida. We delve deeper into Miami, and other counties like Palm Beach. This how-to guide should tell you everything you need to know about taxes on properties, land, houses, or apartments in Florida, and Florida counties. Further down we include a list of all counties in Florida ranked by property tax. Including the most expensive property tax rates in Florida, as well as areas with lowest property tax in the sunshine state. Back to: Property Tax Guide USA

Taxes on Property in Florida

Florida is home to endless beaches, celebrity, and luxury. But what about real estate? What do you need to know about property taxes in Florida? Everything and more below. First we explain a bit about property taxes in general, and then delve into Florida’s property tax system. Florida’s property taxes are considered quite high, yet they fall below the average for the USA, at 0.94%.

- Florida Property Tax: 0,94%

- New York Property Tax: 0,86%

- California Property Tax: 0,77%

What are Property Taxes?

Property Taxes are ad-valorem taxes which you pay for owning property, meaning that it is based on the monetary value which is estimated to be attached to an item, piece of land, property, etc. A property appraiser provides the basis for calculation.

Property tax is often confused as being a tax on real estate property. Yet this is a misconception. The largest proportion of property taxes come from real estate, because this is the most expensive property most people own. Yet property taxes can also be levied on airplanes, computers, furniture, etc. When buying a house, these must be paid in advance, and then received back from the seller. Property taxes are typically a rate which is multiplied by the estimated value of the property. This value is estimated by an appraiser, and takes into account location, age, etc.

How are Property Taxes Calculated?

Property taxes are ad-valorem taxes, meaning the amount you have to pay on these taxes is determined by the value of the property. This value is estimated by an appraiser, and takes into account location, age, etc. Property taxes are typically a rate which is multiplied by the estimated value of the property. E.g. a property in California will be subject to a property tax of about 0.77%. A property valued at a total of $3 mio. will require the owner to pay property tax to the sum of $23.100.

Tax Bill = Property Tax Rate x Value of Property

Property taxes are a complicated concept. To learn more about U.S. property taxes, when you have to pay them, and how much each state pays in property taxes,

Mill Rates are Tax Rates

What is millage or what is a mill rate? Florida, like New York State, uses millage rates to calculate the tax you need to pay. They serve the same purpose and work quite similarly to conventional property tax rates. A millage rate, is first and foremost a number. This number indicates the amount of property tax a property owner is required to pay for their property. A mill rate of 1 indicates 1$ of tax for $1.000 worth of property, a mill rate of 24 indicates $24 of tax per $1.000 worth of property.

- Mill Rate of 1 indicates 1$ of tax for $1.000 worth of property

Important, as cited on the State of Florida’s official website:

Florida Property Tax is based on market value as of January 1st that year.

Florida Property Tax

In different states and counties, different items count as ‘property’. In Florida, the state itself actually does not levy any sort of property tax. It is counties which levy these taxes. Note that you may already be paying property tax without knowing it. In Florida, property tax payments are often included in mortgage payments.

What is Taxed under Florida Property Tax?

While you may expect Florida, like other states to include items like boats in their property taxes, they stick to real property. I.e. Land, buildings on land, and other improvements. For this reason, legally, the tax is also called the real property tax in Florida.

What is Florida Property Tax used For?

In Florida, the majority of property tax are used for citizen support measures such as protective services, first responders and law enforcement. Other agencies include payment of other municipal employees, citizen services like garbage collection, and recreational services.

Florida’s uses for property tax aren’t much different than all states’ uses for e.g. transfer tax. These typically are always motivated by a payment to the government to improve public good.

How do they Work?

In the U.S., because there are state as well as county and city property taxes, it is a complicated system. If you live in New York, you may even have to account for additional taxes such as a mansion tax. In general, for any given piece of land you have state property taxes as well as county property taxes. In addition to this, some cities levy additional taxes for property. Therefore, when owning property, it is important to be informed about property taxes at all government levels. In Florida, of all the money the state receives from taxes, 36.4% originate from property taxes. This is much more than California’s property tax proportion of 26.0%, and similar to New York State’s property tax proportion of 32,0%

Saving Money on Property Tax

Paying property tax means you can dave money on property tax. As all across the United States, there’s a wide variety of tax deductions and exemptions to look out for when paying property tax in Florida.

Property Tax Exemptions

In Florida, taxes on your real estate inevitably mean, saving money on taxes on your real estate. Its wealth of property tax exemptions mean that fairly high initial rates can be lessened by clever handling. One important fact to know right off the bat is the Save our Homes cap, an initiative which caps increases in assessed value at 3%. There is much more to learn though, and these are the most important property tax exemptions you have to know.

You too want to take advantage of the tax exemptions available in the US, take a look at our article

Homestead Exemptions

Homestead Exemptions are available for primary residences in Florida. This means that you can receive these exemptions on a property, if you live in this piece of real estate. These exemptions can be granted up to $50,000. However, only the first $25,000 of this exemption applies to all taxes. The remaining $25,000 is for out-of-school taxes only. This means that the assessed value of your home can be reduced by $25,000. Yet, an additional $25,000 can be deducted on which you also don’t pay property taxes (except for school taxes).

Limit of up to $50,000

Exemptions for Disabilities, Age, Service

In addition to the homestead exemption, some counties allow for senior citizen exemptions and deductions. They are around $50,000 for residents aged 65 years and older.

Widows and widowers who have not remarried are eligible for widowhood and widower exemptions of $500. Although, this exemption does not apply if you were divorced the time of the death of your ex-spouse.

Regarding disabilities, the $500 Blind Liberation is available to Floridians who are legally blind. Homesteaders who have a complete and permanent disability may qualify for exemptions from the tax exemption for total and permanent disability.

Exemptions for veterans also exist in a number of different forms. E.g. given an honorable discharge, disabled veterans who resided in Florida at the time of enlistment for military service may be eligible for additional exemption.

Is Florida Property Tax High?

If you’re looking to invest in property in Florida, it’s good to know how it compares, whether to your home state or other investment options. Below is a short run-down of how Florida compares to other states, and the most important facts all about its placement in the national average. For a comparison on all US states, make sure to check our property tax guide.

Average in the U.S.

In general, the U.S. has fairly low property taxes. Although, it is difficult to compare to other countries as all have their own systems. Still, investing in real estate in the U.S. is all the more attractive for the low costs which are attached to owning property and buildings. Do note though, that across states, tax rates for owning property are change strongly.

- Average property tax rate – 1.1%

Comparison of States

Does Florida have a high property tax rate? Florida ranks 29th on average income from property tax. Yet this is deceiving. Florida has very high property tax rates in some counties. Yet these rates are lowered through exemptions. Therefore, when looking at how much citizens in this state actually pay, you see that Florida is somewhere in the middle, neither high nor very low in how much each individual actually pays in property tax.

Ranked 29th for most Property Taxes Paid per person

Florida’s property tax rate of 0.94% is 0.17% less than the national average. Coming from Alabama, the state with the lowest property tax rate with0.40%, you may be surprised, but generally Florida fares well in comparison to other states.

- Hawaii 0.30%

- California 0.74%

- Washington 0.92%

- Florida 0.94%

- New York 1.40%

- Illinois 2.05%

For a full list of property tax rates by state, check out our article

Miami Property Taxes

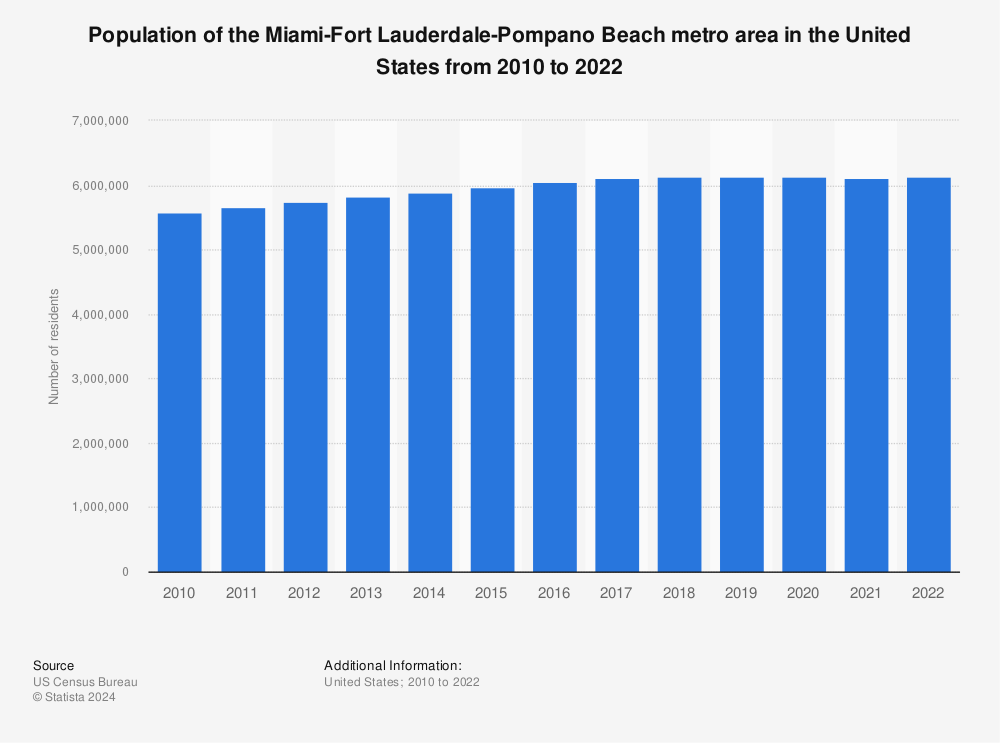

Miami is famous for its celebrities, and the dream lifestyle of fast cars, all-inclusive hotels, shopping, and glamour. This dream doesn’t include property taxes though, and investing in Miami real estate, whether for yourself or for profit, you should know the following things about property tax in Miami. Miami-Dade is a large county with some 2,7 mil. inhabitants, but also home to the vicious everglades. Investing here means cash and capital.

Properties in Miami

Properties in Miami are often upwards of millions of dollars. The median house price here is $242.800, meaning there are just as many houses more expensive than this, as there are less expensive. Since the 2008 recession, Miami, unlike many other real estate markets has found good success, with strong investments and high sales. The average home here fains $65.000 between purchase and sale. Population in the area is also steady, promising a safe investment in real estate.

How High are Taxes in Miami?

Miami lies in Miami-Dade county. Meaning that a house likely pays around 1.04% property tax, as this is the county average. So for example, a Miami Beach property taxes on a $2 mil. home are somewhere in the range of $20.780. Here, like in all of Florida, property taxes are calculated in millage rates. These lie between 17 and 25 mills. The highest rate therefore i in Biscayne Park, with 25 mills.

2 mil. House in Miami = $20.780 Property Tax/Year

Miami-Dade has the 11th highest effective tax rate in the state.

- Avg. Property Tax Rate – 1.04%

Lowering your Property Tax in Miami

One easy way to pay less on your taxes, is to just pay them earlier. There are discounts for early payment for properties in Miami-Dade county.

- Paying in November: 4%

- Paying in December: 3%

- Paying in January: 2%

- Paying in February: 1%

- Before March 31: None

Homeowners in Miami, just as in Florida also make use of the popular homestead exemption. Where up to $50.000 can be exempted. Otherwise, you can apply for the Save our Homes Portability benefit, in case you have moved, where you can accredit the difference in value between the assessed and the market value of the home which you sold to your tax bill.

Property Taxes in Florida Counties

Florida property taxes, as explained above, do not originate from statewide regulations. Rather from individual counties and municipalities. Comparing the effective rate in individual counties allows one to guage about where each lies and what to look for. The lowest effective property tax rates can be found in the counties of Walton (0.54%), Gulf (0.59%), and Jackson (0.61%). The highest in Okeechobee (1.26%), Hendry, and Sarasota (both 1.23%). Scroll further to see the full list.

Orange County

Orlando is one of Florida’s most popular tourist destinations. This is reflected in a bustling housing market, and many visitors each year. From sandy beaches, to massive shopping malls, theme parks, and golf courses, Orlando has everything for a luxury property, steeped in the American dream.

- Median House Price – $192.400

- Avg. Property Tax Rate – 1.01%

Palm Beach County

Palm beach county is epitimous of Florida’s drawing power, being home to world famous celebrities like Bill Gates, Howard Stern, and Jimmy Buffet. Property here is much like its fabled billionaires row: massive, oceanside, and a dream for those looking to live like kings.

- Median House Price – $242.500

- Avg. Property Tax Rate – 1.12%

Broward County

Home to Fort Lauderdale and the other Hollywood, this is truly a place for a permanent vacation. Snow has only ever fallen once here, in 1977. If you want a house with sun and sea, this is the place. Owning a house here certainly isn’t cheap though, with the median home owner paying $2.503 a year in property taxes.

- Median House Price – $223.400

- Avg. Property Tax Rate – 1.12%

All Property Tax Rates – Florida Counties

These are the rankings for the lowest and highest property tax rates in Floridian Counties. Below a comprehensive list of all counties, and the average effective property tax rate, ranked from lowest average effective property tax rate to highest. Note, effective tax rate takes into account additional exemptions or additions which come about as a result of district or municipal property taxes.

- Walton – 0.54%

- Gulf – 0.59%

- Jackson – 0.61%

- Holmes – 0.62%

- Calhoun – 0.65%

- Franklin – 0.67%

- Washington – 0.68%

- Bay – 0.69%

- Monroe – 0.69%

- Collier – 0.71%

- Okaloosa – 0.72%

- Dixie – 0.76%

- Seminole – 0.76%

- Baker – 0.78%

- Escambia – 0.79%

- Gilchrist – 0.79%

- Lafayette – 0.79%

- Wakulla – 0.79%

- Citrus – 0.80%

- Bradford – 0.84%

- Levy – 0.84%

- Gadsden – 0.85%

- Nassau – 0.85%

- Indian River – 0.86%

- Jefferson – 0.86%

- Clay – 0.87%

- Madison – 0.88%

- St. Johns – 0.88%

- Union – 0.88%

- Brevard – 0.90%

- Taylor – 0.90%

- Hernando – 0.91%

- Osceola – 0.91%

- Polk – 0.91%

- Flagler – 0.92%

- Liberty – 0.92%

- Manatee – 0.93%

- Pinellas – 0.94%

- St. Lucie – 0.94%

- Sumter – 0.94%

- Lake – 0.95%

- Highlands – 0.96%

- Pasco – 0.96%

- Duval – 0.97%

- Hamilton – 0.97%

- Lee – 0.97%

- Santa Rosa – 0.97%

- Martin – 0.98%

- Suwannee – 0.98%

- Volusia – 0.98%

- Leon – 0.99%

- Marion – 0.99%

- Orange – 1.01%

- Columbia – 1.02%

- Hillsborough – 1.02%

- Charlotte – 1.03%

- Hardee – 1.04%

- Miami-Dade – 1.04%

- Glades – 1.06%

- Putnam – 1.10%

- Broward – 1.12%

- Palm Beach – 1.12%

- Alachua – 1.18%

- DeSoto – 1.21%

- Hendry – 1.23%

- Sarasota – 1.23%

- Okeechobee – 1.26%

Property Tax in Florida

No matter what your intentions are with real estate property in Florida, its vital to understand how the property tax system fucntions. It’s near impossible to get your head around millage rates or effective tax rates without the right guide, and know how.

Investing in real estate is difficult and complicated, with taxes being a significant part of this. Our guide for when you need to buy a house is sure to be of help to you,